Did you know that in some cases, you can end up paying more in taxes than you made in profits from your day trading? Understanding how short-term trading affects your tax rate is crucial for every trader. This article dives into the nuances of short-term versus long-term trading taxation, revealing how frequent trading can impact your overall tax bracket and capital gains taxes. We explore essential tax implications, including the effects of holding periods, wash sales, and reporting requirements. Additionally, we provide strategies to minimize taxes on short-term gains, ensuring you keep more of your hard-earned profits. Join DayTradingBusiness as we break down the complex world of trading taxes to help you navigate your financial future effectively.

Does short-term trading increase my tax rate?

Yes, short-term trading usually increases your tax rate because profits are taxed as ordinary income, which can be higher than long-term capital gains.

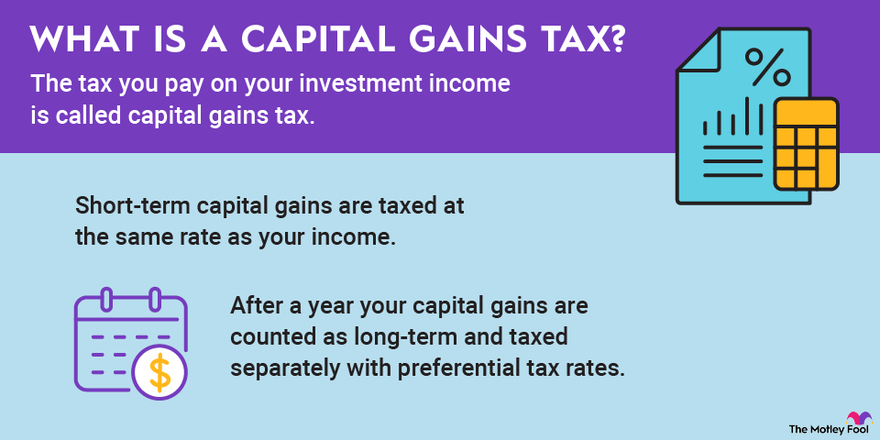

How is short-term trading taxed compared to long-term trading?

Short-term trading is taxed at your ordinary income tax rate, which can be higher—up to 37%—depending on your income. Long-term trading profits are taxed at lower rates, typically 0%, 15%, or 20%, depending on your tax bracket. This means short-term gains often result in a bigger tax hit than long-term gains.

What are the tax implications of frequent trading?

Frequent trading typically results in short-term capital gains, taxed at your ordinary income tax rate, which is usually higher than the long-term capital gains rate. This means you pay more taxes on profits from quick trades, often bumping your tax rate into higher brackets. If you trade daily or weekly, expect to owe taxes regularly, reducing your net gains. The IRS treats these gains as ordinary income, so your overall tax bill can increase significantly compared to holding investments long-term.

Do I pay higher taxes on short-term gains?

Yes, short-term gains are taxed at your ordinary income tax rate, which is usually higher than the long-term capital gains rate.

How does holding period affect my taxes?

Holding period determines your tax rate on trades. Short-term trades (held under a year) are taxed at your ordinary income rate, which can be higher. Long-term trades (held over a year) qualify for lower capital gains tax rates. Faster trades mean higher taxes, slower holding can save you money.

Can short-term trading push me into a higher tax bracket?

Yes, profits from short-term trading are taxed at your ordinary income tax rate, which can be higher than long-term capital gains. If your short-term gains boost your annual income enough, they could push you into a higher tax bracket.

What are the tax rates for day trading profits?

Day trading profits are taxed as ordinary income, so your tax rate depends on your income bracket. If you're in the 24% tax bracket, your day trading gains are taxed at 24%. Short-term trading profits are subject to federal income tax rates ranging from 10% to 37%, based on your total annual income. No special tax rate applies specifically to day trading; it’s taxed the same as regular income.

How do wash sales impact my taxes in short-term trading?

Wash sales disallow the loss from a trade if you buy the same or a substantially identical security within 30 days before or after selling at a loss. This loss can't be deducted immediately; instead, it's added to the cost basis of the new shares, delaying the tax benefit. In short-term trading, this prevents you from claiming quick losses to offset gains, potentially increasing your taxable income and your short-term capital gains tax rate.

Are there specific tax rules for active traders?

Yes, active traders typically report gains as short-term capital gains, taxed at ordinary income rates. They must track each trade’s profit or loss and may need to file Schedule D and Form 8949. Frequent trading can trigger IRS scrutiny, so accurate records are essential. Some traders qualify for trader tax status, which offers benefits like deduction of trading expenses, but it requires meeting specific criteria.

How does short-term trading affect my capital gains taxes?

Short-term trading increases your capital gains taxes because profits from trades held under a year are taxed at your ordinary income rate, which is usually higher than the long-term capital gains rate. This means more of your gains are taxed at higher rates, reducing net profit. Frequent trading can also lead to complex tax reporting and potential wash sale rules, further impacting your taxes.

