Did you know that if day trading were a sport, the Pattern Day Trader (PDT) rule would be its referee, ensuring everyone plays by the same rules? Understanding how the PDT rule operates is crucial for traders looking to maximize their strategies without running into regulatory hurdles. This article dives into the core aspects of the PDT rule, including what it is, how it affects your trading, the criteria for classification, and the required account balances. You'll learn about the limits on day trades, the potential consequences of violations, and strategies to stay compliant. Plus, we’ll explore exceptions, the impact on margin requirements, and whether options or futures can be used to sidestep this rule. With insights from DayTradingBusiness, you’ll be equipped to navigate the complexities of the PDT rule like a pro.

What is the Pattern Day Trader rule?

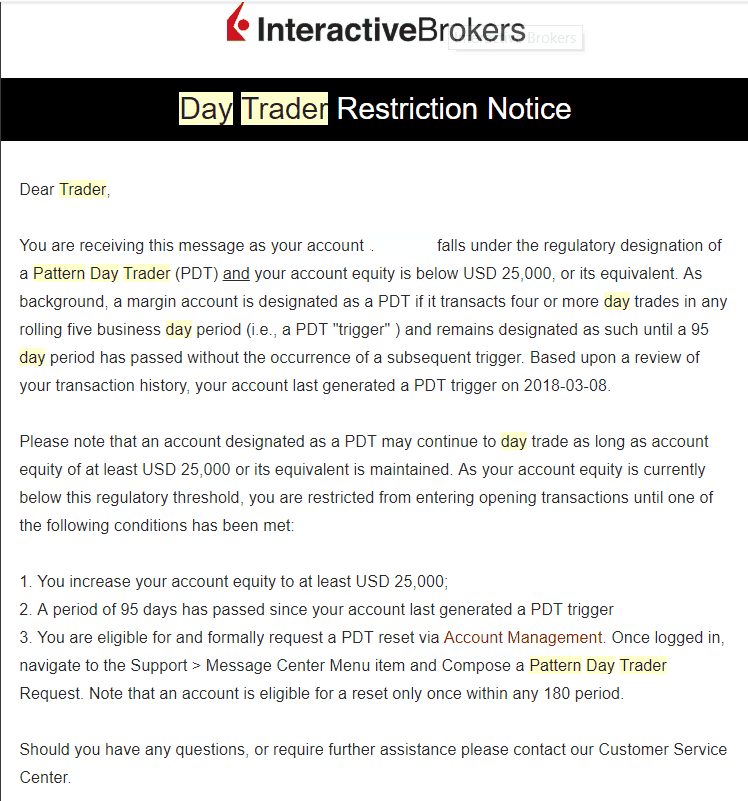

The Pattern Day Trader (PDT) rule applies to traders who execute four or more day trades within five business days in a margin account. If you trigger the rule, you must maintain a minimum account balance of $25,000. If your account falls below this, you can't make new day trades until you restore the minimum. The rule aims to prevent excessive trading without sufficient capital.

How does the PDT rule affect my trading?

The PDT rule limits traders to three day trades within five business days unless they maintain at least $25,000 in their account. This prevents frequent day trading unless you meet the minimum equity requirement. If you violate the rule, your account gets restricted for 90 days or until you add enough funds. It forces traders to plan trades carefully and can slow down active trading strategies.

What are the criteria to be classified as a pattern day trader?

To be classified as a pattern day trader, you must execute four or more day trades within five business days in a margin account, provided these trades make up more than 6% of your total trading activity during that period. Once labeled, you need at least $25,000 in your account to continue day trading without restrictions.

How many day trades can I make without violating the PDT rule?

You can make up to three day trades within five business days without violating the Pattern Day Trader (PDT) rule if your account equity is at least $25,000. If your account is under $25,000, you’re limited to one day trade every five business days.

What are the minimum account balance requirements for pattern day traders?

The minimum account balance for pattern day traders is $25,000.

Can I avoid the PDT rule with a cash account?

Yes, with a cash account, you avoid the PDT rule because it only applies to margin accounts.

