Did you know that ignoring trading regulations is like trying to make a cake without a recipe? You might end up with a messy disaster! In this article, we dive into the crucial legal risks of neglecting trading regulations, highlighting how non-compliance can lead to hefty fines, criminal charges, and even asset seizures. We’ll explore the penalties imposed by regulators, the impact on trading licenses, and the specific legal challenges faced by international traders. Additionally, we’ll discuss the reputational damage that can arise from regulatory breaches and the long-term consequences of failing to stay updated on legal requirements. Finally, we’ll provide actionable steps to ensure compliance and safeguard your trading endeavors. Join us at DayTradingBusiness for essential insights that can protect you from legal pitfalls in the trading world.

What are the legal risks of ignoring trading regulations?

Ignoring trading regulations can lead to hefty fines, criminal charges, and license suspensions. You risk lawsuits from authorities or investors for fraud or market manipulation. Regulatory bodies may freeze or seize assets, and your trading privileges could be revoked permanently. Non-compliance also damages your reputation, making future trading or business difficult. In worst cases, it can result in jail time if laws are intentionally broken.

How can non-compliance with trading rules lead to fines?

Ignoring trading rules can result in fines because regulators enforce compliance to ensure fair markets. When you break these rules—like insider trading, misreporting, or market manipulation—regulators detect violations and penalize offenders financially. Fines serve as deterrents, making non-compliance costly and risking your reputation. Regulatory agencies, such as the SEC, track trading activities and impose penalties to maintain market integrity.

What penalties do regulators impose for regulatory violations?

Regulators impose fines, sanctions, license revocations, and trading bans for violations. They may also pursue criminal charges leading to imprisonment. In severe cases, companies face reputational damage and increased oversight.

Can ignoring trading regulations result in criminal charges?

Yes, ignoring trading regulations can lead to criminal charges. Authorities may pursue prosecution for violations like market manipulation, insider trading, or fraud. These legal actions can result in fines, imprisonment, and a permanent record.

How does regulatory breach affect trading licenses?

A regulatory breach can lead to suspension or revocation of trading licenses, preventing a business from legally operating. It can also result in hefty fines, legal penalties, or criminal charges. Ignoring trading regulations damages reputation, making it harder to obtain or renew licenses in the future. In severe cases, authorities may impose restrictions or bans, halting all trading activities.

What legal actions can authorities take against non-compliant traders?

Authorities can impose fines, seize assets, shut down trading operations, revoke licenses, and pursue criminal charges like fraud or market manipulation against non-compliant traders.

