Did you know that the world of day trading is almost as regulated as the secret recipe for Coca-Cola? In this article, we dive into the crucial legal requirements that day trading brokers must navigate to ensure compliance. From the essential licenses needed to operate legally and the stringent client identity verification processes, to capital requirements and anti-money laundering measures, we've got you covered. We’ll explore brokers’ responsibilities regarding SEC and FINRA regulations, the importance of client fund segregation, and how they manage compliance monitoring and risk. Additionally, we discuss the necessary disclosures to clients, handling suspicious activity reports, trade execution transparency, and fair trading practices. With insights from DayTradingBusiness, learn how brokers maintain meticulous record-keeping and adapt to ever-changing regulations, as well as the penalties they face for non-compliance.

What licenses do day trading brokers need?

Day trading brokers need licenses from financial regulatory authorities like the SEC in the U.S., FINRA membership, and possibly state licenses, depending on location. They must also register as broker-dealers, comply with anti-money laundering (AML) regulations, and meet capital requirements. Licensing ensures they adhere to standards for investor protection and market integrity.

How do brokers verify client identities for compliance?

Brokers verify client identities using Know Your Customer (KYC) procedures, requiring government-issued ID, proof of address, and sometimes financial statements. They run these documents through identity verification systems, check against watchlists, and perform background checks to ensure compliance with AML and AMLD regulations.

What are the capital requirements for day trading brokers?

The minimum capital requirement for day trading brokers is typically $25,000 in regulatory capital, as mandated by the SEC and FINRA. Brokers must maintain this amount to ensure they can cover client trades and operational risks. Some jurisdictions or specific trading activities may impose higher capital thresholds.

How do brokers ensure adherence to anti-money laundering laws?

Brokers ensure compliance with anti-money laundering laws by implementing customer due diligence, verifying identities, monitoring transactions for suspicious activity, maintaining detailed records, and reporting any suspicious transactions to authorities.

What reporting obligations do day trading brokers have?

Day trading brokers must report clients’ trade activity, including transaction details, to regulatory agencies like the SEC or FINRA. They are required to file suspicious activity reports (SARs) if they detect potential fraud or money laundering. Brokers must also report large cash deposits or withdrawals above certain thresholds and provide annual or quarterly statements to regulators. Additionally, they must keep detailed records of client transactions for audit purposes and ensure compliance with anti-money laundering (AML) laws.

How do brokers comply with SEC and FINRA regulations?

Brokers comply with SEC and FINRA regulations by registering properly, adhering to capital requirements, implementing robust anti-money laundering measures, maintaining accurate records, and following rules on customer disclosures and trading practices. They must also conduct regular audits, ensure transparent communication, and report suspicious activities promptly.

What are the rules for client fund segregation?

Client funds must be kept separate from the broker’s own money at all times. This means maintaining dedicated accounts—segregated accounts—that only hold client assets. Brokers cannot use client funds for operational expenses or investments. Regular audits and transparent record-keeping are required to ensure compliance. If the broker faces insolvency, client funds should be protected and promptly returned.

How do brokers manage risk and compliance monitoring?

Brokers manage risk and compliance by using advanced software to monitor trades, ensure adherence to regulations, and flag suspicious activity. They implement strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to verify client identities and prevent fraud. Regular audits and real-time reporting help identify potential violations early. Compliance officers review trading activities to ensure they follow legal standards set by authorities like the SEC or FINRA. Automated risk management tools limit exposure and enforce trading limits, reducing legal and financial risks.

What disclosures must brokers provide to clients?

Brokers must disclose their fee structures, commissions, and any conflicts of interest. They must inform clients about risks associated with day trading, including potential losses. Additionally, brokers need to disclose their licensing status, registration details, and any disciplinary actions. They should also explain account security measures and policies on order execution, such as potential for price improvements or delays. Finally, brokers must provide clear disclosures about margin requirements, leverage risks, and the firm’s privacy policies.

