Did you know that even professional traders sometimes feel like they’re playing a game of poker with their money? Just like bluffing your way through a hand, day trading requires strategy, skill, and a bit of luck. In this article, we delve into the essential practice of backtesting technical analysis strategies in day trading. Learn what backtesting is and why it’s crucial for refining your trading approaches. Discover how to effectively backtest, interpret results, and choose the right tools and strategies. We’ll also cover best practices, common pitfalls to avoid, and how to adjust your strategies based on feedback. With insights from DayTradingBusiness, you'll be equipped to enhance your trading performance and make informed decisions based on historical data.

What is backtesting in day trading?

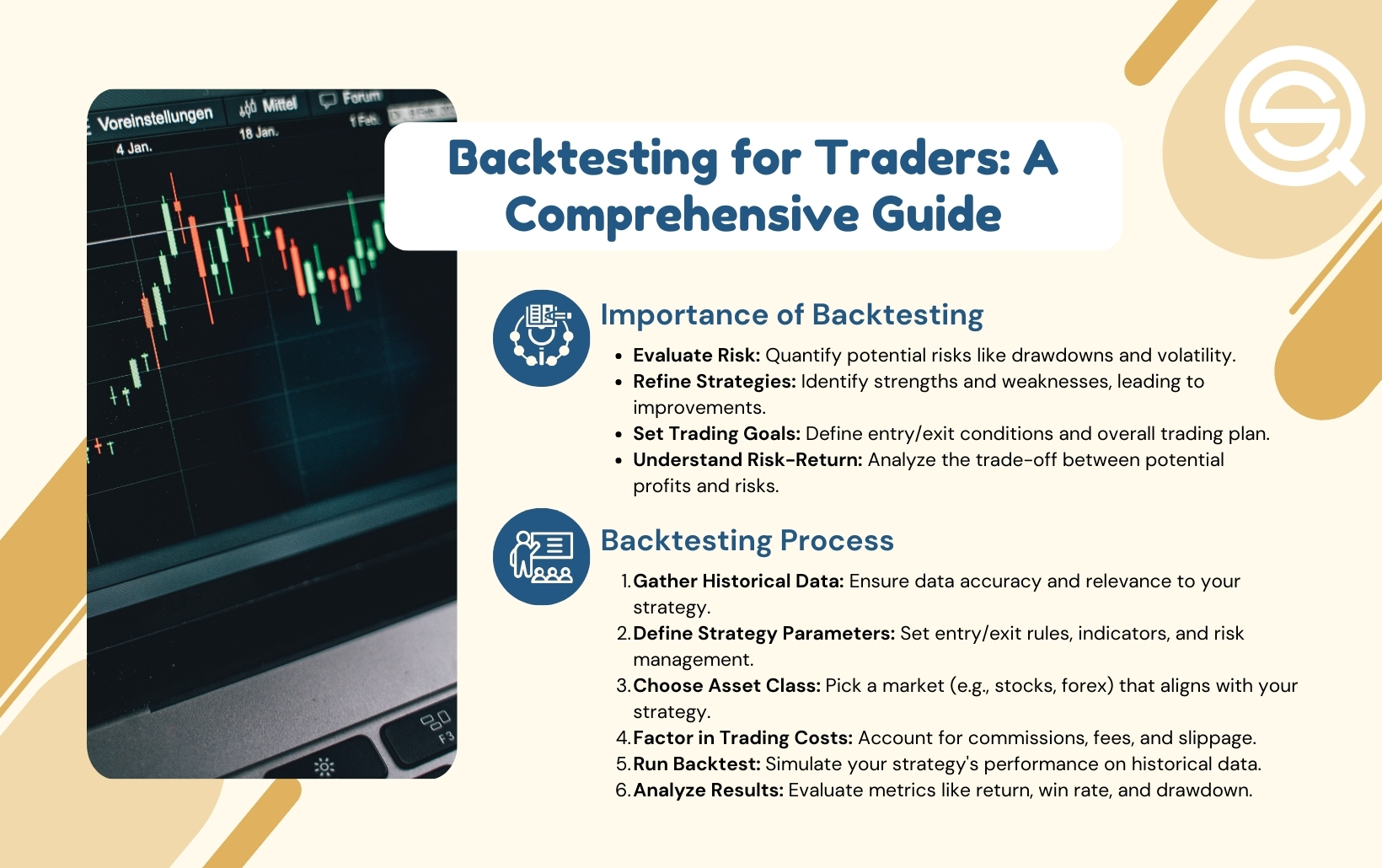

Backtesting in day trading is the process of testing a trading strategy using historical market data to evaluate its effectiveness. Traders apply technical analysis strategies to past price movements to see how their trades would have performed. This helps identify the strategy’s strengths and weaknesses, allowing traders to refine their approach before risking real capital.

How do I backtest technical analysis strategies?

To backtest technical analysis strategies in day trading, follow these steps:

1. Choose a Strategy: Define the technical indicators and rules you want to test, like moving averages or RSI.

2. Select a Platform: Use trading software or platforms like TradingView, MetaTrader, or custom scripts in Python.

3. Gather Historical Data: Obtain historical price data for the assets you're trading, ensuring it includes minute or hourly intervals for day trading.

