Did you know that a penny saved is technically a penny earned, but when it comes to penny stocks, it’s more like a penny lost? In the world of day trading, understanding the restrictions on certain securities is crucial for success. This article dives into the legal limits surrounding specific securities, including penny stocks, options, and ETFs, while highlighting how regulations differ by country and trading platforms. We’ll explore the implications of margin requirements, short-selling rules, and the impact of broker policies on your trading strategy. Additionally, we’ll cover the unique challenges of trading foreign stocks and cryptocurrencies for day traders. Stay informed and navigate these complexities with insights from DayTradingBusiness!

Are there legal limits on trading specific securities for day traders?

Yes, day traders face restrictions on trading certain securities, especially pattern day trading rules requiring a minimum account balance of $25,000 for frequent trading. The SEC and FINRA also limit trading in penny stocks, foreign securities, and unregistered or restricted shares to prevent fraud and manipulation. Some securities may be restricted due to broker-specific rules or regulatory bans.

Which securities are restricted for day trading?

Yes, pattern day traders must maintain a minimum of $25,000 in their margin account. They are restricted from trading certain securities like penny stocks (stocks under $5), OTC securities, and thinly traded stocks more than three times in five business days. These restrictions aim to limit excessive risk and protect both traders and brokers.

Do regulations vary by country or trading platform?

Yes, regulations on trading restrictions vary by country and trading platform. Different countries have specific rules on leverage, minimum capital, and allowable securities for day traders. Some platforms impose their own restrictions based on local laws or risk management policies.

Are there rules on trading penny stocks for day traders?

Yes, day traders face restrictions on trading penny stocks. The SEC requires pattern day traders to maintain a minimum of $25,000 in their account. Penny stocks are often subject to additional rules, like limited trading or higher volatility limits, due to their risk and potential for manipulation. Some brokerages restrict or flag penny stock trades for day traders to comply with regulations.

Can day traders trade options freely or are there restrictions?

Day traders can trade options freely, but they face restrictions like the Pattern Day Trader (PDT) rule, which requires maintaining a minimum $25,000 account balance and limits the number of day trades if below that. Certain broker restrictions or specific options contracts may also limit trading activities.

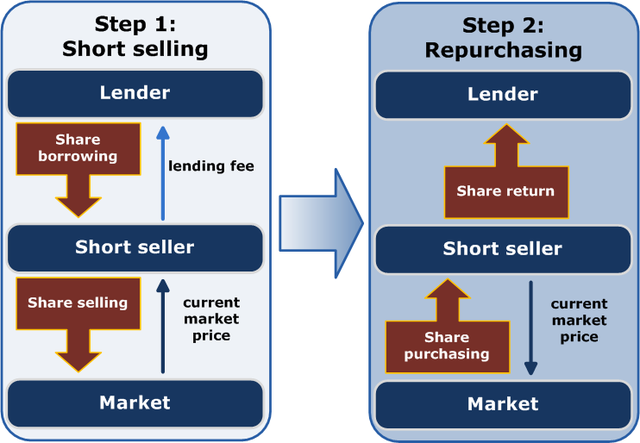

Are short-selling restrictions different for day traders?

Yes, short-selling restrictions often apply differently to day traders. Pattern day traders must maintain a minimum $25,000 account balance and face specific rules on short sales, like the uptick rule or Regulation SHO restrictions. These rules limit how and when they can short sell securities, especially during volatile conditions. Regular investors face fewer restrictions, but day traders must adhere to stricter short-selling rules to prevent excessive risk.

Do margin requirements limit day trading certain securities?

Yes, margin requirements limit day trading certain securities by restricting leverage and imposing minimum equity levels. For example, the Pattern Day Trader rule requires a minimum of $25,000 in margin account equity to execute four or more day trades within five business days on the same security. This restricts traders with lower balances from engaging in frequent day trading of certain stocks.

Are there restrictions on trading foreign stocks for day traders?

