Did you know that the average person spends about six months of their life waiting for red lights to turn green? In the world of day trading, waiting can be a costly mistake, especially if you fall foul of the Pattern Day Trader (PDT) Rule. This article dives into the intricacies of the PDT Rule, highlighting its importance and the potential pitfalls traders can encounter. We’ll explore effective strategies to avoid violations, common mistakes to watch out for, and how to accurately calculate your day trades. Moreover, learn how to leverage cash accounts, utilize margin accounts wisely, and discover alternatives to PDT-compliant accounts. With insights on tracking your trading activity and the benefits of automated tools, DayTradingBusiness is here to guide you through ensuring compliance while maximizing your trading potential.

What is the PDT Rule and why does it matter?

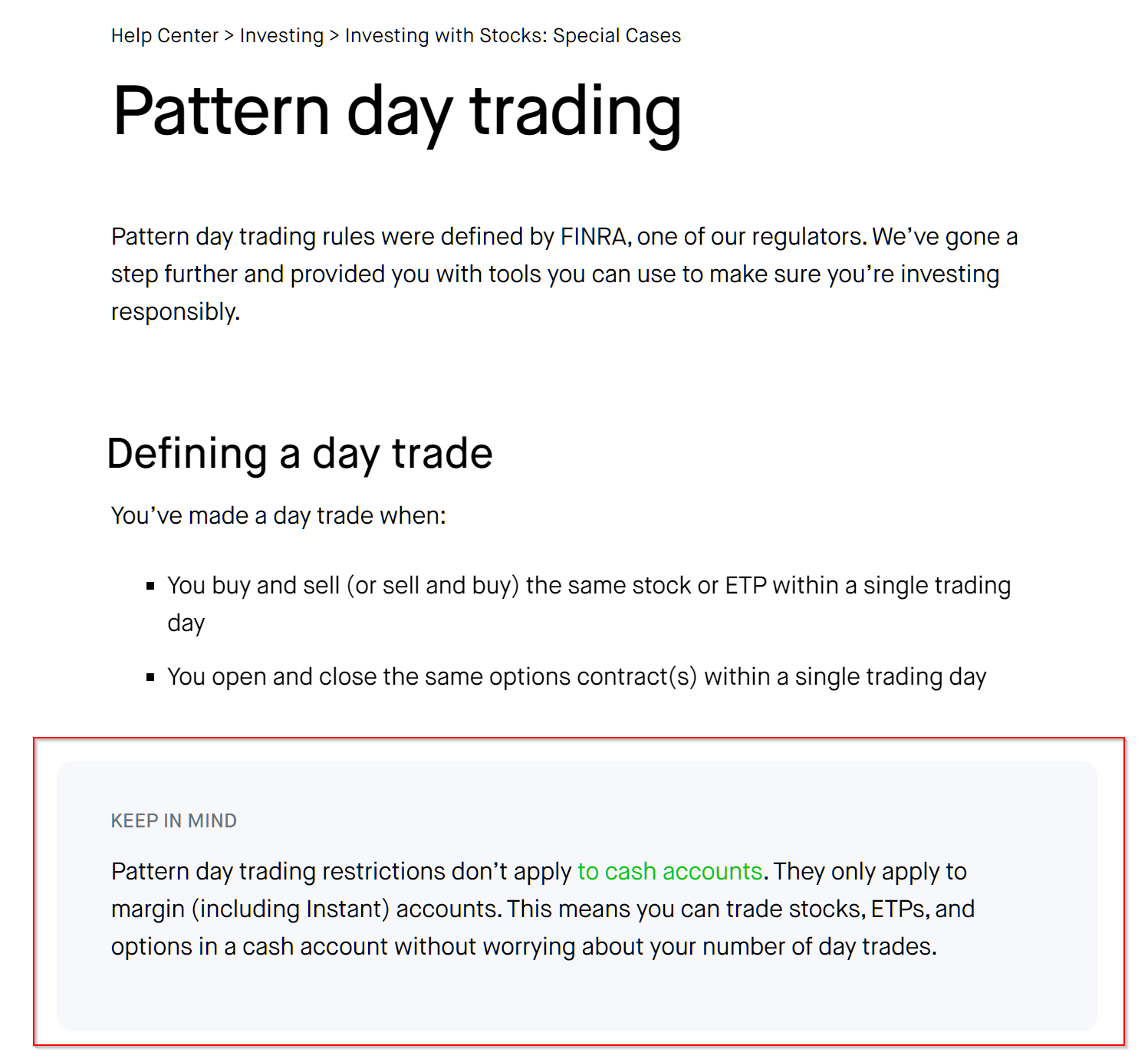

The PDT Rule limits pattern day traders to four or fewer day trades within five business days unless they maintain a minimum of $25,000 in their trading account. It matters because violating it can freeze your trading account or restrict your ability to day trade. To stay compliant, avoid executing more than three day trades in five days, or keep your account above $25,000. Using cash accounts or swing trading instead of day trading can also help you stay within the rules.

How can traders avoid violating the PDT Rule?

Traders avoid violating the PDT Rule by maintaining at least $25,000 in their trading account, using cash accounts instead of margin accounts, or limiting their day trades to four per five-day rolling period. They can also open multiple accounts to spread trades across them, or focus on swing trading and longer-term investing strategies that don’t count as day trades. Setting alerts to monitor their trading activity helps prevent accidental violations.

What are the common mistakes leading to PDT violations?

Common mistakes leading to PDT violations include trading with less than $25,000 in the account, holding positions overnight in pattern day trading stocks, and executing multiple day trades within five business days without sufficient funds. Failing to monitor trading activity, misinterpreting the rule, or not maintaining proper account equity also cause violations.

