Did you know that the stock market can sometimes react to news like a toddler reacts to a cookie jar—excited one moment and crying the next? Understanding market sentiment is crucial for day traders, as it directly influences trading strategies and decisions. This article dives into the essence of market sentiment in day trading, exploring how it impacts strategies, the importance of gauging sentiment effectively, and the tools available for analysis. We’ll also discuss the influence of news events, social media, and economic reports on market sentiment, along with common pitfalls traders might encounter. With insights from DayTradingBusiness, you'll learn how to leverage sentiment analysis to enhance your trading returns while managing risk effectively.

What is market sentiment in day trading?

Market sentiment in day trading refers to the overall attitude and emotional tone of traders toward a particular stock or market. It influences buying and selling decisions, often driven by news, earnings reports, or economic indicators. Positive sentiment can lead to increased buying, while negative sentiment may trigger selling. Understanding market sentiment helps day traders anticipate price movements and adjust their strategies accordingly.

How does market sentiment affect day trading strategies?

Market sentiment significantly influences day trading strategies by shaping traders' perceptions of price movements. Positive sentiment can lead to increased buying pressure, prompting strategies that capitalize on upward trends. Conversely, negative sentiment may trigger selling strategies to profit from downturns. Day traders often use sentiment analysis through news, social media, and market indicators to gauge the mood and adjust their tactics accordingly. Understanding sentiment helps traders anticipate potential volatility and make informed entry and exit decisions.

Why is understanding market sentiment important for day traders?

Understanding market sentiment is crucial for day traders because it influences price movements and trading opportunities. Positive sentiment can drive prices up, while negative sentiment can lead to declines. By gauging sentiment through news, social media, and market indicators, traders can make informed decisions, anticipate trends, and manage risks effectively. This awareness helps traders enter and exit positions at optimal times, maximizing profits and minimizing losses.

How can traders gauge market sentiment effectively?

Traders can gauge market sentiment effectively by analyzing several key indicators. First, monitor social media platforms and financial news for trending topics and emotions. Second, use sentiment analysis tools that aggregate data from various sources to provide a clear picture of market mood. Third, observe the volume of trades and price movements—rising prices on high volume often indicate bullish sentiment, while falling prices suggest bearishness. Fourth, look at the Commitment of Traders (COT) report for insights into how different market participants are positioned. Lastly, keep an eye on technical indicators like the Relative Strength Index (RSI) to identify overbought or oversold conditions, reflecting trader sentiment.

What tools help analyze market sentiment in day trading?

Key tools for analyzing market sentiment in day trading include:

1. Social Media Platforms: Twitter and Reddit provide real-time discussions and sentiment analysis from traders.

2. Sentiment Analysis Tools: Tools like MarketPsych and SentimentTrader analyze news and social media data for bullish or bearish trends.

3. News Aggregators: Services like Benzinga and Yahoo Finance offer breaking news that can influence market sentiment.

4. Technical Indicators: Indicators like the Relative Strength Index (RSI) and Moving Averages can help gauge market sentiment based on price movements.

5. Trading Platforms: Platforms like Thinkorswim and TradeStation offer sentiment indicators and trader positioning data.

These tools help traders gauge the emotional state of the market and make informed decisions.

How do news events influence market sentiment?

News events can significantly influence market sentiment by shaping traders' perceptions of economic conditions and future trends. Positive news, like strong earnings reports or favorable economic data, can boost optimism and lead to buying pressure. Conversely, negative news, such as geopolitical tensions or poor economic indicators, can create fear and prompt selling. Day traders often react quickly to these events, adjusting their strategies based on the prevailing sentiment, which can lead to increased volatility and rapid price movements in the market.

What indicators signal changes in market sentiment?

Indicators that signal changes in market sentiment include:

1. Price Action: Sudden price movements or reversals often indicate shifts in trader sentiment.

2. Volume: Increased trading volume can signal stronger conviction behind price movements, reflecting changing sentiment.

3. News Events: Major news releases or economic reports can swiftly alter market sentiment.

4. Technical Indicators: Tools like the Relative Strength Index (RSI) or Moving Averages can show overbought or oversold conditions, hinting at sentiment shifts.