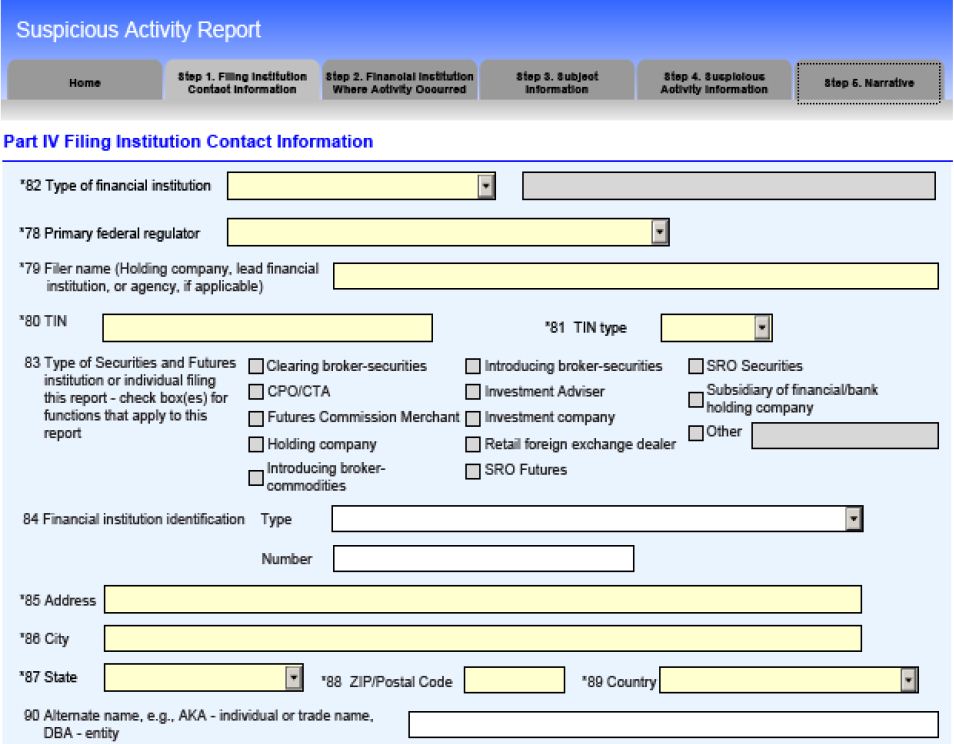

How do brokers handle suspicious activity reports?

Brokers review suspicious activity reports (SARs) promptly, investigate the flagged transactions, and file SARs with FinCEN if they detect potential money laundering or fraud. They must keep these reports confidential, avoid tipping off clients, and ensure compliance with AML laws. If necessary, brokers cooperate with authorities during investigations and adjust their monitoring processes to prevent future suspicious activity.

What are the requirements for trade execution transparency?

Trade execution transparency requires brokers to clearly disclose order routing practices, execution quality, and any potential conflicts of interest. They must provide real-time data on trade prices, execution speed, and order fills, ensuring clients see how and where their trades are executed. Additionally, brokers need to comply with regulations that mandate fair, non-discriminatory order handling, often monitored by agencies like the SEC or FINRA, to prevent preferential treatment and ensure fair market practices.

How do brokers ensure fair trading practices?

Brokers ensure fair trading by following strict legal requirements like implementing transparent order execution, adhering to regulations from authorities like the SEC, providing clear disclosures, and maintaining unbiased trading platforms. They monitor transactions for manipulation, enforce anti-fraud measures, and regularly audit their compliance with trading laws. These steps prevent unfair advantages and protect investors.

What record-keeping standards must brokers follow?

Brokers must keep detailed records of all client transactions, communications, and account activities for at least five years. They need to maintain accurate, easily retrievable records of trade orders, confirmations, and account statements. Compliance includes documenting client identification, anti-money laundering info, and ensuring data security. These standards align with SEC and FINRA regulations to ensure transparency and accountability in day trading.

How do brokers stay updated on changing regulations?

Brokers stay updated on changing regulations by regularly reviewing official financial authority updates, subscribing to industry newsletters, attending compliance webinars, and consulting legal experts. They monitor regulatory websites like the SEC or FINRA, participate in industry associations, and implement compliance software that tracks legal changes. This ensures they meet legal requirements for day trading broker compliance and adapt quickly to new rules.

What penalties can brokers face for non-compliance?

Brokers can face hefty fines, license suspension or revocation, legal lawsuits, and criminal charges for non-compliance with day trading regulations. They may also be required to pay restitution, face regulatory bans, or be subject to increased scrutiny and audits.

Conclusion about What Are the Legal Requirements for Day Trading Broker Compliance?

In summary, day trading brokers must navigate a complex landscape of legal requirements to ensure compliance with regulations set forth by entities like the SEC and FINRA. This includes obtaining necessary licenses, verifying client identities, adhering to capital requirements, and implementing robust anti-money laundering practices. Additionally, brokers are responsible for transparent trade execution, maintaining segregation of client funds, and managing compliance risks effectively. Staying informed about evolving regulations is crucial, as non-compliance can lead to serious penalties. For those seeking comprehensive insights and support in understanding these critical aspects of day trading, DayTradingBusiness offers valuable resources and guidance.

Learn about What Are the Legal Requirements for Day Trading Accounts?