Did you know that trading violations can make you feel like a kid caught sneaking cookies before dinner? In the world of day trading, ignoring regulations can lead to serious consequences. This article dives into the legal risks of violating day trading rules, including hefty fines and penalties imposed by regulators. We'll explore how breaching these regulations can result in criminal charges, account suspensions, and financial losses. Additionally, we'll discuss the impact of improper leverage use and the importance of proper registration. By understanding common mistakes and how regulators detect illegal trading activities, traders can protect their reputations and avoid costly pitfalls. Stay informed with DayTradingBusiness to navigate these risks effectively!

What are the legal risks of violating day trading rules?

Violating day trading rules can lead to hefty fines, account suspensions, and regulatory bans. You might face legal action, including fines from the SEC or FINRA, if authorities determine you're intentionally evading regulations. Repeated violations can result in your broker refusing to serve you or closing your account. In severe cases, you could be sued or face criminal charges for fraud or market manipulation. These risks can damage your reputation and financial stability long-term.

How can violating day trading regulations lead to fines?

Violating day trading regulations can lead to fines because regulators like the SEC enforce rules to protect fair markets. If you trade excessively without meeting pattern day trader rules or misrepresent your account status, authorities can impose monetary penalties. The fines serve to penalize illegal practices, such as unauthorized leverage or failing to maintain minimum equity. Regulatory bodies monitor trading activity and can audit accounts, imposing fines when violations are detected.

What penalties do regulators impose for illegal day trading?

Regulators can impose fines, bans on trading, account restrictions, and even criminal charges for illegal day trading. They may revoke licenses or impose civil penalties up to hundreds of thousands of dollars. In severe cases, traders face criminal prosecution, fines, and imprisonment.

Can you face criminal charges for breaching trading laws?

Yes, you can face criminal charges for breaching trading laws. Violating securities regulations or engaging in illegal trading practices can lead to criminal prosecution, fines, and jail time.

What are the consequences of trading without proper registration?

Trading without proper registration can lead to severe penalties, including hefty fines and account freezes. It can result in legal action, potential suspension from trading platforms, and damage to your reputation. You might face audits or investigations from regulatory authorities like the SEC or FINRA. These violations could also disqualify you from certain trading privileges or licenses, making it harder to operate legally in the future.

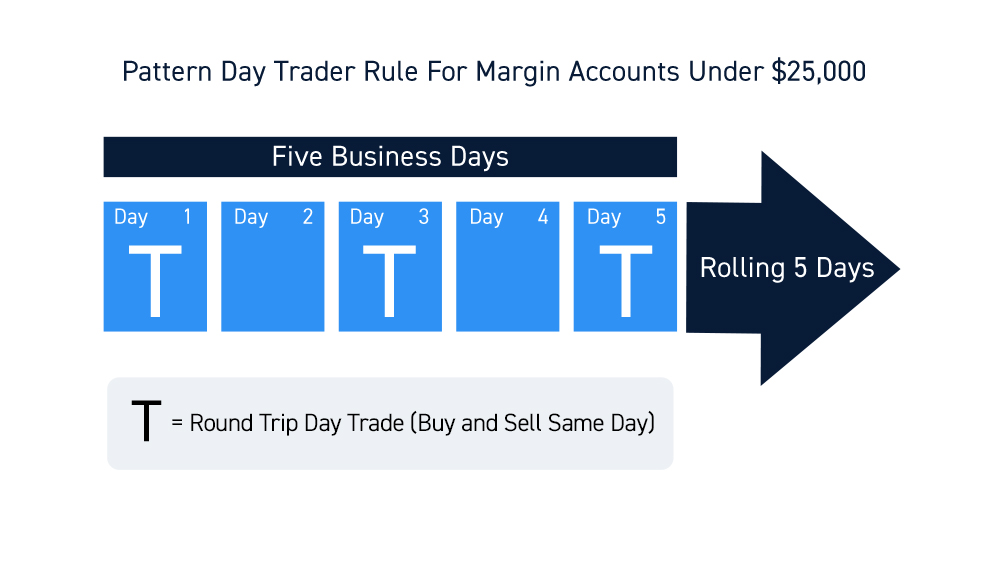

How does violating pattern day trading rules affect your account?