5. Market Breadth: The number of advancing versus declining stocks can provide insight into overall market sentiment.

6. Social Media Trends: Sentiment analysis from platforms like Twitter can reveal trader emotions and expectations.

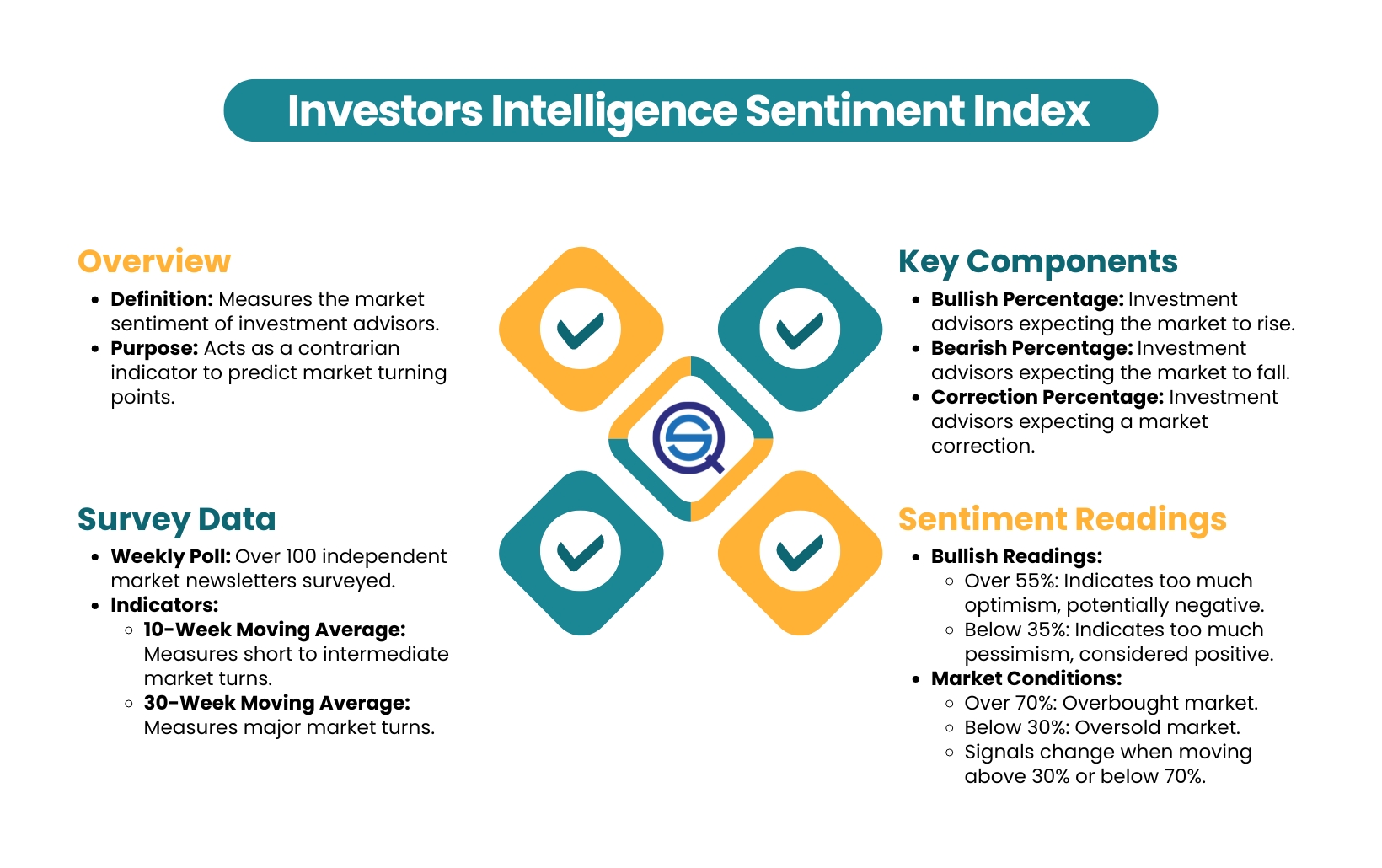

7. Sentiment Surveys: Reports from sources like the AAII Sentiment Survey offer insights into investor sentiment.

Monitoring these indicators helps day traders gauge market sentiment changes effectively.

How can social media impact market sentiment for day traders?

Social media can significantly impact market sentiment for day traders by influencing perceptions and driving rapid price movements. Posts from influential figures or trending topics can create hype, leading to increased buying or selling activity. For example, a viral tweet about a stock can spark interest, causing traders to jump in, which often results in price spikes. Conversely, negative news can trigger panic selling. Day traders must monitor social platforms to gauge sentiment shifts and react quickly to capitalize on these trends.

What role do economic reports play in shaping market sentiment?

