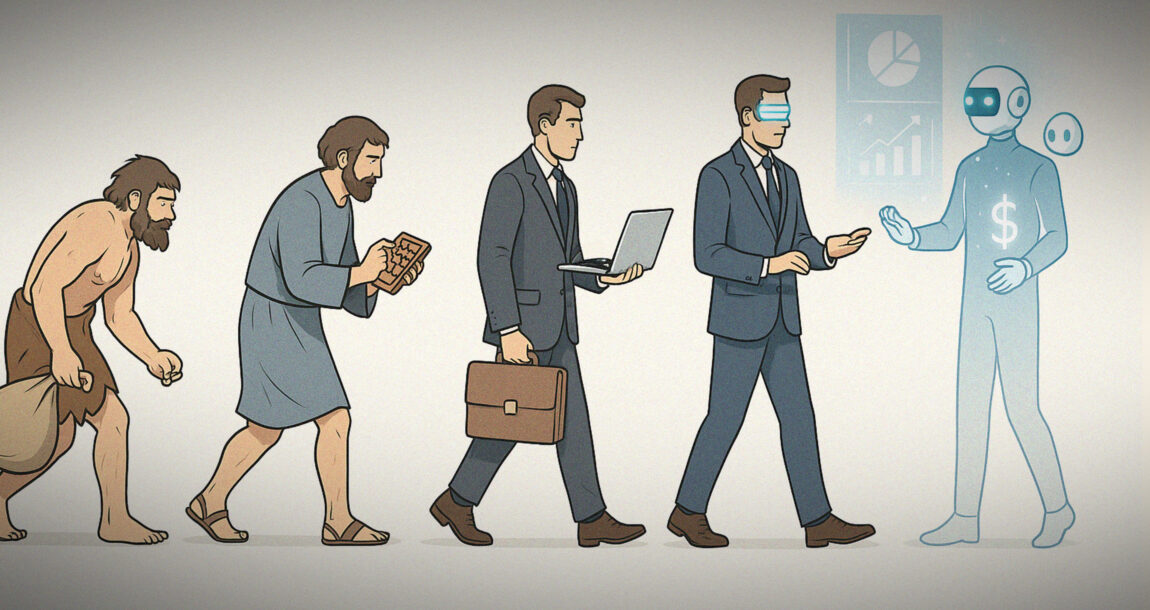

Did you know that 90% of day traders lose money, and many of them are influenced by non-compliant brokers? Choosing the right broker is crucial for safeguarding your investments and ensuring a fair trading environment. This article dives deep into the myriad risks associated with non-compliant day trading brokers, including potential financial scams, security threats to your trading funds, and the legal complications that could arise from using unregulated platforms. Learn how to identify non-compliant brokers, the signs to watch for, and the consequences of broker insolvency. With insights from DayTradingBusiness, we’ll equip you with the knowledge to make informed decisions and protect your trading assets effectively.

What are the main risks of using non-compliant day trading brokers?

Using non-compliant day trading brokers risks account freezes, fund loss, and lack of legal protections. They may engage in fraud, misappropriating your money or providing misleading information. Without regulatory oversight, there's no guarantee of fair practices or dispute resolution. You could face sudden account closures or poor trade execution, leading to unexpected losses. Overall, non-compliant brokers put your investments and financial security at serious risk.

How can non-compliant brokers affect my trading funds?

Non-compliant brokers can risk your trading funds by potentially misappropriating or losing your money without accountability, offering fake account balances, or refusing withdrawals. They might lack proper regulation, increasing chances of fraud, sudden shutdowns, or unfair trading practices. Using such brokers leaves your funds exposed to theft or unrecoverable losses if the broker collapses or engages in illegal activities.

What legal issues arise from choosing an unregulated broker?

Using an unregulated broker exposes you to fraud, lack of investor protection, and potential manipulation of your trades. There's no oversight to ensure fair practices, so your funds could be misappropriated or lost without recourse. If the broker faces legal trouble, your assets might become inaccessible. You also risk inadequate or no dispute resolution, leaving you vulnerable if issues arise.

How does broker non-compliance impact my trading account security?

Broker non-compliance risks your trading account security by increasing the chance of fraud, mismanagement, or insolvency. Non-compliant brokers may lack proper regulatory oversight, making your funds vulnerable to theft or loss. They might not follow strict security protocols, risking data breaches or unauthorized access. If the broker faces legal issues or shuts down, your assets could become inaccessible or lost entirely. Using a non-compliant broker exposes you to higher chances of scams, account freezes, or unfair trading practices that compromise your funds.

What are the signs of a non-compliant day trading broker?

Signs of a non-compliant day trading broker include lack of proper licensing, unclear or hidden fees, unresponsive customer support, and absence of regulatory disclosures. They might also offer unrealistic promises, pressure quick trades, or refuse to provide transparent account statements. These brokers often operate without adherence to financial authority standards, increasing risk of fraud or account loss.

Can using a non-regulated broker lead to financial scams?

Yes, using a non-regulated broker can lead to financial scams. These brokers often lack oversight, making it easier for them to manipulate or steal your funds. They might offer fake promises, mislead you about risks, or disappear with your money. Without proper regulation, there's no guarantee your trades are fair or your account is secure.

How does non-compliance increase the risk of trade execution problems?

