Did you know that a tweet can sometimes move the market more than an earnings report? In the world of day trading, understanding social media sentiment is key to making informed decisions. This article delves into what social media sentiment is, how it impacts stock prices, and the best platforms for tracking it. We’ll explore effective tools for measuring sentiment, how traders interpret the data, and the role of sentiment analysis in crafting trading strategies. Additionally, we’ll discuss the risks involved, the potential for market manipulation, and best practices for leveraging sentiment to predict trends. By the end, you’ll also learn how to combine social media sentiment with technical analysis while avoiding common pitfalls. DayTradingBusiness is here to guide you through this dynamic landscape, ensuring you make the most of social media in your trading journey.

What is social media sentiment in day trading?

Social media sentiment in day trading refers to the overall mood or attitude expressed by traders and investors on platforms like Twitter, Reddit, and StockTwits regarding specific stocks or the market. Traders analyze this sentiment—positive, negative, or neutral—to gauge potential price movements. For example, a surge in positive tweets about a stock could indicate bullish sentiment, prompting traders to buy, while negative sentiment might lead to selling. Monitoring social media sentiment helps day traders make informed decisions based on real-time market reactions and trends.

How does social media sentiment affect stock prices?

Social media sentiment significantly impacts stock prices due to real-time public perception. Positive sentiment can drive demand, leading to price increases, while negative sentiment can trigger sell-offs, causing declines. Traders analyze trends, hashtags, and mentions to gauge sentiment, often making quick trades based on this data. For day trading, being aware of social media buzz allows traders to capitalize on rapid price movements.

Which platforms are best for tracking social media sentiment?

The best platforms for tracking social media sentiment in day trading are:

1. Twitter: Use tools like TweetDeck or Hootsuite for real-time sentiment analysis.

2. StockTwits: Focuses on market sentiment with user-generated content specific to stocks.

3. Sentiment Analysis Tools: Platforms like Brandwatch or Crimson Hexagon analyze social media conversations.

4. Reddit: Subreddits like r/stocks can provide insights; use tools like Swaggy Stocks for sentiment tracking.

5. Google Trends: Monitor search trends related to stocks to gauge public interest.

These platforms help you gauge market sentiment quickly and effectively.

How can I analyze social media sentiment for day trading?

To analyze social media sentiment for day trading, start by monitoring platforms like Twitter, Reddit, and StockTwits. Use sentiment analysis tools or APIs to gauge the mood around specific stocks. Look for keywords and hashtags related to your target stocks to assess positive or negative sentiment. Track volume and frequency of mentions to identify trends. Combine this data with price movements to make informed trading decisions. Regularly review sentiment shifts for real-time insights that can influence your trades.

What tools help measure social media sentiment effectively?

