Did you know that in the world of finance, some traders can actually make more money by keeping track of their losses than others do by celebrating their gains? In the realm of day trading, understanding mark-to-market accounting is crucial. This article dives into the essentials of mark-to-market accounting for day traders, highlighting its definition, effects on daily profits, tax implications, and how it influences trading strategies. We’ll explore the benefits and risks associated with this accounting method, what records are necessary, and the IRS rules that govern it. Additionally, we'll clear up common misconceptions and discuss how mark-to-market can impact margin requirements and trading across various asset classes. Join us at DayTradingBusiness to uncover how mastering this accounting method can enhance your trading approach and potentially reduce your tax liability.

What is mark-to-market accounting for day traders?

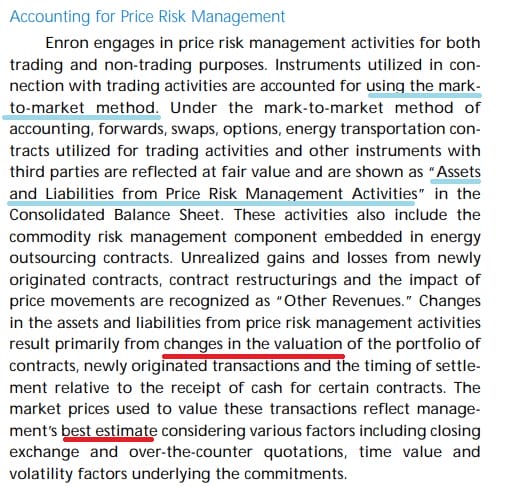

Mark-to-market accounting for day traders means valuing their open positions at current market prices daily. It requires profits and losses to be recognized immediately, affecting taxable income each trading day. This approach gives a real-time view of trading performance but can lead to higher tax bills during volatile periods. It simplifies tax reporting and aligns accounting with actual market value.

How does mark-to-market affect daily trading profits?

Mark-to-market updates trading profits daily by valuing positions at current market prices. This means gains and losses are recognized immediately, reflecting real-time profit or loss. For day traders, it shows an accurate snapshot of their daily performance, influencing decisions and closing out positions. It can cause significant swings in reported profits based on market fluctuations, highlighting gains or losses instantly.

What are the tax implications of mark-to-market accounting?

Mark-to-market accounting requires day traders to recognize gains and losses on their trading positions daily. This means profits are taxed as ordinary income in the year they occur, even if profits aren’t realized through actual sale. It can lead to higher tax bills in profitable years and allows traders to deduct losses immediately. The IRS treats these gains as ordinary income, not capital gains, affecting tax rates and deductions.

Can day traders choose to use mark-to-market accounting?

Yes, day traders can choose to use mark-to-market accounting if they qualify as traders in securities and elect it on IRS Form 3115.

How does mark-to-market impact reported income on tax returns?

Mark-to-market accounting forces traders to report unrealized gains and losses as if they were realized every day. This means fluctuations in market value directly affect reported income on tax returns, making gains taxable even if not cashed out. Traders using mark-to-market must include these daily changes in income, leading to more consistent and predictable tax obligations.

What are the benefits of mark-to-market for active traders?

Mark-to-market accounting updates a trader’s portfolio to current market value daily, providing real-time profit and loss clarity. It helps active traders assess their true financial position instantly, aiding quicker decision-making. This approach ensures accurate tax reporting by reflecting gains or losses as they occur, avoiding year-end surprises. It also facilitates better risk management by showing the immediate impact of market swings. Overall, mark-to-market promotes transparency, enabling day traders to track performance precisely and adjust strategies swiftly.

What are the risks of using mark-to-market accounting?

Mark-to-market accounting can cause volatile earnings swings because asset values fluctuate daily, leading to unpredictable financial statements. It may incentivize traders to delay recognizing losses or manipulate holdings to improve short-term appearances. During market crashes, it can force firms to realize losses prematurely, risking insolvency. The approach amplifies market volatility and can mislead investors about true financial health.

How does mark-to-market influence trading strategies?