What happens if I violate the pattern day trader rule?

If you violate the pattern day trader rule by executing four or more day trades within five business days without enough margin, your brokerage will restrict your account for 90 days. You'll be limited to only closing trades or trading with cash until you meet the minimum $25,000 equity requirement. If you ignore the restriction, your broker can suspend or close your account.

How can I regain pattern day trader status?

To regain pattern day trader (PDT) status, you must wait 90 days without executing four or more day trades within five business days, or you can deposit at least $25,000 to meet the minimum equity requirement.

Are there exceptions to the pattern day trader rule?

Yes, there are exceptions. If you have at least $25,000 in your trading account on any day, you can trade freely without triggering the pattern day trader (PDT) rule. Also, traders who only execute trades on margin accounts registered as futures or forex accounts aren't subject to PDT rules. Additionally, if you make fewer than four day trades within five business days, the PDT rule doesn't apply.

How does the PDT rule impact margin requirements?

The PDT rule requires traders with less than $25,000 in their account to maintain minimum margin requirements of $25,000 to day trade frequently. If you violate the rule by executing four or more day trades in five business days without meeting the minimum equity, your account gets flagged as a pattern day trader. This means your margin requirements increase, limiting your trading to cash or reducing your trading frequency until you meet the minimum equity threshold.

Learn about How Does the PDT Rule Impact Small Account Traders?

Can I use options or futures to bypass the PDT rule?

No, using options or futures doesn't bypass the PDT rule. The rule applies to all margin accounts trading any securities, including options and futures. If you execute four or more day trades within five business days and have less than $25,000 in your account, the PDT rule restricts you from day trading until you meet the minimum equity requirement.

What are the risks of violating the pattern day trader rule?

If you violate the pattern day trader rule by executing four or more day trades within five business days without maintaining a $25,000 minimum account balance, your account gets flagged. Your broker will restrict your account to only closing trades for 90 days or until you meet the minimum equity requirement. This limits your ability to actively trade, potentially causing missed opportunities and increased frustration.

How do brokers enforce the pattern day trader rule?

Brokers enforce the pattern day trader rule by flagging accounts that execute four or more day trades within five business days, provided the account has less than $25,000. Once flagged, the broker restricts the account to only closing trades until the minimum equity requirement is met. If the account falls below $25,000, the broker may impose a trading restriction or margin call.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

Does the PDT rule apply to all brokerage accounts?

No, the PDT rule applies only to margin accounts used for trading stocks actively. Cash accounts are exempt.

How can I increase my trading limits under the PDT rule?

To increase your trading limits under the PDT rule, you need a minimum of $25,000 in your margin account on any day you plan to day trade. If your account falls below this, you can't make more than three day trades in five business days. To raise your limit, deposit additional funds to reach the $25,000 threshold or wait until your account balance recovers. Alternatively, switch to a cash account, which isn't subject to the PDT rule, but you'll need to avoid using leverage.

Learn about How to Identify Day Trading Restrictions Under the PDT Rule?

What strategies can I use to stay compliant with the PDT rule?

To stay compliant with the PDT rule, keep your day trades under four in five business days unless you maintain a minimum of $25,000 in your margin account. Use a cash account instead of margin to avoid the PDT rule altogether. Track your trades carefully to prevent exceeding the limit. Consider trading outside the U.S. markets or using swing trading strategies that don’t count as pattern day trades. Keep a close eye on your account balance, and if it drops below $25,000, pause day trading until you top it up. Use alerts or trading software to monitor your activity and avoid accidental violations.

Conclusion about How Does the Pattern Day Trader Rule Work?

Understanding the Pattern Day Trader (PDT) rule is crucial for anyone looking to engage in frequent day trading. By recognizing the criteria for classification, the implications for your trading activities, and the potential risks of non-compliance, you can navigate the rules effectively. Exploring strategies to remain compliant and increase your trading limits can enhance your trading experience. For tailored advice and deeper insights into day trading, consider leveraging the resources available through DayTradingBusiness.

Learn about What is the Pattern Day Trader (PDT) rule and how does it affect traders?