Did you know that the average day trader spends more time staring at charts than a cat spends napping? In the world of trading, understanding the Pattern Day Trading (PDT) rule is crucial for avoiding penalties and ensuring compliance with brokerage regulations. This article delves into how brokerage firms enforce the PDT rule, what it entails, and the implications for traders, especially beginners. Learn how brokers monitor day trades, the consequences of violating the PDT rule, and explore legal ways to navigate around it. Additionally, discover the criteria for being classified as a pattern day trader, the penalties for breaking the rules, and alternative strategies to trade without PDT restrictions. With insights from DayTradingBusiness, you’ll be better equipped to manage your trading activities effectively and safely.

How Do Brokerage Firms Enforce the PDT Rule?

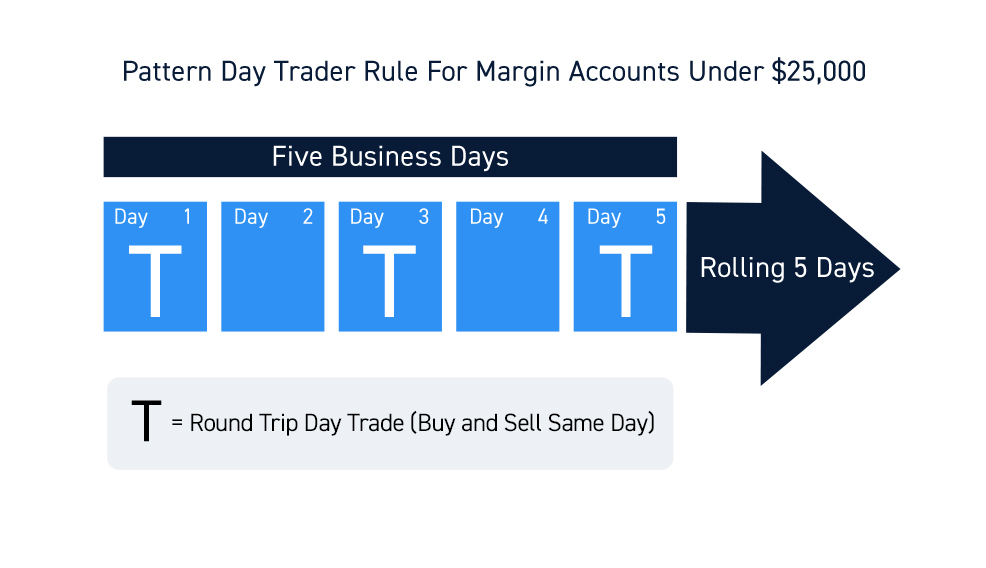

Brokerage firms enforce the PDT (Pattern Day Trader) rule by setting a minimum account balance of $25,000. If your account falls below this, they restrict your trading activities, preventing you from executing more than three day trades within five business days. They monitor your trading activity electronically, flagging accounts that violate the rule, and automatically restrict your ability to day trade until the account is restored to the required balance.

What Is the PDT Rule in Stock Trading?

Brokerage firms enforce the PDT (Pattern Day Trader) rule by flagging accounts that execute four or more day trades within five business days, provided the account has less than $25,000 in equity. They restrict these accounts from making additional day trades until the equity surpasses $25,000. If violated, the broker can restrict trading activity, require a deposit to meet the minimum, or suspend the account for 90 days.

How Do Brokerage Firms Monitor Day Trades?

Brokerage firms monitor day trades by tracking the number of trades a client makes within five business days. If a trader executes four or more day trades in a five-day period in a margin account, the firm flags it as a pattern. They automatically restrict the account from making further day trades unless the trader maintains at least $25,000 in equity, complying with the Pattern Day Trader (PDT) rule. Firms use real-time data and trading activity analysis to enforce this rule consistently.

What Happens if You Violate the PDT Rule?

If you violate the PDT rule, your brokerage account gets restricted. Specifically, you'll face a 90-day period where you're only allowed three day trades. After hitting this limit, you'll be designated as a pattern day trader and must maintain at least $25,000 in your account to continue trading actively. If you don’t meet the minimum equity requirement, your broker can restrict or close your account.

How Do Brokers Track Your Trading Activity?

Brokers track your trading activity through their trading platforms, monitoring the number of day trades you make within a rolling five-business-day period. They record each buy and sell order, calculating if you exceed the three-day-trade limit for pattern day trading (PDT). If you hit four or more day trades in five days, they flag your account, enforce the PDT rule, and restrict further day trading unless you meet margin requirements or maintain minimum equity.

