Did you know that the term "day trading" sounds a lot more exciting than it actually is—kind of like "extreme ironing"? But for serious traders, understanding the Pattern Day Trader (PDT) rule is crucial. This article dives into what the PDT rule entails, who qualifies, and how day trades are defined. We'll clarify the trading limits imposed by the rule and discuss its impact on margin accounts. Plus, you'll learn how to avoid the PDT designation, the consequences of violations, and how brokerages enforce these rules. We also cover the minimum equity requirements for day trading, tax implications, and strategies to minimize both PDT and tax impacts. Lastly, we’ll explore how to transition from day trading to long-term investing. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of day trading and its financial ramifications.

What Is the Pattern Day Trader (PDT) Rule?

The Pattern Day Trader (PDT) rule restricts traders who execute four or more day trades within five business days in a margin account, unless they maintain at least $25,000 equity. If you’re classified as a PDT, you can’t day trade without meeting this threshold, or your account gets restricted. It mainly affects account requirements and trading frequency, not taxes directly. However, frequent day trading can lead to short-term capital gains taxed at higher rates.

Who Qualifies as a Pattern Day Trader?

A pattern day trader is someone who executes four or more day trades within five business days in a margin account, provided these trades make up more than 6% of their total trading activity during that period. They must maintain a minimum equity of $25,000 in their account to continue day trading without restrictions.

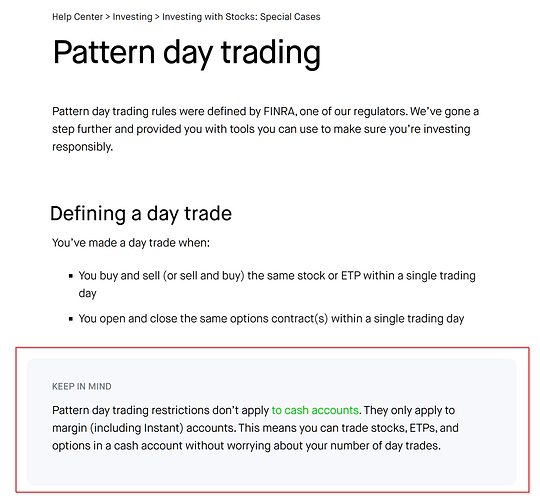

How Is a Day Trade Defined?

A day trade occurs when you buy and sell the same security within a single trading day. If you execute four or more day trades within five business days, using a margin account and maintaining a minimum of $25,000, you're considered a pattern day trader under the PDT rule. This designation requires maintaining the minimum equity and impacts your trading frequency and tax reporting.

What Are the PDT Rule’s Trading Limits?

The PDT rule limits traders to three day trades within five business days if their account balance is under $25,000. If you exceed three day trades in that period, your account gets restricted to cash-only trading for 90 days or until you meet the $25,000 minimum equity.

How Does the PDT Rule Affect Margin Accounts?

The PDT rule restricts margin accounts to four day trades in five business days unless the account has at least $25,000. If you violate this, your account gets restricted from day trading for 90 days. It forces traders to maintain higher account balances or limit trades, affecting liquidity and trading flexibility. Tax-wise, it doesn’t directly impact taxes but influences trading activity and potential gains or losses.

Can You Avoid the PDT Rule?

You can't legally avoid the PDT rule if you're classified as a pattern day trader with less than $25,000 in your margin account. To bypass it, you need to keep your account above $25,000 or trade only on cash accounts, which limits frequent day trading. Using multiple accounts or switching brokerages doesn't help avoid the rule. The tax impact remains unchanged regardless of the rule—profits are taxed as short-term capital gains if held under a year.

What Are the Consequences of Violating the PDT Rule?

Violating the PDT rule leads to a 90-day trading ban on accounts with less than $25,000 in equity. During this period, you can't day trade—buying and selling the same security within the same day. If you ignore the rule repeatedly, your account may be restricted or frozen. Tax-wise, frequent day trading can increase your taxable income, potentially pushing you into a higher tax bracket and making record-keeping more complicated.

How Do Brokerages Enforce the PDT Rule?

Brokerages enforce the PDT rule by placing a 25% margin requirement on day trades for accounts with less than $25,000. If you execute four day trades within five business days and your account is under $25,000, they restrict further day trading activity. They may also freeze your trading account or limit trading options until you deposit more funds.

