Did you know that some day traders have been known to drink more coffee than a barista during a Monday morning rush? While caffeine might keep you alert, understanding the legal landscape of day trading is crucial. This article dives into whether day trading stocks is legal in the U.S., the regulations that govern this fast-paced activity, and the necessary licenses for traders. It also explores restrictions for beginners, the pattern day trading rules, and the required capital to start. Additionally, we discuss the consequences of violating day trading laws, the role of broker regulations, and the tax implications of your trading activities. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of day trading legally and effectively.

Are Day Trading Stocks Legal in the US?

Yes, day trading stocks is legal in the US. The SEC and FINRA regulate trading rules, but no law bans daily buying and selling of stocks. However, if you execute four or more day trades within five business days and your account has less than $25,000, you'll be flagged as a pattern day trader and must meet specific requirements.

What Are the Regulations for Day Trading?

Yes, there are legal restrictions on day trading stocks. In the U.S., pattern day traders must maintain a minimum of $25,000 in their trading account. If your account falls below this, you can't execute four or more day trades within five business days. The FINRA and SEC regulate these rules to prevent excessive risk. Some brokerages also impose their own restrictions, like margin requirements or trading limits. Always verify your broker's policies and stay compliant with federal regulations to avoid account restrictions or penalties.

Do You Need a License to Day Trade Stocks?

Yes, you need a margin account with a registered broker to day trade stocks. The SEC requires pattern day traders to maintain at least $25,000 in their account. Without this, you can’t legally execute four or more day trades within five business days.

Are There Restrictions for Beginner Day Traders?

Yes, beginner day traders face restrictions like the Pattern Day Trader rule, which requires maintaining at least $25,000 in their trading account. If they don't meet this, they can't execute more than three day trades within five business days. Additionally, brokerages may impose limits on margin and trading frequency for new traders.

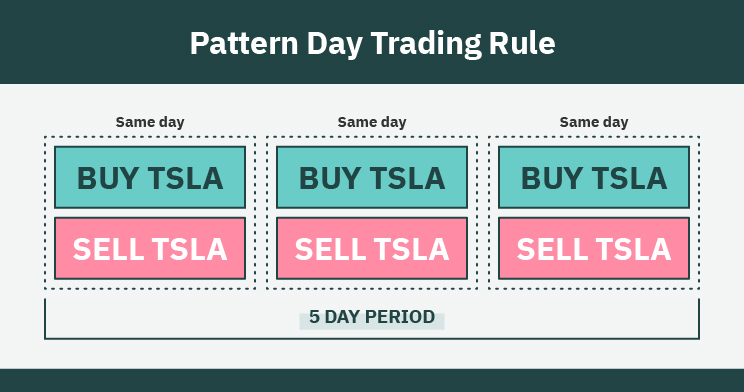

What Are the Pattern Day Trading Rules?

Pattern Day Trading rules require traders to maintain a minimum of $25,000 in their trading account if they execute four or more day trades within five business days. If your account falls below this threshold, you're restricted from making additional day trades until you restore the minimum equity. These rules apply to margin accounts and are enforced by FINRA to prevent excessive risk.

How Much Capital Is Required for Day Trading?

There's no fixed legal minimum capital for day trading stocks, but the SEC requires a minimum of $25,000 in your trading account to qualify for pattern day trading rules. If your account falls below that, you can't execute more than three day trades within five business days. Some brokers may have their own minimum deposit requirements, often ranging from $500 to $2,500.

Can You Day Trade Without a Margin Account?

No, you can't legally day trade stocks in the U.S. without a margin account if you make four or more day trades within five business days. The Pattern Day Trader (PDT) rule requires a minimum of $25,000 in your account to avoid restrictions. Some brokers allow day trading on cash accounts, but you’ll be limited to using only settled funds, which restricts frequent trading.

Are There Financial Penalties for Violating Day Trading Laws?

Yes, violating day trading laws can lead to financial penalties, including fines and account restrictions from regulators like the SEC.

How Do Regulations Differ in Other Countries?

Regulations on day trading stocks vary globally. In the U.S., the SEC requires a minimum of $25,000 in your account for pattern day trading and mandates specific reporting rules. In Canada, traders face similar rules but with different minimum balances and restrictions, often requiring a 30-day waiting period after margin calls. Europe’s markets have stricter leverage limits and risk disclosures, with some countries imposing bans on certain high-frequency trading practices. Australia regulates day trading through the ASX, emphasizing investor protection and requiring brokers to monitor risky trading behaviors. Japan enforces strict rules on margin trading, including leverage caps and mandatory disclosures. Each country’s rules reflect its financial stability goals and investor protection standards, shaping how freely day trading is conducted.

