Did you know that day trading with a cash account can feel like trying to run a marathon in flip-flops? It's possible, but definitely tricky! In this article, we dive into the essentials of day trading using a cash account, exploring its risks and limitations compared to margin accounts. You'll discover whether day trading is permissible with cash accounts, the rules governing pattern day trading, and the funds required to start. We also cover crucial factors like settlement rules, leverage options, and the tax implications for traders. Finally, we outline effective strategies and risk management techniques to help you navigate the cash account landscape successfully. With insights from DayTradingBusiness, you'll be better equipped to make informed trading decisions.

Can You Day Trade with a Cash Account?

No, you can't day trade with a cash account unless you have enough cash to cover the trades every time. The pattern day trader rule requires a minimum $25,000 account balance, which cash accounts can't meet. In a cash account, you must wait for funds to settle before reinvesting, limiting quick, multiple trades needed for day trading.

What Are the Risks of Day Trading with Cash?

With a cash account, the main risk of day trading is losing your invested money quickly if the market moves against you. You can't use leverage, so gains are limited to your available cash, but losses can still wipe out your funds. There’s also the risk of not being able to fully capitalize on quick price movements because you need to have the cash settled before reinvesting. Additionally, if you make multiple trades within a day, you might face restrictions like the Pattern Day Trader rule if your account balance isn't high enough, which could limit your trading activity.

