Did you know that some traders have more moves in a week than a dancer at a wedding? But if you’re a pattern day trader, you might find yourself limited by the PDT Rule. This article dives deep into what the PDT Rule is, its significance for day traders, and how it restricts trading activity. We’ll explore who it affects, the minimum account balance required for exemption, and the consequences of violating the rule. Additionally, we’ll discuss strategies for compliant trading and alternatives to navigate around these restrictions. With insights from DayTradingBusiness, you’ll be well-equipped to understand and effectively manage the PDT Rule in your trading journey.

What is the PDT Rule in Day Trading?

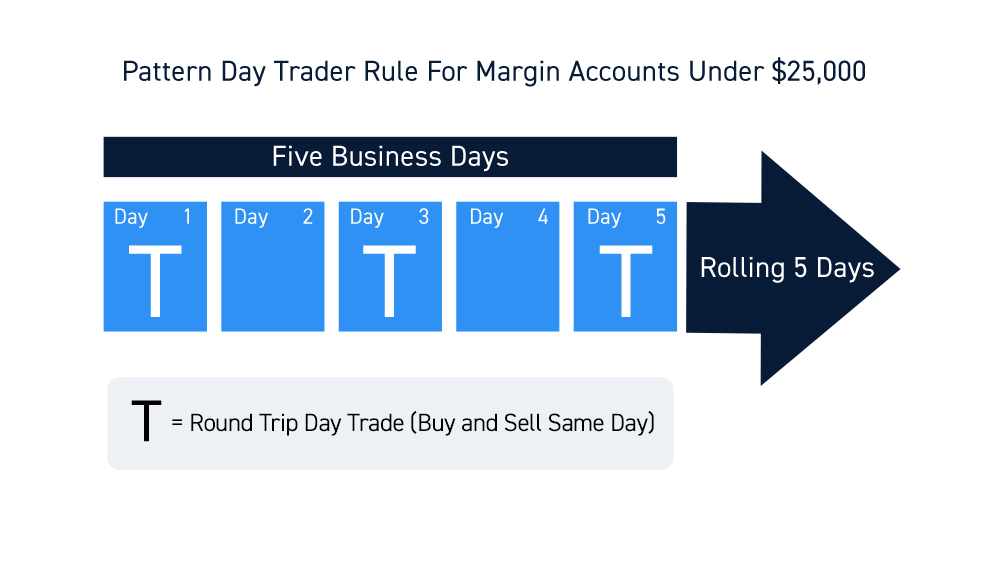

The PDT Rule in day trading is a U.S. regulation that restricts traders with less than $25,000 in their account from making more than three day trades within five business days. If you hit that limit, your account gets flagged as a pattern day trader and you must maintain a minimum equity of $25,000 to continue trading actively. It’s designed to prevent excessive risk-taking by small traders.

Why does the PDT Rule matter for traders?

The PDT Rule matters because it limits day traders to a max of $25,000 in account equity if they execute four or more day trades within five business days. Without meeting this threshold, traders can't open new day trades or must maintain the minimum balance, which prevents over-leveraging and encourages responsible trading. It protects traders from excessive risk and ensures they have enough capital to cover potential losses.

How does the PDT Rule limit trading activity?

The PDT Rule limits trading activity by requiring traders with less than $25,000 in their account to only execute three day trades within five business days. If they hit this limit, they must hold any new trades overnight or risk being restricted from day trading for 90 days. It prevents frequent, risky trades that could lead to quick losses, enforcing a minimum capital threshold for active day traders.

Who is affected by the PDT Rule?

The PDT (Pattern Day Trader) Rule impacts traders who execute four or more day trades within five business days using a margin account with less than $25,000.

How can traders avoid PDT restrictions?

Traders avoid PDT restrictions by maintaining a minimum account balance of $25,000, using multiple accounts, or trading on a cash account instead of margin.

What is the minimum account balance for PDT exemption?

The minimum account balance for PDT exemption is $25,000.

How does the PDT Rule define a pattern day trader?

A pattern day trader is someone who executes four or more day trades within five business days in a margin account, provided those trades make up more than 6% of their total trading activity for that period. The PDT Rule applies if the account has less than $25,000, requiring traders to maintain that minimum to continue day trading freely.

Can you trade more than three times a week under PDT rules?

No, under PDT rules, you can't make more than three day trades within five business days unless you have a minimum of $25,000 in your account.

What happens if you violate the PDT Rule?

If you violate the PDT Rule, your brokerage will restrict you from placing new day trades for 90 days unless you deposit at least $25,000 into your account.

How do brokers enforce the PDT Rule?

Brokers enforce the PDT (Pattern Day Trader) Rule by requiring traders with less than $25,000 in their account to limit their day trades to no more than three within five business days. If a trader exceeds this limit, the broker automatically restricts their account from making further day trades until the account balance is increased to $25,000 or more. They also flag the account to monitor and prevent future violations.

Learn about How Do Brokerage Firms Enforce the PDT Rule?

Are there any exceptions to the PDT Rule?

Yes, the PDT (Pattern Day Trader) Rule has exceptions. If your account has at least $25,000 in equity, you’re not restricted by the PDT rule. Also, if you execute fewer than four day trades within five business days, the rule doesn’t apply. Additionally, cash accounts aren’t subject to the PDT rule since they don’t involve margin.

Learn about Are There Any Loopholes in the PDT Rule?

How does the PDT Rule impact swing traders?

The PDT Rule requires traders with less than $25,000 in their account to limit their day trades to three within five business days. For swing traders, this means they must be careful not to hit this limit, or they’ll be restricted from making further day trades until the account balance is restored. It often forces swing traders to hold positions longer or maintain higher account balances to avoid restrictions.

Learn about How Does the PDT Rule Impact Small Account Traders?

What are the best strategies for PDT-compliant trading?

To comply with the PDT (Pattern Day Trader) rule, keep your account above $25,000 in equity. If you fall below, avoid making more than three day trades in five business days. Use a cash account instead of margin to bypass PDT restrictions. Spread out your trades over multiple days or limit your trading frequency. Consider trading in a non-PDT account, such as a futures or forex account, where the rule doesn't apply. Keep accurate records of your trades and avoid excessive short-term trading to stay compliant.

How can traders convert a pattern day trader account?

To convert a pattern day trader (PDT) account, you need to either wait 90 days without violating the rule or increase your account equity to at least $25,000. Alternatively, switch to trading with a cash account, which doesn’t impose PDT restrictions.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

What are alternatives to avoid PDT restrictions?

To avoid PDT restrictions, open accounts with less than $25,000 or trade with a cash account. Alternatively, trade only three or fewer day trades per five business days in a margin account, or use a swing trading strategy that doesn’t count as day trades. You can also consider trading on foreign markets or using a pattern day trader exemption if eligible.

Conclusion about What is the PDT Rule in Day Trading?

Understanding the PDT Rule is crucial for traders aiming to navigate the complexities of day trading effectively. By recognizing its implications and limitations, traders can make informed decisions and optimize their strategies. For those seeking further insights and guidance on trading practices, DayTradingBusiness offers valuable resources to enhance your trading journey.

Sources:

- Predicting Stock Prices using Permutation Decision Trees and ...

- A Theory of the Interday Variations in Volume, Variance, and ...

- FRB: Appendix B: Models to Project Net Income and Stressed ...

- Predicting Stock Prices Using Permutation Decision Trees And ...

- Short-Sale Restrictions and Market Reaction to Short-Interest ...

- Dealers, information and liquidity provision in safe assets