Did you know that if day trading were a country, it would have a tax code thicker than a phone book? Navigating the complexities of reporting day trading income on your tax return can feel overwhelming, but it's essential for maximizing your profits and minimizing your liabilities. In this article, we break down the key elements you need to know, including how to report your trading income, the necessary forms, and the differences between day trading and regular investment income. We'll also cover critical aspects like tax implications for sole proprietors, expense deductions, the wash sale rule, and best practices for record-keeping. Whether you’re dealing with multiple brokerage accounts or trying to understand trader tax status, DayTradingBusiness has you covered with straightforward guidance to help you avoid common pitfalls and stay compliant.

How do I report day trading income on my tax return?

Report your day trading income on Schedule C if you're considered a trader, detailing profits and losses from your trades. Include any net gains or losses on Form 8949 and Schedule D if you're classified as an investor. If your trading activity qualifies as a business, use Schedule C to report income and expenses; if not, report gains on Schedule D. Keep detailed records of all trades, including purchase and sale dates, amounts, and associated costs.

What forms do I need to include for day trading profits?

You need to include Schedule C (Profit or Loss from Business) if you trade as a sole proprietor, or Schedule D (Capital Gains and Losses) if you classify trading profits as capital gains. If you’re a trader using a mark-to-market accounting method, report gains and losses on Schedule C and Form 4797. Also, include Form 8949 for detailed capital gain/loss transactions.

How is day trading income taxed differently from regular investment income?

Day trading income is taxed as ordinary income, meaning it’s subject to your regular income tax rates. If you qualify as a trader-in-business, you can report it on Schedule C, deducting related expenses. Unlike long-term investment gains, which are taxed at lower capital gains rates, day trading profits are taxed as short-term capital gains or ordinary income. You must also pay self-employment taxes if you’re considered a trader-in-business.

Should I report day trading as business income or capital gains?

Report day trading as business income if you actively trade daily, keep detailed records, and intend to make trading your main source of income. If you buy and sell securities occasionally for profit, report gains as capital gains. The IRS considers active, frequent trading as a business, requiring Schedule C; casual trading falls under capital gains on Schedule D.

What are the tax implications of day trading as a sole proprietor?

As a sole proprietor, day trading income is taxed as ordinary self-employment income. You must report it on Schedule C (Profit or Loss from Business) and pay self-employment taxes via Schedule SE. If you qualify, you may also report gains and losses on Schedule D, but profits from day trading are often considered business income, making Schedule C the primary form. Keep detailed records of all trades and expenses to accurately report your net income.

How do I calculate my day trading gains and losses?

To calculate your day trading gains and losses, track every trade’s purchase and sale price, including fees. Subtract the cost basis from the sale price for each trade to find individual gains or losses. Sum all gains and losses to get your total for the year. Use this total to report your day trading income or loss on IRS Schedule C or Schedule D, depending on your trading activity classification. Keep detailed records of all transactions for accurate reporting.

Can I deduct expenses related to day trading on my taxes?

Yes, you can deduct expenses related to day trading on your taxes if you qualify as a trader in securities. These expenses include trading software, internet costs, books, and home office expenses. Report your day trading income on Schedule C if you’re considered a trader, and deduct your related expenses there. If you’re classified as an investor, you typically report income on Schedule D and cannot deduct trading expenses.

What is the wash sale rule and how does it affect day trading taxes?

The wash sale rule disallows claiming a loss on a security if you buy the same or a substantially identical stock within 30 days before or after selling it at a loss. For day traders, this means any losses from such transactions are added to the cost basis of the repurchased security, delaying their deduction. It prevents traders from claiming quick losses to reduce taxable income, complicating how you report gains and losses on your tax return.

How do I handle multiple brokerage accounts when reporting day trading income?

Combine all brokerage accounts’ income and expenses when reporting day trading on Schedule C or Schedule D. Use a single consolidated broker statement or transaction summary to calculate total gains, losses, and expenses. Clearly identify each account’s activity if needed, but report the total day trading income as one figure on your tax return. Keep detailed records of trades and account statements to support your income calculation.

When are my day trading profits taxable during the year?

Your day trading profits are taxable in the year you realize them, meaning when you close a trade and lock in the gain or loss. If you sell a position at a profit in 2023, that profit is taxable in 2023. If you hold the position and don’t sell, you don’t recognize the profit until you close the trade.

How does the mark-to-market accounting method impact my tax reporting?

Mark-to-market accounting treats all open trading positions as sold at fair market value at year-end, which means your unrealized gains and losses become taxable or deductible. This simplifies tax reporting for day traders because you report all gains and losses as if you've closed every position daily, avoiding the wash sale rule. It results in more predictable income and losses, but also means you pay taxes on paper gains even if you haven't actually received cash. You must file Form 3115 to elect mark-to-market accounting, and it affects how you report day trading income on Schedule C or Schedule D.

What records should I keep for accurate day trading tax reporting?

Keep detailed records of all trades, including dates, prices, quantities, and commissions. Save brokerage statements and trade confirmations. Track your realized gains and losses separately from unrealized ones. Maintain a journal of your trading activities and strategies. Store bank and payment records related to trading funds. Keep receipts for any trading-related expenses or tools. These records ensure accurate reporting of day trading income on your tax return.