Violating pattern day trading rules can freeze your account for 90 days, limit trading activity, and require you to maintain a minimum $25,000 balance. If you violate the rules, your broker may restrict your ability to execute further day trades until you meet the requirements or the restriction lifts. Repeated violations can lead to account suspension or permanent restrictions.

What are the risks of using leverage improperly in day trading?

Using leverage improperly in day trading can lead to massive losses beyond your initial investment, margin calls, and forced liquidation of positions. It increases the risk of losing more than you can afford, triggering regulatory penalties if rules are violated. Excessive leverage can also cause emotional trading mistakes, making it harder to stick to strategies and increasing the chance of violating day trading regulations.

How can regulatory violations impact your trading license?

Regulatory violations can lead to the suspension or revocation of your trading license, preventing you from legally trading. They can result in hefty fines, legal actions, or bans from trading platforms. Repeated violations damage your reputation, making it harder to get licensed again. Ultimately, violating day trading rules risks losing your ability to trade professionally and can lead to financial penalties.

What are the potential financial losses from rule violations?

Violating day trading regulations can lead to significant financial losses, including fines, account bans, and the loss of trading privileges. You might face hefty penalties from regulatory agencies like the SEC or FINRA, which can amount to thousands or even millions of dollars. Additionally, illegal trading can result in civil or criminal charges, leading to court costs, legal fees, and potential jail time. Losing access to your trading account or being forced to liquidate positions unexpectedly can wipe out your invested capital. In worst cases, regulatory violations damage your reputation, making future trading or investing difficult.

Can violating day trading laws result in account suspension?

Yes, violating day trading laws can lead to account suspension. When you break rules like exceeding pattern day trader limits or failing to meet minimum equity requirements, brokers often suspend or restrict your account to prevent further violations.

How does non-compliance affect your trading reputation?

Non-compliance damages your trading reputation by eroding trust with brokers and clients. It can lead to account suspensions, fines, or bans, making it harder to trade legally. Word spreads among the trading community, branding you as untrustworthy, which discourages future opportunities. In the long run, violations create a reputation of recklessness, risking your ability to grow or sustain a successful trading career.

What are common mistakes that lead to regulatory violations?

Common mistakes include failing to understand or follow pattern day trading rules, risking more than the allowed capital, ignoring margin requirements, executing trades without proper documentation, and not staying updated on changing regulations. Overtrading without sufficient funds or ignoring account minimums also triggers violations. Many traders neglect to keep accurate records, leading to compliance issues, and misunderstand the rules around trade frequency and account types.

How do regulators detect illegal day trading activities?

Regulators detect illegal day trading by monitoring trading patterns for excessive activity, sudden large trades, and account behaviors that violate pattern rules. They analyze trading data for patterns like pattern day trader violations, frequent trades without proper margin, or accounts that show suspicious timing and volume. They also use advanced algorithms and surveillance systems to flag unusual activity, cross-checking with broker reports and customer records. Tips from whistleblowers or complaints can trigger investigations. Ultimately, they look for signs that traders are circumventing rules on margin, reporting, or pattern restrictions.

Learn about How Regulators Detect Insider Trading in Day Markets

What should traders do to avoid violating regulations?

Traders should fully understand and follow the specific day trading regulations of their jurisdiction, including pattern day trading rules. They must maintain minimum account balances, keep accurate records, and avoid excessive trading that triggers regulatory alerts. Staying informed through official sources and consulting with financial advisors helps ensure compliance. Use approved trading platforms and avoid manipulative or deceptive practices.

Are there specific risks for foreign traders violating local laws?

Yes, foreign traders violating local day trading laws face legal penalties, fines, account freezes, and potential deportation. They risk losing access to local markets and damaging their reputation, which can hinder future trading opportunities.

Conclusion about Risks of Violating Day Trading Regulations

In summary, understanding and adhering to day trading regulations is crucial for avoiding severe legal and financial repercussions. Violating these rules can lead to hefty fines, account suspensions, and even criminal charges, jeopardizing your trading career and reputation. To navigate the complex landscape of day trading, it's essential to stay informed and compliant with regulations. Partnering with experts at DayTradingBusiness can provide you with the insights and guidance necessary to trade responsibly and successfully.