Did you know that not all brokers are created equal—some might be as secure as a bank vault, while others could be as risky as a game of poker with your in-laws? In the world of day trading, broker compliance plays a crucial role in protecting your funds and ensuring the security of your trading account. This article delves into how compliance standards safeguard your investments, the importance of regulatory oversight, and the common measures brokers use to prevent fraud. We’ll also explore the risks associated with non-compliant brokers and what certifications indicate a broker's commitment to security. By understanding these key points, traders can make informed decisions about their brokers and enhance their overall trading platform security, as highlighted by DayTradingBusiness.

How Does Broker Compliance Affect Day Trading Account Security?

Broker compliance ensures your day trading account security by enforcing strict regulations that prevent fraud, unauthorized access, and financial misconduct. Compliant brokers follow cybersecurity standards, use encryption, and conduct regular audits, reducing the risk of hacking or data breaches. They also adhere to capital and margin requirements, protecting your funds from insolvency. When brokers meet compliance standards, they’re less likely to engage in risky practices that could jeopardize your account, giving you peace of mind while day trading.

Why Is Broker Compliance Important for Protecting Your Funds?

Broker compliance ensures your funds are protected by enforcing regulations that prevent fraud, misappropriation, and unfair practices. It mandates strict security measures, transparent operations, and regular audits, reducing the risk of broker insolvency or misconduct. When a broker follows compliance standards, your money is safeguarded through investor protections, segregated accounts, and legal accountability. Without compliance, your funds are vulnerable to theft, loss, or broker failure.

What Are Common Compliance Measures Brokers Use for Security?

Brokers use encryption, multi-factor authentication, regular security audits, and strict data access controls to protect day trading accounts. They also monitor transactions for suspicious activity and comply with regulations like AML and KYC to prevent fraud. These measures ensure your account remains secure from hacking and unauthorized access, directly impacting your day trading safety.

How Does Regulatory Oversight Safeguard Day Trading Accounts?

Broker compliance ensures regulatory oversight by enforcing rules that protect day trading accounts from fraud, unauthorized access, and financial misconduct. It mandates strict security protocols, transparent reporting, and regular audits, which prevent scams and unauthorized trades. Compliance also requires brokers to verify client identities and monitor suspicious activity, reducing the risk of account hacking or manipulation. Overall, it creates a secure environment where traders’ funds and data are safeguarded against misuse.

Can Non-Compliant Brokers Compromise Your Account Security?

Yes, non-compliant brokers can compromise your account security by exposing your funds to fraud, hacking, or mismanagement. They often lack proper security protocols and regulatory oversight, increasing the risk of unauthorized access or theft. Choosing a compliant broker ensures your account benefits from security standards, regular audits, and investor protections, reducing vulnerability to scams and cyber threats.

What Are the Risks of Trading with Unregulated Brokers?

Trading with unregulated brokers risks losing your funds to fraud or insolvency because they lack legal oversight. Without regulation, there's no watchdog to enforce transparency or fair practices, making it easy for them to manipulate or abandon accounts. You can face sudden account freezes, hidden fees, or unfulfilled withdrawals. Regulatory compliance ensures brokers follow strict security standards, protecting your money and personal info. Trading with unregulated brokers leaves you vulnerable to scams and reduces your chances of legal recourse if issues arise.

How Do Compliance Standards Prevent Fraud in Day Trading?

Compliance standards require brokers to follow strict rules that prevent fraud, like verifying customer identities through KYC processes and monitoring for suspicious activity. They enforce transparent trading practices, ensuring fair execution and preventing manipulation. Regular audits and regulatory oversight catch irregularities early, reducing the risk of fraudulent trades. These standards also mandate secure data handling, protecting traders from identity theft and account hacking. Overall, broker compliance creates a safer environment, making it harder for fraudsters to exploit day trading accounts.

What Certifications Show a Broker’s Commitment to Security?

Certifications like FINRA membership, SEC registration, and the ISO 27001 security standard demonstrate a broker’s commitment to security. These credentials show the broker follows strict regulatory and cybersecurity practices, protecting your trading account. Look for brokers with SSL certification, regular security audits, and compliance with data protection laws. Such certifications ensure your funds and personal info are handled securely, reducing risk during day trading.

