Did you know that the only thing more complex than a day trader's strategy might just be the compliance rules governing their brokerages? Understanding how compliance rules differ across brokerages is crucial for traders at all levels. This article dives into the nuances between online and traditional brokerages, highlighting key differences in regulatory requirements, domestic versus international standards, and the specific rules that apply to retail and institutional firms. We’ll also explore how brokerages protect client data, handle fee disclosures, and comply with anti-money laundering regulations. Additionally, we’ll discuss the implications of licensing, anti-fraud measures, margin trading rules, and the evolving landscape of compliance amid new financial technologies. Join DayTradingBusiness as we unravel these complexities to help you navigate the trading world more effectively.

How do compliance rules vary between online and traditional brokerages?

Online brokerages face stricter, more detailed compliance rules focused on digital security, data privacy, and real-time monitoring. Traditional brokerages follow established regulatory frameworks but often have less emphasis on instant data protection and online transaction security. Online brokers must implement advanced cybersecurity measures, transparent disclosures, and continuous audit trails. Traditional brokers rely more on in-person verification, paper records, and less frequent compliance checks. Overall, online brokerages are held to higher standards for digital compliance, while traditional brokers emphasize physical document security and face-to-face client verification.

What are the key differences in regulatory requirements for brokerage firms?

Regulatory requirements for brokerage firms vary based on jurisdiction, but common differences include the level of capital reserves, client fund protection rules, reporting obligations, and licensing standards. Some brokerages face stricter anti-money laundering (AML) and know-your-customer (KYC) procedures, while others may have more lenient compliance checks. The type of financial products offered also influences rules—firms dealing with derivatives or securities often adhere to tighter regulations. Additionally, regulatory bodies like the SEC, FINRA, or FCA impose different standards, affecting disclosures, record-keeping, and audit processes.

How do compliance standards differ for domestic versus international brokerages?

Domestic brokerages follow local regulations like SEC or FCA rules, focusing on national investor protection and reporting standards. International brokerages must comply with multiple jurisdictions, often balancing differing rules from SEC, MiFID II, and others, which can mean stricter cross-border transparency, anti-money laundering measures, and client fund protections. They face more complex licensing, reporting, and operational requirements to meet diverse global standards.

What specific compliance rules apply to retail versus institutional brokerages?

Retail brokerages must follow rules like FINRA and SEC regulations, focusing on investor protection, disclosure, suitability, and anti-money laundering. They must provide transparent fee disclosures, ensure client suitability, and adhere to advertising standards. Institutional brokerages face fewer restrictions, mainly complying with SEC and FINRA rules, but their focus is on confidentiality, best execution, and large transaction standards. They aren’t bound by the same client disclosure or suitability requirements as retail brokers.

How do brokerages handle client data protection under different rules?

Brokerages handle client data protection differently based on local regulations. Some follow strict rules like GDPR in Europe, requiring explicit consent and data minimization. Others comply with industry standards like FINRA or SEC regulations in the US, emphasizing secure storage and reporting. Many brokerages implement encryption, access controls, and regular audits to meet these rules. Their compliance depends on jurisdiction, company policies, and the specific client data they handle.

What are the main compliance differences in fee disclosure requirements?

Main compliance differences in fee disclosure requirements include the level of detail required, timing of disclosures, and whether fees are disclosed upfront or later. Some brokerages must provide clear, itemized fee breakdowns before or at the point of service, while others may have more lenient deadlines. Certain firms are mandated to explain all potential costs transparently, including hidden fees, whereas others only need to disclose standard charges. Regulatory standards like FINRA or SEC impose stricter rules on some brokerages, especially those dealing with retail investors, leading to more comprehensive fee disclosures.

How do anti-money laundering regulations impact brokerage compliance?

Anti-money laundering regulations require brokerages to implement strict customer verification, monitor transactions for suspicious activity, and report large or unusual trades. These rules force brokerages to adopt robust compliance procedures, conduct regular audits, and train staff to detect money laundering. Differences in compliance across brokerages stem from varying internal policies, technology, and risk management strategies, but all must adhere to AML laws to prevent illegal financial flows.

What role do licensing and registration requirements play across brokerages?

