Did you know that the only thing more complicated than a day trader’s strategy might just be the regulations they need to follow? Understanding the key regulations is crucial for any day trader looking to navigate the fast-paced market safely and effectively. This article delves into essential regulations such as SEC rules, Pattern Day Trader (PDT) rules, and minimum equity requirements. We’ll also explore the influence of FINRA regulations, tax laws, and trading hour restrictions on day trading activities. Furthermore, we’ll cover the implications of margin use, short selling rules, and the importance of compliance with anti-fraud laws. Finally, we’ll touch on how international regulations can affect traders outside the US and share best practices for staying compliant. Join us at DayTradingBusiness as we break down these vital regulations to help you trade smarter and stay informed.

What are the basic regulations every day trader must follow?

Every day trader must follow regulations like maintaining a minimum account balance of $25,000 in the U.S., adhering to Pattern Day Trader rules, and avoiding excessive leverage. They must also report all trades accurately to the SEC, comply with FINRA rules, and avoid insider trading or market manipulation. Keeping detailed records of trades and understanding margin requirements are essential. Lastly, traders should stay updated on changing regulations to avoid penalties.

How do SEC rules impact day trading activities?

SEC rules require pattern day traders to maintain a minimum account balance of $25,000, affecting how often you can trade without restrictions. They also mandate strict record-keeping and disclosure for certain trading activities, limiting risky or excessive trades. Violating these rules can lead to trading restrictions or account freezes. Understanding SEC regulations helps day traders avoid penalties and ensures compliance with financial laws.

What are the Pattern Day Trader (PDT) rules and how do they affect traders?

Pattern Day Trader (PDT) rules require traders who execute four or more day trades within five business days to maintain a minimum of $25,000 in their trading account. If your account falls below this, you can't make new day trades until you restore the balance. These rules mainly target active traders using margin, limiting their trading frequency to prevent excessive risk. They force traders to either increase their capital, switch to longer-term strategies, or face restrictions that can halt their day trading activities.

What are the minimum equity requirements for day traders?

The minimum equity requirement for day traders is $25,000 in a margin account.

How does the FINRA regulation influence day trading practices?

FINRA regulation limits day trading by requiring a minimum equity of $25,000 in your margin account and enforcing pattern day trader rules. It also mandates strict disclosure and communication standards, ensuring transparency and fair practices. These rules prevent excessive risk-taking and protect traders from potential losses. Complying with FINRA regulations is essential to avoid account restrictions or suspensions, shaping how often and how aggressively day traders can trade.

What are the key rules for using margin in day trading?

In day trading, margin rules require traders to maintain a minimum equity level, usually 25% of the total trade value, known as the initial margin. The Pattern Day Trader rule mandates a minimum of $25,000 in your trading account if you execute four or more day trades within five business days. You must also adhere to maintenance margin requirements, which are typically around 25%, ensuring you have enough equity to cover your positions. Using margin amplifies both gains and losses, so strict risk management is essential. Always stay within your account’s margin limits to avoid margin calls or forced liquidations.

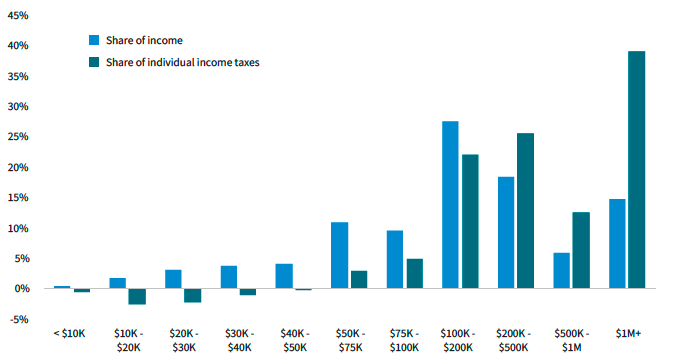

How do tax laws affect day traders’ profits and reporting?

Tax laws impact day traders by defining how their profits are taxed, often as short-term capital gains, which are taxed at higher ordinary income rates. Traders must accurately report all gains and losses, typically using Schedule C or Form 8949, to avoid penalties. They can deduct trading-related expenses, like software and data feeds, but strict record-keeping is essential. The IRS requires traders to distinguish between investors and active traders, affecting tax treatment. Failing to comply with these regulations can lead to audits, fines, or disallowed deductions.

What are the restrictions on trading hours for day traders?