Mark-to-market adjusts asset values daily, forcing traders to realize gains or losses immediately. This volatility pushes day traders to stay alert, manage risk tightly, and close positions quickly to avoid large swings. It encourages frequent trading, as traders capitalize on short-term price movements rather than holding long-term. Mark-to-market also means traders can quickly see the impact of market shifts, influencing their decisions and strategy adjustments throughout the day.

What records are needed for mark-to-market accounting?

You need records of all open positions, daily market prices, transaction dates, trade details (price, size, time), and account balances. Also, document any adjustments or fair value estimates used in valuation.

How does mark-to-market compare to historical cost accounting?

Mark-to-market accounting values assets at current market prices, reflecting real-time gains or losses, which makes it highly responsive to market fluctuations. In contrast, historical cost accounting records assets at their original purchase price, ignoring current market changes. For day traders, mark-to-market provides immediate profit or loss clarity, enabling quick decisions, while historical cost offers less relevant long-term valuation, often distorting current performance.

What are the IRS rules on mark-to-market for traders?

IRS rules allow traders to elect mark-to-market accounting under Section 475(f), which treats all gains and losses as ordinary income or loss, avoiding wash sale rules. This election must be made by the tax return due date, including extensions. Once elected, traders must use mark-to-market accounting for all trading in securities, resetting their gains and losses to fair market value at year-end. This simplifies tax reporting for active traders but requires consistent application.

How does mark-to-market affect margin requirements?

Mark-to-market increases margin requirements when the value of a trader’s position declines, forcing them to deposit more funds to cover potential losses. It adjusts margin levels daily based on current market prices, so losses can trigger higher margin calls. Conversely, if the market moves favorably, margin requirements may decrease, freeing up capital. This daily revaluation keeps margin requirements closely tied to real-time market conditions, impacting a trader’s liquidity and risk management.

Can mark-to-market accounting help reduce tax liability?

Yes, mark-to-market accounting can help day traders reduce tax liability by allowing them to treat gains and losses as ordinary income and losses. It enables traders to offset gains with losses in the same year, avoiding the wash sale rule and simplifying tax reporting. This approach often results in more favorable tax treatment compared to capital gains, especially for frequent traders.

What challenges do traders face with mark-to-market?

Traders face volatility swings because mark-to-market updates their account values daily, forcing them to realize gains or losses immediately. This can lead to margin calls if markets move against them quickly. It also increases stress, as they must constantly monitor positions to avoid sudden liquidation. Small price fluctuations can cause significant swings in their reported equity, making risk management more complex. Overall, mark-to-market intensifies the pressure of rapid decision-making and exposes traders to higher financial risk.

How does mark-to-market impact trading in different asset classes?

Mark-to-market updates asset values daily, forcing day traders to realize gains or losses immediately. In stocks, it means real-time profit calculation, increasing pressure to act quickly. For commodities, volatile prices cause rapid value swings, heightening risk and trading activity. In futures, mark-to-market adjusts margins daily, impacting leverage and liquidity. Overall, it makes trading more transparent but also more stressful, as traders see exact profit or loss at every market move.

What are the common misconceptions about mark-to-market?

Many believe mark-to-market means daily profits are real and guaranteed, but it only reflects current market value, not actual cash. Some think it forces traders to realize losses daily, but it simply updates asset values; losses aren't mandatory unless assets are sold. Others assume mark-to-market inflates gains during rising markets, creating false impressions of profitability; it shows paper gains, not actual cash. Lastly, some believe mark-to-market causes excessive volatility in trader accounts, but it just reports true value fluctuations, not additional risk.

Conclusion about Implications of Mark-to-Market Accounting for Day Traders

Understanding mark-to-market accounting is essential for day traders to optimize their trading strategies and manage tax implications effectively. By recognizing its impact on daily profits, reported income, and margin requirements, traders can make informed decisions that align with their financial goals. While there are benefits, such as potential tax liability reduction, there are also risks and challenges that must be navigated. For those seeking expert guidance on mark-to-market and its implications, DayTradingBusiness offers valuable resources to enhance your trading journey.