Did you know that even the stock market has rules, just like a game of Monopoly? In the world of day trading, regulations play a crucial role in safeguarding investors and ensuring a fair marketplace. This article dives into how regulatory measures prevent fraud, enforce fair trading practices, and oversee day trading activities, particularly through the SEC and FINRA. We’ll explore the Pattern Day Trader rule, margin requirements, and the essential disclosures needed for traders. Additionally, we’ll discuss how these regulations help curb risky behaviors, protect novice traders, and maintain market transparency. Finally, we’ll examine the penalties for violations and the proactive measures regulatory bodies take against trading abuses. With insights from DayTradingBusiness, you'll gain a comprehensive understanding of how regulations shape your trading experience.

How do regulations prevent fraud in day trading?

Regulations prevent fraud in day trading by requiring brokers to follow strict licensing standards, ensuring transparency and honesty. They enforce real-time reporting of trades and account activities, making it harder to manipulate markets or hide scams. Rules prohibit misleading advertising and false claims, protecting investors from scams. They also set limits on leverage and margin requirements, reducing the risk of reckless trading and losses. Overall, regulations create oversight, accountability, and clear rules that discourage fraudulent practices and safeguard day trading investors.

What rules ensure fair trading practices?

Regulations require transparent disclosure of risks, enforce fair trading practices, prevent market manipulation, and mandate timely information sharing. They limit leverage to reduce excessive risk, enforce anti-fraud measures, and establish dispute resolution processes. These rules ensure traders operate on a level playing field, protecting day trading investors from deception and unfair tactics.

How does the SEC oversee day trading activities?

The SEC monitors day trading by enforcing rules on margin requirements, ensuring transparency, and investigating suspicious activities. It requires brokers to report large or unusual trades and monitors trading patterns for signs of manipulation. The SEC also enforces rules against insider trading and market abuse, protecting investors from unfair practices. They review compliance with pattern day trader rules, ensuring traders maintain the minimum account balance to limit excessive risk. Overall, the SEC's oversight aims to prevent fraud, promote fair markets, and safeguard day trading investors.

What is the Pattern Day Trader rule?

The Pattern Day Trader rule requires traders who execute four or more day trades within five business days to maintain a minimum account balance of $25,000. It aims to prevent reckless trading and protect investors from excessive risk. If your account falls below this threshold, you can't day trade until you restore the balance.

