Did you know that the term "Pattern Day Trader" sounds like a superhero name but actually comes with some serious trading restrictions? In this article, we break down the critical aspects of the Pattern Day Trader (PDT) rule, including what it is and how it affects your trading activities. Learn how much equity you need to avoid PDT regulations, the minimum account balance for PDT exemption, and whether a cash account can help you skirt these rules. We also cover the requirements for being classified as a Pattern Day Trader, how your margin account impacts these requirements, and the exceptions that exist. Additionally, discover practical strategies to quickly meet the necessary equity threshold and what happens if your account dips below it. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of the PDT rule and optimize your trading strategies.

What is the PDT rule?

The PDT (Pattern Day Trader) rule requires a minimum equity of $25,000 in your trading account to avoid restrictions.

How much equity do I need to avoid the PDT rule?

You need at least $25,000 in your trading account to avoid the PDT rule.

What is the minimum account balance for PDT exemption?

The minimum account balance required to avoid the PDT (Pattern Day Trader) rule is $25,000 in equity.

Can I avoid the PDT rule with a cash account?

Yes, using a cash account avoids the Pattern Day Trader (PDT) rule because it doesn’t require a minimum equity of $25,000. The PDT rule applies only to margin accounts with less than $25,000 in equity.

How does the PDT rule affect day trading?

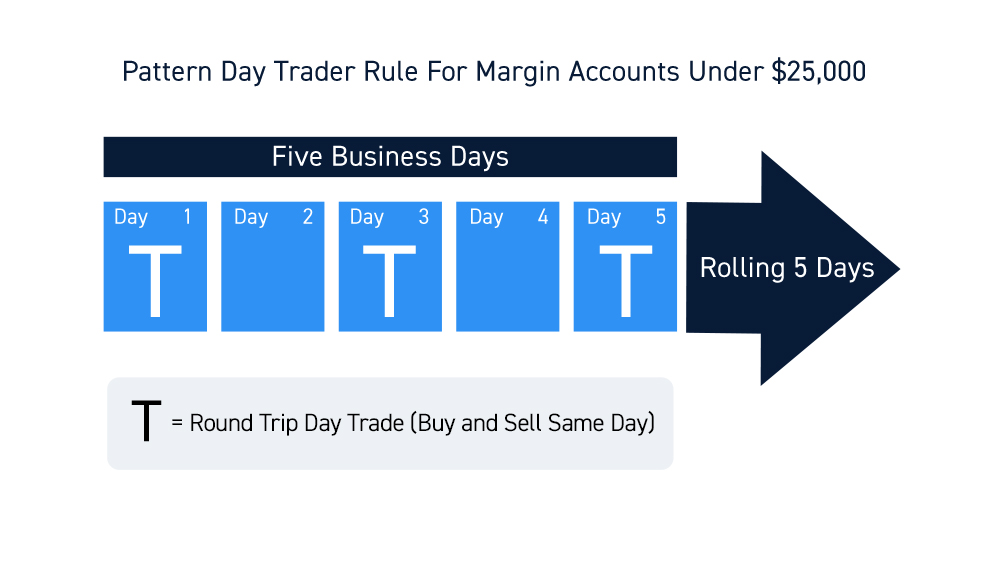

The PDT rule requires a minimum of $25,000 in your trading account to avoid restrictions on pattern day trading. If you have less than $25,000, you can only execute up to three day trades within five business days; after that, your account gets restricted for 90 days unless you add more funds.

What are the requirements for a Pattern Day Trader?

You need a minimum of $25,000 in your trading account to avoid the Pattern Day Trader (PDT) rule. If your account falls below this, you can't make more than three day trades in five business days unless you restore the equity to $25,000.

Does margin account affect PDT requirements?

Yes, a margin account affects PDT requirements because only margin accounts are subject to the Pattern Day Trader (PDT) rule. If your account is a cash account, PDT rules don’t apply. To avoid PDT restrictions, you need at least $25,000 in your margin account equity.

How can I meet the minimum equity to bypass PDT?

To meet the minimum equity to bypass the PDT rule, you need at least $25,000 in your margin account on any day you plan to make day trades. If your account falls below this, you'll be restricted from day trading until you restore the balance.

Are there exceptions to the PDT rule?

Yes, there are exceptions. If you have a Pattern Day Trader (PDT) exemption or maintain a margin account with at least $25,000 in equity, you avoid the PDT rule. Additionally, some brokerages may offer limited exemptions under specific circumstances.

How does the $25,000 minimum equity threshold work?

The $25,000 minimum equity threshold means you need at least $25,000 in your trading account to avoid the Pattern Day Trader (PDT) rule. If your account falls below this amount, you can't make more than three day trades within five business days. To stay compliant, maintain your account balance at or above $25,000; otherwise, your trading is restricted until you deposit enough funds.

Can I use multiple accounts to avoid PDT?

No, using multiple accounts won't help you avoid the Pattern Day Trading (PDT) rule. The PDT rule applies to your overall trading activity across all accounts with the same broker. To avoid PDT, you need at least $25,000 in equity across your combined accounts, not just in one.

What happens if my account falls below the minimum equity?

If your account falls below the minimum equity, your trading ability is restricted. You won’t be able to make new margin trades until you deposit more funds to meet the minimum equity requirement. This is especially important if you’re under Pattern Day Trader (PDT) rules, which require a minimum of $25,000 in your account to avoid restrictions.

How long does the minimum equity requirement last?

The minimum equity requirement lasts until you meet the pattern day trader (PDT) rule threshold again, which is maintaining at least $25,000 in your trading account on any day you execute four or more day trades within five business days.

Is the $25,000 rule the same for all brokers?

No, the $25,000 rule isn't the same for all brokers. It specifically applies to pattern day traders under FINRA rules, but some brokers may have higher minimum equity requirements or different policies. Always check your broker’s specific margin and account rules.

What strategies help meet the equity requirement quickly?

To meet the equity requirement quickly, deposit sufficient funds to reach the minimum equity threshold, usually $25,000, and avoid margin calls. Use cash to fund your account instead of relying on borrowed money, ensuring your equity stays above the PDT rule limit. Avoid frequent day trades that risk margin depletion, and consider consolidating trades or reducing position sizes to maintain the required equity. Quickly adjusting your holdings or adding funds during market hours also helps meet the minimum equity requirement promptly.

Conclusion about What Is the Minimum Equity Required to Avoid the PDT Rule?

In summary, understanding the Pattern Day Trader (PDT) rule is essential for any active trader looking to optimize their day trading strategy. To avoid the PDT rule, maintaining a minimum equity of $25,000 in a margin account is crucial, and various strategies can help you reach this threshold efficiently. While some exceptions and alternatives exist, they often come with their own set of considerations. For comprehensive guidance and tailored strategies, look to DayTradingBusiness to enhance your trading journey.