Can You Avoid the PDT Rule Legally?

No, you can't legally avoid the Pattern Day Trader (PDT) rule. Brokerage firms enforce it because it's a FINRA regulation requiring a minimum $25,000 account balance for day trading. To comply, you must maintain that minimum or limit your day trades. Using multiple accounts or switching brokers doesn't exempt you from the rule.

What Are the Criteria for the PDT Rule?

The PDT rule requires that traders who execute four or more day trades within five business days must maintain a minimum account balance of $25,000. If the account falls below this, trading restrictions apply until the balance is restored.

How Does Pattern Day Trading Affect Beginners?

Brokerage firms enforce the PDT (Pattern Day Trader) rule by requiring traders with less than $25,000 in their account to limit their day trades to three within five business days. If a trader exceeds this limit, the broker will restrict further day trading until the account balance is raised above $25,000 or the trader waits 90 days. They flag accounts that meet the pattern criteria, monitor trading activity, and place restrictions or margin limits accordingly.

What Are the Penalties for Breaking the PDT Rule?

Brokerage firms enforce the PDT (Pattern Day Trader) rule by closing your account if you violate it. If you execute four or more day trades within five business days and your account equity is below $25,000, they’ll restrict your trading for 90 days or until you meet the minimum equity requirement. Penalties include account suspension, restricted trading, or forced liquidation of positions.

Do All Brokerage Firms Enforce the PDT Rule?

No, not all brokerage firms enforce the Pattern Day Trader (PDT) rule. Some firms, especially those catering to casual traders or offering no-margin accounts, may not strictly apply it. However, most registered brokerages that handle margin accounts are required by FINRA to enforce the PDT rule, which limits traders to three day trades within five business days unless they maintain a minimum of $25,000.

How Can Traders Bypass the PDT Rule?

Traders can bypass the Pattern Day Trader (PDT) rule by opening a margin account with less than $25,000, trading in a cash account, or using multiple accounts at different brokerages. Some also split trades across accounts or trade on non-U.S. platforms not subject to PDT restrictions.

What Are Alternative Ways to Trade Without PDT Restrictions?

To trade without PDT restrictions, use a cash account instead of a margin account, as the PDT rule only applies to margin accounts. Another option is to trade less than four times in a five-business-day period, avoiding pattern day trader designation. You can also open a futures or forex trading account, which isn't subject to PDT rules. Additionally, trading with international brokerages that don’t enforce the PDT rule allows unlimited day trading. Lastly, consider trading on a different platform that supports pattern day trader exemptions or offers alternative account types.

How Do Margin Requirements Relate to the PDT Rule?

Brokerage firms enforce the Pattern Day Trader (PDT) rule by requiring a minimum of $25,000 in your margin account before allowing you to make more than three day trades in five business days. If your account falls below this, they restrict your trading activity to prevent violations. They also automatically flag and restrict accounts that breach the rule until the balance is restored.

How Quickly Do Brokers Detect Pattern Day Trading?

Brokers typically detect pattern day trading within minutes to hours based on real-time account activity and trade frequency. They monitor trading patterns continuously, flagging accounts that execute four or more day trades within five business days with a margin account. Once detected, enforcement—like restricting trading or requiring additional margin—happens immediately or by the next trading day.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

Can You Trade More Than Three Times a Week Safely?

No, trading more than three times a week in a margin account triggers the Pattern Day Trader (PDT) rule, which requires a minimum $25,000 account balance. Brokerage firms enforce this by flagging accounts that exceed three day trades within five business days and restrict further trading until the balance is restored.

What Are the Best Strategies for Pattern Day Traders?

Brokerage firms enforce the PDT rule by requiring pattern day traders to maintain a minimum equity of $25,000 in their margin accounts. If the account falls below this, they restrict trading until it is restored. They monitor trading activity daily; executing four or more day trades within five business days triggers PDT designation. Once flagged, traders must adhere to the rule or risk account restrictions, such as limiting trades or closing positions until the minimum equity is met.

Conclusion about How Do Brokerage Firms Enforce the PDT Rule?

In conclusion, understanding the PDT rule is crucial for any trader looking to navigate the complexities of day trading without incurring penalties. Brokerage firms enforce this rule through diligent monitoring of trading activities and strict adherence to margin requirements. For those eager to trade without these restrictions, alternative strategies exist that can help you remain compliant while maximizing trading opportunities. By leveraging resources and insights from DayTradingBusiness, traders can enhance their knowledge and skill set to thrive in the dynamic trading environment.