Did you know that the term "short selling" originated from the idea of selling something you don’t own, much like borrowing your neighbor’s lawnmower and charging others to use it? In the world of day trading, understanding the regulations surrounding short selling is crucial. This article dives into the SEC and FINRA restrictions that impact day traders, covering key topics like specific rules for short selling during market declines, the implications of uptick rules, and the consequences of non-compliance. We also explore exemptions for certain traders, the intricacies of short sale Rule 105, and how recent regulatory changes could affect your trading strategy. With insights from DayTradingBusiness, you'll be equipped with the knowledge to navigate the complexities of intraday short selling while staying compliant with SEC and FINRA regulations.

What are SEC restrictions on short selling for day traders?

The SEC restricts short selling for day traders through Regulation SHO, which requires locate and close-out requirements. Traders must borrow or arrange to borrow stock before shorting (the locate rule). If a shorted stock's price rises, traders must close out fail-to-delivers within 13 days. The uptick rule (Rule 201) also limits short selling during a downtrend, preventing shorting at or below the last different price to avoid exacerbating declines. These rules aim to prevent manipulation and excessive downward pressure, especially for active day traders.

How does FINRA regulate short selling activities?

FINRA enforces rules on short selling, including the uptick rule, which limits short sales to when the last price move was upward, preventing market abuse. It requires short sale reports through the Regulation SHO, which flags stocks with substantial fails to deliver, aiming to curb naked short selling. FINRA monitors trading patterns for manipulative activity and can suspend or restrict short selling if violations occur. It also enforces compliance with SEC regulations, ensuring day traders follow proper procedures for short selling, especially during volatile periods.

Are there specific rules for short selling during market declines?

Yes, SEC and FINRA impose rules during market declines, like the uptick rule, which restricts short selling unless the last trade was at a higher price. Additionally, the Regulation SHO requires locate and close-out procedures to prevent abusive short selling. During extreme volatility, regulators can implement temporary bans or additional restrictions on short selling.

Can day traders still short sell on uptick rules?

No, day traders cannot short sell on uptick rules anymore. The SEC eliminated the uptick rule in 2007, so short selling is allowed regardless of the stock’s price movement. FINRA also does not enforce uptick restrictions for short sales.

What are the penalties for violating SEC short selling rules?

Violating SEC and FINRA short selling rules can lead to fines, trading suspensions, and account restrictions. The SEC can impose civil penalties up to $250,000 per violation, and FINRA can suspend or bar traders from the industry. Repeated violations may result in permanent bans and legal action.

How do SEC and FINRA restrictions affect intraday short selling?

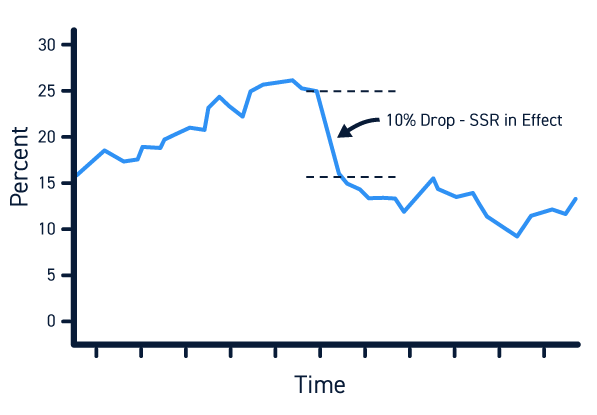

SEC and FINRA restrictions limit intraday short selling by implementing rules like the uptick rule, which requires a stock to be traded upward before shorting, and restrictions on shorting during volatile periods. These rules prevent traders from executing rapid short sales on falling stocks, reducing potential for market manipulation. Short sale bans or circuit breakers can temporarily halt short selling if a stock drops sharply. Overall, these restrictions make intraday short selling more cautious, increasing the cost and complexity for day traders aiming to profit from quick declines.

Are there exemptions for certain traders from short sale rules?

Yes, some traders, like market makers and those meeting specific hedge fund or institutional criteria, may qualify for exemptions from SEC and FINRA short sale rules, but typical day traders usually must follow the same regulations.

What is the short sale rule 105 and how does it impact day trading?