What Are the Risks of Illegal Day Trading?

Illegal day trading can lead to hefty fines, account freezes, and even criminal charges. You risk losing all invested capital if trades are deemed fraudulent or manipulative. Regulatory authorities like the SEC can pursue legal action if trading violates laws or involves market manipulation. Also, unlicensed traders might face penalties or bans from trading platforms. The legal restrictions aim to prevent fraud and protect investors, so ignoring them can result in serious consequences.

Are Penny Stocks Allowed in Day Trading?

Yes, penny stocks are allowed in day trading, but they come with high risks and are often more heavily scrutinized due to their volatility and potential for manipulation.

How Do Broker Regulations Affect Day Traders?

Broker regulations limit day traders by requiring minimum account balances, like the Pattern Day Trader rule with $25,000 in the account. They also restrict the number of trades you can make in a week without meeting certain criteria. Brokers may impose additional restrictions on margin trading and require verification processes to prevent excessive risk. These rules aim to protect traders from overleveraging and ensure regulatory compliance, but they can also limit trading flexibility for individual investors.

Learn about How Does Insider Trading Affect Day Traders?

What Are the Tax Implications of Day Trading?

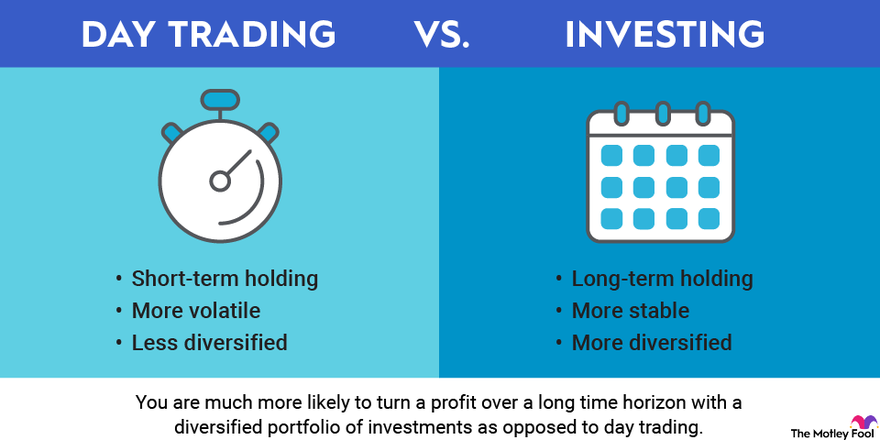

Day trading stocks can trigger tax obligations on your profits, classified as short-term capital gains taxed at your ordinary income rate. You must report each trade on your tax return, keeping detailed records of gains and losses. Frequent trading may also subject you to the IRS’s pattern day trader rule, which requires maintaining a minimum account balance of $25,000. Additionally, if you’re classified as a professional trader, your trading expenses might be deductible, but this status has strict criteria. Always consult a tax professional to navigate specific implications and ensure compliance.

Can You Be Banned for Breaking Day Trading Rules?

Yes, you can be banned for breaking day trading rules, especially if you violate pattern day trader regulations or broker policies. Repeated rule violations can lead to account restrictions or closures.

Are There Restrictions on Using Leverage in Day Trading?

Yes, there are legal restrictions on using leverage in day trading. Pattern day traders must maintain a minimum account balance of $25,000 and are limited in how much leverage they can use if their account falls below that. The SEC and FINRA regulate leverage, preventing excessive borrowing to reduce risky speculation.

Learn about Are There Legal Limits on Leverage in Day Trading?

How Do Regulatory Bodies Monitor Day Trading Activities?

Regulatory bodies like the SEC and FINRA monitor day trading by analyzing trading patterns, reviewing suspicious activity, and enforcing rules on margin and reporting. They track high-volume trades, look for signs of market manipulation, and require disclosures for certain accounts. They also use surveillance systems to flag unusual behavior, ensuring traders follow legal restrictions like pattern day trading rules and margin limits.

Learn about How Do Regulatory Bodies Monitor Day Trading?

Conclusion about Are There Legal Restrictions on Day Trading Stocks?

In summary, while day trading stocks is legal in the US, it comes with specific regulations and requirements that traders must adhere to. Understanding the pattern day trading rules, capital requirements, and the implications of violating regulations is crucial for anyone looking to engage in this fast-paced trading strategy. Additionally, international regulations may vary, highlighting the importance of being informed about the trading landscape. For comprehensive guidance on navigating these complexities, DayTradingBusiness is here to assist you in making informed trading decisions.

Learn about Are There Restrictions on Day Trading in Certain Jurisdictions?