How do I calculate my day trades under the PDT Rule?

To calculate your day trades under the PDT (Pattern Day Trader) Rule, count any buy and sell transactions of the same security executed within a single trading day. If you make four or more day trades in five business days and your account equity is below $25,000, you’re flagged as a pattern day trader. Each round-trip (buy and sell of the same stock) counts as one day trade. Keep a record of all trades, and if you hit three or fewer day trades in five days, you stay compliant.

What are the best ways to track my trading activity for PDT compliance?

Use a trading journal or software to log every trade, including date, time, security, size, and price. Regularly review your account activity and set alerts for pattern day trader thresholds. Maintain detailed records of all trades, account statements, and correspondence with your broker. Consider automated tracking tools that sync with your brokerage account to monitor trading frequency. Keep spreadsheets updated to analyze your trading patterns and ensure you stay below the 4-day rule limit.

Can I use margin accounts to bypass the PDT Rule?

No, using margin accounts doesn’t bypass the Pattern Day Trader (PDT) Rule. If you have less than $25,000 in your margin account, you’re restricted to four day trades within five business days. To avoid PDT restrictions, keep your trading below four day trades weekly, or maintain at least $25,000 in your account.

What are the alternatives to PDT-compliant accounts?

Alternatives to PDT-compliant accounts include using a cash account for all trades, waiting 90 days to lift the pattern day trader restriction, or opening a margin account with a broker that allows higher trading limits without PDT rules. Some traders split their capital across multiple accounts to avoid PDT designations. Another option is trading in non-United States markets or using international brokers that don’t enforce PDT rules.

How does the 90-day trading pattern affect PDT status?

The 90-day trading pattern determines if you trigger Pattern Day Trader (PDT) status. If you execute four or more day trades within five business days in a margin account, and those trades make up over 6% of your total trading activity, you become a PDT. This status limits you to $25,000 in account equity to continue day trading. Avoiding four or more day trades in five days keeps you under PDT rules, allowing more flexibility. Conversely, frequent 90-day patterns of day trading can push you into PDT status, requiring you to maintain the minimum equity to avoid restrictions.

What are the risks of not complying with the PDT Rule?

Not complying with the PDT Rule risks account restrictions, including being flagged for pattern day trading and having limited trading capacity. Your brokerage may freeze your account or impose a trading halt until you meet the minimum equity requirements. Repeated violations can lead to account suspension or permanent restrictions, making it difficult to trade stocks actively. It can also damage your reputation with brokers and hinder your ability to execute strategies involving frequent trades.

How can traders leverage cash accounts to stay compliant?

Traders use cash accounts to avoid Pattern Day Trader (PDT) rule restrictions since PDT rules only apply to margin accounts. By trading only with available cash, they can execute unlimited trades without the 25-day limit or minimum equity requirements. This ensures compliance, as no margin calls or PDT designations are triggered. Switching to cash accounts or maintaining sufficient cash balances helps traders stay within regulatory limits and avoid account restrictions.

Are there broker-specific strategies to manage PDT restrictions?

Yes, some brokers offer strategies like opting for cash accounts, using pattern day trader (PDT) exemptions, or switching to a broker that allows more frequent trading without PDT restrictions. They might also provide margin accounts with higher buying power or offer partial exemptions based on account history.

What role do pattern day trader exemptions play?

Pattern day trader exemptions let traders avoid the $25,000 minimum equity requirement if they meet specific criteria, like trading less frequently or using different account types. These exemptions provide flexibility, allowing traders to execute more day trades without maintaining the large account balance. They’re crucial for traders who want to stay compliant while actively trading, but they require careful understanding of the rules to avoid violations.

How can automated trading tools help with PDT compliance?

Automated trading tools help with PDT compliance by tracking your trading activity in real-time, ensuring you don’t exceed the six-day trading limit. They can set alerts or automatically restrict trades when approaching the pattern day trader threshold. These tools also help manage account equity requirements by monitoring margin levels, preventing violations that could lead to account restrictions. Overall, they keep your trading within the PDT rules effortlessly, reducing the risk of account suspension.

What are the benefits of switching to a non-PTD account?

Switching to a non-PTD account lets you avoid the 90-day restriction on day trades, giving you more flexibility to trade frequently. It also helps you build a larger trading history without the pressure of PTD limitations, allowing for quicker account growth. Plus, it reduces the risk of account freezes or restrictions if you’re trying to execute multiple day trades. Overall, it gives you more freedom to develop your trading strategy without the constraints of PDT rules.

How do international brokers handle PDT Rule restrictions?

International brokers often bypass PDT rules because they aren’t U.S. registered, allowing traders to avoid the $25,000 minimum equity requirement. Some offer margin accounts with higher leverage or set no minimum deposit, letting traders execute multiple day trades without restrictions. Others provide accounts that are not subject to the Pattern Day Trader rule, giving more flexibility. Always verify if the broker is regulated outside the U.S. and understand their specific policies on day trading rules.

Conclusion about What Are the Best Strategies for PDT Rule Compliance?

In summary, understanding and adhering to the Pattern Day Trader (PDT) Rule is crucial for any trader looking to navigate the complexities of day trading effectively. By implementing strategies such as tracking your trades, utilizing cash accounts, and being aware of broker-specific guidelines, you can avoid common pitfalls and remain compliant. For those seeking further assistance in mastering these strategies and enhancing their trading journey, DayTradingBusiness offers invaluable resources and insights tailored to your needs.