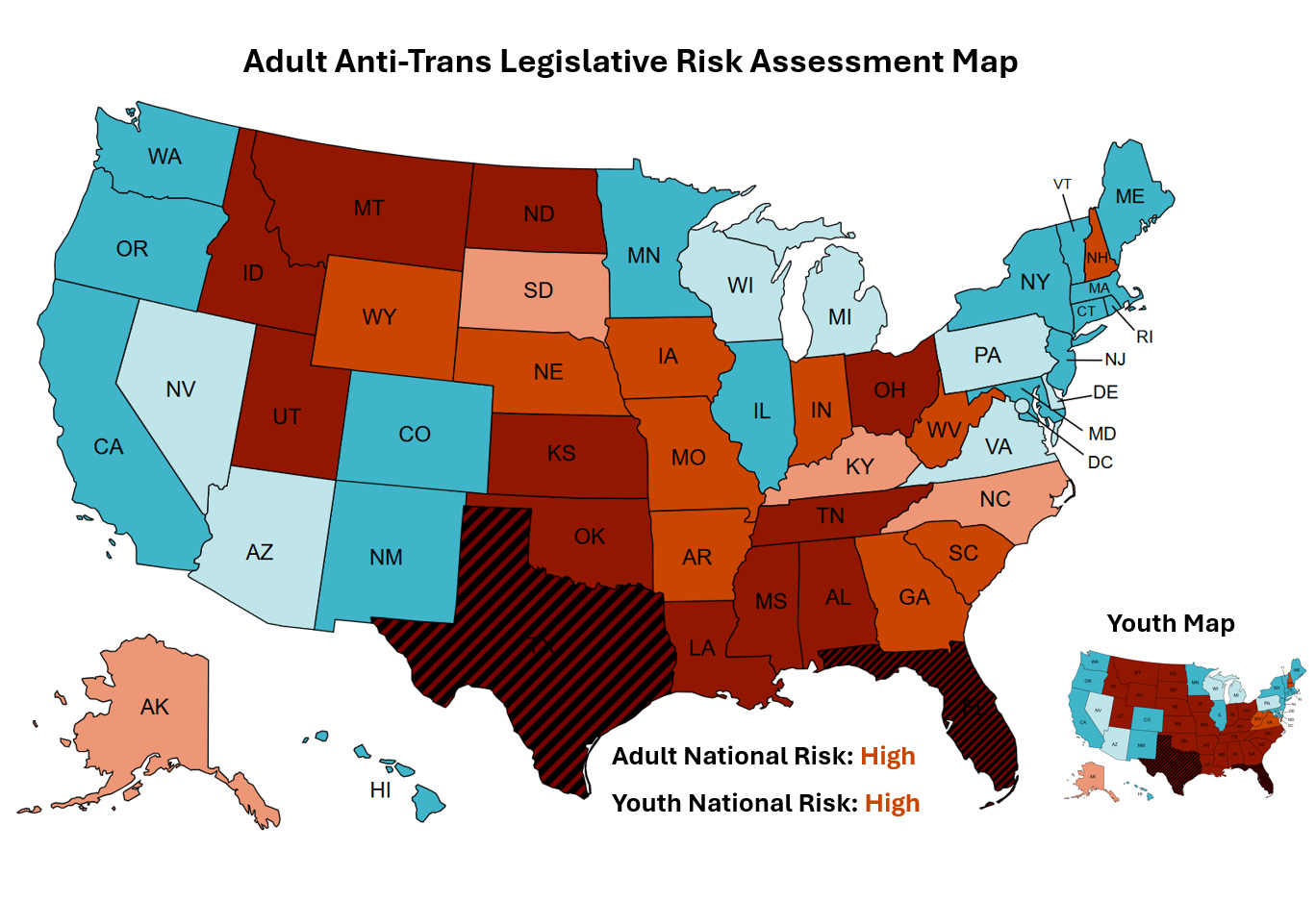

Are there specific legal risks for international traders ignoring local laws?

Yes, international traders ignoring local laws face fines, sanctions, and bans. They risk criminal charges, asset seizures, and damage to reputation. Non-compliance can lead to legal disputes and loss of trading licenses. Ignoring local regulations also increases the chance of customs issues and legal penalties.

How does regulatory violation impact your trading reputation?

Regulatory violations damage your trading reputation by eroding trust with clients, partners, and regulators. They can lead to fines, sanctions, and legal action, which paint you as unreliable and risky. Once labeled non-compliant, it’s harder to attract investors or broker support, and your credibility takes a hit. Ignoring trading regulations signals poor risk management, making others hesitant to do business with you.

What are the common legal consequences of fraudulent trading practices?

Common legal consequences of fraudulent trading practices include hefty fines, imprisonment, asset forfeiture, and bans from trading. Authorities can also pursue civil lawsuits for damages, leading to significant financial penalties. Regulatory agencies may revoke licenses and impose restrictions on future trading activities. Criminal charges for fraud can result in jail time, while civil penalties damage reputation and financial stability.

How can ignoring trading regulations lead to asset freezes or seizures?

Ignoring trading regulations can trigger government investigations, leading to asset freezes or seizures. Authorities may freeze assets suspected of illegal activity or non-compliance to prevent further violations. Regulatory agencies can seize assets if they find evidence of fraud, money laundering, or other violations. Non-compliance signals risk, prompting legal action that targets your assets to recover losses or enforce penalties.

