Did you know that the average person makes about 35,000 decisions a day, but brokers have to make sure their clients are making the right ones for their financial futures? This article dives into the essential practices brokers employ to ensure customer suitability and compliance. From assessing client eligibility and evaluating risk tolerance to verifying information through KYC processes, we explore how brokers tailor products to match profiles while navigating common compliance challenges. We'll also discuss the critical role of compliance officers, the impact of digital platforms, and the importance of staying updated on regulatory changes. Join us as we uncover how DayTradingBusiness provides insights into these processes, ensuring that both brokers and clients thrive in a compliant trading environment.

How do brokers assess customer suitability?

Brokers assess customer suitability by analyzing financial goals, risk tolerance, investment experience, and financial situation through questionnaires and interviews. They evaluate whether investment products match the client’s risk profile and objectives. Regulatory rules require brokers to ensure recommendations align with the customer’s capacity to handle potential losses. They document this assessment to comply with compliance standards.

What criteria do brokers use to determine client eligibility?

Brokers evaluate client eligibility based on financial goals, risk tolerance, investment experience, income, net worth, and liquidity needs. They also consider the client’s age, investment knowledge, and trading history to ensure suitability and compliance with regulations.

How do brokers ensure compliance with financial regulations?

Brokers ensure compliance by thoroughly assessing customer financial profiles, investment experience, and risk tolerance to meet suitability standards. They follow strict procedures for Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, maintaining detailed records. Regular staff training keeps them updated on changing rules. They implement compliance checks within trading platforms and conduct internal audits. Clear disclosures and informed consent documents protect both clients and the firm. Overall, they embed regulatory requirements into daily operations to avoid violations and penalties.

What steps do brokers take to verify client information?

Brokers verify client information by requesting identification documents like passports or driver’s licenses, confirming income and employment details through pay stubs or bank statements, and checking financial backgrounds via credit reports. They also assess the client’s investment experience and risk tolerance through questionnaires. Additionally, brokers may use third-party verification services and cross-check data against public records to ensure accuracy and compliance with regulations.

How do brokers evaluate a client's risk tolerance?

Brokers assess a client's risk tolerance through questionnaires that gauge their investment goals, experience, and comfort with volatility. They analyze the client's financial situation to determine how much risk they can handle without jeopardizing their finances. Brokers often discuss investment scenarios and use profiling tools to match the client’s risk appetite with suitable products. They also review past investment behavior and ask targeted questions to understand emotional responses to market fluctuations. This evaluation ensures recommendations align with the client's risk capacity and compliance standards.

What role does KYC play in brokerage suitability checks?

KYC collects customer identity and financial info, helping brokers assess if investment products match the client’s risk profile and financial goals. It ensures compliance with regulations, prevents fraud, and verifies that the client can afford and understand the investments they choose. KYC forms the foundation for suitability checks by providing accurate data to evaluate whether a broker’s recommendations align with the customer’s experience and financial situation.

How do brokers match products to client profiles?

Brokers match products to client profiles by assessing their financial goals, risk tolerance, investment experience, and income. They gather detailed information through questionnaires and interviews, then compare this data against product features. Brokers ensure compliance by verifying that recommended products align with regulatory standards and the client’s suitability, avoiding conflicts of interest. They document their recommendation process to demonstrate adherence to suitability rules.

What are common compliance challenges brokers face?

Brokers often struggle with accurately assessing customer suitability, staying updated with changing regulations, and maintaining thorough documentation. They face challenges in balancing sales targets with strict compliance standards, avoiding conflicts of interest, and ensuring transparency in recommendations. Keeping up with evolving compliance rules across different jurisdictions complicates the process, and inadequate training can lead to unintentional violations.

How do brokers document suitability and compliance decisions?

Brokers document suitability and compliance decisions by recording detailed notes about customer profiles, investment goals, risk tolerance, and the rationale for recommendations. They often use standardized forms or electronic systems to log these assessments, ensuring each decision aligns with regulatory requirements. Brokers also keep records of communications, disclosures, and any suitability questionnaires completed by the customer. This documentation provides a clear trail showing how they determined investments matched the client’s needs and complied with industry rules.

How often do brokers review client suitability?