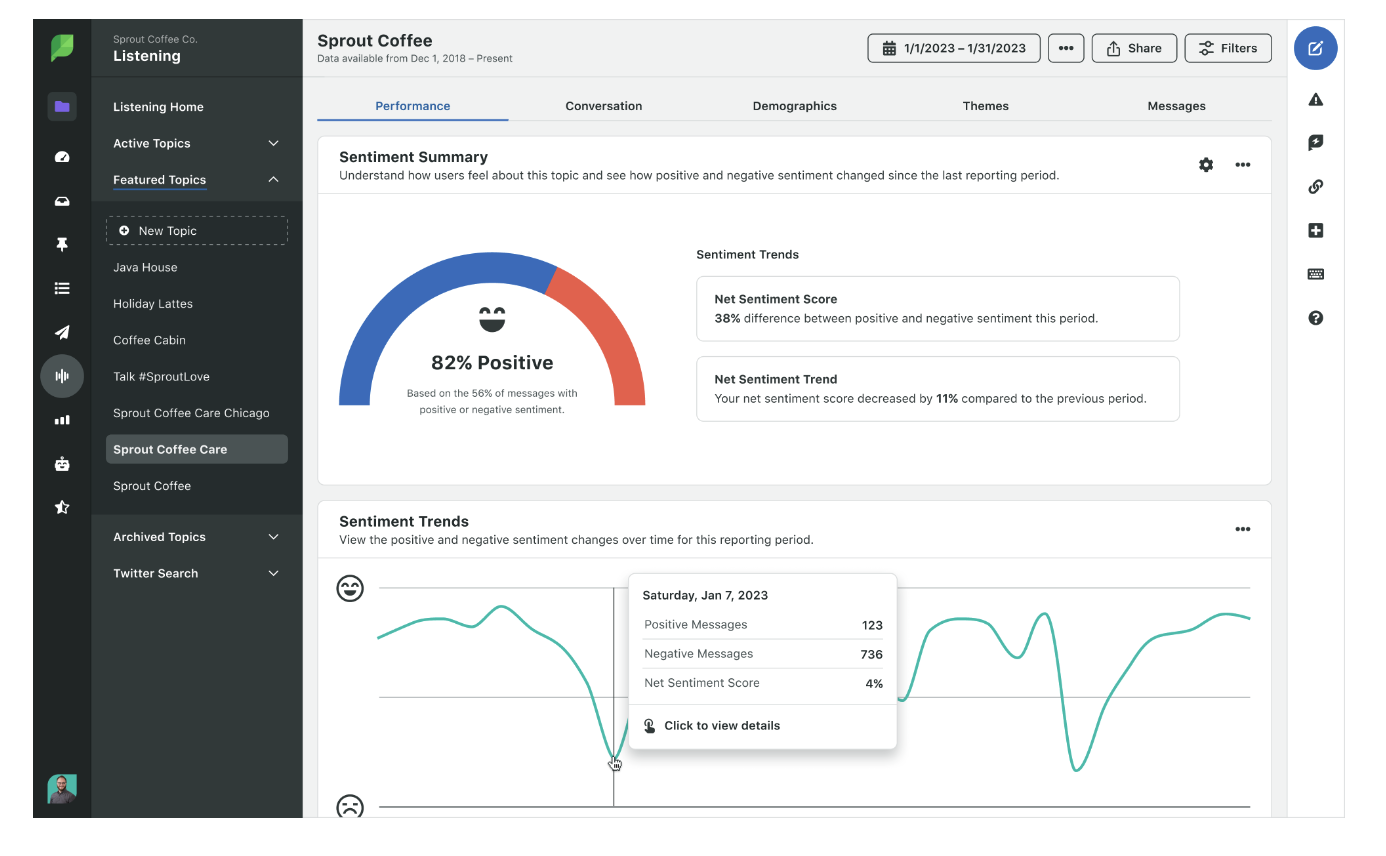

Tools that effectively measure social media sentiment for day trading include:

1. TweetDeck – Monitor Twitter feeds and hashtags in real-time.

2. Hootsuite Insights – Analyze sentiment across multiple platforms.

3. Brandwatch – Offers deep insights into online conversations.

4. Sprout Social – Provides sentiment analysis and engagement metrics.

5. BuzzSumo – Tracks social media content and engagement trends.

6. Sentiment Analysis APIs – Such as Google Cloud Natural Language or IBM Watson for custom analysis.

Using these tools can help traders gauge market mood and make informed decisions quickly.

How do traders interpret social media sentiment data?

Traders interpret social media sentiment data by analyzing posts, comments, and trends to gauge market mood. They look for keywords, hashtags, and overall sentiment (positive, negative, neutral) related to specific stocks or markets. Tools like sentiment analysis algorithms help quantify this data, revealing shifts that could indicate buying or selling opportunities. Traders often cross-reference sentiment data with price movements to confirm trends, using spikes in positive sentiment as signals to buy and negative sentiment to sell.

What role does sentiment analysis play in trading strategies?

Sentiment analysis helps traders gauge market mood by analyzing social media posts, news articles, and forums. It provides insights into public perception, allowing traders to identify bullish or bearish trends. For day trading, positive sentiment can signal buying opportunities, while negative sentiment may indicate when to sell or short. By integrating sentiment analysis with technical indicators, traders can make more informed decisions, enhancing their strategy's effectiveness and potentially increasing profits.

How can I use social media sentiment to predict market trends?

To use social media sentiment for predicting market trends in day trading, start by monitoring platforms like Twitter and Reddit for discussions on specific stocks or sectors. Use sentiment analysis tools to gauge positive or negative feelings about these assets. Identify spikes in sentiment that correlate with price movements, paying attention to volume and engagement levels. Combine this data with technical indicators to validate trends. Regularly analyze patterns over time to improve your predictions and adjust your trading strategies accordingly.

What are the risks of relying on social media sentiment in trading?

Relying on social media sentiment in trading carries several risks. First, sentiment can be misleading; trends may not reflect actual market conditions but rather hype or panic. Second, social media can amplify misinformation, leading to poor investment decisions. Third, sentiment shifts rapidly, making it hard to predict long-term outcomes. Additionally, overreacting to social trends can cause emotional trading, which often results in losses. Finally, reliance on sentiment neglects fundamental analysis and technical indicators, which are crucial for informed trading.