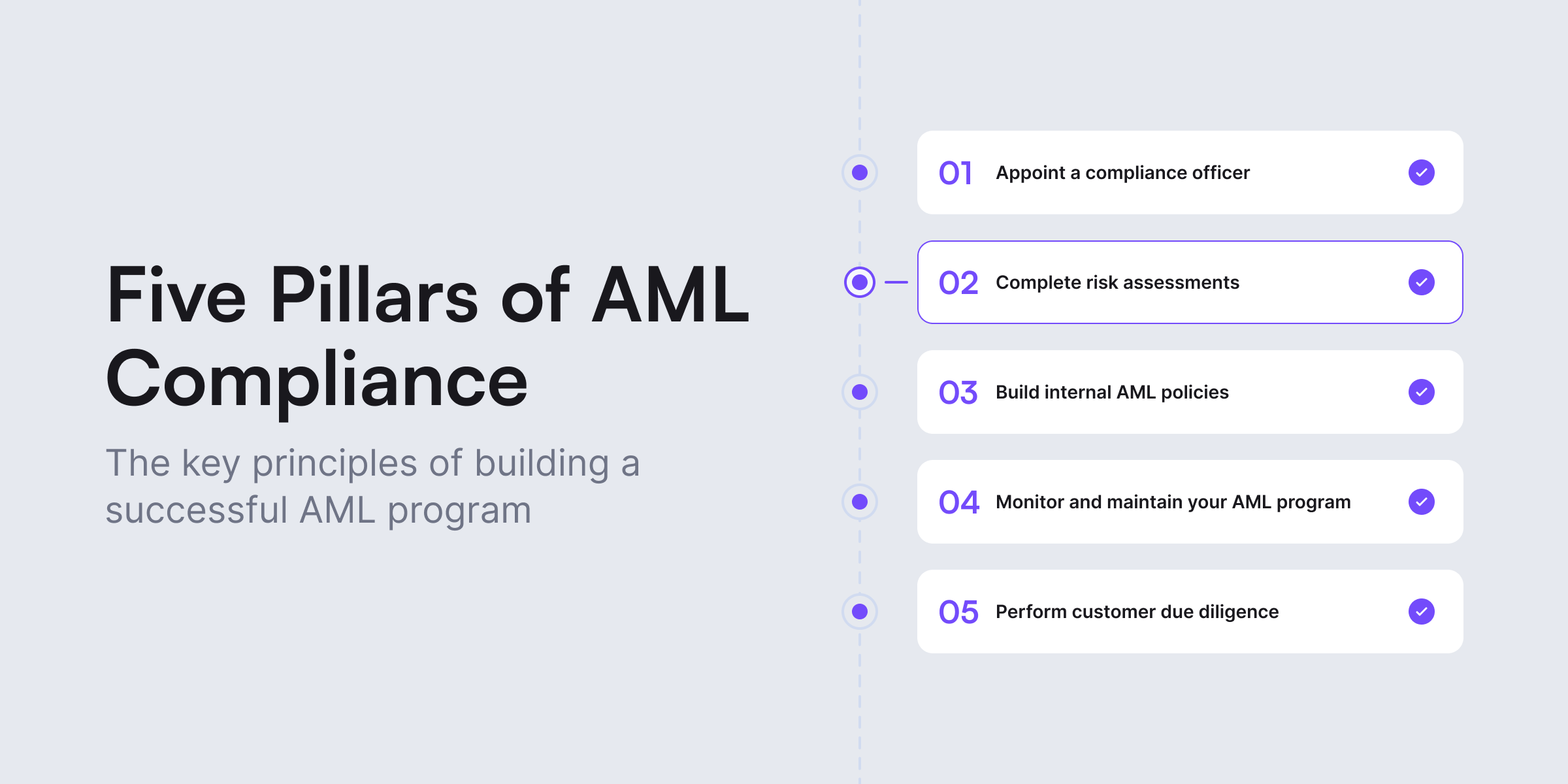

What are the risks of neglecting anti-money laundering laws in trading?

Ignoring anti-money laundering laws in trading can lead to severe legal penalties, including hefty fines and criminal charges. It increases the risk of being linked to illegal activities like fraud or drug trafficking, which can result in asset freezes or confiscation. You may face license revocation or suspension, losing the ability to trade legally. Regulators may impose stricter oversight or audits, disrupting your operations. Additionally, neglecting AML laws damages reputation, leading to loss of clients and business opportunities.

How does non-compliance affect legal liability in trading disputes?

Non-compliance increases legal liability in trading disputes by exposing traders to fines, penalties, and lawsuits. Ignoring regulations can lead to breach of contract claims, regulatory sanctions, and loss of trading licenses. It also raises the risk of criminal charges if illegal activities are involved. Non-compliance weakens your defense in disputes, making legal consequences more severe.

What are the long-term legal risks of ignoring regulatory updates?

Ignoring regulatory updates in trading can lead to severe long-term legal risks like hefty fines, sanctions, and license revocation. It increases the chance of legal action, lawsuits, or criminal charges for non-compliance. Over time, it damages your reputation, making future regulatory approvals harder. Persistent neglect can result in business bans or even criminal prosecution, ultimately risking your entire trading operation.

How can regulatory violations lead to civil lawsuits?

Regulatory violations can lead to civil lawsuits because authorities or affected parties may sue for damages or penalties resulting from non-compliance. Ignoring trading regulations can be seen as misconduct, prompting investors, clients, or competitors to pursue legal action for fraud, breach of fiduciary duty, or unfair practices. Courts often hold violators accountable for financial harm caused by regulatory breaches, making civil lawsuits a common consequence of disregarding trading rules.

What steps should traders take to ensure compliance and avoid legal risks?

Traders should stay updated on relevant regulations, maintain accurate records, and follow proper reporting procedures. They must understand and adhere to licensing requirements, avoid insider trading, and implement robust compliance programs. Consulting legal experts regularly, monitoring regulatory changes, and using compliant trading platforms also help mitigate legal risks.

Conclusion about Legal Risks of Ignoring Trading Regulations

In summary, ignoring trading regulations can lead to severe legal consequences, including fines, penalties, and even criminal charges. Non-compliance not only jeopardizes your trading license but also tarnishes your reputation and can result in asset seizures. To mitigate these risks, traders must stay informed about regulatory updates and adhere strictly to both local and international laws. By prioritizing compliance, you protect not just your investments but also your trading career. For more insights on navigating these complexities, reach out to DayTradingBusiness.