Did you know that the IRS once mistakenly classified a group of day traders as "professional gamblers"? While the stakes in day trading are high, understanding the IRS rules is crucial to keep your profits intact. In this article, we delve into essential aspects like reporting day trading income, the classification of profits, and the tax implications that distinguish day trading from traditional investing. We’ll clarify when to file Schedule C, how losses are treated, and explain the wash sale rule. Additionally, we’ll define the difference between traders and investors, highlight tax advantages for traders, and outline necessary record-keeping for IRS compliance. Finally, we'll cover the nuances of margin, leverage, and the penalties for misreporting. Equip yourself with this vital information from DayTradingBusiness to navigate the complex world of day trading taxes effectively.

What are the IRS rules for reporting day trading income?

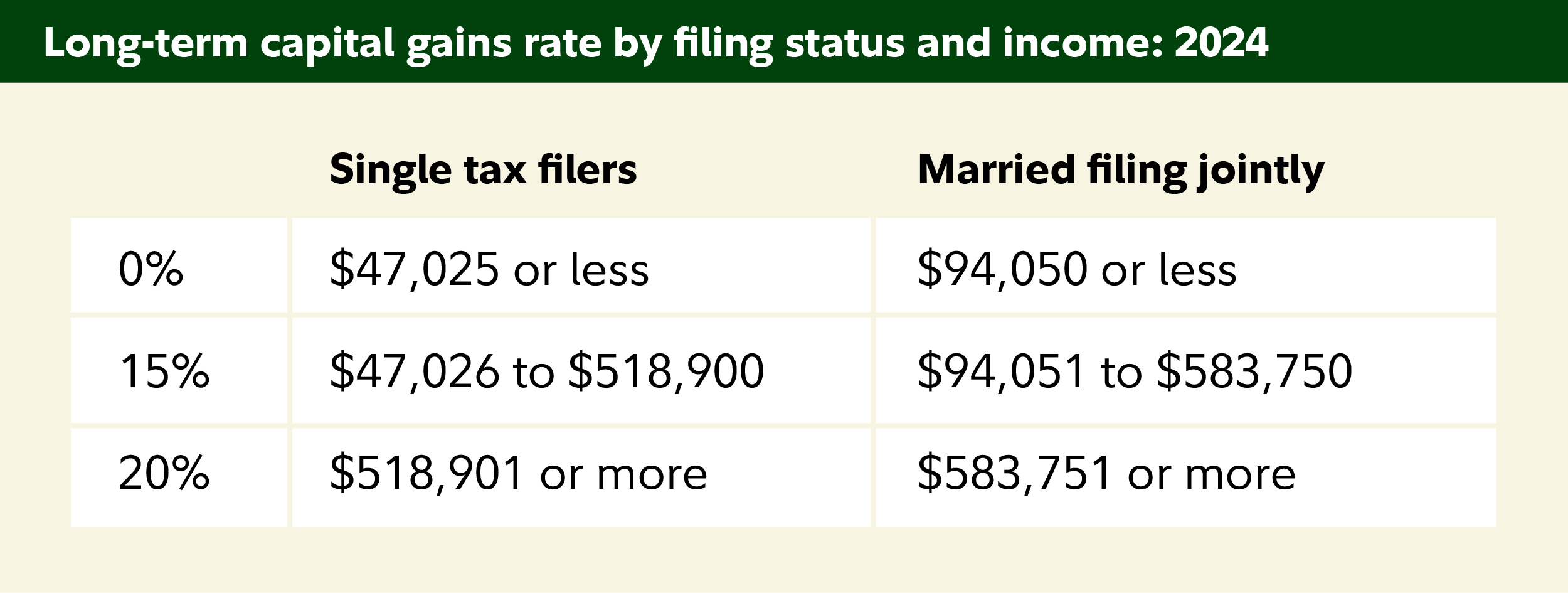

The IRS treats day trading income as either business income or capital gains, depending on your trading activity. If you actively buy and sell securities with the intent to profit daily, the IRS may classify you as a trader, allowing you to report earnings as business income on Schedule C. Otherwise, profits from buying and selling stocks or options are generally taxed as capital gains, reported on Schedule D. Short-term gains (held under a year) are taxed at your ordinary income rate, while long-term gains (held over a year) benefit from lower tax rates. You must keep detailed records of all trades, including dates, prices, and commissions. If you're considered a trader, you can deduct related expenses and mark-to-market losses, but you must meet specific IRS criteria for trader status.

