Did you know that in the world of day trading, leverage can make your profits soar—just like it can make your losses plummet? Understanding the legal limits on leverage is crucial for every trader looking to navigate this volatile landscape. In this article, we’ll explore how much leverage is allowed for day traders, the regulations that restrict it, and the specific rules set by the SEC and FINRA. We’ll also discuss how leverage limits differ for various asset classes, the risks of high leverage, and the influence of broker policies. Plus, we’ll touch on whether these rules apply to forex and crypto day trading. Join us at DayTradingBusiness as we break down these essential insights to help you trade smarter and stay compliant.

Are There Legal Limits on Leverage in Day Trading?

Yes, there are legal limits on leverage in day trading. In the U.S., the Financial Industry Regulatory Authority (FINRA) and the SEC restrict leverage for day traders to 4:1 on margin accounts for stocks. The Pattern Day Trader rule requires maintaining at least $25,000 in your account if you execute four or more day trades within five business days. Other countries have similar regulations, often capping leverage to protect retail traders from excessive risk.

How Much Leverage Is Allowed for Day Traders?

In the U.S., the Financial Industry Regulatory Authority (FINRA) caps leverage for pattern day traders at 4:1 on margin accounts. This means you can borrow up to four times your account equity for day trading. Outside the U.S., leverage limits vary by country and broker, but generally range from 2:1 to 4:1 for retail traders. Some brokers may offer higher leverage, but regulators often restrict it to protect traders from excessive risk.

What Regulations Restrict Leverage in Day Trading?

Yes. Regulations like FINRA and SEC limit leverage for retail day traders—typically to 2:1 or 4:1, depending on the asset. The Pattern Day Trader rule requires a minimum account balance of $25,000 to access higher leverage and frequent trading. These rules aim to prevent excessive risk and protect traders from large losses.

Does the SEC Limit Leverage for Day Traders?

Yes, the SEC limits leverage for day traders by requiring pattern day trader (PDT) rules, which mandate a minimum of $25,000 in account equity for margin trading. The Financial Industry Regulatory Authority (FINRA) also restricts leverage to 2:1 for day traders.

Are There Restrictions on Forex Day Trading Leverage?

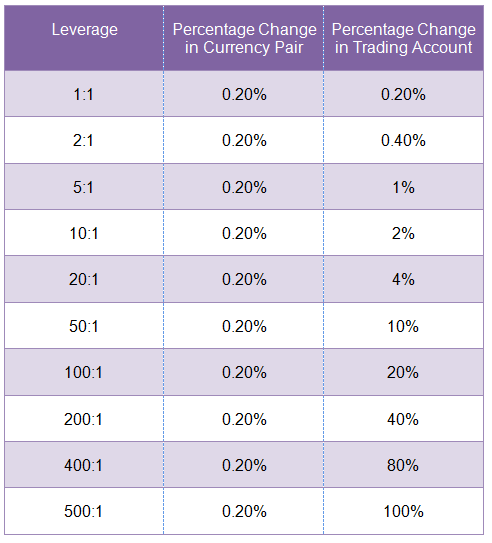

Yes, most countries impose legal limits on leverage for forex day trading. For example, the U.S. restricts leverage to 50:1 for major currency pairs and 20:1 for others. European regulators often cap leverage at 30:1. These limits aim to reduce risk and protect traders from excessive losses. Always check your local financial authority’s rules, as they vary by jurisdiction.

How Do FINRA Rules Affect Day Trading Leverage?

FINRA rules limit the leverage day traders can use by requiring a minimum equity of $25,000 in their account. For pattern day traders, this means they can only trade with up to 4:1 leverage, effectively restricting the amount of borrowed money they can use. If they don't meet the $25,000 minimum, they face restrictions like a 90-day trading limit or account suspension. These rules prevent excessive leverage, reducing risk and ensuring traders have enough capital to cover potential losses.