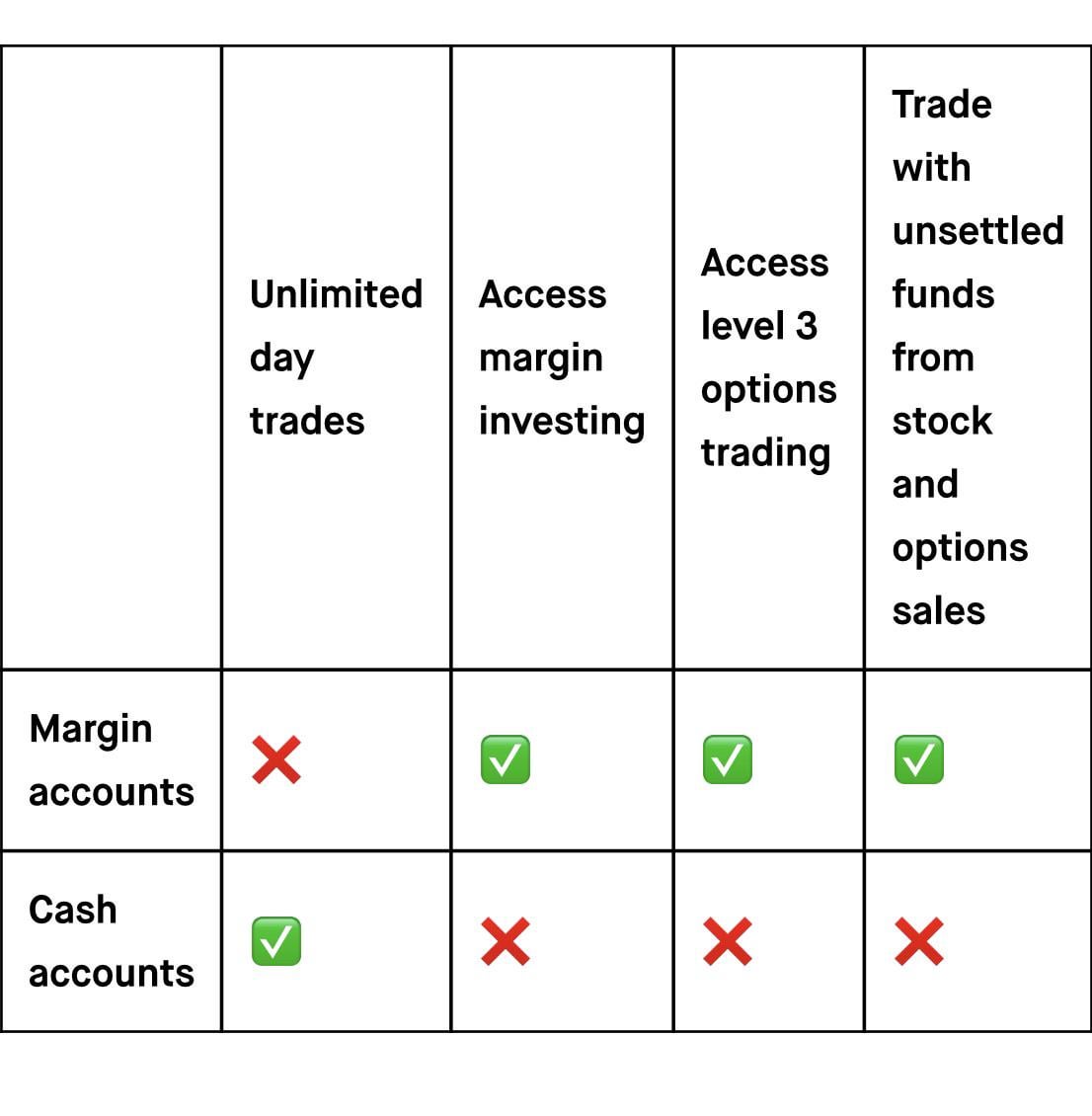

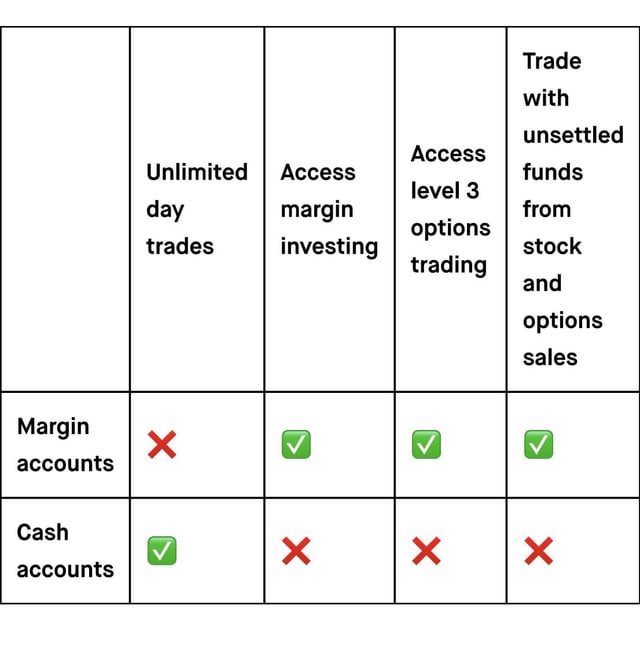

How Does a Cash Account Differ from a Margin Account?

You can't day trade with a cash account because you're limited to the funds you have on hand; you must wait for trades to settle before using the proceeds. A margin account lets you borrow money from your broker, enabling more frequent and larger trades, including day trading, since you can leverage your position.

Is Day Trading Allowed in a Cash Account?

No, you cannot legally day trade in a cash account unless you have enough settled funds to cover each trade. Federal regulations require a pattern of day trading to be done in a margin account with at least $25,000. In a cash account, you're limited to trading only with available settled cash, making frequent day trading impossible without violating rules.

What Are the Rules for Pattern Day Trading with Cash?

You can't day trade with a cash account because you need a margin account to meet the pattern day trading rule. In a cash account, you must fully fund your trades and wait for settlement before selling again. The pattern day trading rule applies only to margin accounts with at least $25,000. If you try to day trade with cash, your broker will restrict your activity after four day trades in five business days.

How Much Money Do You Need to Start Day Trading with Cash?

You need at least $25,000 in your cash account to meet the pattern day trader rule. Without that, you can’t day trade more than three times in five business days. If you have less, you should use a cash account, which requires enough funds to buy and sell stocks without borrowing. The exact amount depends on your trading frequency and the stocks’ price, but usually, having $5,000 to $10,000 is a solid starting point for small-scale day trading.

Can You Avoid Pattern Day Trading Rules with a Cash Account?

Yes, you can avoid pattern day trading rules with a cash account because those rules only apply to margin accounts. In a cash account, you can execute unlimited day trades as long as you have enough settled funds, with no minimum equity requirement or pattern day trader designation.

What Are the Limitations of Day Trading in a Cash Account?