How does the IRS classify day trading profits?

The IRS classifies day trading profits as ordinary income, taxed at your regular income tax rates.

What are the tax implications of day trading versus investing?

Day trading taxes are treated as ordinary income, so profits are taxed at your regular income tax rate, and losses can offset other income. In contrast, long-term investing profits are taxed at lower capital gains rates if held over a year. Day traders may qualify as a trader in securities, allowing for certain tax deductions, but they must meet strict IRS criteria. Frequent trading can trigger wash sale rules, disallowing losses if you buy the same security within 30 days. Overall, day trading's tax implications involve higher short-term tax rates and complex rules, while investing offers lower long-term capital gains taxes.

When do day traders need to file Schedule C?

Day traders need to file Schedule C if they qualify as sole proprietors and report their trading as a business. This applies when their trading activity is regular, substantial, and conducted with the intent to profit from short-term market moves. If trading is more of an investment activity, they typically report gains on Schedule D instead.

How are day trading losses treated by the IRS?

Day trading losses can be used to offset gains, reducing taxable income. If losses exceed gains, up to $3,000 can be deducted from other income annually. Excess losses beyond $3,000 can be carried forward to future years. These losses are reported on Schedule D and Form 8949, and day traders may also qualify for trader tax status, affecting how losses are treated.

What is the wash sale rule and how does it affect day traders?

The wash sale rule disallows claiming a loss on a security if you buy the same or a substantially identical stock within 30 days before or after selling it at a loss. For day traders, this means any losses from quick trades can’t be deducted if they repurchase the same stock within that window, potentially delaying tax benefits and complicating record-keeping. It forces traders to track their trades carefully to avoid disallowed losses and adjust cost basis calculations accordingly.

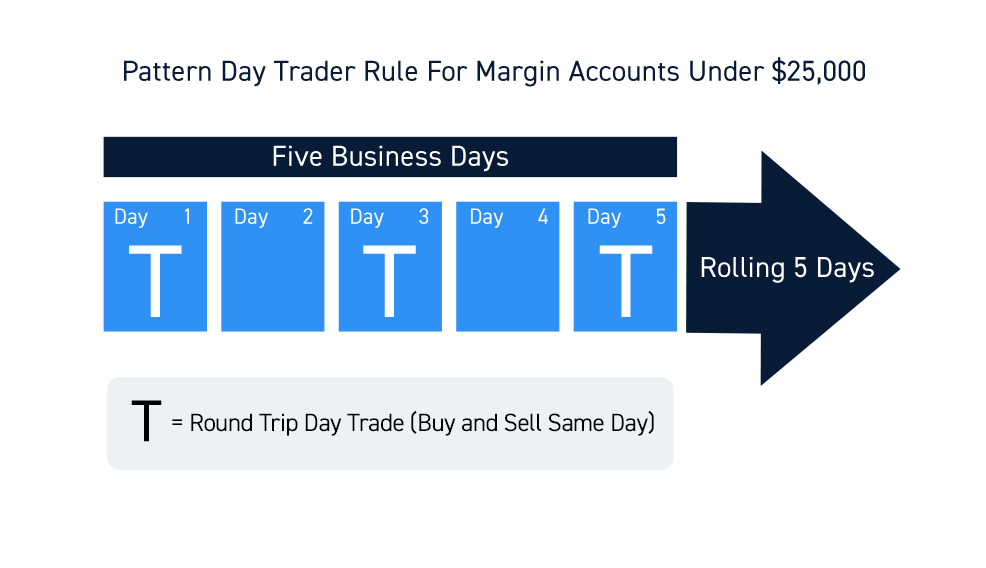

Are there specific IRS rules for pattern day traders?

Yes, IRS rules for pattern day traders require reporting profits and losses on Schedule C or Schedule D, and they must track trading activity closely. While IRS doesn't have a specific "pattern day trader" designation like FINRA, frequent traders may be subject to wash sale rules, and large gains could trigger higher tax rates. It's important to keep detailed records of trades for accurate tax reporting.

How does the IRS define a trader vs. an investor?