Economic reports significantly influence market sentiment by providing data that traders use to gauge the health of the economy. Positive reports, like strong employment figures, can boost confidence, leading to bullish trends. Conversely, negative reports, such as rising inflation, can create fear, prompting bearish movements. Traders react to these reports quickly, adjusting their strategies based on perceived opportunities or risks. Thus, economic reports are crucial in shaping day trading decisions and overall market dynamics.

How does market sentiment differ between bullish and bearish trends?

Market sentiment in bullish trends is generally optimistic, with traders feeling confident about rising prices and increased buying activity. In contrast, bearish trends evoke pessimism, leading to a decline in prices and heightened selling pressure. Bullish sentiment encourages traders to buy, anticipating further gains, while bearish sentiment prompts selling or short-selling, expecting further losses. This emotional response significantly impacts trading strategies and decision-making in day trading.

What psychological factors drive market sentiment in day trading?

Psychological factors driving market sentiment in day trading include fear, greed, and herd behavior. Fear of missing out (FOMO) can lead traders to jump into positions quickly, while fear of loss may prompt them to sell prematurely. Greed can push traders to hold onto winning positions longer than they should, hoping for even greater profits. Herd behavior often causes traders to follow trends, amplifying market moves based on collective sentiment rather than fundamentals. Additionally, emotional responses to news and social media can rapidly shift sentiment, influencing decision-making in real-time.

How can day traders use sentiment analysis to improve returns?

Day traders can improve returns by using sentiment analysis to gauge market emotions and trends. They can monitor social media platforms, news outlets, and financial forums for real-time sentiment shifts. By identifying bullish or bearish sentiments, traders can make informed decisions on entry and exit points. For example, if sentiment turns positive on a stock following good earnings news, a trader might buy in before the price rises. Additionally, tracking sentiment indicators, like the Fear & Greed Index, can help in timing trades. Ultimately, combining sentiment analysis with technical indicators enhances decision-making in day trading.

Learn about How to Use Sentiment Data to Improve Day Trading Performance

What are common mistakes traders make regarding market sentiment?

Common mistakes traders make regarding market sentiment include overreacting to news, misinterpreting emotional reactions, and ignoring data trends. Many fail to recognize that sentiment can shift rapidly, leading to impulsive trades. Others might follow the crowd without critical analysis, assuming popular sentiment always indicates future movements. Additionally, traders often neglect to consider the broader market context, focusing too narrowly on short-term sentiment shifts. This can result in missed opportunities or unnecessary losses. Understanding that sentiment is just one part of a larger analysis is crucial for effective day trading.

How can traders manage risk based on market sentiment?

Traders can manage risk based on market sentiment by using the following strategies:

1. Sentiment Analysis: Monitor news, social media, and forums to gauge trader sentiment. High bullish or bearish sentiment can indicate potential price movements.

2. Position Sizing: Adjust the size of trades based on sentiment strength. In a strongly bullish market, consider larger positions; in bearish sentiment, reduce exposure.

3. Stop-Loss Orders: Set stop-loss orders based on sentiment shifts. If sentiment turns against a position, a stop-loss can minimize losses.

4. Contrarian Strategies: Consider taking the opposite position when sentiment is overly positive or negative, as extreme sentiment often precedes reversals.

5. Diversification: Spread investments across different assets to mitigate risk when sentiment is volatile in one area.

6. Technical Indicators: Use indicators like the Fear and Greed Index to assess market sentiment and adjust trading strategies accordingly.

By integrating these strategies, traders can effectively manage risk in alignment with market sentiment.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

How does sentiment analysis complement technical analysis in trading?

