Did you know that some traders are more restricted than a cat in a room full of rocking chairs? The Pattern Day Trader (PDT) rule can seem daunting, but understanding it is crucial for anyone looking to navigate the fast-paced world of day trading. This article breaks down the essentials of the PDT rule, including how traders can identify if they’re affected, the limitations imposed, and effective strategies to avoid violations. We’ll explore the nuances of margin and cash accounts, the importance of swing and position trading, and how to optimize trading plans while staying compliant. With insights on broker options and the risks of circumventing PDT restrictions, you’ll be well-equipped to manage your trading strategy. Let’s dive into how you can successfully navigate PDT constraints with the help of DayTradingBusiness!

What is the Pattern Day Trader (PDT) rule?

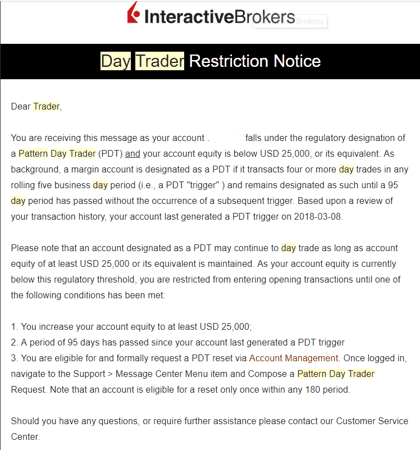

The Pattern Day Trader (PDT) rule requires traders with less than $25,000 in their account to limit their day trades to a maximum of three within five business days. If they exceed this limit, their account gets restricted from day trading for 90 days unless they add funds to meet the $25,000 minimum.

How do traders identify if they are subject to PDT restrictions?

Traders know they’re subject to PDT restrictions if they have fewer than $25,000 in their trading account and engage in four or more day trades within five business days. The brokerage flags accounts exceeding three day trades in five days as pattern day trading accounts. They also receive alerts or messages warning of PDT status. Checking account balance and trade activity history helps confirm if restrictions apply.

What are the main limitations imposed by PDT rules?

PDT rules limit traders to four day trades within five business days using a margin account, unless the account has $25,000 or more equity. If you hit this limit, your account gets restricted from day trading until the restriction period resets. This forces traders to plan trades carefully and avoid excessive short-term trades.

How can traders avoid violating PDT rules?

Traders avoid violating PDT rules by maintaining a minimum equity of $25,000 in their margin account, which allows unlimited day trades. If below that, they can only make three day trades within five business days; exceeding that triggers restrictions. To stay compliant, traders track their trading activity carefully, avoid excessive day trades, and consider using cash accounts instead of margin accounts. Using multiple accounts or spreading trades over different days can also help manage PDT restrictions.

What are the best strategies to manage PDT restrictions?

To manage PDT restrictions, pattern day traders (PDTs) should diversify their trading accounts, avoid risking more than the $25,000 minimum in a single account, and spread trades across multiple accounts if needed. Using cash accounts instead of margin accounts eliminates PDT rules, but limits leverage. Keeping fewer than four day trades per five business days prevents triggering the PDT rule. Some traders also use offshore or international brokers with different regulations. Monitoring trading activity closely and planning trades to stay within the rule limits helps avoid account restrictions.

Can traders use margin accounts without hitting PDT limits?

Yes, traders can use margin accounts without hitting PDT limits by trading less than four times in five days or using a cash account. Alternatively, they can open accounts at brokerages that don’t enforce PDT rules or maintain a higher account balance—over $25,000—to avoid PDT restrictions.

How do traders use cash accounts to bypass PDT restrictions?

Traders use cash accounts to avoid PDT (Pattern Day Trader) restrictions because cash accounts require full payment for trades, preventing the 25% margin rule that triggers PDT rules in margin accounts. Without margin leverage, they can execute unlimited day trades without being labeled as pattern day traders. This allows them to trade more frequently without maintaining the minimum $25,000 equity needed for margin accounts under PDT rules.

What role do swing trading and position trading play under PDT rules?

Swing trading and position trading help traders avoid Pattern Day Trader (PDT) restrictions because they don't execute four or more day trades within five business days. These longer-term strategies focus on holding positions overnight or for weeks, so traders stay under the 4-day trade limit that triggers PDT status. By doing so, they bypass the mandatory $25,000 account minimum required for active day trading.

Are there specific broker options for traders restricted by PDT?

