Did you know that money laundering is so old, it’s been around longer than sliced bread? In the world of day trading, brokers play a crucial role in preventing financial crimes like money laundering and fraud. This article dives into how brokers detect and combat these risks through identity verification, anti-money laundering (AML) policies, and advanced technology. We’ll explore the various fraud risks that traders face, the importance of Know Your Customer (KYC) procedures, and how compliance teams monitor suspicious activities. Additionally, we'll highlight the regulations brokers must follow and the consequences of failing to uphold these standards. Join us as we uncover how traders can also contribute to a safer trading environment, all while leveraging insights from DayTradingBusiness to enhance your trading strategies.

How Do Brokers Detect Money Laundering in Day Trading?

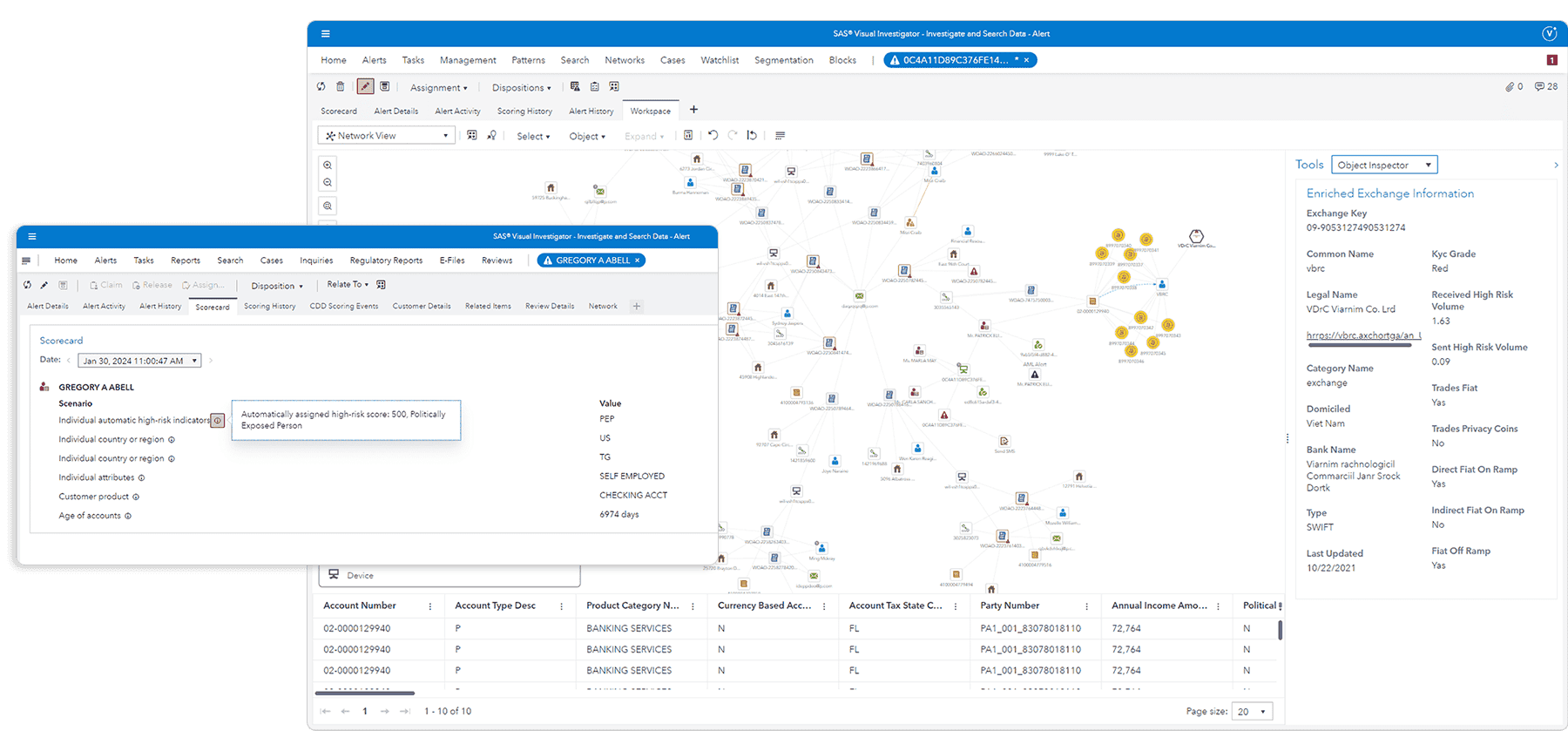

Brokers detect money laundering in day trading through transaction monitoring systems that flag suspicious activity, such as large, unusual trades, rapid deposits and withdrawals, or inconsistent account behavior. They use anti-money laundering (AML) software to analyze patterns, verify customer identities via Know Your Customer (KYC) procedures, and scrutinize trades that don't match a trader’s typical activity. Alerts trigger manual reviews, and suspicious cases are reported to authorities.

What Are Common Fraud Risks in Day Trading?

Common fraud risks in day trading include pump-and-dump schemes, fake insider tips, account spoofing, and unauthorized trades. Brokers prevent money laundering and fraud by implementing strict identity verification, monitoring unusual trading activity, using anti-money laundering (AML) software, and enforcing compliance with financial regulations. They also conduct regular audits and suspicious activity reports to catch deceptive practices early.

How Do Brokers Verify Client Identities to Prevent Fraud?

Brokers verify client identities through government-issued ID checks, address verification, and biometric authentication. They often require proof of income or source of funds, and perform anti-money laundering (AML) screenings using databases to flag suspicious activity. These steps ensure the client is who they claim to be, reducing fraud and money laundering risks in day trading.

What Are Anti-Money Laundering (AML) Policies in Day Trading?

