Did you know that day trading can sometimes feel like a high-stakes game of musical chairs, where the music stops just when you're ready to make your move? This article dives into the essential FINRA guidelines for day trading accounts, covering everything from rules for opening an account to the definition of a pattern day trader. Learn about minimum equity requirements, leverage limits, and how to avoid restrictions. We’ll also explore the consequences of violating these rules, the necessary documentation, and the differences between retail and institutional traders. Plus, discover best practices for compliance and what to do if you find yourself flagged as a pattern day trader. With insights from DayTradingBusiness, you'll be equipped to navigate the complexities of trading while staying within regulatory boundaries.

What are FINRA’s rules for opening a day trading account?

FINRA requires pattern day traders to maintain a minimum of $25,000 in their trading account on any day they execute four or more day trades within five business days. The account must be marked as a pattern day trader account. If the balance falls below $25,000, trading restrictions apply until the minimum is restored. Additionally, FINRA mandates clear disclosures about risks and requires traders to understand margin requirements and the potential for increased losses.

How does FINRA define a pattern day trader?

FINRA defines a pattern day trader as someone who executes four or more day trades within five business days, provided those trades represent more than 6% of their total trading activity during that period.

What are the minimum equity requirements for day trading accounts?

The minimum equity requirement for day trading accounts under FINRA is $25,000.

How do FINRA rules impact margin requirements for day traders?

FINRA rules set minimum margin requirements for day traders, requiring a 25% initial margin on day trading positions. This means traders must have at least 25% of the total trade value in their account to open a position. Additionally, FINRA mandates a minimum equity of $25,000 for pattern day traders, ensuring they can sustain frequent trading without excessive risk. These rules limit how much leverage day traders can use, reducing potential losses and promoting market stability.

What are the specific leverage limits for day trading under FINRA?

FINRA limits day trading accounts to a maximum of four day trades within five business days if the account has less than $25,000. If the account falls below $25,000, it is designated as a Pattern Day Trader and must maintain a minimum equity of $25,000 to continue day trading.

How can I avoid pattern day trader restrictions?

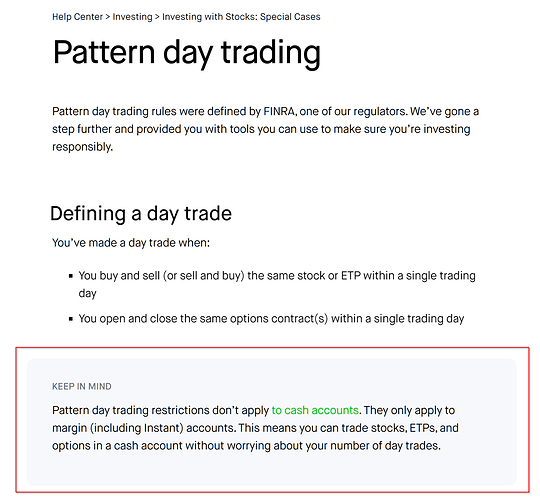

To avoid pattern day trader restrictions, keep your trading days under four within a rolling five-day period, or maintain more than $25,000 in your account at all times. If you stay below four day trades in five days, your account isn’t classified as a pattern day trader, avoiding the $25,000 minimum equity requirement. Avoid executing five or more day trades within five business days unless you meet the minimum equity threshold. Consider trading longer-term positions instead of frequent daily trades. Alternatively, open a cash account where pattern day trader rules don’t apply.

What are the consequences of violating FINRA’s day trading rules?

Violating FINRA’s day trading rules can lead to account restrictions, such as being labeled a pattern day trader with a $25,000 minimum equity requirement. You may face suspension from day trading activities, financial penalties, or account liquidation. Repeated violations can result in permanent bans from day trading and damage your brokerage’s reputation.

How does FINRA supervise day trading activity?