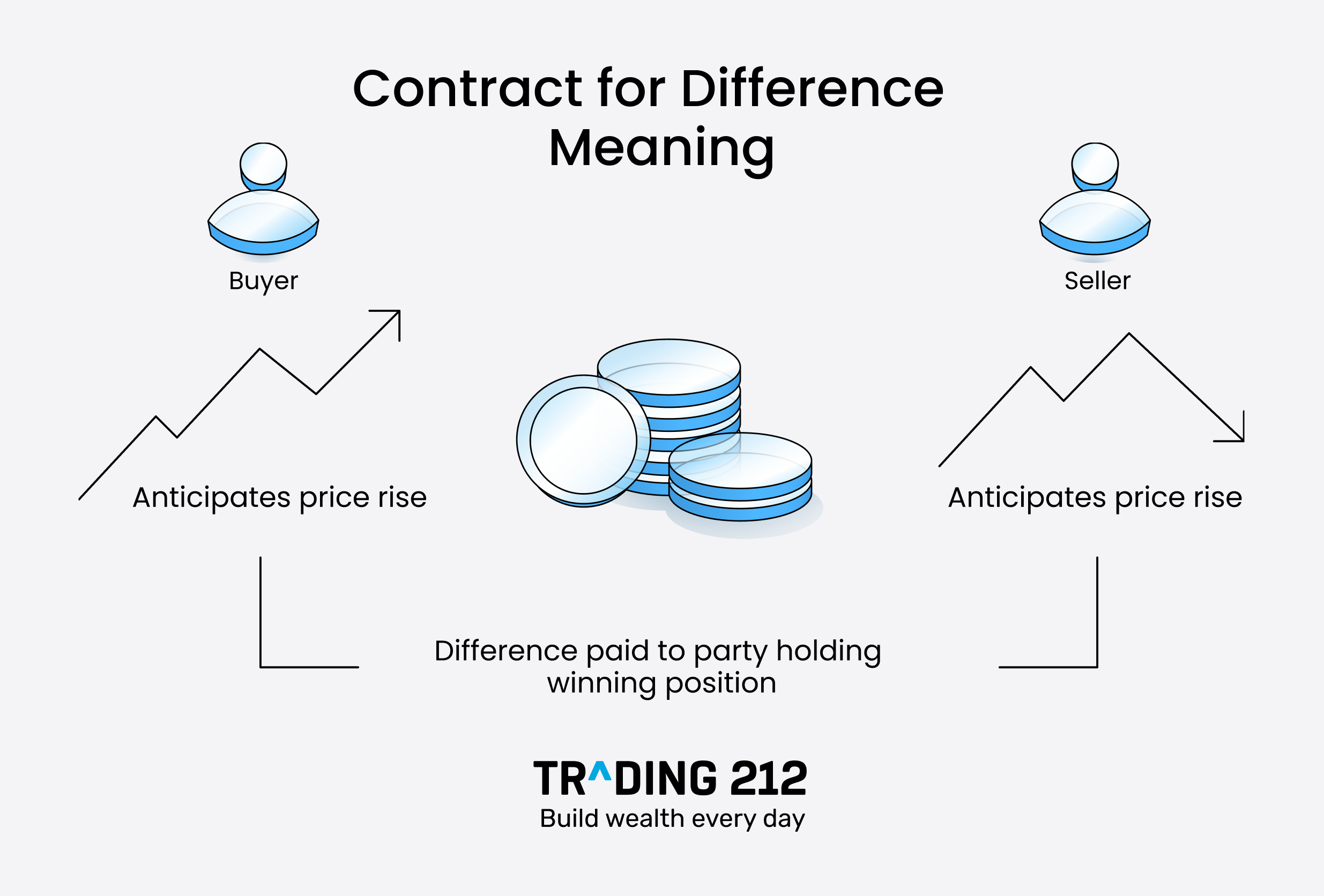

How do margin requirements protect traders?

Margin requirements protect traders by limiting how much they can borrow, reducing the risk of large losses. They ensure traders have enough equity to cover potential market swings, preventing reckless trading. By setting minimum margin levels, regulations stop traders from taking on excessive leverage that could wipe out their accounts quickly. This safety net encourages responsible trading and keeps markets more stable.

What role does FINRA play in day trading regulation?

FINRA enforces rules that ensure fair trading practices, monitor broker-dealer activities, and enforce disclosure requirements to protect day trading investors. It sets margin requirements to prevent excessive risk-taking. FINRA also investigates misconduct and enforces penalties for violations, helping maintain market integrity and investor confidence.

How are trading restrictions enforced?

Trading restrictions are enforced through monitoring by regulatory agencies like the SEC and FINRA, which set rules on margin requirements, pattern day trader rules, and trade limits. Brokers implement these rules automatically, blocking or flagging trades that violate restrictions. Violations can lead to account freezes, increased margin requirements, or suspension. These measures prevent excessive risk, keep traders within safe boundaries, and ensure fair market practices.

What disclosures are required for day traders?

Day traders must disclose their trading activity and financial status to brokers and regulators. They need to report their net worth, trading experience, and investment objectives to qualify for pattern day trader rules. If using margin, they must also disclose their margin account details. Brokers are required to provide risk disclosures about day trading's high risks and potential losses. Any promotional or educational material must clearly state risks involved in day trading.

How do regulations limit risky trading behaviors?

Regulations restrict risky trading behaviors by enforcing margin limits, requiring disclosures, and banning manipulative practices. They set rules for short-selling, prevent insider trading, and mandate transparency to reduce fraud. These measures ensure traders don’t take excessive leverage or engage in manipulative schemes, protecting investors from catastrophic losses.

What penalties exist for regulatory violations?

Penalties for regulatory violations include fines, suspension or revocation of trading licenses, legal action, and bans from trading platforms.

Regulators may also impose criminal charges for serious infractions, leading to potential jail time.

Violations can result in reputational damage, increased scrutiny, and financial restitution requirements.

