Did you know that ignoring regulatory compliance in day trading is like trying to build a house on quicksand? In the fast-paced world of day trading, understanding the importance of regulatory compliance is crucial for long-term success. This article delves into why compliance matters, how it impacts your trading performance, and the key regulations you need to follow. We’ll cover the risks of non-compliance, the necessary steps for registering as a day trader, and the implications of anti-money laundering laws. Additionally, learn how compliance affects your choice of brokers, the penalties for violations, and best practices to stay updated. By following these guidelines, traders can safeguard their investments and enhance their overall trading operations—all with insights from DayTradingBusiness.

Why is regulatory compliance crucial for day traders?

Regulatory compliance is crucial for day traders because it safeguards their capital, prevents legal penalties, and ensures transparency. It helps traders avoid fines, sanctions, or account freezes caused by violating trading laws. Complying with regulations also boosts trust with brokers and clients, making it easier to operate smoothly. Without it, traders risk significant financial loss, reputation damage, and disqualification from markets.

How does compliance affect your trading success?

Compliance ensures your trading follows legal standards, reducing the risk of fines or account bans. It builds trust with brokers and investors, giving you better access to trading tools and markets. Staying compliant helps you avoid costly penalties and reputational damage that can derail your success. Plus, it encourages disciplined trading habits aligned with industry rules, improving long-term profitability. Without compliance, you risk losing everything over regulatory violations.

What are the main regulations day traders must follow?

Day traders must follow SEC and FINRA regulations, including maintaining minimum account balances (e.g., Pattern Day Trader rule requires $25,000), adhering to margin rules, and avoiding insider trading. They need to report suspicious activities, follow proper order execution protocols, and comply with record-keeping requirements. Staying within legal trading hours and avoiding manipulative practices like pump-and-dump are essential.

How can non-compliance harm your trading career?

Non-compliance can lead to fines, account suspension, or loss of trading privileges. It damages your reputation, making it harder to build trust with brokers and clients. Regulatory violations can trigger legal actions, draining time and resources. Overall, ignoring rules increases the risk of financial penalties and career-ending setbacks.

What are the key rules for registering as a day trader?

To register as a day trader, you must meet the pattern day trader rule: maintaining a minimum of $25,000 in your trading account. You need to file the appropriate paperwork with your broker and comply with FINRA and SEC regulations. Keep detailed records of all trades, and adhere to margin rules to avoid being flagged as a pattern trader. Regularly verify your account balance and trading activity to stay compliant.

How do anti-money laundering laws impact day trading?

Anti-money laundering laws require day traders to verify their identities and report suspicious activities, increasing compliance obligations. This means stricter know-your-customer (KYC) procedures and transaction monitoring, which can delay account setup or fund transfers. Non-compliance risks fines or account suspension, making traders more cautious about their trading practices. Overall, these laws promote transparency but add layers of regulation that day traders must navigate to stay lawful and avoid penalties.

What are the risks of ignoring financial regulatory requirements?

Ignoring financial regulatory requirements can lead to hefty fines, legal action, and license suspension. It increases the risk of fraud allegations, which can ruin your reputation and trading career. Non-compliance might result in account freezes or closures, halting your ability to trade. It also exposes you to increased scrutiny from authorities, making audits more likely. Ultimately, neglecting regulations can lead to significant financial losses and even criminal charges.