4. Set Up the Backtest: Input your strategy parameters into the platform. Define entry and exit points based on your chosen indicators.

5. Run the Backtest: Execute the backtest over a specified historical period. Analyze how your strategy would have performed.

6. Analyze Results: Review key metrics such as win rate, profit factor, maximum drawdown, and overall profitability.

7. Refine the Strategy: Adjust parameters based on your findings and retest to improve performance.

8. Validate with Forward Testing: Once satisfied, test the strategy in a simulated environment before deploying it in live trading.

This process helps you evaluate the effectiveness of your technical analysis strategies in day trading.

Why is backtesting important for day trading?

Backtesting is crucial for day trading because it allows traders to evaluate the effectiveness of technical analysis strategies using historical data. By simulating trades based on past market conditions, traders can identify potential profitability, understand risk-reward ratios, and refine their strategies before risking real capital. It helps in recognizing patterns and improving decision-making in live trading environments. Without backtesting, traders rely on guesswork, increasing the likelihood of losses.

What tools are available for backtesting strategies?

Popular tools for backtesting technical analysis strategies in day trading include:

1. TradingView – Offers extensive charting tools and a built-in Pine Script for custom backtesting.

2. MetaTrader 4/5 – Provides historical data and strategy testing features for forex and stocks.

3. Amibroker – A powerful platform with advanced backtesting capabilities and an easy-to-use interface.

4. NinjaTrader – Supports strategy development and backtesting with a focus on futures and forex.

5. QuantConnect – A cloud-based platform that allows coding in C# or Python for sophisticated backtesting.

6. Backtrader – A Python library for backtesting and trading strategies with flexibility for custom indicators.

Choose a tool based on your specific trading needs and programming skills.

How can I interpret backtesting results?

To interpret backtesting results in day trading, focus on key metrics:

1. Win Rate: Check the percentage of profitable trades. A higher win rate indicates a more reliable strategy.

2. Risk-Reward Ratio: Analyze the average profit per trade against average loss. A ratio above 1:1 is ideal.

3. Drawdown: Look at the maximum drawdown to understand potential losses during downturns. Smaller drawdowns suggest less risk.

4. Profit Factor: This is the ratio of gross profits to gross losses. A factor above 1 indicates a profitable strategy.

5. Consistency: Evaluate results across different market conditions. Consistent performance strengthens confidence in the strategy.

Use these metrics to assess the viability of your technical analysis strategy and make informed adjustments.

What are the best practices for backtesting in day trading?

1. Define Clear Objectives: Set specific goals for your backtest, such as target returns and acceptable risk levels.

2. Use Quality Data: Ensure you have accurate, high-resolution historical data to reflect real market conditions.

3. Select Relevant Strategies: Focus on technical analysis strategies that align with your trading style and market conditions.

4. Implement Robust Parameters: Test various parameters for indicators to find optimal settings without overfitting.

5. Simulate Real Conditions: Incorporate slippage, commissions, and realistic execution scenarios to emulate live trading.

6. Analyze Performance Metrics: Evaluate key metrics like win rate, average profit/loss, and drawdown to gauge strategy effectiveness.

7. Optimize and Iterate: Continuously refine your strategy based on backtest results, but avoid curve fitting.

8. Validate with Walk-Forward Testing: Use walk-forward analysis to ensure your strategy performs well on unseen data.

9. Keep a Trading Journal: Document your findings and decisions to improve future strategies and maintain accountability.

10. Stay Disciplined: Stick to your strategy during live trading, relying on your backtest as a guide.

How do I choose a trading strategy to backtest?

To choose a trading strategy to backtest, start by defining your trading goals and risk tolerance. Research various technical analysis strategies, like moving averages, RSI, or candlestick patterns, that align with your objectives. Select a strategy based on historical performance and market conditions. Ensure it has clear entry and exit signals. Then, gather historical data relevant to your chosen strategy. Use backtesting software to simulate trades and analyze results, focusing on metrics like win rate and drawdown. Adjust your strategy based on findings, and repeat the process for refinement.

What timeframes should I use for backtesting?

Use multiple timeframes for backtesting day trading strategies:

1. 1-Minute and 5-Minute Charts: Ideal for assessing short-term strategies and identifying entry and exit points.

2. 15-Minute and 30-Minute Charts: Useful for spotting intraday trends and confirming signals from shorter timeframes.

3. Hourly Charts: Good for understanding broader market trends throughout the day and for filtering out noise from lower timeframes.

Combine these timeframes to validate your strategy across different market conditions. Always ensure your backtesting data is reliable and covers various market scenarios.

Can I automate my backtesting process?

Yes, you can automate your backtesting process for technical analysis strategies in day trading. Use software like TradingView, MetaTrader, or Python libraries such as Backtrader or Zipline. These tools allow you to input your strategy parameters, run simulations against historical data, and analyze results quickly. Automating backtesting saves time and enhances accuracy, helping you refine your strategies effectively.

What common mistakes should I avoid in backtesting?

