Did you know that the PDT Rule can feel like a strict gym instructor limiting your sets? In the world of trading, it’s crucial to understand how this rule applies—or doesn’t apply—to Forex and cryptocurrency markets. This article delves into the specifics of the PDT Rule, clarifying its relevance for Forex traders and crypto enthusiasts alike. We’ll explore how the rule impacts trading strategies, the exceptions that exist, and the penalties for non-compliance. Additionally, we'll highlight ways to navigate around the PDT Rule while keeping your trading game strong. Let DayTradingBusiness guide you through these complex regulations to enhance your trading experience.

Does the PDT Rule apply to Forex trading?

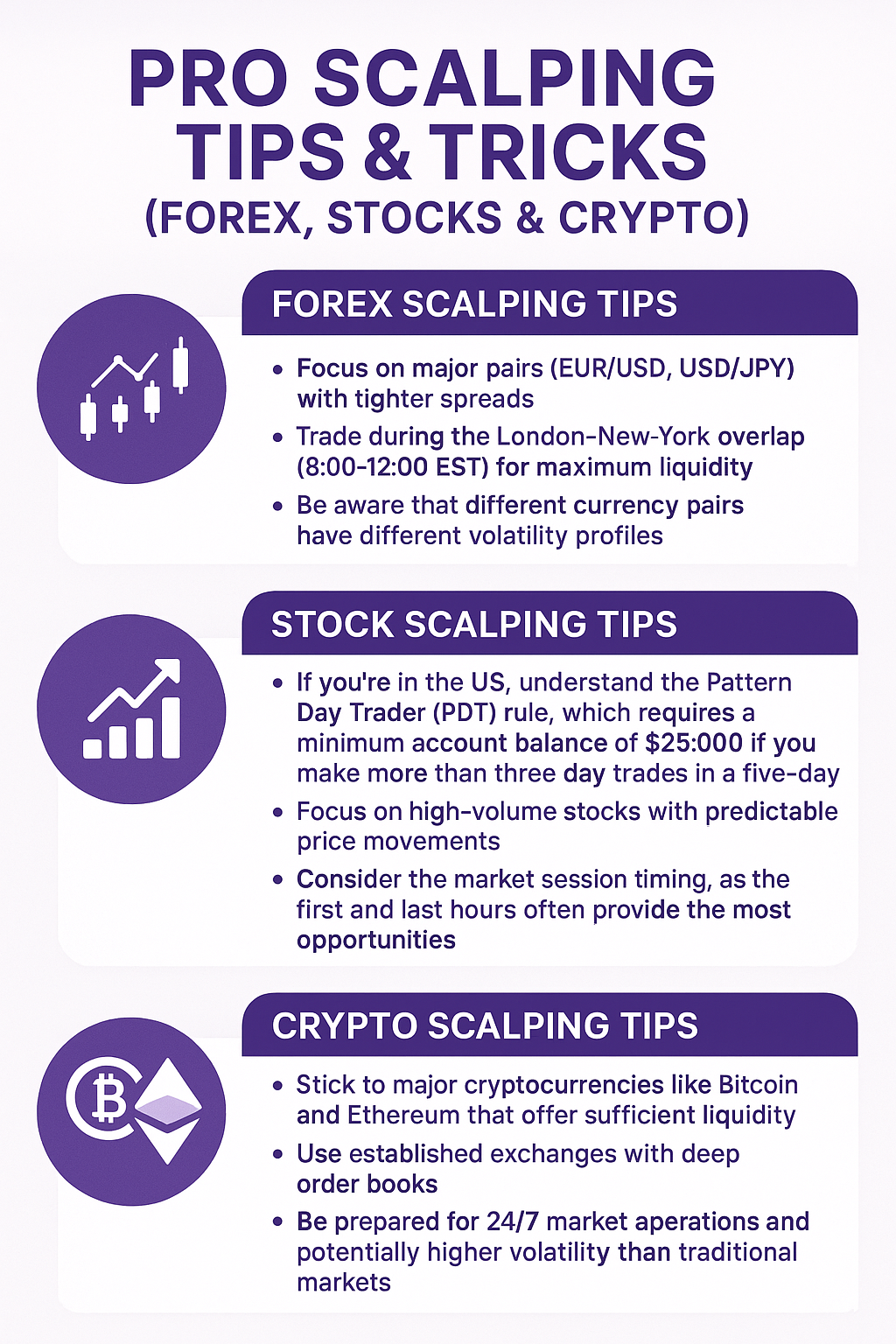

No, the PDT (Pattern Day Trader) rule does not apply to Forex trading. It only affects stock trading in the US. Forex brokers aren’t bound by the same pattern day trading restrictions.

Is the PDT Rule relevant for cryptocurrency trading?

No, the PDT (Pattern Day Trader) rule does not apply to cryptocurrency trading. It’s specific to stock trading on the U.S. equities market. Forex trading isn’t subject to the PDT rule either, since it’s decentralized and regulated differently.

How does the PDT Rule impact forex traders?

