Did you know that the average person spends about 6 months of their life waiting for red lights to turn green? Just like those moments of impatience, waiting for the right conditions in trading can be crucial—especially when it comes to ETF liquidity. In this article, we dive into the essentials of ETF liquidity and its significance for day trading success. You’ll learn how to measure liquidity, the factors that influence it, and the impact of trading volume and bid-ask spreads. We also explore market conditions, the risks of illiquid ETFs, and strategies for finding highly liquid options. Lastly, we’ll compare ETF liquidity to stock liquidity and share insights on assessing historical liquidity and minimizing slippage. Let DayTradingBusiness guide you through the intricacies of trading liquid ETFs for optimal results.

What is ETF liquidity and why is it important for day trading?

ETF liquidity refers to how easily an exchange-traded fund can be bought or sold in the market without affecting its price. It’s crucial for day trading because higher liquidity means tighter bid-ask spreads and less price slippage, allowing traders to enter and exit positions quickly and at desired prices. Low liquidity can lead to larger price swings and difficulty in executing trades, increasing risk.

How can I measure the liquidity of an ETF?

To measure the liquidity of an ETF, check the average daily trading volume and the bid-ask spread. A high average volume indicates active trading, while a narrow bid-ask spread shows that you can enter and exit positions easily. Additionally, examine the assets under management (AUM); larger AUM typically correlates with better liquidity. Use tools like stock screeners or financial news sites to find this data quickly.

What factors affect ETF liquidity?

ETF liquidity is affected by several key factors:

1. Trading Volume: Higher trading volumes usually indicate better liquidity, making it easier to buy and sell without significant price changes.

2. Bid-Ask Spread: A narrower bid-ask spread suggests higher liquidity, as it reflects a smaller difference between what buyers are willing to pay and what sellers are asking.

3. Underlying Assets: The liquidity of the assets within the ETF impacts overall liquidity. ETFs holding liquid stocks tend to be more liquid.

4. Market Maker Activity: Active market makers help maintain liquidity by facilitating trades and providing quotes.

5. Fund Size: Larger ETFs generally have better liquidity due to more investor interest and trading activity.

6. Time of Day: Liquidity can vary throughout the trading day, often peaking during market open and close.

7. Market Conditions: Overall market volatility can affect liquidity; during high volatility, liquidity may decrease as traders become more cautious.

Understanding these factors can help you gauge an ETF’s liquidity for day trading effectively.

How does trading volume influence ETF liquidity?

Trading volume impacts ETF liquidity by determining how easily shares can be bought or sold without affecting the price. Higher trading volume typically indicates greater liquidity, allowing for quicker trades and smaller bid-ask spreads. Conversely, low trading volume can lead to slippage and difficulty entering or exiting positions. For day trading, choosing ETFs with high trading volume ensures efficient transactions and less price impact.

What role do bid-ask spreads play in ETF liquidity?

Bid-ask spreads are crucial for ETF liquidity because they indicate the cost of trading. A narrow spread means lower trading costs and higher liquidity, allowing day traders to enter and exit positions easily. Conversely, a wide spread can signal lower liquidity, making trades more expensive and slower. In essence, tighter bid-ask spreads enhance ETF liquidity, facilitating more efficient trading for day traders.

How do market conditions impact ETF liquidity?

Market conditions significantly impact ETF liquidity by influencing trading volume and bid-ask spreads. In volatile markets, liquidity often decreases as fewer participants are willing to trade, leading to wider spreads. Conversely, stable markets typically see higher trading volumes and tighter spreads, enhancing liquidity. Economic news, geopolitical events, or market trends can also drive sudden changes in liquidity. For day trading, understanding these dynamics helps in timing trades and managing risk effectively.

What are the risks of trading illiquid ETFs?

Trading illiquid ETFs poses several risks. First, you may face wider bid-ask spreads, leading to higher trading costs. Second, executing large orders can significantly impact the ETF's price, increasing slippage. Third, you might struggle to sell your position quickly, especially during market volatility, which can result in unexpected losses. Lastly, low trading volumes can lead to poor price discovery, making it harder to assess the ETF's true value.

How can I find highly liquid ETFs for day trading?

To find highly liquid ETFs for day trading, check the average daily trading volume and bid-ask spread. Look for ETFs with a high volume, typically over 1 million shares traded daily, and narrow bid-ask spreads, ideally under 0.1%. Use financial websites or tools like Yahoo Finance, Morningstar, or your brokerage platform to filter ETFs based on these criteria. Additionally, consider sector ETFs that track popular indices, as they usually have higher liquidity.

What are the best platforms for trading liquid ETFs?

The best platforms for trading liquid ETFs include:

1. TD Ameritrade: Offers a user-friendly interface and advanced trading tools.

2. Charles Schwab: Provides commission-free trades on ETFs and robust research resources.

3. Fidelity: Known for low fees and a wide selection of liquid ETFs.

4. E*TRADE: Features a strong trading platform with real-time data.

5. Interactive Brokers: Great for experienced traders, with low margin rates and a global range of ETFs.

Choose a platform that aligns with your trading style and needs.

