Did you know that the SEC once fined a day trader for using a trading strategy called “pump and dump” that involved more drama than a soap opera? In the world of day trading, understanding the roles of the SEC and FINRA is crucial for navigating the complex regulatory landscape. This article dives into how the SEC regulates day trading, protects traders, and enforces rules, while also exploring FINRA's responsibilities and monitoring efforts. Key topics include registration requirements, penalties for violations, and the impact of regulations on trading strategies. By grasping these essentials, day traders can better safeguard their investments and ensure compliance with the law, all with insights from DayTradingBusiness.

What Does the SEC Regulate in Day Trading?

The SEC regulates securities trading to prevent fraud, ensure transparency, and protect investors. It enforces rules on trading practices, disclosure requirements, and market integrity. FINRA oversees broker-dealers, enforces trading regulations, and monitors compliance in day trading. Both agencies set rules for margin accounts, order execution, and reporting to keep the market fair and transparent for day traders.

How Does the SEC Protect Day Traders?

The SEC protects day traders by enforcing securities laws that prevent fraud and manipulation, ensuring fair trading practices. It requires transparency from brokers and trading platforms, monitors for insider trading, and enforces rules against market abuse. The SEC also sets regulations for margin accounts and trading disclosures, helping traders avoid risky or deceptive practices. FINRA, as a self-regulatory organization under SEC oversight, enforces rules on broker conduct, supervises trading activity, and provides investor protections, ensuring day traders operate in a fair, regulated environment.

What Are FINRA’s Responsibilities for Day Trading?

FINRA oversees broker-dealers involved in day trading, ensuring they follow rules to protect investors. It enforces regulations on pattern day trading, requiring a minimum $25,000 account balance for frequent traders. FINRA monitors trading activity for compliance and investigates misconduct. It also enforces margin requirements and ensures brokers provide proper disclosures. Overall, FINRA’s role is to regulate, supervise, and enforce rules that keep day trading fair and transparent.

How Does FINRA Enforce Day Trading Rules?

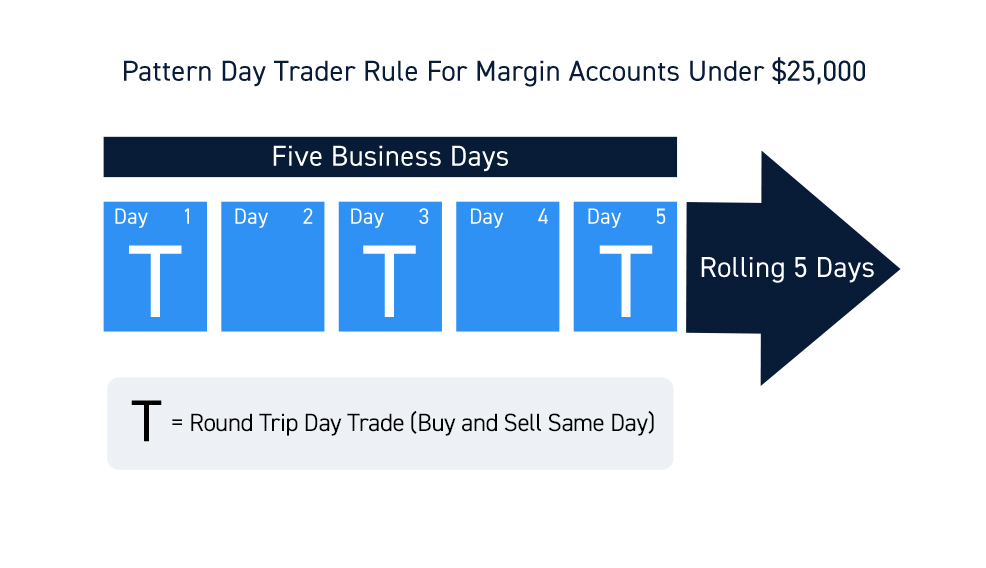

FINRA enforces day trading rules by monitoring trading activity, flagging pattern day traders who exceed four day trades in five days, and imposing a minimum $25,000 equity requirement. It audits brokerages, investigates suspicious trades, and enforces penalties like fines or account restrictions. The SEC oversees FINRA’s regulations, ensuring compliance and protecting investors in day trading activities.

Are Day Traders Required to Register with the SEC?

Day traders aren't always required to register with the SEC unless they are part of a registered investment advisory or broker-dealer. However, if a day trader's activities involve managing client funds or operating as a broker, registration is necessary. The SEC oversees securities markets and enforces federal securities laws, while FINRA regulates broker-dealers and ensures compliance in day trading activities.

What Are the Key SEC Regulations for Day Traders?

The SEC regulates day trading by enforcing rules on margin accounts, pattern day trader status (requiring $25,000 minimum equity), and disclosure requirements. FINRA oversees broker-dealers, ensuring transparency, fair practices, and accurate reporting. Both require day traders to follow specific compliance rules, like proper record-keeping and adherence to anti-fraud laws.