Anti-Money Laundering (AML) policies in day trading require brokers to verify customer identities, monitor transactions for suspicious activity, and report large or unusual trades to authorities. They enforce Know Your Customer (KYC) procedures to prevent anonymous accounts. Brokers track trading patterns to detect money laundering schemes, flagging rapid, large, or inconsistent transactions. They also restrict access for high-risk clients and conduct ongoing compliance checks to stop fraud and illicit funds from entering the trading system.

How Do Brokers Monitor Suspicious Trading Activities?

Brokers monitor suspicious trading activities by analyzing large, unusual trades, rapid order placements, and sudden volume spikes. They use automated algorithms and real-time surveillance tools to flag patterns that resemble money laundering or fraud. Brokers also track account activity for inconsistencies, such as sudden deposits or withdrawals, and cross-reference trades against known illegal schemes. Suspicious behavior triggers alerts, prompting manual review or account freezes. They comply with AML regulations by reporting suspicious transactions to authorities.

What Are Know Your Customer (KYC) Procedures for Day Traders?

KYC procedures for day traders require brokers to verify identity through documents like ID, proof of address, and sometimes financial statements before opening accounts. They may also conduct background checks, assess trading experience, and monitor transactions for suspicious activity. This helps brokers prevent money laundering and fraud by ensuring traders are who they say they are and their trading activity is legitimate.

How Is Transaction Monitoring Used to Stop Money Laundering?

Transaction monitoring detects suspicious patterns like large, rapid trades or unusual account activity. Brokers use it to flag and review transactions that deviate from normal behavior, catching potential money laundering. Automated systems scan for red flags—like multiple small deposits followed by large withdrawals—to stop laundering attempts early. When anomalies are identified, they trigger alerts for further investigation, helping prevent fraud and laundering in day trading.

What Role Do Compliance Teams Play in Fraud Prevention?

Compliance teams enforce anti-money laundering (AML) policies, monitor transactions for suspicious activity, and verify client identities. They ensure brokers follow regulations, flag unusual trading patterns, and conduct ongoing risk assessments. Their role is to catch fraud early, prevent money laundering, and maintain regulatory standards to protect the broker and clients.

How Do Brokers Use Technology to Detect Unusual Trading Patterns?