Brokers review client suitability at least annually. They also reassess whenever a client’s financial situation, investment goals, or risk tolerance change.

What training do brokers receive on compliance standards?

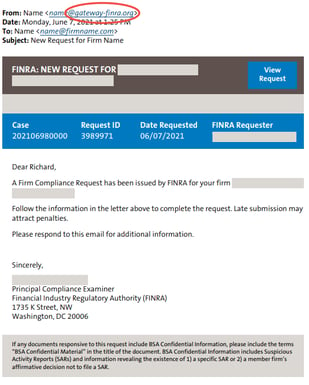

Brokers receive training on compliance standards through mandatory courses on regulations like FINRA, SEC rules, and industry best practices. They learn to assess customer suitability, disclose risks, and follow anti-money laundering protocols. Ongoing education ensures they stay updated on changing laws and compliance requirements.

How do brokers handle conflicts of interest?

Brokers handle conflicts of interest by disclosing them to clients, implementing policies to manage potential bias, and prioritizing customer interests through fiduciary duties or best execution standards. They also establish internal compliance procedures to monitor and address conflicts proactively, ensuring transparency and fairness in advice and transactions.

What are the penalties for non-compliance in brokerage?

Penalties for non-compliance in brokerage include fines, license suspension or revocation, legal action, and reputational damage. Regulatory authorities like the SEC or FINRA can impose monetary penalties and ban brokers from industry activities. Violations of customer suitability rules can also lead to lawsuits and restitution demands.

How do brokers stay updated on regulatory changes?

Brokers stay updated on regulatory changes by subscribing to industry newsletters, attending compliance webinars, and monitoring official regulatory agency updates. They also participate in professional associations and regularly consult legal and compliance experts. Using compliance management software helps them track and implement new rules efficiently.

How do digital platforms impact suitability assessments?

Digital platforms streamline suitability assessments by automating data collection, risk profiling, and compliance checks in real-time. They enable brokers to quickly analyze customer information, match investment options to risk tolerance, and ensure regulatory standards are met. This speeds up decision-making, reduces human error, and improves accuracy in assessing customer suitability.

How do brokers manage client data securely?

Brokers handle customer suitability and compliance by using secure data encryption, strict access controls, and regular audits. They verify client identities through KYC procedures, maintain detailed compliance records, and monitor transactions for suspicious activity. Data is stored on secure servers with restricted access, ensuring only authorized personnel can view sensitive information. They also follow industry regulations like AML and GDPR to protect client data and ensure transparency.

How do brokers address unsuitable recommendations?

Brokers handle unsuitable recommendations by reviewing client profiles, identifying mismatched investments, and immediately correcting or reversing the advice. They notify clients about the issue, explain why the recommendation was unsuitable, and offer alternative options aligned with the client’s risk tolerance and financial goals. If necessary, they escalate the matter to compliance or supervisory teams to ensure proper resolution and prevent future missteps.

What role do compliance officers play in brokerage?

Compliance officers ensure brokers follow regulations by reviewing customer profiles, verifying suitability, and preventing illegal activities. They monitor transactions, enforce internal policies, and keep the brokerage aligned with legal standards. Their role is to identify and mitigate compliance risks, safeguarding both the broker and clients.

How do brokers balance sales targets with compliance?

Brokers balance sales targets with compliance by prioritizing customer suitability, ensuring recommendations match clients’ financial profiles and risk tolerance. They follow strict regulatory guidelines, use compliance checks, and document all advice to avoid conflicts. Many integrate compliance software to flag unsuitable products, while sales teams are trained regularly on ethical standards. They focus on long-term trust over short-term gains, aligning sales efforts with legal and ethical responsibilities.

Conclusion about How Do Brokers Handle Customer Suitability and Compliance?

Brokers play a crucial role in ensuring customer suitability and compliance with financial regulations. They assess client profiles through rigorous criteria, verify information via KYC processes, and evaluate risk tolerance to match suitable products. Regular reviews and training on compliance standards are essential for adapting to regulatory changes. While brokers face challenges like conflicts of interest and the need for secure data management, their commitment to maintaining compliance is vital to safeguarding clients. For those seeking further insights into trading and brokerage practices, DayTradingBusiness offers comprehensive resources to enhance your understanding.