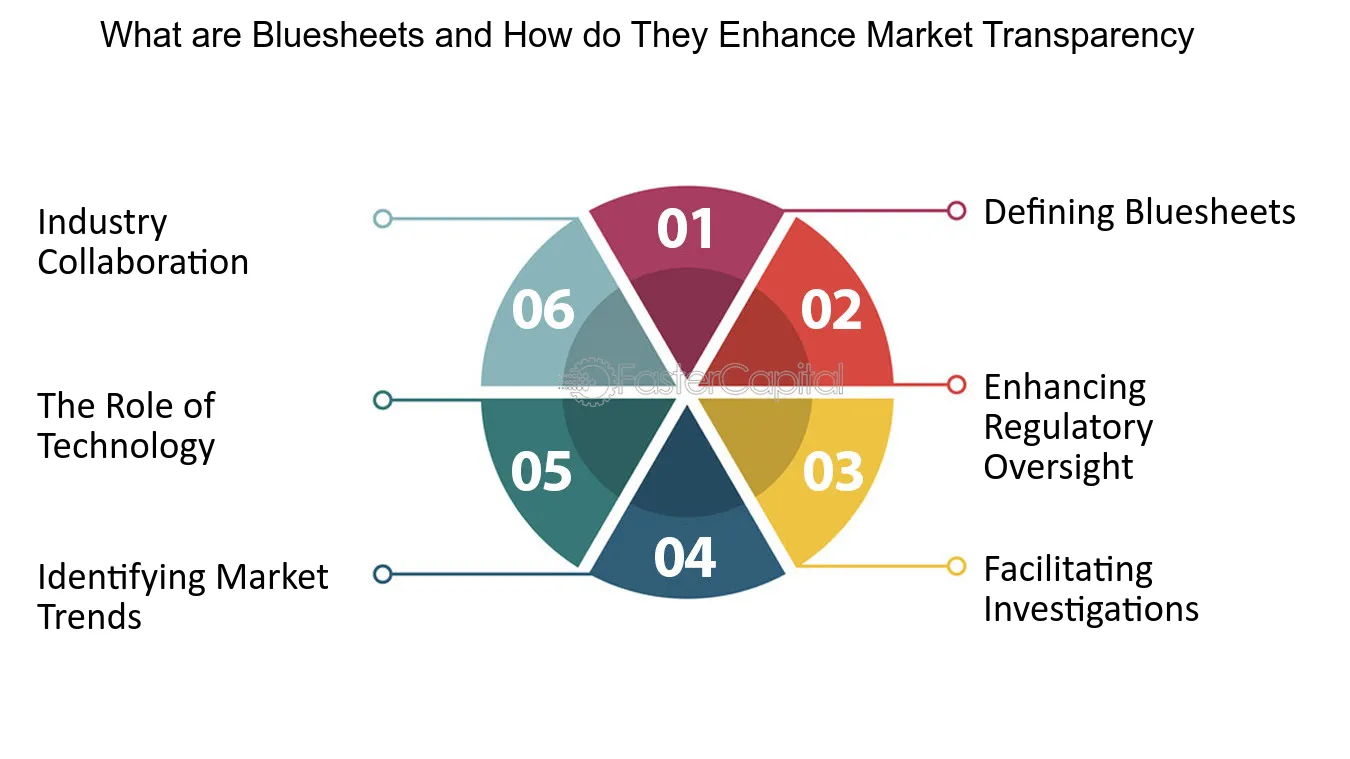

How does regulatory oversight improve market transparency?

Regulatory oversight ensures clear rules and disclosure requirements, making market activities visible and understandable. It prevents manipulation and fraud, so investors see the true market conditions. By enforcing transparency standards, regulators reduce information asymmetry, helping day traders make informed decisions. This oversight also monitors trading practices, discouraging unfair tactics and building trust in the market’s integrity.

What measures prevent market manipulation by day traders?

Regulations prevent market manipulation by day traders through strict rules against insider trading, pump-and-dump schemes, and false information. The SEC enforces reporting requirements and monitors trading activity to spot suspicious patterns. Circuit breakers halt trading during extreme volatility, preventing manipulation from causing chaos. Margin rules limit the amount of leverage day traders can use, reducing risky manipulative tactics. Additionally, broker-dealer oversight ensures compliance with fair trading practices, making it harder for traders to manipulate prices.

Learn about How do regulations prevent market manipulation in day trading?

How do regulations protect novice traders?

Regulations protect novice traders by setting clear rules on fair trading practices, preventing fraud, and requiring transparency from brokers. They enforce minimum capital requirements and limit leverage to reduce risky losses. Regulatory bodies oversee trading platforms to ensure they follow strict standards, minimizing scams and manipulative schemes. They also mandate disclosures about risks and costs, helping beginners make informed decisions. Overall, regulations create a safer environment, shielding inexperienced traders from exploitation and excessive risk.

What is the impact of regulation on trading costs?

Regulations lower trading costs by increasing market transparency, reducing fraud, and promoting fair practices, which leads to narrower spreads and fewer hidden fees. They also impose limits on leverage and require disclosures that help traders make informed decisions, ultimately decreasing the overall expense of executing trades.

How do regulatory bodies respond to trading abuses?

Regulatory bodies monitor trading activity for abuses like insider trading or market manipulation, then impose fines, ban traders, or file criminal charges. They enforce rules requiring transparency, fair practices, and disclosures, making it harder for manipulative tactics to succeed. They also conduct investigations into suspicious trades and update regulations to close loopholes. These actions deter misconduct and protect day trading investors from unfair practices.

Conclusion about How Do Regulations Protect Day Trading Investors?

In summary, regulations play a crucial role in safeguarding day trading investors by preventing fraud, ensuring fair practices, and maintaining market integrity. The oversight of organizations like the SEC and FINRA, alongside specific rules like the Pattern Day Trader rule and established margin requirements, helps mitigate risks and protect novice traders. By fostering transparency and enforcing penalties for violations, these regulations not only enhance market confidence but also contribute to a more stable trading environment. For those seeking in-depth knowledge and assistance in navigating these complexities, DayTradingBusiness offers valuable resources and insights.

Learn about How Do Regulations Impact Day Trading Capital Requirements?

Sources:

- Crypto Needs Comprehensive Policies to Protect Economies and ...

- Doing Business 2020: Comparing Business Regulation in 190 ...

- Is Illiquidity a Blessing in Disguise for Some Investors? | CFA ...

- Flying under the radar: The effects of short-sale disclosure rules on ...

- Publication: Doing Business 2010 : Reforming through Difficult ...

- VI Regulation of Hedge Funds in: Hedge Funds and Financial ...