Do I need to report every trade for tax purposes?

Yes, you need to report every trade on your taxes. The IRS requires tracking all buy and sell transactions, especially for short-term trades, which are taxed at your ordinary income rate. Failing to report any trade can lead to penalties or audits. Keep detailed records of each trade to ensure accurate reporting.

What deductions are available for active traders?

Active traders can deduct trading-related expenses like home office costs, trading software, and research materials. They may also deduct commissions and fees directly tied to trading activities. If they qualify as traders, they can elect to mark-to-market accounting, which allows gains and losses to be treated as ordinary income or loss, avoiding capital gains tax rates. Expenses for education, seminars, and subscriptions specific to trading can also be deductible.

How does short-term trading impact my taxable income?

Short-term trading increases taxable income because profits from trades held less than a year are taxed at your ordinary income tax rate. This can push you into a higher tax bracket, raising the overall tax you owe. Frequent short-term trades can lead to higher tax bills compared to long-term investing, which benefits from lower capital gains rates.

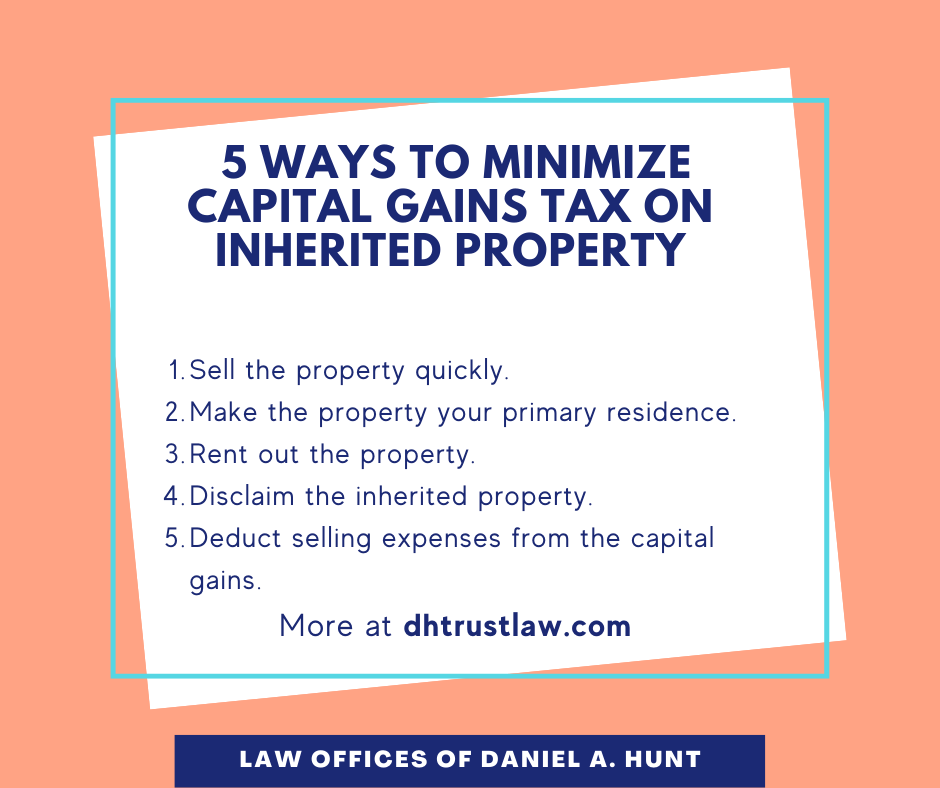

What are the best strategies to minimize taxes on short-term gains?

To minimize taxes on short-term gains, hold assets longer than a year to qualify for long-term capital gains rates. Use tax-loss harvesting by selling losing investments to offset gains. Invest through tax-advantaged accounts like IRAs or 401(k)s to avoid immediate taxes. Consider timing trades to spread gains across tax years. Be aware of the wash sale rule to prevent disallowed losses. Keep detailed records of all trades for accurate tax reporting. Consult a tax professional for personalized strategies.

How do I calculate taxes owed on short-term trading profits?

To calculate taxes owed on short-term trading profits, add up your gains from buying and selling assets held for a year or less. Then, include these profits in your ordinary income and apply your current income tax rate. For example, if you made $5,000 in short-term gains and your total income puts you in the 24% tax bracket, you'll owe $1,200 in taxes on those gains. Keep detailed records of every trade to accurately report your short-term trading profits on your tax return.

Conclusion about How Does Short-Term Trading Affect Your Tax Rate?

In conclusion, short-term trading has significant tax implications that can elevate your tax rate and affect your overall financial strategy. Understanding the differences between short-term and long-term capital gains, as well as the impact of frequent trading, is essential for effective tax planning. Active traders must be aware of specific IRS rules, including wash sales and potential deductions. By staying informed and employing strategic methods to minimize tax liabilities, you can navigate the complexities of short-term trading more effectively. For comprehensive insights and guidance on managing your trading taxes, DayTradingBusiness is here to help.