Did you know that the PDT (Pattern Day Trader) rule can be as confusing as trying to explain cryptocurrency to your grandma? For small account traders, understanding the PDT rule is crucial, as it imposes significant restrictions and can affect trading strategies and profit potential. This article dives into how the PDT rule limits trading frequency, its importance for beginners, and the risks of violating it. We’ll explore ways to navigate these rules legally, alternative trading methods, and how to choose the best brokerage options. Plus, we'll discuss whether small traders can still succeed and lift PDT restrictions through account growth. Let DayTradingBusiness guide you through the complexities of day trading with a small account!

How does the PDT rule restrict small account traders?

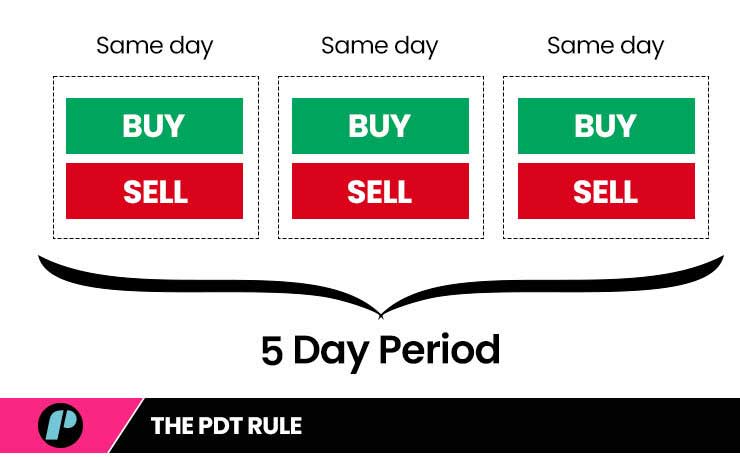

The PDT rule limits small account traders by requiring a minimum of $25,000 in account equity to execute more than three day trades within five business days. If they fall below this threshold, they can’t make new day trades until they restore the balance. This restricts frequent trading and forces traders to hold positions longer or add more funds.

Why is the PDT rule important for small trading accounts?

The PDT rule limits small account traders from making more than three day trades within five business days unless they maintain a $25,000 account balance. It prevents rapid, risky trades that could wipe out small accounts quickly. Traders must either keep the minimum balance or use cash accounts, which restricts frequent trading and encourages more cautious, strategic moves. Without it, small accounts could face heavy losses from impulsive or excessive day trading.

What are the main limitations of the PDT rule for beginners?

The main limitations of the PDT rule for beginners are that it restricts trading to only three day trades within a rolling five-day period, which can limit quick trading opportunities and discourage active trading strategies. It also forces small account traders to maintain a minimum $25,000 balance to avoid restrictions, making it harder for beginners with smaller funds to fully engage in day trading. This rule can lead to missed trades and increased frustration for new traders trying to learn the market dynamics.

How can small traders avoid PDT restrictions?

Small traders can avoid PDT restrictions by opening a pattern day trader (PDT) account with at least $25,000 in equity or trading only on a cash basis. They can also limit their day trades to no more than three within five business days if their account is below $25,000. Alternatively, trading through a forex or futures account, which aren't subject to PDT rules, helps bypass restrictions. Using multiple brokerage accounts or trading on platforms that don’t enforce PDT rules is another option.

Does the PDT rule affect day trading strategies?

Yes, the PDT rule limits small account traders by requiring a minimum of $25,000 in account equity to day trade more than three times in five business days. If you have less than that, you can't execute four or more day trades within a week without facing restrictions or account margin calls. This forces small traders to either increase their account size, limit their trades, or switch to longer-term strategies.

Can small accounts still succeed with the PDT rule?

Yes, small accounts can succeed with the PDT rule by using strategies like pattern day trader exemptions, trading on margin with a pattern day trader exemption, or focusing on longer-term trades that don’t require daily activity. They might also consider opening a cash account or spreading out trades over multiple days to avoid the PDT restriction.

What are the exceptions to the PDT rule?

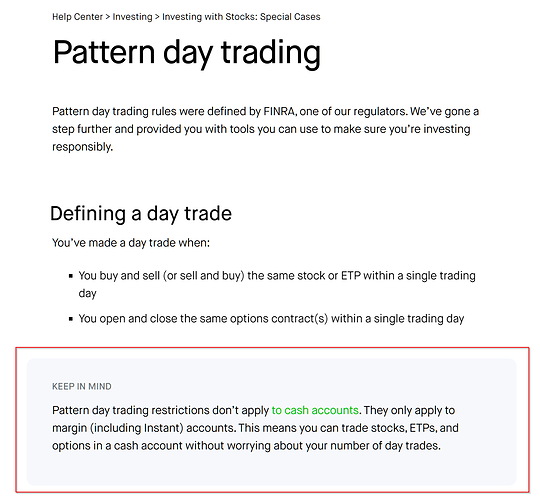

The main exception to the PDT rule is if your account is over $25,000 in equity. Also, traders using a cash account aren’t subject to the PDT rule because it only applies to margin accounts. Certain retirement accounts, like IRAs, are exempt. Finally, if you’re trading futures or forex, the PDT rule doesn’t apply.