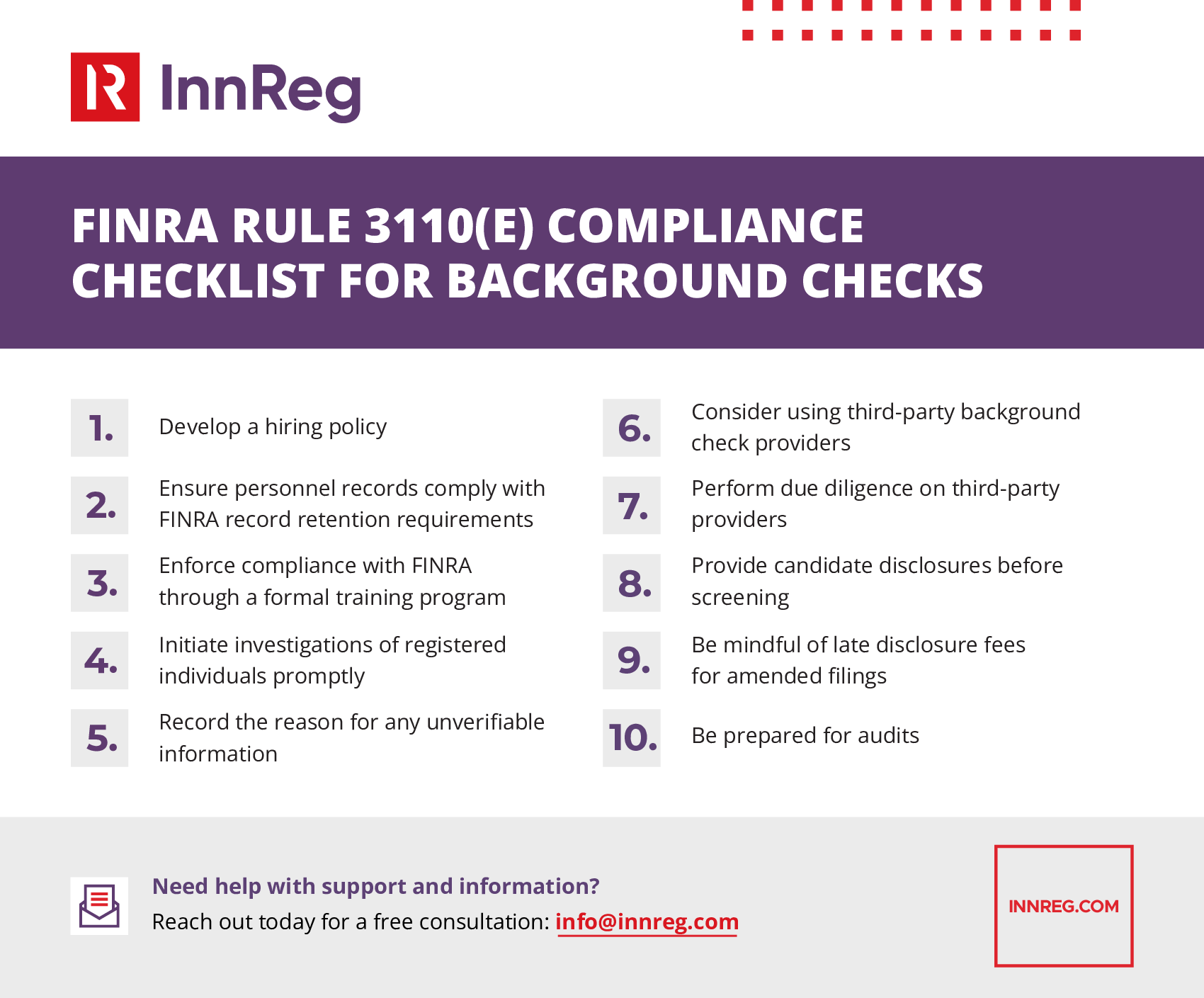

FINRA supervises day trading activity by monitoring trading patterns for pattern day traders, enforcing minimum equity requirements of $25,000, and reviewing account activity for excessive trading and compliance with rules. They use automated systems to flag suspicious or risky trades, ensure firms verify client identities, and conduct audits to detect violations. Broker-dealers must report large or suspicious trades and keep detailed records to support supervision.

What documentation is needed to open a day trading account?

