Did you know that economic news can move markets faster than a squirrel on espresso? Understanding how economic news influences trading sentiment is crucial for any trader looking to navigate market trends effectively. In this article, we delve into the various types of economic news that impact trader behavior, from interest rate changes and unemployment data to inflation reports and consumer confidence. We'll explore why traders react to these indicators and how they can lead to market volatility. Additionally, we'll discuss effective strategies for trading on economic news and the psychological factors at play. Join us at DayTradingBusiness as we equip you with the tools and knowledge to analyze economic data and make informed trading decisions.

How does economic news influence trading sentiment?

Economic news influences trading sentiment by shaping traders' perceptions of market conditions and future performance. Positive news, like strong job reports or GDP growth, typically boosts confidence, leading to increased buying activity. Conversely, negative news, such as rising unemployment or inflation, can create fear, prompting selling. Traders often react quickly to news releases, adjusting their positions based on anticipated market movements. This reaction can lead to volatility, as sentiment shifts rapidly in response to changing economic indicators.

What types of economic news affect market trends?

Economic news that affects market trends includes employment reports, GDP growth, inflation data, interest rate changes, and consumer confidence indices. Positive job growth can boost investor sentiment, while rising inflation might lead to fears of interest rate hikes. Central bank announcements, trade balances, and manufacturing reports also play crucial roles. Each of these factors can shift trading sentiment significantly, influencing market movements.

Why do traders react to economic indicators?

Traders react to economic indicators because these reports provide insights into the health of the economy, influencing market sentiment and expectations. Positive indicators can boost confidence, leading to increased buying activity, while negative ones can trigger selling pressure. Economic news affects interest rates, inflation, and employment, all of which directly impact asset prices. For example, stronger-than-expected job growth may lead traders to anticipate higher consumer spending, driving stock prices up. Conversely, poor GDP figures can signal economic weakness, prompting traders to sell off assets.

Which economic reports are most impactful for traders?

The most impactful economic reports for traders include:

1. Non-Farm Payrolls (NFP): Indicates job growth and overall economic health.

2. Consumer Price Index (CPI): Measures inflation, influencing interest rate decisions.

3. Gross Domestic Product (GDP): Reflects economic performance and growth rates.

4. Federal Reserve Interest Rate Decisions: Affects currency values and market sentiment.

5. Retail Sales: Shows consumer spending trends, impacting stock and currency markets.

6. Durable Goods Orders: Signals manufacturing health and future economic activity.

7. Trade Balance: Impacts currency value based on import/export levels.

Traders closely watch these reports to gauge market sentiment and make informed decisions.

How can economic news lead to market volatility?

Economic news can lead to market volatility by influencing trader sentiment and expectations. Positive reports, like job growth or GDP increases, may boost confidence, driving stock prices up. Conversely, negative news, such as rising inflation or poor earnings, can trigger panic selling, leading to sharp declines. Traders react quickly to economic indicators, affecting supply and demand, which causes price fluctuations. Unexpected data can create uncertainty, amplifying volatility as investors adjust their strategies based on the new information.

What is the relationship between economic forecasts and trading behavior?

Economic forecasts significantly influence trading behavior by shaping trader sentiment and expectations. Positive forecasts often lead to increased buying as traders anticipate growth, while negative forecasts can trigger selling due to fears of downturns. Market participants analyze economic indicators—like GDP, unemployment rates, and inflation—to inform their trading decisions. When forecasts suggest strong economic performance, optimism rises, driving stock prices up. Conversely, weak forecasts can create panic, resulting in sell-offs. Ultimately, economic news serves as a key driver of market sentiment, directly impacting trading strategies and outcomes.

How do interest rate changes affect trading sentiment?

Interest rate changes directly influence trading sentiment by affecting expectations around economic growth and inflation. When rates rise, traders may anticipate slower growth and reduced consumer spending, leading to bearish sentiment in markets. Conversely, lower rates often boost sentiment, as they suggest easier borrowing and potential economic expansion. Additionally, interest rate changes can impact currencies, with higher rates attracting foreign investment, which can strengthen a currency and shift sentiment in forex markets. Overall, traders closely monitor these changes to gauge market direction and adjust their strategies accordingly.

What role does unemployment data play in market sentiment?

Unemployment data significantly influences market sentiment by shaping investor expectations about economic health. High unemployment rates can signal economic weakness, leading to negative sentiment and sell-offs in stocks. Conversely, low unemployment often boosts confidence, encouraging buying and driving up prices. Traders analyze unemployment figures to gauge potential central bank actions, such as interest rate changes, further impacting market behavior. Overall, unemployment data serves as a key indicator that affects trading strategies and market dynamics.

How do inflation reports impact trader confidence?