How Does KYC and AML Compliance Protect Traders?

KYC and AML compliance protect traders by verifying identities to prevent fraud and money laundering, ensuring only legitimate account holders trade. This reduces the risk of unauthorized access and scams. It also helps brokers monitor suspicious activities, catching potential fraud early. Overall, compliance creates a secure trading environment, safeguarding your funds and personal information.

What Role Does Data Encryption Play in Broker Security?

Data encryption protects sensitive broker and trader information from cyber threats, ensuring secure transactions and account confidentiality. It prevents unauthorized access to personal details, trade data, and financial information, reducing hacking risks. Strong encryption standards help brokers meet compliance requirements, which in turn enhances overall security for day trading accounts. Without encryption, vulnerabilities increase, exposing traders to fraud and identity theft.

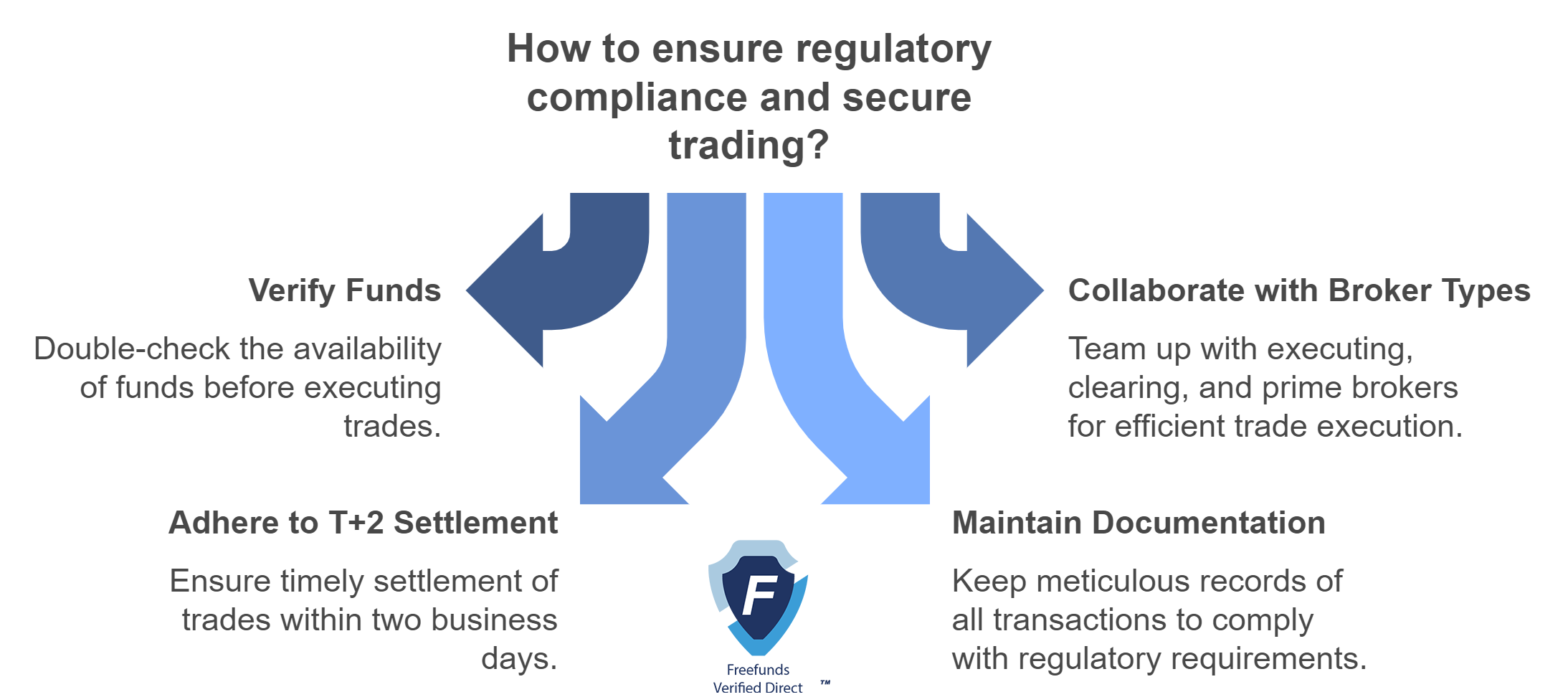

How Can Traders Verify a Broker’s Compliance Status?