You need proof of identity (passport or driver’s license), proof of address (utility bill or bank statement), and possibly your Social Security number. Some brokers require financial statements or proof of income to verify your trading experience and financial suitability.

How do FINRA guidelines affect trading restrictions during market volatility?

FINRA guidelines limit day trading activity during market volatility by enforcing minimum equity requirements, such as the $25,000 account minimum for pattern day traders. They also restrict the number of day trades allowed within five business days—no more than four unless the account meets the pattern day trader criteria. During high volatility, these rules tighten trading flexibility to prevent excessive risk, forcing traders to maintain sufficient capital and adhere to specific trading limits.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

Are there specific restrictions for retail vs. institutional day traders?

Yes. Retail day traders must meet a $25,000 minimum equity requirement to engage in pattern day trading, as per FINRA rules. Institutional traders aren’t subject to this minimum but must follow different regulations, often set by their firm or industry standards. Retail traders need to maintain the minimum equity daily, or they can face restrictions or account freezes.

Learn about Are there restrictions on trading certain securities for day traders?

How do FINRA rules differ from SEC regulations for day trading?

FINRA rules for day trading focus on margin requirements, pattern day trader (PDT) rules, and account restrictions, requiring a minimum of $25,000 in equity for pattern day traders. SEC regulations set broader rules on market conduct, disclosure, and investor protections, but do not specify day trading margin or account thresholds. FINRA enforces specific day trading rules, while SEC oversees overall market fairness and transparency.

Learn about How Do SEC and FINRA Regulations Influence Day Trading Strategies?

What are the best practices to stay compliant with FINRA’s day trading rules?

Open a pattern day trader account with at least $25,000 in equity.

Maintain the minimum equity daily; if it drops below, you'll face restrictions.

Avoid executing more than three day trades within five business days unless your account meets the $25,000 threshold.

Keep detailed records of all trades and account activity.

Use margin responsibly and understand the risks involved.

Stay updated on FINRA rules and brokerage-specific policies.

Consult with a financial advisor to ensure compliance and proper risk management.

Learn about How to Stay Compliant With Day Trading Laws

How does FINRA monitor for suspicious or manipulative trading?

FINRA monitors suspicious or manipulative trading through real-time data analysis, pattern recognition, and automated alerts. They track unusual volume spikes, price swings, and order activity that deviate from typical patterns. FINRA also reviews trading activity flagged by their surveillance systems and investigates any anomalies or behaviors that suggest manipulation or fraud.

What steps should I take if I’m flagged as a pattern day trader?

If flagged as a pattern day trader, you must maintain a minimum of $25,000 in your trading account, either as cash or margin equity. You can no longer execute four or more day trades within five business days unless your account meets this threshold. To resolve the issue, deposit additional funds to reach the $25,000 minimum or stop day trading until you do. Alternatively, switch to a cash account, which doesn't restrict the number of day trades but limits trading to settled funds.

Are there exemptions for certain traders under FINRA guidelines?

Yes, some traders may qualify for exemptions under FINRA guidelines, such as those classified as pattern day traders who meet specific criteria or traders with margin accounts below certain thresholds.

Conclusion about FINRA Guidelines for Day Trading Accounts

Understanding FINRA's guidelines is crucial for any day trader looking to navigate the complexities of trading regulations. By being aware of the definition of pattern day traders, minimum equity requirements, and margin rules, traders can effectively manage their accounts while avoiding unnecessary restrictions. Staying compliant with these regulations not only safeguards your trading activities but also enhances your overall trading strategy. For more in-depth insights and assistance in day trading, consider leveraging the expertise offered by DayTradingBusiness.

Sources:

- The Fed - Unlocking the Treasury Market through TRACE

- FR 2956 Treasury Securities and Agency Debt and Mortgage ...

- Analyst Tipping: New Evidence from Directional Options Trading ...

- Analyst Tipping: New Evidence from Directional Options Trading ...

- The Fed - Quantifying Treasury Cash-Futures Basis Trades

- Reporting Treasury Securities and Agency Debt and Mortgage ...