Inflation reports directly influence trader confidence by affecting expectations for monetary policy. High inflation often leads traders to anticipate interest rate hikes, which can create uncertainty and volatility in markets. Conversely, lower-than-expected inflation can boost confidence, suggesting stability and potential for economic growth. Traders adjust their positions based on these reports, impacting stock prices, bond yields, and currency values. Overall, inflation data shapes market sentiment and decision-making for traders.

Why is consumer confidence important for trading?

Consumer confidence is crucial for trading because it indicates how optimistic consumers feel about the economy. High consumer confidence leads to increased spending, boosting company revenues and stock prices. When confidence drops, consumers cut back on spending, which can negatively impact market performance. Traders closely monitor consumer confidence reports as they provide insights into potential market trends and economic health, influencing trading decisions.

How do geopolitical events interact with economic news?

Geopolitical events can significantly impact trading sentiment by influencing market perceptions of risk and stability. For instance, news about conflicts or diplomatic relations can lead to volatility in stock prices, commodities, and currencies. Positive geopolitical developments may boost investor confidence, driving markets upward, while negative events can trigger sell-offs and increased demand for safe-haven assets like gold or government bonds. Economic news, such as employment reports or inflation data, also shapes sentiment; strong data can reinforce positive geopolitical trends, while weak data amid geopolitical tensions may exacerbate market fears. In essence, the interplay between geopolitical events and economic news creates a dynamic environment that traders must navigate carefully.

What are the best strategies for trading on economic news?

The best strategies for trading on economic news include:

1. Stay Informed: Follow economic calendars to know when key reports are released, such as GDP, employment figures, or inflation rates.

2. Analyze Pre-News Sentiment: Gauge market sentiment leading up to the news release. Look for trends or patterns in price action.

3. Use a Trading Plan: Define entry and exit points before the news hits. Have a clear risk management strategy to protect your capital.

4. React Quickly: Be ready to act immediately after the news is released. Volatility can create both opportunities and risks.

5. Focus on Major Events: Prioritize high-impact news releases that typically cause significant price movements in the market.

6. Consider Market Expectations: Analyze if the actual news aligns with or diverges from market expectations. This can drive price reactions.

7. Avoid Overleveraging: Use conservative leverage to manage risk during volatile news periods.

8. Review Historical Reactions: Study how past economic news has affected market movements to inform your strategies.

Each of these strategies can help you navigate trading around economic news effectively.

How can traders prepare for major economic announcements?

Traders can prepare for major economic announcements by following these steps:

1. Research Release Dates: Know when key reports, like GDP or employment figures, are scheduled.

2. Understand Expectations: Analyze forecasts and market consensus to gauge potential impacts on trading sentiment.

3. Review Historical Data: Look at past reactions to similar announcements to anticipate market movements.

4. Set Alerts: Use trading platforms to set notifications for economic news releases.

5. Adjust Positions: Consider positioning ahead of announcements, either by limiting exposure or hedging against volatility.