Learn about How to Keep Records for Day Trading Tax Purposes

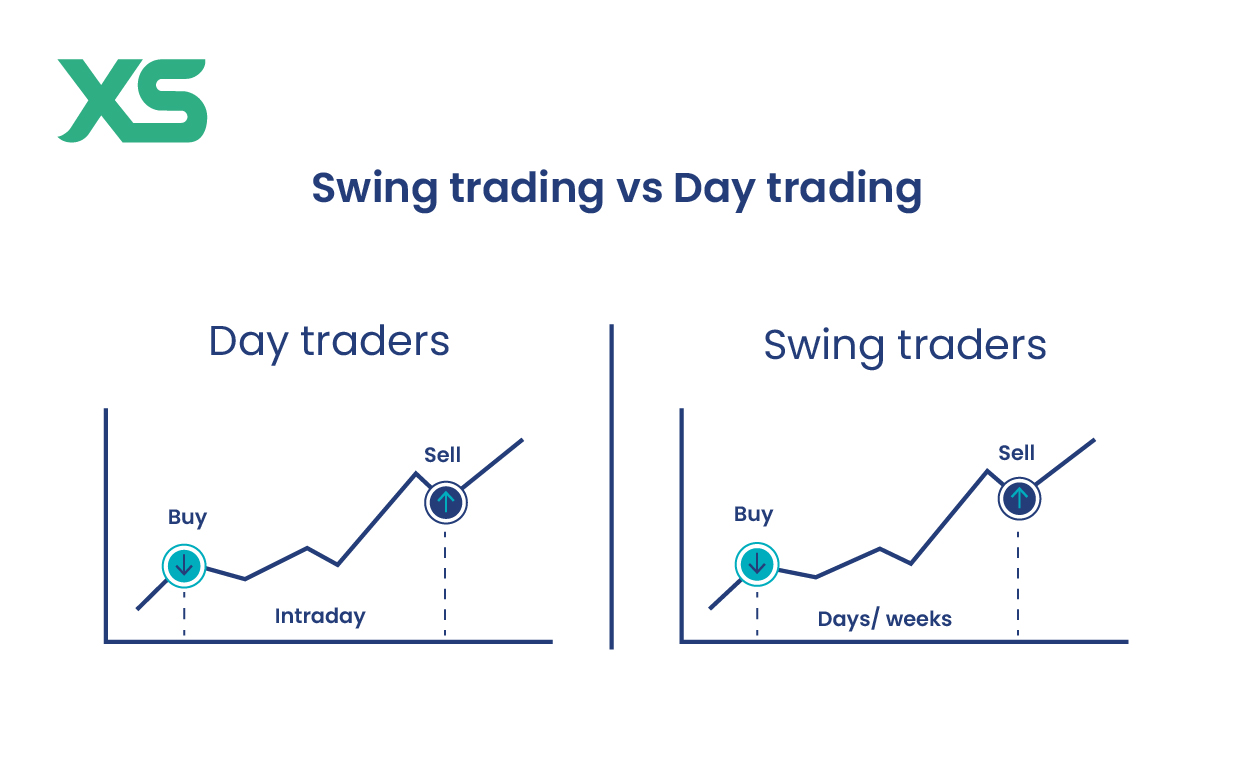

How do I report swing trades versus day trades?

Report swing trades and day trades separately on Schedule D and Form 8949. Use different codes for short-term (less than a year) and long-term (more than a year) transactions. For day trades, typically report them as short-term capital gains on Schedule D, using the appropriate box for day trading activity. Ensure each trade is listed with the correct purchase and sale dates, amounts, and cost basis. Keep detailed records of each trade to support your tax reporting.

Are there specific tax forms for traders using the trader tax status?

Yes, traders using the trader tax status typically file Schedule C (Profit or Loss from Business) and may also need Schedule SE for self-employment tax. They often report their income and expenses related to trading activities directly on Schedule C.

Learn about Are There Tax Benefits for Day Traders Using Retirement Accounts?

What are common mistakes to avoid when reporting day trading income?

Avoid underreporting or forgetting to include all trading income, including gains from options and futures. Don’t mix trading income with investment income—use the correct IRS forms like Schedule C or Schedule D. Skip detailed records—keep track of every trade, date, and profit/loss. Fail to differentiate between short-term and long-term gains, which affects tax rates. Overlooking wash sales or failing to report them properly can lead to audits. Don't neglect to report expenses like trading software or education costs if applicable. Lastly, avoid procrastinating on reporting; late filings or inaccuracies can trigger penalties.

Learn about Common Mistakes in Day Trading Analysis to Avoid

Conclusion about How to Report Day Trading Income on Your Tax Return

In summary, accurately reporting day trading income on your tax return requires careful attention to detail and an understanding of various tax implications. Depending on your trading frequency and strategy, you may need to differentiate between capital gains and business income, utilize specific forms, and consider deductions for trading-related expenses. Keeping thorough records and understanding rules like the wash sale can significantly impact your tax outcomes. For personalized guidance, DayTradingBusiness offers valuable resources to help you navigate these complexities effectively.

Learn about How to Handle Foreign Day Trading Tax Regulations