Brokers use advanced algorithms and real-time data analysis to spot unusual trading patterns, like rapid spikes or large volume shifts. They monitor for suspicious activity such as wash trades, layering, or pump-and-dump schemes. Automated systems flag anomalies and trigger alerts, helping brokers investigate potential money laundering or fraud. Machine learning models analyze behavioral patterns over time to detect deviations from normal trading, preventing illegal activities.

What Are Red Flags for Potential Money Laundering in Day Trading?

Red flags for potential money laundering in day trading include sudden large deposits without clear source, frequent quick trades with no real profit, inconsistent or fake documentation, accounts showing high activity from dubious origins, and unusual patterns like rapid fund transfers between accounts. Brokers prevent this by implementing AML (Anti-Money Laundering) checks, verifying identities through KYC, monitoring suspicious transactions with software, flagging large or unusual trades, and conducting manual reviews when needed.

How Can Traders Help Prevent Fraud and Money Laundering?

Brokers prevent money laundering and fraud in day trading by implementing strict KYC procedures, monitoring transactions for suspicious activity, and using advanced fraud detection software. They enforce adherence to AML regulations, flag unusual trading patterns, and conduct regular audits. Educating traders about fraud risks and maintaining transparent reporting channels also help catch and prevent illicit activities.

What Regulations Do Brokers Follow to Prevent Financial Crimes?

Brokers follow AML (Anti-Money Laundering) laws, KYC (Know Your Customer) procedures, and report suspicious activities to authorities. They implement customer identity verification, monitor transactions for unusual patterns, and maintain compliance with regulations like the Bank Secrecy Act and the Patriot Act. These measures help detect and prevent money laundering, fraud, and other financial crimes in day trading.

How Do Brokers Report Suspicious Activities to Authorities?

Brokers report suspicious activities by monitoring trades for unusual patterns, flagging anomalies like large, inconsistent transactions or rapid account changes. When they detect potential money laundering or fraud, they file Suspicious Activity Reports (SARs) with authorities like FinCEN in the U.S. or the FCA in the UK. These reports include details of the activity, account information, and evidence, which help regulators investigate and prevent financial crimes.

What Are the Consequences for Brokers Failing to Prevent Money Laundering?

Brokers who fail to prevent money laundering face heavy fines, legal penalties, and reputational damage. They may be sued, lose licenses, or face criminal charges. Customers might withdraw trust, leading to decreased trading volume and profits. Regulatory authorities can impose sanctions, and the broker’s operations could be suspended or shut down.

How Do Broker Systems Flag High-Risk Transactions?

Broker systems flag high-risk transactions by analyzing patterns like sudden large trades, rapid buy-sell sequences, and unusual account activity. They use real-time monitoring tools with algorithms that detect suspicious behaviors matching known money laundering or fraud tactics. If a transaction looks risky, the system flags it for manual review or blocks it outright. These systems also check customer profiles against blacklists, watch for inconsistent info, and monitor for transactions that deviate from typical behavior.

How Does Customer Due Diligence Work in Day Trading?

Customer Due Diligence in day trading involves brokers verifying your identity with ID checks and financial background assessments. They monitor your trading activity for suspicious patterns, like rapid trades or large, inconsistent deposits. Brokers also flag unusual transactions and request additional info if something seems off. This process helps prevent money laundering and fraud by ensuring traders are legitimate and their funds are clean.

Learn about Why is skipping due diligence dangerous in day trading?

Conclusion about How Do Brokers Prevent Money Laundering and Fraud in Day Trading?

In summary, brokers play a crucial role in preventing money laundering and fraud in day trading through a combination of robust detection methods, client identity verification, and adherence to strict regulatory frameworks. By implementing Anti-Money Laundering (AML) policies and Know Your Customer (KYC) procedures, they ensure a secure trading environment. Traders also have a part to play in this process by staying vigilant and reporting suspicious activities. For comprehensive insights on navigating these complexities, DayTradingBusiness is here to support you in enhancing your trading strategies while maintaining compliance and security.

Learn about How do regulations prevent market manipulation in day trading?