Day traders can only execute trades during regular market hours, typically 9:30 a.m. to 4 p.m. Eastern Time for US stocks. The Pattern Day Trader rule limits traders to no more than three day trades within five business days unless maintaining a minimum account balance of $25,000. After-hours trading, from 4 p.m. to 8 p.m., has limited liquidity and higher risk. These restrictions aim to regulate trading activity and protect investors.

How do pattern recognition and trading suspensions work under regulations?

Pattern recognition in trading involves spotting chart formations like head and shoulders or double tops that signal potential price moves. Trading suspensions halt trading on a stock if there’s abnormal activity or suspected manipulation, giving regulators time to investigate. Under regulations, traders must avoid manipulating markets with false patterns or misleading signals and adhere to rules that trigger suspensions if unusual trading spikes happen. These rules aim to prevent market abuse, ensure fair trading, and protect investors from false signals or coordinated manipulation.

What disclosures must day traders make to brokers and regulators?

Day traders must disclose their trading activity, including account details and risk disclosures, to brokers. They must also report large trades or suspicious activity to regulators like the SEC or FINRA. Additionally, they need to confirm they understand the pattern day trading rules, such as maintaining a minimum account balance of $25,000.

How do regulations differ between stocks, options, and futures trading?

Stocks are regulated by the SEC and FINRA, requiring registration and disclosure, with rules on trading halts and margin requirements. Options trading is overseen by the SEC and OCC, with strict rules on leverage, pattern day trading limits, and approval processes for certain strategies. Futures are regulated by the CFTC and exchanges, with higher margin requirements, standardized contracts, and specific rules on trading hours and position limits. Each market has distinct rules on reporting, leverage, and trading restrictions that every day trader must understand.