In a cash account, you can't day trade more than the cash available without waiting for settled funds. If you execute a day trade using unsettled cash, you'll face a pattern day trader (PDT) rule violation. You can't use margin to increase buying power, limiting your trades. Settling times mean you must wait two business days for funds to clear, restricting quick, multiple trades. This delay reduces flexibility and can cause missed opportunities.

How Do Settlement Rules Affect Day Trading in Cash Accounts?

Settlement rules limit day trading in cash accounts because you can't use the proceeds from a sale to buy again until the trade settles, which takes two business days (T+2). This means if you sell a stock today, you must wait two days before using that cash to buy another stock. Unlike margin accounts, cash accounts restrict rapid, repeated trades, making it harder to execute multiple day trades quickly. This "settlement delay" prevents you from meeting the Pattern Day Trader rules unless you switch to a margin account.

Can You Use Leverage in a Cash Account for Day Trading?

No, you can't use leverage in a cash account for day trading. Leverage requires a margin account. In a cash account, you can only trade with the funds you have, limiting your ability to day trade frequently or on margin.

Learn about How Do Institutional Traders Use Leverage in Day Trading?

What Are the Pros of Day Trading with a Cash Account?

You can day trade with a cash account without risking margin calls. It avoids leverage, so losses are limited to your actual cash. No pattern day trade rule applies, giving more flexibility. It’s simpler, with fewer regulatory restrictions. You won’t pay interest on borrowed funds. Plus, it encourages disciplined trading since you can only trade with available cash.

What Are the Cons of Day Trading with a Cash Account?

You can’t meet the Pattern Day Trader (PDT) rule with a cash account, limiting frequent day trading. You must wait for trades to settle, which can delay quick moves or limit buying power. It’s harder to leverage capital, reducing potential gains. If a trade results in a loss, you can’t immediately reinvest that money without waiting for settlement. This setup can restrict flexibility and speed needed for successful day trading.

How Do Taxes Work for Day Traders Using Cash Accounts?

Day traders using cash accounts can’t execute more than three day trades in five business days without triggering the pattern day trader rule. They must settle each trade in full before using the proceeds for another trade, which can limit quick, repeated buying and selling. Unlike margin accounts, cash accounts don’t allow borrowing, so taxes are based on realized gains and losses from actual trades. Traders report these on Schedule D and Form 8949, paying capital gains tax on profits. Since no margin interest is involved, there’s no margin interest deduction, but they must keep detailed records of each trade’s cost basis and sale price for accurate tax reporting.

Learn about Are There Tax Benefits for Day Traders Using Retirement Accounts?

What Are the Best Strategies for Day Trading with a Cash Account?

You can day trade with a cash account, but you'll need to pay full price for each trade, limiting quick moves. Focus on trading liquid stocks and avoid holding positions overnight to prevent pattern day trading rules. Use strategies like swing trading within the cash account's limits, and keep your trades small to manage risk. Always monitor market news and set strict stop-loss orders to protect your capital. Since cash accounts don't allow margin, stay disciplined and avoid overleveraging.

Learn about Best Strategies for Success with Day Trading Prop Firms

How Do You Manage Risks When Day Trading in a Cash Account?

You manage risks in a cash account by avoiding margin and leverage, sticking to your available cash, and limiting trades to your capital. Use stop-loss orders to cut losses quickly. Diversify trades to prevent heavy exposure. Keep a close eye on market movements and avoid overtrading. Stick to a solid plan and don't chase losses.

Learn about How to Mitigate Risks When Day Trading ETFs

Can You Switch from a Cash to a Margin Account for Day Trading?

No, you cannot switch directly from a cash account to a margin account for day trading. You need to open a margin account separately, as they are different account types. Once approved for margin trading, you can use margin to execute day trades.

Conclusion about Can You Day Trade with a Cash Account?

In conclusion, day trading with a cash account presents both opportunities and challenges. While it allows for more control over funds without the risks of margin, traders must navigate strict settlement rules and limitations on trading frequency. It's essential to understand the implications of pattern day trading and to have a solid strategy in place to manage risks. For those looking to enhance their trading knowledge and skills, resources from DayTradingBusiness can provide valuable insights and support.