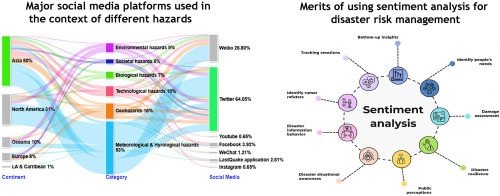

How does sentiment differ between various social media platforms?

Sentiment on social media varies by platform due to user demographics and engagement styles. For instance, Twitter often reflects real-time reactions and news, leading to fast, volatile sentiment swings. Facebook tends to showcase more personal opinions and community discussions, resulting in a mix of positive and negative sentiments around topics. Instagram focuses on visual content, usually displaying more positive sentiment, particularly in lifestyle and brand-related posts. Reddit features niche communities where sentiment can be more polarized, often driven by specific interests. Understanding these nuances helps day traders gauge market sentiment more accurately across platforms.

Can social media sentiment lead to market manipulation?

Yes, social media sentiment can lead to market manipulation. Traders often analyze social media posts to gauge public perception and sentiment around stocks. Positive or negative trends can influence trading behavior, prompting rapid buying or selling based on hype or fear. This can artificially inflate or deflate stock prices, creating opportunities for manipulative practices like pump-and-dump schemes.

What are the best practices for leveraging social media sentiment?

1. Monitor Trends: Use tools like Twitter and Reddit sentiment analysis to track real-time market sentiments related to stocks.

2. Analyze Sentiment Scores: Focus on sentiment scores from platforms like StockTwits to gauge positive or negative trends.

3. Correlate with Price Movements: Look for correlations between sentiment spikes and stock price changes to identify potential trading opportunities.

4. Engage with Influencers: Follow and interact with influential traders and analysts on social media for insights and sentiment shifts.

5. Diversify Sources: Combine insights from various platforms to get a comprehensive view of sentiment, avoiding reliance on a single source.

6. Act Quickly: Timing is crucial; act on sentiment trends before they fully impact stock prices.

7. Stay Updated: Continuously adjust your strategies based on evolving sentiments and market conditions.

How often should I monitor social media sentiment for trading?

Monitor social media sentiment for trading at least daily, ideally multiple times throughout the day. Track trends, spikes in sentiment, and shifts in public opinion that may impact stock prices. Use tools to automate sentiment analysis for efficiency. This approach helps you stay ahead of market movements and make informed trading decisions.

What indicators signal a change in social media sentiment?

Indicators that signal a change in social media sentiment include spikes in mentions or hashtags related to a stock, shifts from positive to negative language in posts, increased engagement (likes, shares, comments), and the emergence of influential voices discussing a stock. Monitoring sentiment analysis tools can help identify trends, while sudden changes in user sentiment often precede significant price movements.

How can I combine social media sentiment with technical analysis?

To combine social media sentiment with technical analysis for day trading, start by using sentiment analysis tools to gauge market emotions about specific stocks. Monitor platforms like Twitter, Reddit, and stock forums for real-time discussions and trends.

Next, overlay this sentiment data with technical indicators like moving averages or RSI on your trading charts. Look for correlations between positive or negative sentiment spikes and price movements. For instance, if social sentiment turns overwhelmingly positive and your technical indicators signal a bullish trend, it may be a good entry point.

Also, consider volume patterns; increased trading volume alongside positive sentiment can confirm a strong move. Finally, keep an eye on key support and resistance levels to refine your trades based on sentiment-driven shifts.

What are common mistakes in using social media sentiment for trading?

Common mistakes in using social media sentiment for trading include:

1. Overreacting to short-term trends without context, leading to impulsive decisions.

2. Relying solely on sentiment analysis without considering fundamental data.

3. Ignoring the source credibility of the sentiment, which can skew results.

4. Misinterpreting sarcasm or irony in posts, leading to incorrect sentiment assessments.

5. Failing to account for market manipulation, where coordinated efforts can create false sentiment.

6. Using outdated tools that don’t capture real-time sentiment accurately.

7. Neglecting to diversify strategies, solely focusing on sentiment can overlook other market factors.

8. Not setting clear entry and exit points based on sentiment data, which can lead to emotional trading.

Conclusion about Understanding Social Media Sentiment for Day Trading

Incorporating social media sentiment into day trading strategies can provide valuable insights into market trends and trader behavior. By utilizing the right tools and platforms, you can effectively analyze sentiment data to inform your trading decisions. However, it's crucial to remain vigilant about the risks and potential for market manipulation. Regularly monitoring sentiment and combining it with technical analysis can enhance your trading approach, but be wary of common pitfalls. For comprehensive guidance on integrating these strategies, explore the resources available at DayTradingBusiness.

Learn about Impact of Social Media on Crypto Day Trading Decisions