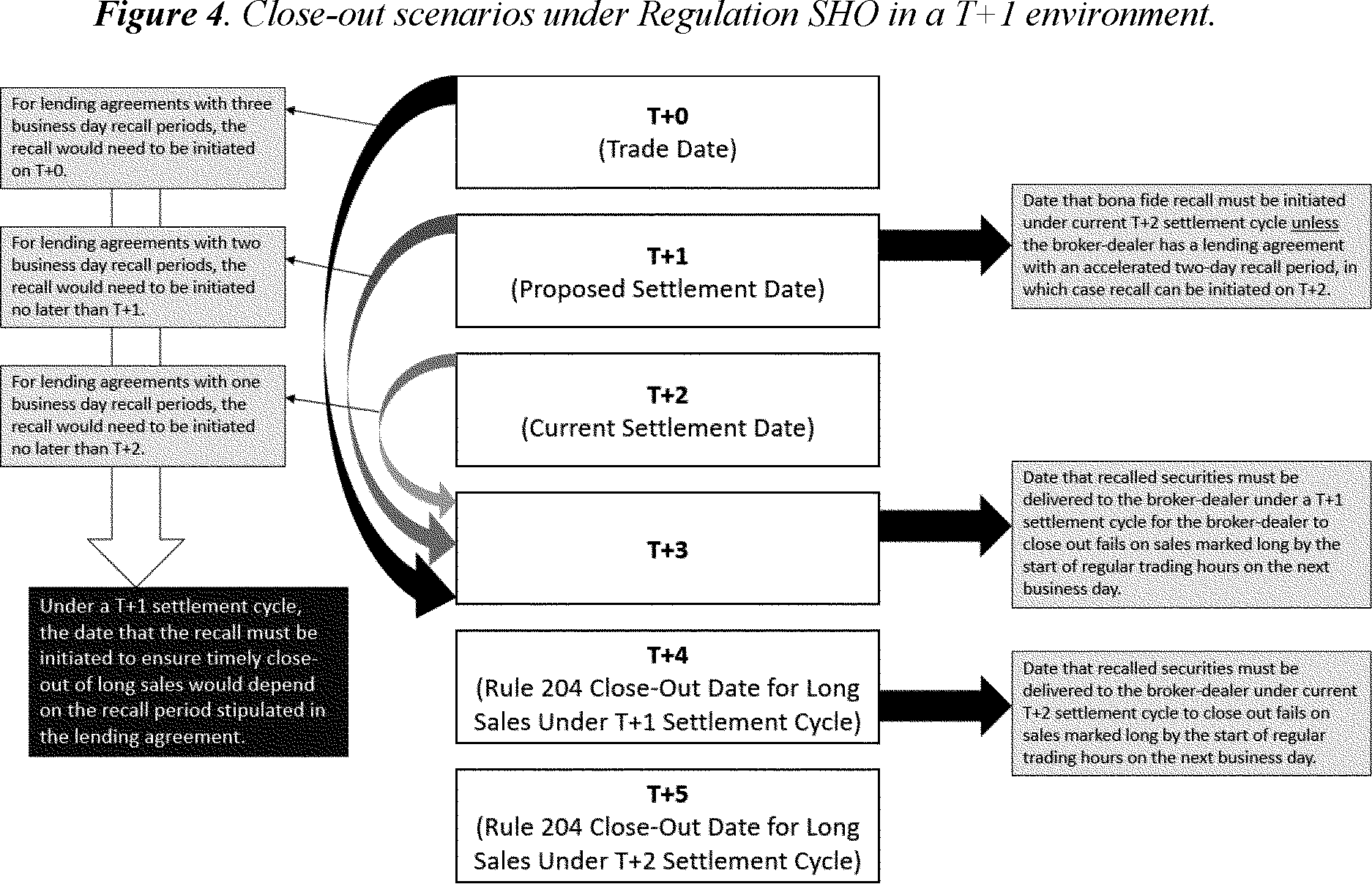

What are the rules regarding short selling for day traders?

Day traders must adhere to regulations like the Pattern Day Trader rule, which requires maintaining a minimum of $25,000 in their trading account. Short selling requires locating and borrowing shares before selling, and traders must comply with SEC rules like Regulation SHO to avoid illegal naked shorting. Borrowed shares must be returned promptly, and traders should understand restrictions on shorting during certain market conditions or on specific stocks. Always follow FINRA and SEC rules to avoid penalties.

Learn about What are the rules regarding short selling in day trading?

How can day traders ensure compliance with anti-fraud laws?

Day traders ensure compliance with anti-fraud laws by thoroughly understanding SEC regulations, avoiding false or misleading statements, and accurately reporting their trades. They should keep detailed records of all transactions, stay updated on FINRA rules, and refrain from market manipulation or insider trading. Using transparent, honest communication and adhering to registration requirements also helps stay compliant.

Learn about How Do Brokers Ensure Compliance in Day Trading?

What are the consequences of violating trading regulations?

Violating trading regulations can lead to hefty fines, account suspensions, and legal action. It can also result in reputational damage, loss of trading privileges, and potential criminal charges. Regulatory breaches might trigger investigations, audits, and even jail time if fraud or manipulation is involved.

How do international regulations impact day trading for traders outside the US?

International regulations affect day trading outside the US by imposing different licensing, reporting, and compliance requirements. Traders must follow local rules on leverage, margin, and disclosure, which can limit trading strategies or increase costs. Some countries restrict access to certain financial instruments or require registration with local authorities. Cross-border regulations may also involve currency controls or tax obligations, complicating international trading. Knowing each country’s rules ensures traders avoid legal issues and fines while maintaining compliance.

Learn about How Do Regulations Impact Day Trading Capital Requirements?

What are the best practices for staying compliant with trading laws?

Know your country's securities laws and trading regulations. Follow registration and reporting requirements, like SEC or FINRA rules. Stay updated on legal changes affecting trading practices. Use compliant trading platforms and tools. Keep detailed records of all trades and communications. Avoid insider trading and market manipulation. Educate yourself regularly on regulatory updates and best practices.

How do regulatory changes affect day trading strategies?

Regulatory changes can limit leverage, impose new reporting requirements, or restrict certain trading practices, forcing day traders to adjust strategies. For example, a new rule capping leverage reduces potential profits but minimizes risk. Changes in margin rules may require more capital upfront, affecting trade frequency. Updated regulations on pattern day trading rules can increase the minimum account balance needed. Overall, traders must stay informed to avoid compliance issues and adapt their strategies to new limits and reporting obligations.

Learn about How Do Prop Firms Affect Day Trading Strategies?

Conclusion about What are the key regulations every day trader should know?

In summary, understanding and adhering to key regulations is essential for successful day trading. From SEC rules to minimum equity requirements and the intricacies of margin usage, compliance safeguards traders against legal repercussions and enhances their market strategies. Awareness of tax implications and trading hour restrictions further contributes to informed decision-making. By staying updated on regulatory changes and best practices, day traders can navigate the complexities of the market effectively. For comprehensive insights and guidance, DayTradingBusiness is here to support your trading journey.

Learn about FINRA Regulations Every Day Trader Should Know

Sources:

- Do regulations work? A comprehensive analysis of price limits and ...

- Issues Brief - Globalization: A Brief Overview

- The Fed - Supervision and Regulation:

- The Fed Explained: What the Central Bank Does

- The past, present, and future of plastic pollution - ScienceDirect

- Guidelines for Public Expenditure Management--Section 3--Budget ...