What Is the Maximum Leverage in U.S. Day Trading?

The maximum leverage in U.S. day trading is 4:1 for pattern day traders using a margin account, as mandated by FINRA and SEC rules. This means you can borrow up to four times your account equity. For non-pattern day traders, the limit is typically 2:1.

Are Leverage Limits Different for Commercial vs. Retail Traders?

Yes, leverage limits differ for commercial and retail traders. Retail traders face strict regulatory caps, often around 20:1 or lower, depending on the asset and jurisdiction. Commercial traders, like institutional investors, typically use much higher leverage because they operate under different regulations and have larger capital buffers.

Can Leverage Limits Vary by Asset Class?

Yes, leverage limits vary by asset class. Stocks often have regulatory caps (e.g., 2:1 or 4:1), while forex and futures trading may allow higher leverage, but it depends on the broker and jurisdiction. Cryptocurrency trading typically has fewer restrictions, but some platforms impose their own limits.

What Are the Risks of High Leverage in Day Trading?

High leverage in day trading increases the risk of significant losses, potentially wiping out your account quickly. It amplifies market swings, so a small move against your position can lead to margin calls or forced liquidation. While some brokers offer high leverage, regulatory limits—like the 50:1 ratio in the U.S.—exist to prevent traders from taking on excessively risky positions that could cause substantial financial harm. Ignoring these limits can lead to legal issues or broker sanctions.

Learn about What are the common leverage risks in day trading?

How Do Margin Requirements Limit Leverage?

Margin requirements limit leverage by setting a minimum amount of equity you must maintain in your trading account. For example, if the margin requirement is 25%, you can only control a position four times your actual capital. This prevents you from borrowing too much relative to your funds, reducing the risk of huge losses. Regulatory bodies often cap leverage ratios to protect traders from excessive risk, effectively restricting how much you can amplify your trades.

Are Leverage Rules the Same Worldwide?

No, leverage rules vary globally. Some countries have strict limits to protect traders, like the EU’s MiFID II cap of 30:1 for major currency pairs. Others, like the US, impose rules through the SEC and FINRA, often limiting leverage for retail traders to 50:1 or lower. In contrast, some markets offer much higher leverage or no specific restrictions, increasing risk. Always check your country’s specific regulations on leverage in day trading.

What Happens if I Exceed Leverage Limits?

Exceeding leverage limits can lead to forced liquidation of your position, margin calls, and potential account penalties. It increases risk of significant losses beyond your initial investment. Regulatory authorities may also impose fines or restrict trading privileges if you surpass legal leverage caps.

Do Broker Policies Influence Leverage Restrictions?

Yes, broker policies directly influence leverage restrictions in day trading. Brokers set maximum leverage limits based on regulatory rules and their internal risk management, affecting how much traders can borrow. These policies vary by broker and jurisdiction, and they determine the leverage ratios available to day traders.

Are There Legal Limits on Crypto Day Trading Leverage?

Yes, many countries set legal limits on leverage for crypto day trading. For example, the U.S. regulates leverage on crypto derivatives through the CFTC and SEC, often capping leverage at 2:1 or lower. The European Union’s ESMA restricts crypto leverage to 2:1. Other regions, like Australia and the UK, have similar caps to protect traders. These limits aim to prevent excessive risk and protect consumers from large losses.

Learn about Legal Risks of Day Trading Forex and Crypto

Conclusion about Are There Legal Limits on Leverage in Day Trading?

In summary, leverage in day trading is subject to various legal limits and regulations that can significantly impact both retail and commercial traders. The SEC and FINRA enforce strict guidelines to ensure market integrity and protect investors from the risks associated with high leverage. It's essential for traders to understand these rules, as they vary by asset class and can differ across jurisdictions. For tailored guidance on navigating these regulations, consider leveraging the expertise available through DayTradingBusiness to enhance your trading strategies.

Learn about What should beginners know about legal compliance in day trading?