How does the PDT rule influence trading frequency?

The PDT rule limits small account traders to three day trades within five business days, forcing them to either wait or increase their account size to avoid restrictions. It reduces trading frequency by restricting quick, repetitive trades, encouraging traders to plan more carefully or hold positions longer. This rule can slow down active trading strategies and push traders into less frequent, more deliberate moves.

What are alternative ways to trade with small accounts?

You can trade with small accounts by using Forex or cryptocurrency markets, which aren't subject to the PDT rule. Consider trading options or futures that have different margin rules. Use swing trading or position trading to reduce the number of trades and avoid pattern day trading limits. Look for brokers offering no PDT restrictions or lower minimum deposit requirements. Finally, focus on long-term investing strategies instead of frequent day trades to stay within regulations.

How does the PDT rule impact profit potential for small traders?

The PDT rule limits small traders by requiring a minimum $25,000 account balance to place more than three day trades in five days, restricting frequent trading. This reduces profit opportunities for small account traders who rely on quick, multiple trades, making it harder to capitalize on short-term market movements. It forces traders to slow their trading pace or increase their account size, which can cap earnings and hinder growth. Overall, the PDT rule can limit profit potential by imposing trading frequency restrictions and increasing capital requirements.

What are the risks of violating the PDT rule?

Violating the PDT (Pattern Day Trader) rule results in a 90-day trading restriction, preventing new small account traders from executing day trades unless they deposit at least $25,000. This limits quick trading opportunities and can stall your ability to respond to market movements. It also forces traders to either raise their account balance or switch to less frequent trading, impacting profits and flexibility.

How do traders work around the PDT rule legally?

Traders work around the Pattern Day Trader (PDT) rule by opening multiple accounts, each under the 25,000-dollar minimum, or using cash accounts instead of margin accounts. Some also trade less than four times in five business days in a single account to avoid the rule. Others partner with traders who have larger accounts or use offshore brokers, though these options can carry legal risks.

Does the PDT rule apply to all brokerage accounts?

No, the PDT (Pattern Day Trader) rule only applies to margin accounts at FINRA-registered brokerages. Cash accounts are exempt.

How does the PDT rule affect margin trading?

The PDT rule limits small account traders by requiring a minimum of $25,000 in account equity to place more than three day trades within five business days. If you fall below this, your account gets flagged as a pattern day trader, restricting your ability to trade intraday until you meet the threshold. This affects margin trading by forcing traders to hold larger cash balances or wait to reset their trading activity, reducing flexibility and increasing capital requirements.

Learn about How Does the PDT Rule Affect Trading Frequency?

What are the best broker options for small traders under the PDT rule?

Small traders under the PDT rule face restrictions on day trading with accounts below $25,000, limiting them to three day trades in five business days. To avoid this, they need brokers that offer options like cash accounts, extended trading hours, or higher leverage. Popular brokers for small traders include Interactive Brokers, which provides low commissions and access to international markets; Webull, offering no PDT restrictions on cash accounts; and TD Ameritrade, with flexible account options and strong research tools. These brokers help small traders navigate PDT rules by allowing more trading flexibility without exceeding the pattern day trader limit.

Learn about What Are the Best Broker Options for PDT Rule Traders?

How does the PDT rule compare internationally?

The PDT rule mainly applies in the U.S, limiting traders with accounts under $25,000 from making more than three day trades in five business days. International markets typically lack such strict rules, allowing small account traders to execute unlimited day trades. This gives international traders more flexibility but also increases risk without regulatory safeguards. In contrast, small U.S. traders face restrictions that often push them toward swing or long-term trading.

Can traders lift the PDT restriction through account growth?

No, traders can't lift the Pattern Day Trader (PDT) restriction through account growth alone. The PDT rule applies if you make four or more day trades within five business days in a margin account with less than $25,000. Increasing account size above $25,000 removes the PDT restriction, but simply growing your account doesn't automatically lift the rule; you must meet the minimum equity requirement.

Conclusion about How Does the PDT Rule Impact Small Account Traders?

In summary, the Pattern Day Trader (PDT) rule presents significant challenges for small account traders, limiting their trading frequency and strategies. However, understanding its implications and exploring legal workarounds can empower traders to navigate these restrictions effectively. With the right approach and tools, small traders can still thrive and achieve their financial goals. For more insights and strategies tailored to your trading journey, consider leveraging the resources provided by DayTradingBusiness.