Non-compliance by day trading brokers can lead to trade execution problems like order delays, rejections, or cancellations. Regulators may freeze or revoke licenses, causing brokers to halt trading suddenly. This disrupts your ability to enter or exit positions at desired prices. Non-compliance also increases the chance of facing fines or legal actions, which can destabilize the broker’s operations. When brokers cut corners on compliance, it raises the risk of inaccurate trade reporting, leading to potential losses or regulatory penalties for traders.

What are the potential losses from broker insolvency due to non-compliance?

Potential losses from broker insolvency due to non-compliance include the full loss of your funds if the broker's financial safeguards fail. Non-compliant brokers may lack proper client money protection, increasing the risk of losing deposits if they go bankrupt. You could face difficulties retrieving your assets, get locked out of your accounts, or lose access to your trading capital. In worst cases, insolvency might mean your trades are left unresolved, leaving you financially exposed and unable to recover your investments.

How does broker non-compliance affect transparency and disclosures?

Broker non-compliance reduces transparency and hampers clear disclosures, making it harder for traders to understand risks, fees, and regulatory status. It can hide unethical practices, expose traders to hidden costs, and increase the chance of fraud or unfair treatment. Without proper disclosures, traders may make uninformed decisions, increasing financial risk.

What should I know about regulatory licenses for day trading brokers?

Using non-compliant day trading brokers risks legal penalties, account freezes, and loss of funds. Regulatory licenses ensure brokers follow strict standards for transparency, security, and fair trading practices. Without proper licensing, brokers might manipulate prices, delay withdrawals, or operate fraudulently. Always verify if a broker is licensed by recognized authorities like the SEC, FCA, or ASIC before trading. Non-compliance increases the chance of scams and financial loss.

Learn about What Should Day Traders Know About Regulatory Changes?

How can I verify if a broker is compliant with regulations?

Check if the broker is registered with regulatory bodies like the SEC, FCA, or ASIC. Look for a license number on their website and verify it on the official regulator’s database. Read reviews and reports about their compliance history. Avoid brokers without clear regulatory status or those operating outside recognized jurisdictions. Non-compliant brokers can manipulate trades, refuse withdrawals, or operate fraudulently. Always confirm their licensing before trading to avoid these risks.

What are the consequences of using an unlicensed trading platform?

Using an unlicensed trading platform risks losing your funds because they lack regulatory oversight. There's no guarantee of fair trading practices, which increases chances of fraud or manipulation. You won’t have access to official dispute resolution or investor protections if problems arise. The platform could shut down suddenly, leaving you unable to withdraw your money. Additionally, unlicensed brokers often have poor security, making your personal and financial information vulnerable.

How does non-compliance influence the fairness of trading conditions?

Non-compliance by day trading brokers can skew trading conditions, leading to unfair practices like hidden fees, manipulated spreads, or delayed executions. It undermines transparency, making it harder for traders to trust price accuracy and order fulfillment. This unfairness can cause traders to lose money or face unexpected risks, compromising the integrity of the trading environment.

What legal recourse do traders have against non-compliant brokers?

Traders can file complaints with financial regulatory authorities, pursue legal action in courts, or seek arbitration through industry dispute resolution services against non-compliant brokers.

How does broker non-compliance affect dispute resolution?

Broker non-compliance can delay or block dispute resolution, making it harder to recover losses. It may result in biased or unfair handling of complaints, leaving traders vulnerable. Non-compliant brokers might withhold necessary documentation or refuse to cooperate, complicating investigations. This increases the risk of unresolved disputes, financial loss, and potential legal battles.

What are the risks of hidden fees with non-compliant brokers?

Using non-compliant day trading brokers exposes you to hidden fees that can drain your profits. They might charge undisclosed commissions, maintenance fees, or extra costs for withdrawals, making trading more expensive than expected. These brokers often lack transparency, increasing the risk of unexpected charges that eat into your capital. Plus, they could impose sudden fees or change fee structures without notice, leaving you vulnerable. Overall, hidden fees from non-compliant brokers can significantly reduce your trading gains and lead to financial loss.

How does using a non-regulated broker impact my tax reporting?

Using a non-regulated broker can cause tax reporting issues because transactions may not be accurately documented or reported to tax authorities. You might face difficulties verifying your trades, leading to potential underreporting or misreporting of income. If the broker doesn't follow proper reporting standards, you could unknowingly file incorrect tax returns, risking penalties or audits. It also increases the chance of losing access to official documentation needed for tax claims or deductions.

Conclusion about What Are the Risks of Using Non-Compliant Day Trading Brokers?

In summary, using non-compliant day trading brokers exposes traders to significant risks, including potential financial scams, lack of security, and legal issues. These brokers can jeopardize trading funds, lead to execution problems, and create hidden costs. To safeguard your investments, it is crucial to choose regulated brokers. By prioritizing compliance, you ensure better protection and transparency in your trading activities. For comprehensive guidance on navigating these challenges, consider the insights offered by DayTradingBusiness.

Learn about What Are the Risks of Using Day Trading Bots?

Sources:

- 1 Supporting Statement for the Treasury Securities and Agency Debt ...

- Futures Brokerage Activities and Futures Commission Merchants ...

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- Regulation U: Credit by Banks or Persons other than Brokers or ...

- FRB: Regulation R: Compliance Guide

- The Challenge of Enforcement in Securities Markets: Mission ...