Yes, many brokers impose restrictions on trading foreign stocks for day traders, like requiring higher margins or limiting certain markets. Some foreign exchanges have rules that restrict frequent trading or require additional documentation. Additionally, foreign stock trading often involves higher risks, so brokers may set limits to protect traders and ensure compliance with international regulations.

How do SEC or other authorities regulate day trading securities?

SEC and other regulators restrict day trading securities through rules like the Pattern Day Trader (PDT) rule, which requires a minimum of $25,000 in margin account equity for frequent trading. They also set limits on leverage, require margin disclosures, and monitor trading activity for suspicious patterns. Some securities, like penny stocks or certain OTC stocks, have tighter restrictions due to higher volatility and fraud risk. Authorities enforce these rules through broker oversight and reporting, aiming to prevent excessive risk and protect investors.

Are there restrictions on trading ETFs or mutual funds for day traders?

Yes, day traders face restrictions on trading ETFs and mutual funds. ETFs are generally tradable within the pattern day trading rules, but mutual funds cannot be day traded—they are priced once daily after hours. Pattern day trading rules apply to ETFs if you execute four or more trades within five business days, requiring a minimum account balance of $25,000. Mutual funds are unsuitable for day trading because of their one-price-per-day structure.

Learn about Are There Restrictions on Day Trading in Certain Jurisdictions?

What securities are off-limits for pattern day traders?

Pattern day traders can't trade certain securities like penny stocks below $5, unregistered securities, and some foreign securities. They must also avoid trading on unregulated exchanges or in securities with limited liquidity that could pose high risks.

Are there specific rules for trading cryptocurrencies as a day trader?

Yes, there are rules for day trading cryptocurrencies. Many platforms require a minimum account balance of $25,000 to qualify as a pattern day trader. Some exchanges impose limits on leverage and trading volume. Unlike stocks, cryptocurrencies generally face fewer regulatory restrictions, but some countries or exchanges may restrict or monitor day trading activities. Always check the specific regulations of your trading platform and local laws.

Do broker policies impose limits on certain security trades?

Yes, broker policies often limit day traders from trading certain securities, especially those with low liquidity, high volatility, or restrictions like penny stocks and foreign securities. These restrictions are to manage risk and comply with regulations.

Are there restrictions on trading foreign securities for US-based day traders?

Yes, US-based day traders face restrictions on trading foreign securities due to regulations like Pattern Day Trader rules and brokerage policies. They must maintain a minimum account balance of $25,000 to execute unlimited day trades. Some foreign securities may have limited availability or higher risks, and brokerages might restrict or flag trading in certain international stocks to comply with regulations.

Learn about Are There Restrictions on Day Trading in Certain Jurisdictions?

How do trading restrictions affect margin and leverage use?

Trading restrictions limit how much margin and leverage day traders can use. They often cap leverage ratios, reducing the size of positions traders can take. Restrictions on specific securities can prevent using high leverage on volatile or risky assets. This means traders have less buying power and need more capital to control the same position. Overall, restrictions make trading safer but limit the potential for large gains from high leverage.

Learn about How does leverage affect day trading psychology?

Conclusion about Are there restrictions on trading certain securities for day traders?

In summary, day traders must navigate a complex landscape of restrictions and regulations that vary by security type, market, and trading platform. From legal limits on certain securities to specific rules governing penny stocks, options, and short selling, understanding these nuances is crucial for successful trading. Additionally, margin requirements and broker policies can further influence trading strategies. Staying informed about these restrictions is essential for day traders looking to optimize their performance and mitigate risks. For comprehensive insights and guidance, DayTradingBusiness is here to support your trading journey.

Learn about Are There Restrictions on Day Trading in Certain Jurisdictions?

Sources:

- Price impact under heterogeneous beliefs and restricted participation

- Stealth-trading: Which traders' trades move stock prices ...

- Do regulations work? A comprehensive analysis of price limits and ...

- Trading rules, competition for order flow and market fragmentation ...

- O/S: The relative trading activity in options and stock - ScienceDirect

- Hidden liquidity: An analysis of order exposure strategies in ...