Traders verify a broker’s compliance by checking regulatory authority websites like the SEC, FCA, or ASIC for registration and licensing details. They can also review the broker’s disclosures, read customer reviews, and ensure the broker adheres to industry standards. Confirming compliance guarantees the broker follows legal practices, protecting your day trading account from fraud and ensuring funds are secure.

Learn about How to Verify a Broker’s Compliance Status for Day Trading

How Does Transparency Impact Account Security?

Transparency ensures brokers clearly disclose security measures, protecting your account from hidden risks. When brokers comply with regulations, they follow strict security protocols, reducing fraud and unauthorized access. Transparent practices build trust, making it easier to spot suspicious activity. Compliance mandates regular audits and data encryption, which guard your funds and personal info. Overall, transparency and broker compliance strengthen your account security by preventing breaches and ensuring accountability.

What Are the Legal Consequences for Non-Compliant Brokers?

Non-compliant brokers can face fines, license suspension, or revocation. They may be sued for fraud or breach of fiduciary duty. Clients might lose their funds if the broker is shut down or penalized. Regulatory agencies can impose sanctions that damage the broker’s reputation and operational ability. In extreme cases, criminal charges could be filed against the broker.

How Does Broker Compliance Influence Account Recovery Options?

Broker compliance ensures robust security measures, making account recovery easier and more reliable if hacked or compromised. When brokers follow strict regulations, they implement secure verification processes, reducing fraud risk and streamlining recovery procedures. Compliance also mandates transparent policies, meaning traders know exactly how to recover their accounts if access is lost. Non-compliant brokers may lack proper safeguards, making recovery difficult, slow, or insecure.

Learn about How do broker compliance standards influence day trading practices?

What Should Traders Look for in a Compliant Broker?

Traders should prioritize brokers with proper licensing, transparent fee structures, strong cybersecurity measures, clear regulatory adherence, and positive client reviews. Compliance ensures the broker follows legal standards, protecting your funds from fraud and unauthorized access, which directly secures your day trading account. A compliant broker also offers reliable trade execution and dispute resolution, reducing risks and boosting confidence in your trading activities.

How Does Compliance Impact Overall Trading Platform Security?

Broker compliance ensures strict adherence to regulations that protect your day trading account from fraud, fraud prevention measures, and regulatory enforcement. It mandates robust data security protocols, encryption, and regular audits, reducing the risk of hacking or data breaches. Compliance also requires transparent procedures for fund segregation, preventing misuse or loss of your assets. Overall, compliant brokers create a safer trading environment by following industry standards, which directly enhances the security of your day trading account.

Conclusion about How Does Broker Compliance Impact Day Trading Account Security?

In summary, broker compliance is crucial for ensuring the security of day trading accounts. Adhering to regulatory standards not only protects your funds but also mitigates the risks associated with fraud and unregulated practices. By prioritizing compliance measures such as KYC, AML, and data encryption, brokers can provide a safer trading environment. Traders should thoroughly verify a broker's compliance status and look for relevant certifications to safeguard their investments. Ultimately, a commitment to compliance enhances transparency and recovery options, making it essential for anyone serious about day trading. For further insights and guidance, consider exploring the resources available at DayTradingBusiness.

Learn about How Do Broker Compliance Rules Affect Day Trading Costs and Fees?

Sources:

- FEDERAL RESERVE SYSTEM 12 CFR Parts 207, 220, 221, 224 ...

- Appendix Comprehensive Review of Regulation W Overview of the ...

- Price Discovery in the U.S. Treasury Cash Market: On Principal ...

- TRV Risk - Leverage and derivatives – the case of Archegos

- Comments on Regulatory capital rule: Amendments applicable to ...