Licensing and registration requirements ensure brokers meet legal standards, maintain professionalism, and protect clients. They vary across brokerages based on jurisdiction, with some enforcing stricter rules or additional certifications. These requirements influence how brokerages operate, their transparency, and their ability to offer certain financial products. Different brokerages may interpret or implement these rules uniquely, leading to compliance variations. Ultimately, licensing and registration set the foundation for trust and accountability in brokerage practices.

How do brokerages ensure compliance with anti-fraud regulations?

Brokerages ensure compliance with anti-fraud regulations by implementing strict internal controls, regular staff training, and advanced monitoring systems to detect suspicious activity. They follow specific regulatory guidelines from bodies like the SEC or FINRA, which may vary in detail and enforcement. Some brokerages use automated software to flag potential fraud, while others conduct manual audits. Compliance rules differ based on brokerage size, client base, and jurisdiction, with larger firms often having more comprehensive protocols. Additionally, brokerages adapt to evolving regulations by updating policies and conducting ongoing compliance reviews.

What are the differences in reporting obligations for various broker types?

Different broker types face varying reporting obligations based on their regulatory classifications. Full-service brokers must report all client transactions, including detailed trade and account activity, to regulators and clients. Discount brokers typically report trades and account summaries, focusing on transparency but with fewer client reporting requirements. Introducing brokers or agents report commissions and referral fees but may have less comprehensive transaction reporting. Custodian or clearing brokers handle custody and settlement reports, ensuring compliance with anti-money laundering rules. Overall, the complexity and scope of reporting increase with the broker’s role, regulatory oversight, and client protections required.