What Is the Minimum Equity Requirement for Day Trading?

The minimum equity requirement for day trading under the Pattern Day Trader (PDT) rule is $25,000.

How Does the PDT Rule Impact Small Investors?

The PDT rule limits small investors to only three day trades within five days unless they maintain at least $25,000 in their account. This restricts frequent trading, forcing smaller traders to hold positions longer or risk account restrictions. It can slow down aggressive strategies and increase the need for careful planning. Tax-wise, frequent day trading can lead to short-term capital gains, which are taxed higher, but the PDT rule itself doesn’t directly affect taxes—only trading activity does.

Learn about How Does the PDT Rule Impact Small Account Traders?

What Are the Tax Implications of Day Trading?

Day trading profits are taxed as ordinary income or capital gains, depending on how long you hold the trades. If you’re classified as a pattern day trader under the PDT rule, any gains are subject to the same tax rules, but frequent trading may lead to more complex tax reporting. Short-term trades usually generate taxable events taxed at your regular income rate, while holding investments longer can qualify for lower long-term capital gains rates. The PDT rule doesn’t change tax treatment but influences your trading activity, which affects your tax reporting and potential deductions.

How Are Day Trades Taxed?

Day trades are taxed as short-term capital gains, meaning profits are taxed at your ordinary income tax rate. The Pattern Day Trader (PDT) rule requires maintaining a minimum $25,000 account balance if you execute four or more day trades within five business days. If you violate the PDT rule, your broker can restrict your trading or require you to keep a higher balance. The tax impact of day trading is that all gains are considered short-term unless you hold positions longer than a year, which then qualifies for long-term capital gains tax rates.

Can You Deduct Day Trading Expenses on Taxes?

Yes, you can deduct day trading expenses on taxes if you qualify as a trader in securities and meet IRS requirements. These expenses include trading software, internet, research, and education costs. However, if you’re classified as an investor rather than a trader, these expenses are generally considered miscellaneous itemized deductions, which are limited or disallowed under current tax law.

How Does the PDT Rule Affect Your Tax Reporting?

The PDT rule requires maintaining a minimum $25,000 account balance if you execute four or more day trades within five days. This prevents you from day trading with less than that amount unless you’re classified as a pattern day trader. For tax reporting, it doesn't directly impact how you report income or losses, but it influences your trading activity—more day trades can lead to more detailed reporting using Schedule D and Form 8949. If you violate the PDT rule, your broker may restrict your account, affecting your trading frequency and, consequently, your tax reporting records.

Learn about How Do Regulations Affect Day Trader Tax Reporting?

What Strategies Minimize PDT and Tax Impact?

To minimize PDT and tax impact, avoid frequent day trading that triggers the pattern day trader rule, or maintain at least $25,000 in your trading account. Use longer-term investment strategies like swing trading or buy-and-hold to reduce daily trading activity and tax events. Consider trading outside the U.S. or with a different account type to sidestep PDT restrictions. For tax impact, hold assets longer to benefit from lower long-term capital gains rates instead of short-term gains, which are taxed higher. Keep detailed records to optimize tax reporting and consider tax-advantaged accounts like IRAs to defer or eliminate taxes on gains.

How Can You Transition from Pattern Day Trading to Long-Term Investing?

To transition from pattern day trading to long-term investing, start by reducing your frequent trades that trigger the PDT rule. Focus on holding stocks for at least 30 days to avoid the pattern day trader designation. Shift your mindset from quick profits to building a diversified portfolio with buy-and-hold strategies. Adjust your brokerage account settings if needed, and limit day trades to stay under the PDT threshold. This move not only reduces regulatory restrictions but also impacts taxes, as long-term investments are taxed at lower capital gains rates compared to short-term gains, which are taxed as ordinary income.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

Conclusion about What Is the Pattern Day Trader (PDT) Rule and Its Tax Impact?

In summary, understanding the Pattern Day Trader (PDT) rule is crucial for anyone engaged in day trading, as it dictates trading limits and margin account requirements. This rule not only affects your trading strategy but also has significant tax implications, necessitating careful planning. By staying informed and leveraging effective strategies, traders can navigate the PDT landscape while minimizing tax liabilities. To optimize your trading approach and gain deeper insights, consider the resources and expertise offered by DayTradingBusiness.

Learn about What is the Pattern Day Trader (PDT) rule and how does it affect traders?