The PDT Rule doesn't apply to forex traders because it's a U.S. regulation for stock trading, requiring a minimum of $25,000 in your account to day trade four or more times in five days. Forex trading isn't restricted by this rule, so traders can open and close positions daily without the $25,000 minimum. Crypto trading also isn't subject to PDT rules, making it easier for traders to execute multiple trades without account size limitations.

Can crypto traders be subject to the PDT Rule?

No, the Pattern Day Trader (PDT) rule applies only to stock trading in the U.S., not to forex or crypto trading. Crypto traders aren’t restricted by the PDT rule, regardless of trading frequency. Forex brokers are typically exempt because forex is considered an over-the-counter market, and crypto exchanges aren't regulated under the same rules.

What is the PDT Rule and who does it affect?

The PDT (Pattern Day Trader) Rule requires traders with less than $25,000 in their brokerage account to limit their day trades to three within five business days. It mainly affects stock traders using U.S. brokerage accounts. The rule does not apply to forex and crypto trading, as those markets are not regulated by the SEC or FINRA, which enforce the PDT Rule.

Do forex brokers enforce the PDT Rule?

No, the PDT (Pattern Day Trader) rule doesn't apply to forex brokers. It only affects stock trading in the U.S. securities market. Forex brokers aren't regulated under the same rules, so you can trade multiple times a day without a minimum account balance of $25,000. Crypto trading isn't subject to the PDT rule either, since it's not part of the traditional stock market regulations.

Are there exceptions to the PDT Rule for crypto traders?

Yes, the PDT rule does not apply to forex trading, but it does apply to crypto trading.

How does the PDT Rule limit day trading in stocks?

The PDT Rule applies only to stock trading, not forex or crypto. It limits day trading by requiring traders with less than $25,000 to maintain a minimum account balance and restricts them to three day trades within five business days. If they exceed this, their account is restricted for 90 days or until the balance is raised. Forex and crypto trading aren’t bound by this rule, so traders can make unlimited trades regardless of account size.

What are the differences between stock, forex, and crypto trading rules?

The Pattern Day Trader (PDT) rule applies only to stock trading and not to forex or crypto trading. For stocks, you need at least $25,000 in your account to day trade more than four times in five days. Forex and crypto trading have no PDT restrictions; you can trade as often and as much as you want without minimum account balances.

Can I avoid the PDT Rule when trading forex or crypto?

Yes, the PDT (Pattern Day Trader) rule doesn't apply to forex or crypto trading. It only restricts stock trading in the U.S. if you make four or more day trades within five business days and have less than $25,000 in your account. Forex and crypto traders aren’t subject to this regulation, so you can day trade freely without the $25,000 minimum.

How does leverage affect PDT Rule restrictions?

Leverage doesn’t affect PDT Rule restrictions because the PDT Rule only applies to stock trading in the U.S. with less than $25,000 in your account. Forex and crypto trading aren’t subject to the PDT Rule, regardless of leverage used.

Learn about How Does the PDT Rule Affect Trading Frequency?

What are the penalties for violating the PDT Rule?

The PDT (Pattern Day Trader) rule penalties include a $225,000 account liquidation if your account falls below the minimum equity of $25,000 after multiple violations. If you violate the rule, your trading account can be restricted to only closing trades for 90 days until you meet the minimum equity requirement. The rule applies only to U.S. stock and options trading, not to forex or crypto trading, which have different regulations and no PDT restrictions.

Learn about What Are the Penalties for Violating the PDT Rule?

Does the PDT Rule apply to trading accounts outside the US?

The PDT rule does not apply to forex and crypto trading outside the US. It only governs US-regulated stock and securities accounts.

How can traders bypass the PDT Rule legally?

Traders can bypass the PDT (Pattern Day Trader) rule legally by trading in forex or cryptocurrency markets, which are not subject to the same pattern day trading regulations as stocks. Forex and crypto trading accounts are not restricted by the PDT rule since the rule applies only to U.S. stock trading accounts with less than $25,000. Opening a forex or crypto account with a broker that accepts U.S. clients allows frequent trading without PDT restrictions. Alternatively, maintaining a balance above $25,000 in a stock account also lifts the PDT rule.

What alternatives exist for frequent traders in forex and crypto?

The Pattern Day Trader (PDT) rule doesn’t apply to forex and crypto trading. Instead, forex brokers often require a minimum account balance (like $500 or $1,000) to avoid margin calls, while crypto traders can use leverage without a pattern day trading restriction. Alternatives for frequent traders include using offshore or forex-specific brokers with higher leverage, trading in crypto exchanges that allow rapid, small-position trades, or setting up multiple accounts to increase trading flexibility. Some traders also switch to spot trading or use derivatives like futures and options on regulated platforms, though these come with their own rules and risks.

Conclusion about Does the PDT Rule Apply to Forex and Crypto Trading?

In summary, the Pattern Day Trader (PDT) Rule primarily governs stock trading and does not apply to forex or cryptocurrency markets. Forex traders typically operate without PDT restrictions, while crypto trading offers even more flexibility. However, it's essential for traders to understand their specific broker's policies and any applicable regulations, especially if trading outside the U.S. For those seeking guidance on navigating these rules and maximizing their trading potential, DayTradingBusiness offers valuable insights and support.