How does ETF liquidity compare to stock liquidity?

ETF liquidity generally varies based on the fund's trading volume and the underlying assets. While many popular ETFs have high liquidity similar to large-cap stocks, others may have lower liquidity due to less trading activity. ETFs can experience wider bid-ask spreads than individual stocks, especially during market volatility. Day traders often prefer ETFs with high average daily trading volumes to ensure quick execution and minimal slippage. Overall, while ETFs can be liquid, stock liquidity can sometimes offer tighter spreads and faster transactions.

What are the advantages of trading liquid ETFs?

Trading liquid ETFs offers several advantages:

1. Tighter Spreads: Liquid ETFs usually have narrower bid-ask spreads, reducing trading costs.

2. Quick Execution: High liquidity allows for faster order execution, essential for day trading strategies.

3. Lower Price Impact: Large trades in liquid ETFs have minimal effect on the price, preserving your entry and exit points.

4. Flexibility: You can easily enter or exit positions without worrying about slippage.

5. More Information: Liquid ETFs often have better market data, making it easier to analyze trends and make informed decisions.

6. Diverse Options: They typically cover various sectors, providing opportunities for diversification within a single trade.

These factors make liquid ETFs a preferred choice for day traders.

How can I assess an ETF's historical liquidity?

To assess an ETF's historical liquidity for day trading, check its average daily trading volume over several months. Look at the bid-ask spread; narrower spreads indicate better liquidity. Analyze the historical price charts for volatility and trading activity spikes. Use tools like the ETF's trading volume on platforms like Yahoo Finance or Bloomberg. Review the number of shares outstanding and the asset size; larger ETFs generally offer better liquidity. Lastly, consider the ETF's trading patterns during different market conditions to gauge its responsiveness and stability.

How Does ETF Liquidity Impact Day Trading Success?

The best ETFs for day trading typically have high liquidity, tight bid-ask spreads, and significant volume. Some top choices include SPDR S&P 500 ETF (SPY), Invesco QQQ Trust (QQQ), and iShares Russell 2000 ETF (IWM). Look for ETFs that track major indices or sectors with active trading. Always check the ETF's average daily trading volume and market capitalization for optimal liquidity.

Learn more about: What Are the Best ETFs for Day Trading?

Learn about How Do Prop Firms Impact Day Trading Profitability?

What impact do large institutional trades have on ETF liquidity?

Large institutional trades can significantly impact ETF liquidity by causing price fluctuations and widening bid-ask spreads. When an institution buys or sells a large volume of shares, it can absorb available liquidity and create temporary imbalances in supply and demand. This can lead to increased volatility, making it harder for day traders to execute orders at desired prices. Additionally, heavy trading activity can attract more retail investors, potentially enhancing overall liquidity in the long run if it leads to increased trading volume.