The IRS defines a trader as someone actively buying and selling securities with the primary goal of generating short-term profits, often trading frequently and holding positions for less than a year. Traders qualify for Mark-to-Market accounting, allowing them to treat gains and losses as ordinary income. Investors, by contrast, buy securities to hold long-term, focusing on appreciation and dividends, and report gains or losses on Schedule D. The key difference is activity level and intent: traders are actively engaged in the market, while investors are more passive.

What are the tax advantages of being classified as a trader?

Being classified as a trader allows you to deduct trading-related expenses directly against your income without the 60/40 split of long-term and short-term gains. It enables you to mark-to-market your securities at year-end, avoiding wash sale rules and allowing full write-offs of losses. Trader status also grants you the ability to treat gains and losses as ordinary income or loss, potentially reducing your tax liability.

How do IRS rules differ for stocks, options, and futures trading?

IRS rules treat stocks, options, and futures differently for tax purposes. Stocks are taxed as capital gains or losses when sold, with short-term if held under a year, long-term if held longer. Options are also taxed as capital gains, but the IRS considers whether the option is a short-term or long-term holding, and some strategies can create different tax treatments. Futures are taxed under Section 1256, which applies a 60% long-term and 40% short-term capital gains split, regardless of holding period, often resulting in more favorable tax rates for active traders.

What records do day traders need to keep for IRS compliance?

Day traders must keep detailed records of all trades, including dates, prices, quantities, and commissions. They should document account statements, trade confirmations, and the rationale for trades. Keep records of all income, expenses related to trading, and any transfers between accounts. Also, track holding periods to distinguish short-term from long-term gains. These records support IRS reporting and help determine whether to file as a trader or investor.

How does the IRS handle margin and leverage in day trading taxes?

The IRS considers margin and leverage as borrowed funds that increase your trading positions. When you use margin, the IRS treats gains and losses as if you owned the full position value, but your cost basis reflects the borrowed amount. Leverage amplifies both gains and losses, which get reported on your taxes; however, the IRS requires accurate tracking of your borrowed funds. You must report gains, losses, and interest paid on margin loans, and leverage doesn’t change the tax rates but can impact your overall tax liability and how you calculate your cost basis.

Learn about How to Handle Foreign Day Trading Tax Regulations

Can day traders qualify for the trader tax status?

Yes, day traders can qualify for trader tax status if they actively buy and sell securities with substantial frequency, intent to profit from daily market movements, and meet IRS criteria. They must demonstrate consistent, regular trading activity and hold themselves out as traders rather than investors.

What are the penalties for not reporting day trading income correctly?

Penalties for not reporting day trading income correctly include fines, interest on unpaid taxes, and potential criminal charges. The IRS can impose a 20% accuracy-related penalty for underreporting, plus interest on owed amounts. In severe cases, fraudulent misreporting can lead to criminal prosecution, hefty fines, and even prison time.

How do IRS rules impact short-term vs. long-term trading gains?

IRS rules treat short-term trading gains as ordinary income, taxed at your regular rate, if assets are held one year or less. Long-term trading gains benefit from lower capital gains tax rates if assets are held over a year. Frequent trading can trigger "trader" status, affecting tax classification, but most casual traders pay taxes based on holding periods—short-term gains taxed higher, long-term gains taxed lower.

Learn about How do SEC rules impact day trading activities?

Conclusion about Understanding IRS Rules on Day Trading Taxes

Navigating IRS rules on day trading taxes is crucial for maintaining compliance and maximizing your financial outcomes. Understanding how day trading profits are classified, the importance of accurate reporting, and the implications of the wash sale rule can significantly impact your tax liabilities. DayTradingBusiness provides essential insights and resources to help you effectively manage your tax obligations and ensure you're taking advantage of all available benefits. Stay informed and organized to optimize your trading strategy and minimize tax risks.

Sources:

- Ex dividend day stock price behavior: discreteness or tax-induced ...

- Economic Issues No. 27 -- Tax Policy for Developing Countries

- 2022 I-111 Form 1 Instructions - Wisconsin Income Tax

- Tax-induced trading around ex-dividend days - ScienceDirect

- Market-based oil spill(overs): Market reactions to the energy windfall ...

- West Virginia - Personal Income Tax Forms & Instructions