How Does FINRA Monitor Day Trading Activity?

FINRA monitors day trading activity through real-time trade reporting, pattern recognition algorithms, and reviewing trading patterns for signs of excessive or suspicious activity. It tracks margin accounts, identifies frequent buying and selling within short periods, and flags potential violations like pattern day trading rules. FINRA also analyzes customer account activity and communicates with brokers to ensure compliance with regulations.

What Are the Rules for Pattern Day Traders?

Pattern day traders must maintain a minimum of $25,000 in their trading account, and they can execute four or more day trades within five business days. The SEC and FINRA regulate these rules to prevent excessive risk-taking and ensure market stability. If you fail to meet the $25,000 requirement, you’re restricted from day trading until you restore your balance. These rules apply to margin accounts and are enforced to protect investors and maintain fair trading practices.

How Do SEC and FINRA Rules Affect Margin Trading?

SEC and FINRA regulate margin trading by setting rules on borrowing money to buy securities, requiring broker-dealers to maintain minimum margin levels, and enforcing disclosures. They limit the amount traders can borrow, monitor margin calls, and ensure broker compliance to prevent risky leverage. Their oversight helps prevent excessive risk-taking in day trading, protecting investors and maintaining market stability.

What Are Common Penalties from SEC or FINRA Violations?

Common penalties from SEC or FINRA violations include fines, suspension or banning from securities trading, cease-and-desist orders, restitution to harmed investors, and disqualification from industry roles.

How Do the SEC and FINRA Ensure Fair Trading?

The SEC and FINRA enforce rules that prevent manipulation, insider trading, and fraud, ensuring transparent, fair trading. The SEC oversees market operations, requires disclosures, and investigates misconduct. FINRA regulates broker-dealers, enforces compliance, and monitors trading activity to protect investors. Both agencies audit firms, set trading standards, and take disciplinary action against violations to maintain market integrity.

Learn about How to Ensure Compliance with SEC & FINRA Regulations

What Are the Reporting Requirements for Day Traders?

Day traders must report their earnings accurately on tax returns, typically using Schedule C or Form 8949 for capital gains. The SEC and FINRA don’t set specific reporting rules for individual traders but oversee brokerages to ensure proper reporting of trades. Brokers send 1099-B forms to traders and the IRS, detailing transactions and gains or losses. Traders need to review these forms and report their profits or losses correctly. Accurate record-keeping of all trades and expenses is essential for compliance.

How Do These Agencies Handle Fraud in Day Trading?

The SEC and FINRA detect and investigate fraudulent activities in day trading through monitoring trading patterns, analyzing suspicious transactions, and enforcing regulations. They review suspicious trades, penalize manipulative practices like pump-and-dump schemes, and require transparent reporting. Both agencies collaborate with brokerages to ensure compliance, and they take enforcement actions against those engaging in illegal schemes. Their goal is to protect investors and maintain fair, transparent markets.

Learn about How Do Prop Firms Handle Losses in Day Trading?

Can the SEC or FINRA Ban a Day Trader?

Yes, the SEC and FINRA can ban a day trader if they violate securities laws or regulations, such as engaging in fraudulent activities or repeatedly violating trading rules.

What Is the Impact of SEC and FINRA Regulations on Day Trading Strategies?

SEC and FINRA regulations set rules that limit risky behavior, like requiring pattern day traders to keep a minimum $25,000 account balance. They enforce margin rules, prevent manipulative practices, and oversee broker compliance, which can restrict certain aggressive strategies. These agencies ensure transparency and fair trading, meaning day traders must follow specific regulations, impacting how they execute high-frequency or leveraged trades. Overall, SEC and FINRA regulations shape the boundaries within which day traders operate, balancing opportunity with investor protection.

Learn about How Do SEC and FINRA Regulations Influence Day Trading Strategies?

Conclusion about What Is the Role of the SEC and FINRA in Day Trading?

In summary, the SEC and FINRA play crucial roles in regulating day trading, ensuring market integrity, and protecting traders from fraud. Their regulations shape trading strategies, enforce registration requirements, and monitor activity to uphold fair practices. Understanding these regulations is essential for day traders to navigate the market effectively. For deeper insights and guidance on day trading, explore the resources available at DayTradingBusiness.

Learn about What is the role of the SEC in regulating day trading?

Sources:

- 1 Supporting Statement for the Treasury Securities and Agency Debt ...

- FR 2956 Treasury Securities and Agency Debt and Mortgage ...

- DC Policy Update: SEC, FINRA Roll Out Proposals to Aid Market ...

- The Fed - Unlocking the Treasury Market through TRACE

- Trust and the Investment Adviser Industry: Congress' Failure to ...