Rule 105, part of SEC and FINRA regulations, limits short selling during certain periods around new IPO offerings. It prevents traders from shorting a stock at the offering price if they bought the same stock earlier at a higher price on the same day. For day traders, this rule restricts quick short sales on IPO stocks, reducing aggressive shorting that could manipulate prices immediately after the IPO. It aims to prevent abusive shorting practices and promote fair trading during IPOs.

How do short sale bans during market volatility work?

Short sale bans during market volatility restrict traders from selling stocks short to prevent downward spirals. The SEC or FINRA can implement temporary restrictions, like banning short selling of specific stocks or all stocks during extreme price swings. These bans aim to stabilize markets by reducing downward pressure and preventing manipulative practices. Traders can still buy stocks normally, but selling short becomes prohibited or limited for the duration of the ban. The restrictions are usually lifted once volatility subsides.

What are the reporting requirements for short sales?

Short sales must be reported to FINRA within 15 minutes of execution via the Trade Reporting and Compliance Engine (TRACE). Additionally, firms must comply with SEC Regulation SHO, which requires locating and borrowing securities before shorting and marking the trade appropriately. Large short sale positions may need to be disclosed in regulatory filings if they cross reporting thresholds.

How do restrictions differ between stocks and ETFs?

Stock short selling restrictions typically involve uptick rules, limiting short sales to when the stock’s price is rising, and specific borrowing rules. ETFs face additional hurdles: shorting ETFs can trigger rules like the “ProShares UltraShort” restrictions, and liquidity issues make borrowing more complex. The SEC’s Regulation SHO applies to both, but ETFs often have tighter borrowing and delivery rules due to their basket of underlying assets. Overall, shorting ETFs can be more restricted because of their structure, liquidity, and potential for rapid price swings, while stocks are mainly affected by uptick rules and borrowing constraints.

Can short selling be restricted during earnings reports?

Yes, the SEC and FINRA can restrict short selling during earnings reports through temporary trading halts or rule restrictions to prevent market manipulation and excessive volatility.

What are the best practices for day traders to comply with SEC rules?

Day traders should stay updated on SEC and FINRA regulations, especially restrictions on short selling during market declines. They must adhere to Regulation SHO, which requires locating and borrowing securities before shorting. Using broker-dealer platforms that enforce short sale thresholds and the uptick rule helps compliance. Avoid engaging in naked short selling, which is prohibited. Keep detailed records of all trades to demonstrate compliance. Stay aware of temporary trading halts or restrictions imposed during volatile periods and follow all reporting and disclosure requirements.

How do FINRA’s short sale rules impact leverage and margin?

FINRA’s short sale rules restrict leverage and margin by limiting the use of borrowed funds for short selling, requiring traders to have sufficient margin and prohibiting short sales during certain decline thresholds. These rules reduce the ability to amplify gains or losses through leverage, making short selling riskier and more regulated for day traders.

Are there recent changes to SEC or FINRA short selling regulations?

Yes, recent changes include the SEC's temporary ban on short selling of certain volatile stocks in 2021, and FINRA's increased scrutiny on short sale disclosures. The SEC has also proposed new rules to improve transparency around short positions, while FINRA is enforcing stricter reporting requirements for high-volume short selling.

Conclusion about SEC and FINRA Restrictions on Short Selling for Day Traders

In summary, understanding SEC and FINRA restrictions on short selling is crucial for day traders to navigate the complexities of the market effectively. Adhering to these regulations not only helps avoid penalties but also enhances trading strategies, especially during volatile periods. Staying informed about the latest rules and best practices is essential for successful and compliant trading. For more insights and guidance, DayTradingBusiness is here to support your trading journey.

Learn about Compliance Checklist for Day Traders Under SEC & FINRA Rules

Sources:

- The options market maker exception to SEC Regulation SHO ...

- Shorting in the Dark: The Dual Role of Short Sales in Off-Exchange ...

- Short-selling activities in the time of COVID-19 - ScienceDirect

- Interest in the Short Interest: The Rise of Private Sector Data Yong ...

- Surprise in short interest - ScienceDirect

- Shorting flows and return predictability in Taiwan - ScienceDirect