6. Monitor Market Sentiment: Keep an eye on social media and news outlets for real-time sentiment shifts.

7. Stay Calm: Develop a trading plan and stick to it, avoiding impulsive decisions based on sudden market reactions.

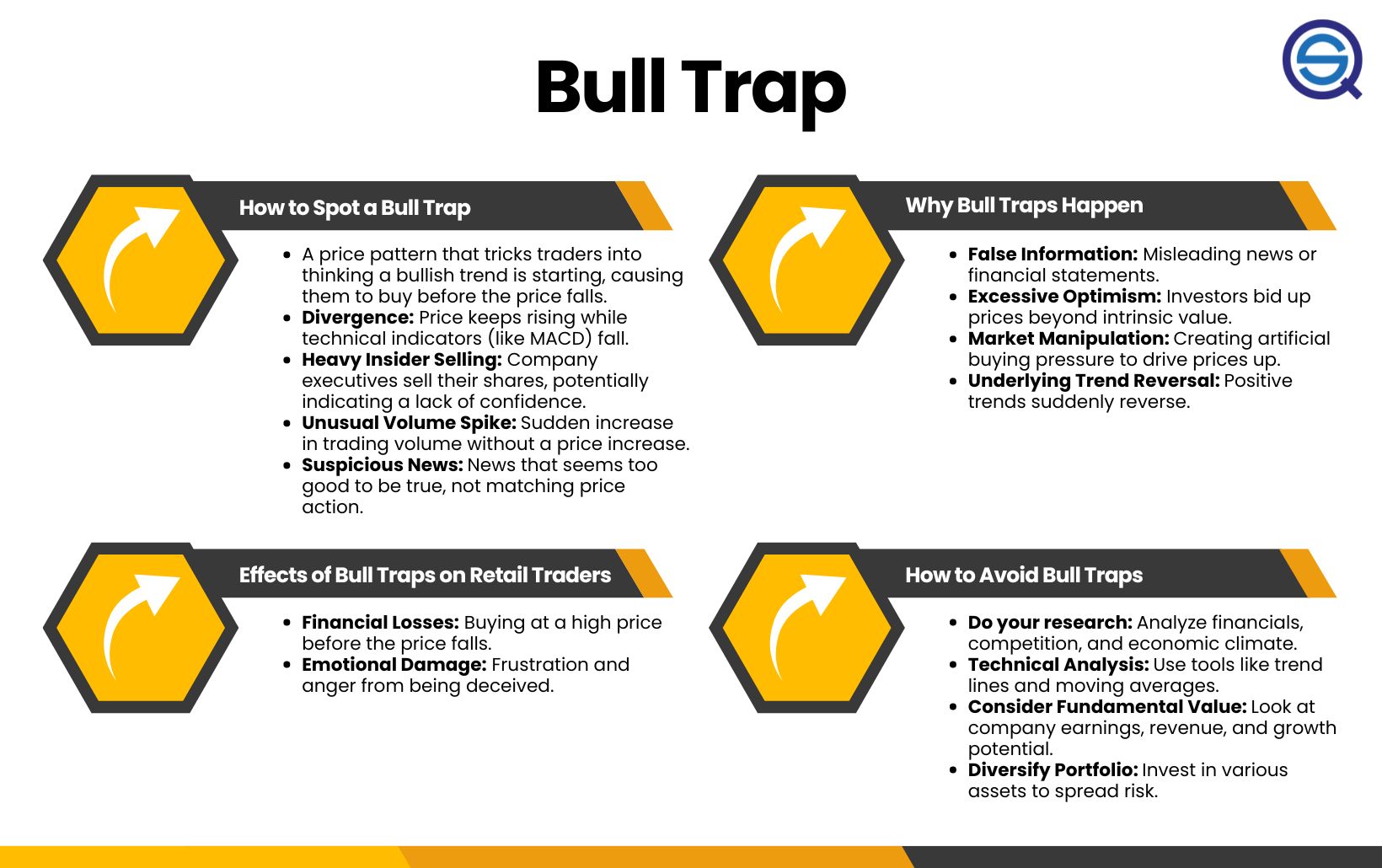

What psychological factors influence trading based on news?

Psychological factors influencing trading based on news include:

1. Fear and Greed: Traders often react emotionally to news, driven by fear of loss or the greed of potential gains, leading to impulsive decisions.

2. Confirmation Bias: Traders seek information that confirms their existing beliefs about a stock or market trend, ignoring contrary data.

3. Overconfidence: Many traders overestimate their ability to predict market movements based on news, leading to increased risk-taking.

4. Herd Behavior: The tendency to follow the crowd can amplify market reactions to news, causing trends to accelerate or reverse quickly.

5. Recency Bias: Traders may give more weight to recent news events, believing they reflect ongoing trends, which can skew judgment.

These psychological factors significantly shape trading sentiment and market dynamics in response to economic news.

How do market participants interpret economic data releases?

Market participants interpret economic data releases by analyzing the figures against expectations and previous data. Positive data, like strong employment numbers, typically boosts sentiment and leads to buying, while negative data, such as rising unemployment, can trigger selling. Traders also consider the broader context, like central bank policies, to gauge potential market reactions. Sentiment shifts quickly based on how the data aligns with forecasts, influencing trading strategies and investment decisions.

Learn about How to Interpret Market Data for Day Trading Analysis

What tools can traders use to analyze economic news?

Traders can use tools like economic calendars, which provide scheduled news releases, and platforms like Bloomberg or Reuters for real-time updates. Charting software, such as TradingView or MetaTrader, helps visualize price movements in response to news. Sentiment analysis tools, like MarketPsych or Social Sentiment, gauge trader sentiment. Additionally, news aggregators like Feedly can curate relevant economic news. Finally, social media platforms can offer insights into market reactions, enhancing understanding of trading sentiment.

Conclusion about The Impact of Economic News on Trading Sentiment

In summary, understanding the impact of economic news on trading sentiment is crucial for successful trading strategies. Economic indicators, including interest rates, unemployment data, and inflation reports, directly influence market trends and trader behavior. By staying informed about these factors and preparing for major economic announcements, traders can better navigate market volatility. Leveraging the insights provided by DayTradingBusiness can enhance your ability to interpret economic data and refine your trading approach for optimal results.

Learn about Impact of Economic News on Forex Day Trading

Sources:

- Novel and old news sentiment in commodity futures markets ...

- The impact of sentiment and attention measures on stock market ...

- News sentiment in the gold futures market - ScienceDirect

- The Power of Text: How News Sentiment Influences Financial Markets

- Measuring market volatility connectedness to media sentiment ...