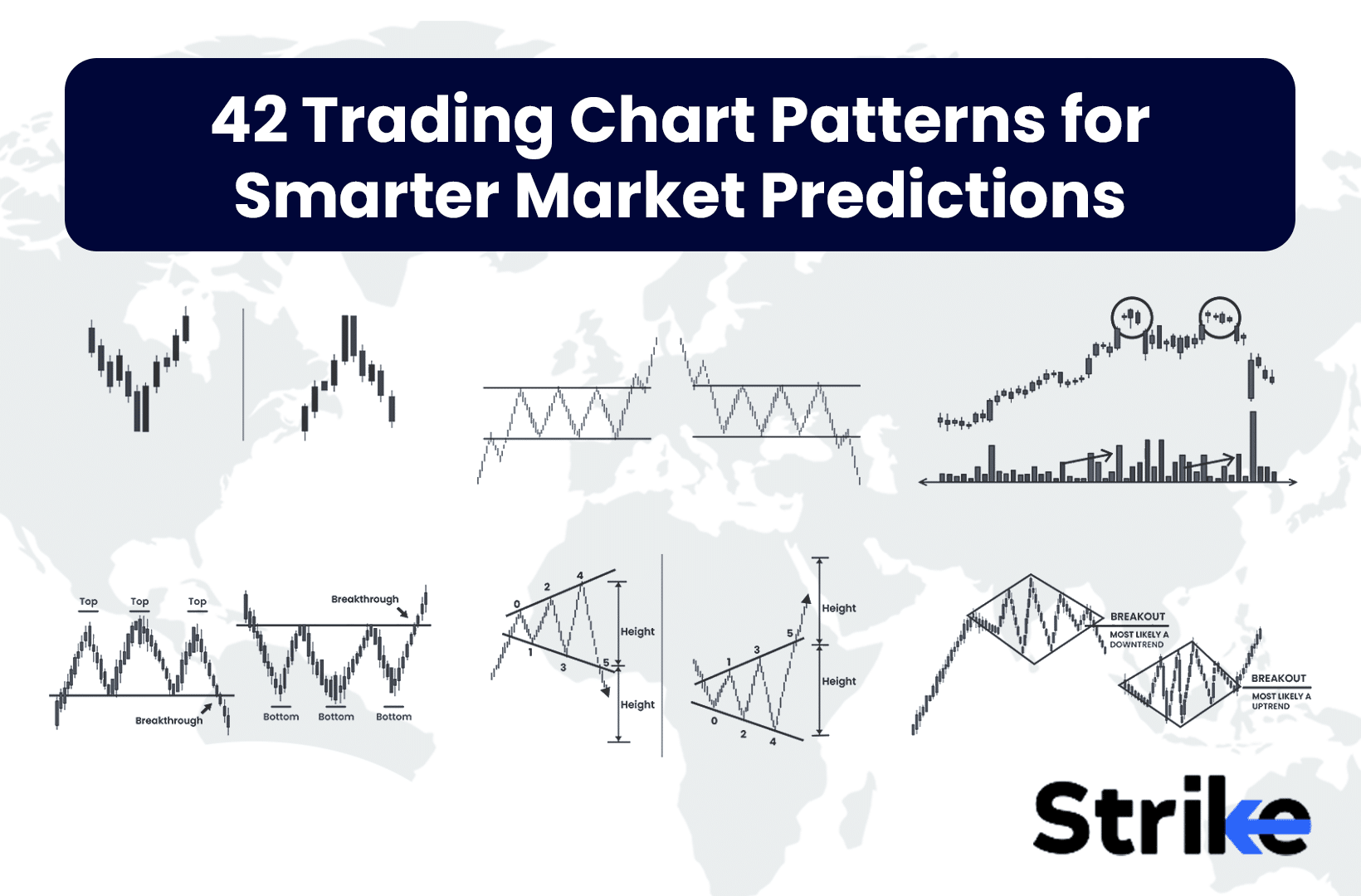

Sentiment analysis complements technical analysis in trading by providing insights into market psychology. While technical analysis focuses on price movements and patterns, sentiment analysis gauges trader emotions and opinions, which can influence price direction. For example, if technical indicators suggest a bullish trend but sentiment is overwhelmingly negative, it may signal a potential reversal. Combining both methods helps traders make more informed decisions, balancing quantitative data with qualitative insights. This dual approach enhances the ability to predict market movements and identify trading opportunities effectively.

Learn about How to Build a Sentiment Analysis Dashboard for Day Trading

What are the limitations of relying on market sentiment in day trading?

Relying on market sentiment in day trading has several limitations. First, sentiment can be highly volatile and change rapidly, leading to unpredictable price movements. Second, it often reflects emotions rather than fundamentals, which can result in irrational trading decisions. Third, overemphasis on sentiment may cause traders to ignore critical data and trends. Additionally, sentiment indicators can generate false signals, leading to potential losses. Lastly, individual interpretations of sentiment can vary widely, causing inconsistent strategies among traders.

Conclusion about The Role of Market Sentiment in Day Trading

In conclusion, understanding market sentiment is crucial for day traders seeking to enhance their strategies and improve returns. By effectively gauging sentiment through various tools and indicators, traders can navigate market fluctuations more adeptly. Incorporating sentiment analysis alongside technical analysis allows for a more comprehensive approach, although it's essential to recognize its limitations. Ultimately, a keen awareness of market sentiment can significantly impact trading decisions and risk management. For further insights and strategies, consider leveraging the expertise offered by DayTradingBusiness.

Learn about The Role of Market Sentiment in Day Trading Patterns