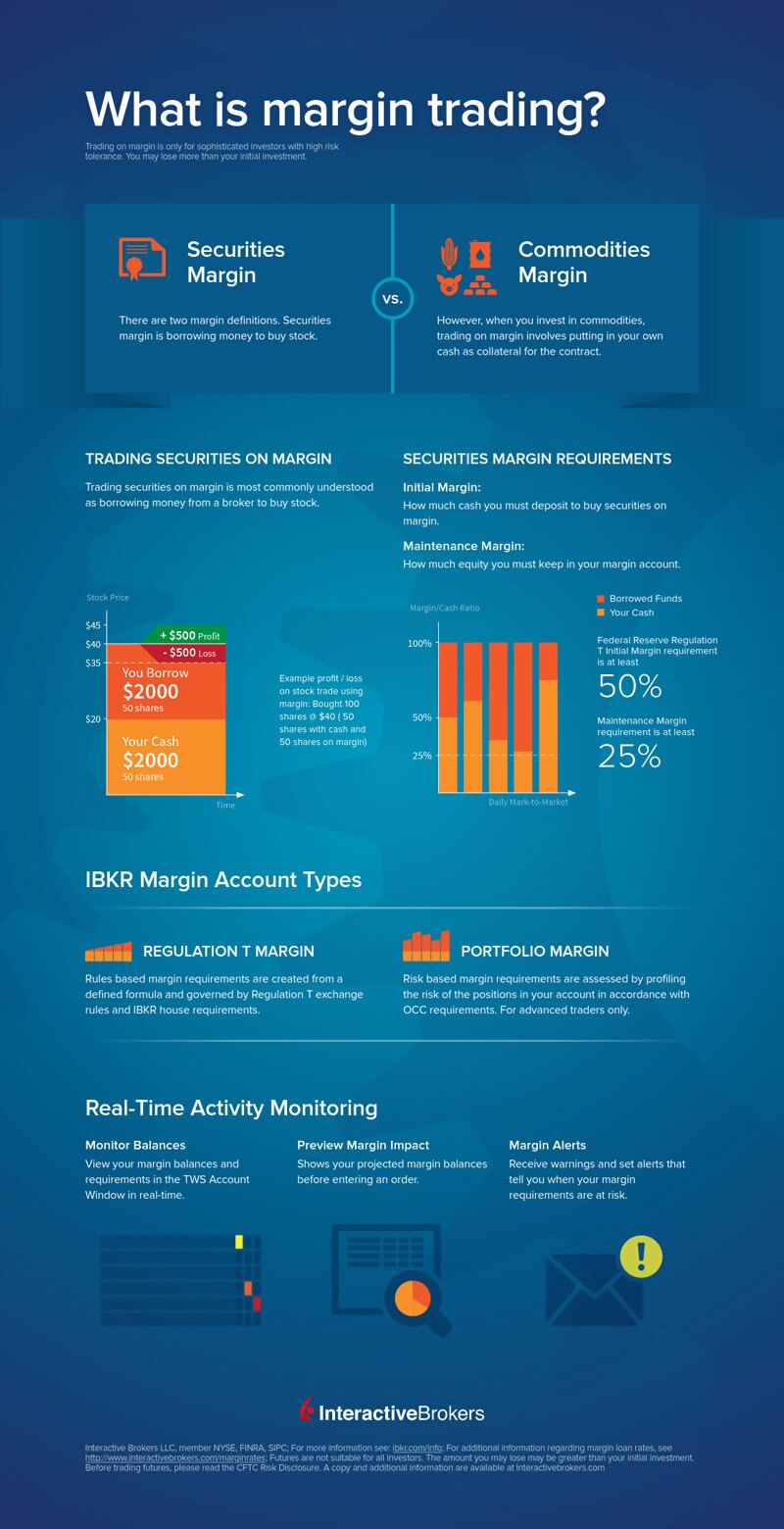

How do compliance rules differ for margin trading versus cash accounts?

Compliance rules for margin trading require higher disclosures, risk warnings, and margin agreement signatures. Brokers must monitor leverage levels, enforce margin calls, and prevent excessive borrowing. For cash accounts, rules are simpler—no borrowing or margin maintenance, just clear settlement of funds before trades. Margin accounts face stricter oversight to prevent over-leverage and ensure investor protection, while cash accounts have fewer regulatory hurdles.

Learn about How Do Broker Compliance Rules Affect Day Trading Costs and Fees?

How do brokerages manage compliance with Know Your Customer (KYC) laws?

Brokerages manage KYC compliance by verifying customer identities through government-issued IDs, proof of address, and financial documents. They use automated systems to screen for fraud, money laundering, and terrorist financing, adhering to local regulations. Compliance procedures vary: some brokerages require extensive documentation and background checks, while others have streamlined digital processes. Larger firms often have dedicated compliance teams, whereas smaller brokerages rely on third-party verification services. Overall, each brokerage’s approach depends on jurisdictional rules, risk appetite, and technology infrastructure.

What are the impact of different compliance rules on brokerage marketing practices?

Compliance rules shape brokerage marketing by dictating what claims, disclosures, and advertising methods are allowed. Different brokerages interpret and enforce these rules uniquely, leading to varied marketing practices. Some prioritize strict transparency and detailed disclosures, limiting aggressive sales tactics. Others may adopt more flexible approaches, risking regulatory scrutiny. These differences affect how brokerages attract clients, the transparency of their messaging, and their overall marketing style.

How do compliance standards evolve with new financial technologies?

Compliance standards adapt to new financial technologies by updating regulations to address emerging risks, such as cybersecurity threats, data privacy, and automated trading. Brokerages must implement new controls for digital platforms, AI, and blockchain, often guided by regulators' evolving frameworks. Differences across brokerages stem from their size, target markets, and technology use; some follow stricter internal policies, while others rely on industry standards, leading to variability in how they meet compliance with innovative financial tools.

What are penalties for non-compliance in different brokerage environments?

Penalties for non-compliance vary: traditional brokerages often impose fines, account suspensions, or termination, while online or discount brokers might restrict trading privileges or close accounts. Regulatory agencies can impose hefty fines, license revocations, or legal actions. In some cases, non-compliance leads to reputational damage or civil lawsuits. The severity depends on the breach—ranging from minor documentation errors to serious violations like insider trading.

Conclusion about How do compliance rules differ across brokerages?

Understanding the varying compliance rules across brokerages is crucial for traders. Each brokerage type—be it online or traditional, domestic or international—faces distinct regulatory requirements that influence everything from client data protection to fee disclosures. Retail and institutional brokerages must also navigate their specific compliance standards, particularly concerning anti-money laundering and fraud regulations. As financial technologies evolve, so too do these compliance standards, impacting how brokerages operate and market their services. For traders looking to navigate this complex landscape, insights from DayTradingBusiness can provide essential guidance on complying with these diverse regulations.