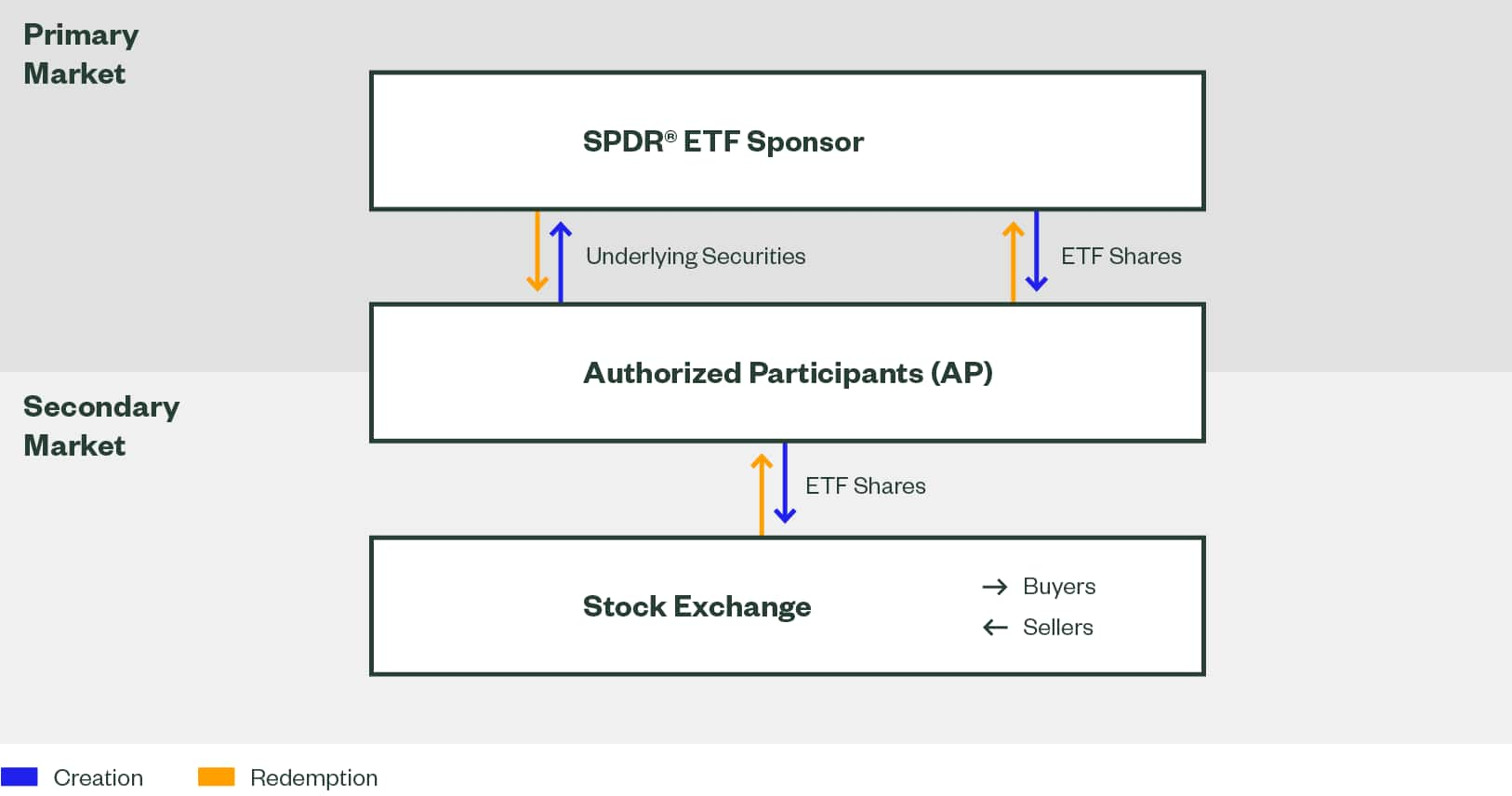

How do ETF creation and redemption processes affect liquidity?

ETF creation and redemption processes enhance liquidity by allowing authorized participants to create or redeem shares based on demand. When an ETF is in high demand, participants can create new shares, increasing supply and lowering spreads. Conversely, if an ETF is underperforming, participants can redeem shares, reducing supply and maintaining price stability. This mechanism ensures that ETF prices closely track their underlying assets, crucial for day traders who rely on tight spreads and quick execution. Overall, these processes help keep ETFs liquid, making them effective trading vehicles.

What strategies can I use to trade ETFs with varying liquidity?

To trade ETFs with varying liquidity effectively, consider these strategies:

1. Choose Liquid ETFs: Focus on ETFs with high average daily trading volumes to ensure tighter spreads and easier entry/exit.

2. Limit Orders: Use limit orders instead of market orders to control the price you pay or receive, especially in less liquid ETFs.

3. Monitor Spreads: Pay attention to bid-ask spreads; wider spreads can indicate lower liquidity, increasing trading costs.

4. Time Your Trades: Trade during peak market hours when liquidity is typically higher, reducing the impact of slippage.

5. Diversify: Trade a mix of liquid and less liquid ETFs to balance potential gains with risk management.

6. Use Technical Analysis: Identify key support and resistance levels to time your trades better, especially in lower liquidity environments.

7. Stay Informed: Keep up with news and events that may impact ETF liquidity, adjusting your strategy accordingly.

8. Practice Risk Management: Set stop-loss orders to protect against unexpected volatility, especially in less liquid ETFs.

How can I avoid slippage when trading ETFs?

To avoid slippage when trading ETFs, follow these strategies:

1. Choose Liquid ETFs: Focus on ETFs with high average daily trading volumes and tight bid-ask spreads.

2. Use Limit Orders: Set limit orders instead of market orders to control the price you pay or receive.

3. Trade During Peak Hours: Execute trades during market hours when liquidity is highest, typically at the market open and close.

4. Monitor Market Conditions: Be aware of news or events that could impact liquidity before placing trades.

5. Avoid Thinly Traded ETFs: Stay clear of ETFs with low trading volumes as they can have larger spreads and more slippage.

Implementing these practices can help you minimize slippage and improve your trading outcomes.

Conclusion about Understanding ETF Liquidity for Day Trading

In conclusion, understanding ETF liquidity is crucial for successful day trading. A liquid ETF ensures tighter bid-ask spreads and facilitates quicker trades, ultimately enhancing profitability. Factors like trading volume, market conditions, and institutional activity play significant roles in determining liquidity. To maximize your trading potential, focus on identifying highly liquid ETFs and utilizing reliable trading platforms. For comprehensive insights and support in navigating these complexities, DayTradingBusiness is here to guide you every step of the way.

Learn about Understanding Dark Pools and Their Effect on Day Trading Liquidity

Sources:

- Unraveling the Dynamics of SPY Trading Volumes: A ...

- Market Liquidity after the Financial Crisis

- The Fed - Crypto ETPs: An Examination of Liquidity and NAV Premium

- Fund Investor Types and Bond Market Volatility

- Exchange Traded Funds (ETFs)

- Liquidity risk and exchange-traded fund returns, variances, and ...