1. Overfitting: Avoid tailoring your strategy too closely to historical data, as it can lead to poor future performance.

2. Ignoring Transaction Costs: Always factor in commissions and slippage, as they can significantly impact profitability.

3. Using Incomplete Data: Ensure your data is comprehensive and includes all relevant market conditions to avoid skewed results.

4. Neglecting Risk Management: Failing to implement stop-loss orders or position sizing can lead to substantial losses.

5. Inadequate Timeframe Testing: Test your strategy across various timeframes to ensure its robustness.

6. Confirmation Bias: Don't cherry-pick data that supports your strategy; objectively analyze all results.

7. Not Updating Your Strategy: Markets change, so regularly revisit and adjust your strategy based on current data.

8. Lack of Realism: Simulate realistic trading conditions, including emotional factors, to better prepare for live trading.

How do I validate my backtesting results?

To validate your backtesting results in day trading, follow these steps:

1. Use Multiple Data Sources: Cross-check results with different historical data providers to ensure accuracy.

2. Out-of-Sample Testing: After optimizing your strategy on one dataset, test it on a separate dataset to confirm its effectiveness.

3. Walk-Forward Analysis: Continuously test your strategy on new data while adjusting parameters periodically to reflect changing market conditions.

4. Check for Overfitting: Ensure your strategy isn’t tailored too closely to past data by using simpler models or reducing parameters.

5. Analyze Performance Metrics: Review metrics like Sharpe ratio, maximum drawdown, and win/loss ratio to gauge real-world viability.

6. Consider Market Conditions: Test your strategy across different market environments to ensure it performs well under various conditions.

7. Use Simulation: Implement a paper trading phase to see how your strategy performs in live conditions without risking real capital.

These steps will help ensure your backtesting results are reliable and applicable to actual trading.

What data do I need for effective backtesting?

For effective backtesting of technical analysis strategies in day trading, you need historical price data, including open, high, low, close (OHLC) prices, and volume. Additionally, having tick data or minute-level data enhances accuracy. Ensure you include data for multiple timeframes to assess strategy performance. Incorporate relevant indicators and signals used in your strategy. Lastly, consider transaction costs and slippage to simulate real trading conditions.

How does slippage affect backtesting outcomes?

Slippage negatively impacts backtesting outcomes by creating a gap between expected and actual trade execution prices. When backtesting technical analysis strategies in day trading, assuming perfect execution can lead to overly optimistic performance results. If slippage is not accounted for, profits may appear larger than they are, and losses may be underestimated. This discrepancy can skew metrics like win rates and return on investment, leading to a false sense of strategy effectiveness. Including realistic slippage in your backtest ensures a more accurate representation of potential real-world performance.

How can I adjust my strategy based on backtesting feedback?

To adjust your strategy based on backtesting feedback, first analyze the results to identify weaknesses. Look for patterns where your strategy underperformed. Tweak parameters like entry and exit points, stop-loss levels, or indicators based on these insights. Test each change individually to gauge its impact on performance. Additionally, refine your risk management approach to better align with your trading goals. Continuously re-evaluate and iterate on your strategy using fresh data to ensure it remains effective in current market conditions.

What are the limitations of backtesting in day trading?

Backtesting in day trading has several limitations:

1. Historical Data Quality: Poor or inaccurate data can lead to misleading results.

2. Market Changes: Strategies that worked in the past may not be effective in future market conditions due to changes in volatility, liquidity, or regulations.

3. Overfitting: Optimizing strategies too closely to historical data can create unrealistic expectations for future performance.

4. Execution Issues: Backtesting doesn't account for slippage, commissions, or real-time execution problems, which can affect profitability.

5. Emotional Factors: Real trading involves emotions that backtesting can't replicate, potentially leading to different decision-making under pressure.

6. Time Constraints: Day trading strategies often rely on quick decisions that backtesting may not accurately simulate due to the speed of information flow.

How does historical performance impact future trading decisions?

Historical performance helps traders evaluate the effectiveness of technical analysis strategies through backtesting. By analyzing past price movements and indicators, traders can identify patterns and trends that may repeat in the future. This data-driven approach allows for informed decision-making, risk management, and strategy optimization. Ultimately, understanding historical performance aids in building confidence and refining trading tactics for day trading.

Learn about How Do Fear and Greed Impact Day Trading Decisions?

Conclusion about Backtesting Technical Analysis Strategies in Day Trading

In conclusion, backtesting is a vital component of developing effective technical analysis strategies in day trading. By utilizing the right tools and adhering to best practices, traders can gather insights that enhance their decision-making. Understanding potential pitfalls, adjusting strategies based on feedback, and acknowledging the limitations of backtesting are essential for success. For those looking to deepen their trading knowledge and refine their strategies, DayTradingBusiness offers valuable insights and resources to support your journey.

Learn about How to Combine Technical Analysis with Day Trading Strategies

Sources:

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- A Profitable Day Trading Strategy For The US Equity Market

- Implementation of Algorithm on Intraday Trading Bot for Trading ...

- Synergizing quantitative finance models and market microstructure ...

- Lessons from the evolution of foreign exchange trading strategies ...