Yes, brokers like Interactive Brokers, TD Ameritrade, and E*TRADE offer options for traders restricted by PDT rules, such as cash accounts, swing trading, or using options strategies that don’t require pattern day trading margins. Some brokers also provide PDT exemption accounts or allow trading with higher cash balances to bypass the pattern day trader restriction.

How does pattern day trading affect trading frequency and volume?

Pattern day trading increases trading frequency and volume because traders execute four or more day trades within five business days, often aiming to capitalize on small price movements. They tend to make multiple trades daily, boosting overall trading activity to meet PDT requirements. To stay compliant, they might use multiple accounts or leverage strategies to manage the 25,000-dollar minimum account balance, which enables higher trading volume without restrictions.

Learn about How Does Insider Trading Affect Day Traders?

What are alternatives to day trading under PDT rules?

Options to avoid PDT rules include trading in non-eligible accounts like cash accounts, using offshore or international brokers, trading on foreign markets not subject to PDT, or waiting 60 days to reset the pattern day trader status. You can also consider swing trading or long-term investing to stay within SEC regulations.

Learn about What Are the Alternatives to Day Trading Under the PDT Rule?

How can traders optimize their trading plans within PDT constraints?

Traders manage PDT restrictions by using multiple accounts to stay under the 25-day trading limit, waiting for the pattern day trader (PDT) rule reset, or trading with cash accounts instead of margin. They plan trades carefully, focusing on longer-term positions to avoid frequent day trades. Some split trades across accounts or use options to reduce the number of day trades recorded. Tracking trading days and avoiding three or more day trades in five days helps stay compliant. Using automation tools or alerts ensures they don’t accidentally breach PDT rules.

What are the risks of trying to circumvent PDT restrictions?

Trying to circumvent PDT restrictions risks account suspension, regulatory penalties, and losing trading privileges. Brokers may flag suspicious activity, leading to account freezes or closures. It can also trigger legal issues if you violate trading regulations. Ultimately, it jeopardizes your ability to trade freely and could result in financial losses.

How do traders transition from pattern day trading to longer-term investing?

Traders switch from pattern day trading to longer-term investing by closing their short-term positions to meet PDT rules, then holding stocks for weeks or months. They shift their account to a cash account or wait 30 days to avoid the PDT minimum equity requirement. Some use their taxable accounts for swing or position trading, focusing on fundamentals instead of frequent trades. This strategy allows them to bypass the $25,000 minimum equity rule and adopt a more relaxed, long-term approach.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

What legal and regulatory considerations exist around PDT management?

Pattern Day Traders (PDT) must comply with FINRA rules requiring a minimum account equity of $25,000. If the account falls below this, trading restrictions kick in, limiting trades to only closing positions until the balance is restored. Broker-dealers enforce these rules, and failure to meet the minimum equity can lead to account suspension. Regulations also require clear disclosures and adherence to SEC rules on margin and trading practices. Some traders navigate PDT restrictions by using cash accounts or trading outside of margin rules to avoid the $25,000 threshold.

How can traders plan their trades to stay compliant with PDT?

Traders manage PDT restrictions by maintaining a minimum equity of $25,000 in their trading account. They avoid executing more than three day trades within five business days unless they meet the minimum equity requirement. Some use multiple accounts to spread out trades or limit their daily trades to stay under the PDT threshold. They also plan trades carefully, focusing on longer-term positions or swing trading to reduce day trading frequency. Keeping track of trade activity with alerts or logs helps ensure compliance with PDT rules.

Conclusion about How Do Pattern Day Traders Manage PDT Restrictions?

Understanding and navigating the Pattern Day Trader (PDT) restrictions is crucial for anyone engaged in active trading. By identifying your trading style and adopting strategies to adhere to these regulations, you can enhance your trading experience and minimize potential pitfalls. Employing methods such as cash accounts or transitioning to swing trading can offer viable alternatives under PDT rules. Always remain compliant with legal guidelines to safeguard your investments. For tailored advice and further insights, DayTradingBusiness is here to support your trading journey.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

Sources:

- Day Traders, Noise, and Cost of Immediacy

- Global Trade Liberalization and the Developing Countries -- An IMF ...

- Asset pricing: A tale of two days - ScienceDirect

- Predicting Stock Prices using Permutation Decision Trees and ...

- Review A survey of deep learning applications in cryptocurrency

- NBER WORKING PAPER SERIES FIVE FACTS ABOUT BELIEFS ...