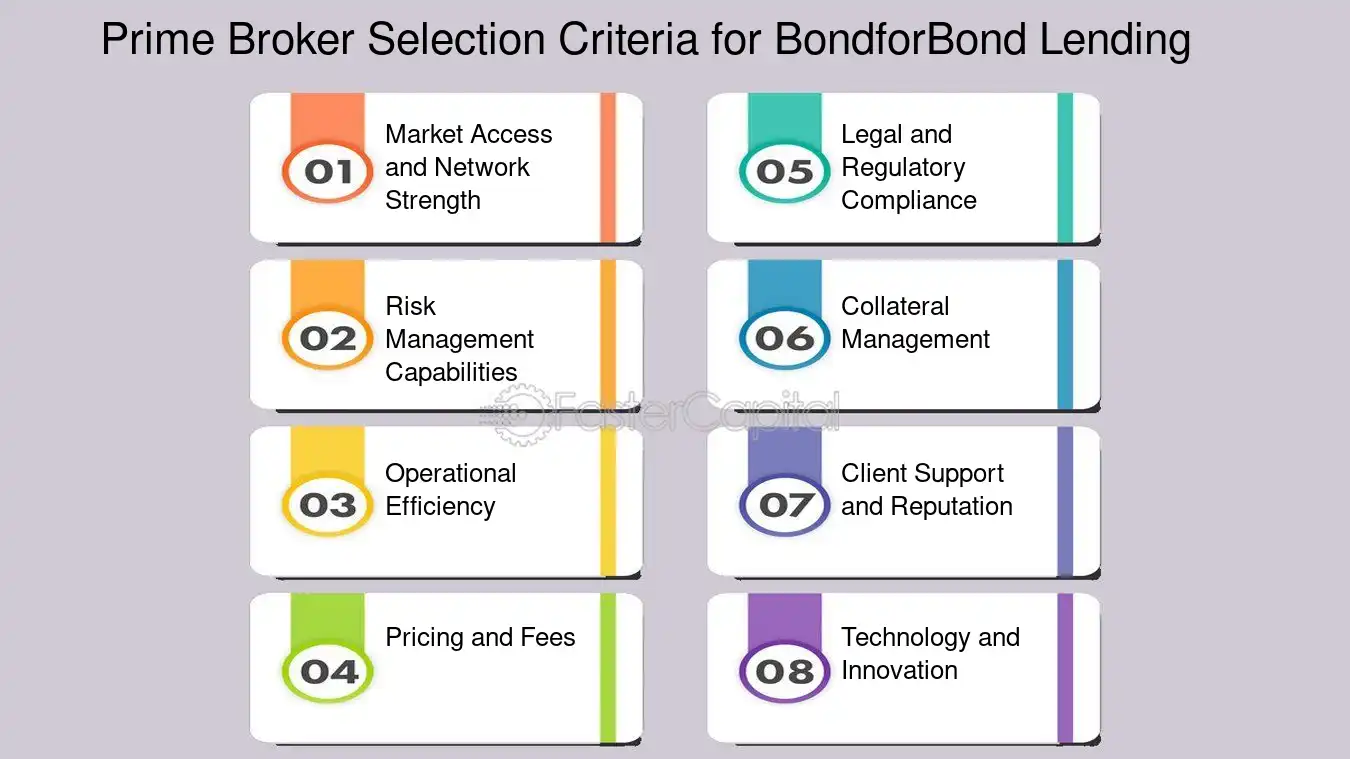

How does compliance influence broker selection?

Compliance influences broker selection by ensuring the broker adheres to regulatory standards, reducing risks like fraud or account freezes. Traders prioritize brokers with strong compliance to protect their funds and avoid legal issues. A compliant broker also offers transparent fee structures and reliable trade execution, boosting confidence. Choosing a regulated broker aligns with trustworthiness and long-term success in day trading.

What penalties do traders face for regulatory violations?

Traders face fines, license suspensions, or bans for regulatory violations. They might also be required to pay restitution or damages. In severe cases, regulators can pursue criminal charges leading to fines or imprisonment. Regulatory violations can also damage reputation, making future trading difficult.

How can traders stay updated on changing regulations?

Traders stay updated on changing regulations by regularly checking official financial authority websites, subscribing to industry newsletters, and joining professional trading groups. Following regulatory news on social media platforms and attending webinars or conferences also helps. Setting alerts for legal updates ensures they don't miss critical changes that could impact their trading strategies.

What are the best practices for maintaining compliance?

Follow relevant regulations, stay updated on rule changes, and keep detailed records of all trades. Use compliance software to monitor trades and prevent violations. Educate yourself regularly on legal requirements and industry standards. Implement internal controls and audits to catch violations early. Keep transparent communication with regulators and seek legal advice when uncertain. Prioritize ethical trading practices to avoid penalties and maintain trust.

Learn about What Are the Best Practices for Maintaining Day Trading Broker Compliance?

How does regulatory compliance protect your investments?

Regulatory compliance protects your investments by ensuring you follow legal trading rules, reducing the risk of fines, penalties, or account freezes. It helps prevent fraud and market manipulation, safeguarding your funds from dishonest practices. Compliance also promotes transparency, giving you confidence in the integrity of your trades. Following regulations keeps you aligned with industry standards, minimizing legal risks that could jeopardize your trading capital.

What role do disclosures and reporting play in compliance?

Disclosures and reporting ensure transparency, helping traders meet legal standards and avoid penalties. They provide a clear record of transactions and financial activity, which regulators review for compliance. Proper disclosures prevent fraud, build trust with regulators, and demonstrate adherence to trading rules, ultimately supporting long-term success in day trading.

How does compliance affect trading platforms and tools?

Compliance ensures trading platforms follow legal standards, protecting your funds and data. It enforces transparency, so you get clear info on fees, risks, and order execution. Regulatory-approved tools meet strict security and fairness benchmarks, reducing fraud and manipulation risks. Non-compliance can lead to account freezes, fines, or platform shutdowns, jeopardizing your trading activities. Overall, compliance builds trust, ensuring your trading environment is safe, fair, and reliable.

Learn about How Do Broker Compliance Rules Affect Day Trading Costs and Fees?

Why is understanding SEC and FINRA rules important?

Understanding SEC and FINRA rules is crucial because they govern legal trading practices, protect investors, and prevent fraud. Complying avoids costly fines and license suspensions, ensuring your trading remains lawful. Knowledge of these regulations helps you navigate the market safely, build trust with clients, and maintain a reputable trading operation. Without it, you risk legal trouble, financial loss, and damage to your reputation.

Learn about Understanding Margin Rules Set by SEC and FINRA

Conclusion about The Importance of Regulatory Compliance in Day Trading Success

In conclusion, regulatory compliance is a cornerstone of successful day trading. Adhering to established regulations not only safeguards your investments but also enhances your credibility with brokers and clients. Understanding the requirements set forth by authorities like the SEC and FINRA is essential for any trader aiming to thrive in this competitive landscape. To ensure a sustainable trading career, stay informed on regulatory changes and adopt best practices for compliance. Remember, a commitment to following the rules not only protects your finances but also fosters long-term success in your trading endeavors. For more insights on navigating these complexities, consider the resources offered by DayTradingBusiness.

Learn about Regulatory Bodies Overseeing Day Trading Broker Compliance

Sources:

- The impact of interventions on health, safety and environment in the ...

- Doing Business 2020: Comparing Business Regulation in 190 ...

- Review of the Federal Reserve's Supervision and Regulation of ...

- Organizations and stakeholders' roles and influence on ...

- The joint impact of the European Union emissions trading system on ...