Did you know that nearly 70% of day traders admit to feeling overwhelmed by breaking news? In the fast-paced world of day trading, news can significantly shape market sentiment, influencing traders' decisions and strategies. This article delves into how various types of news, from economic reports to political events, impact trading approaches. Learn how to effectively gauge market sentiment, utilize earnings reports, and navigate the complexities of social media reactions. Discover essential tools for monitoring news and strategies to mitigate risks associated with news-based trading. Stay informed and enhance your trading game with insights from DayTradingBusiness!

How Does News Impact Day Trading Sentiment?

News significantly impacts day trading sentiment by influencing traders' perceptions and reactions in real-time. Positive news, like strong earnings reports, often drives prices up and creates bullish sentiment, leading to increased buying activity. Conversely, negative news, such as economic downturns or scandals, can trigger panic selling and bearish sentiment. Traders closely monitor news feeds to capitalize on these shifts, adjusting their strategies based on breaking news events. Overall, news acts as a catalyst for rapid price movements, shaping day traders' decisions and market behavior.

What Types of News Affect Day Trading?

Economic reports, earnings announcements, geopolitical events, and regulatory changes significantly affect day trading sentiment. Positive earnings can drive stock prices up, while negative news can cause rapid declines. Economic indicators like unemployment rates or inflation can create volatility. Geopolitical tensions may lead to uncertainty, influencing traders to react quickly. Keeping an eye on breaking news helps day traders capitalize on these market shifts.

How Can Traders Use News to Gauge Market Sentiment?

Traders can use news to gauge market sentiment by monitoring economic reports, earnings announcements, and geopolitical events. Positive news, like strong job reports or favorable earnings, often boosts investor confidence, leading to bullish sentiment. Conversely, negative news, such as economic downturns or political instability, can trigger fear and result in bearish sentiment.

To effectively use news, traders should follow reliable financial news sources, track social media reactions, and analyze how the market responds to specific headlines. Tools like sentiment analysis software can help quantify public sentiment. Ultimately, understanding the impact of news on market psychology allows traders to make informed decisions about buying or selling stocks based on prevailing sentiment.

What Role Does Economic News Play in Day Trading?

Economic news significantly influences day trading sentiment by impacting market volatility and trader behavior. Positive economic reports can drive prices up, encouraging buying, while negative news often leads to selling pressure. Traders react quickly to announcements like unemployment rates or GDP growth, making news a key factor in short-term price movements. Staying updated on economic news helps traders make informed decisions and capitalize on market fluctuations.

How Do Earnings Reports Influence Day Trading Sentiment?

Earnings reports significantly impact day trading sentiment by providing key insights into a company's financial health. Positive earnings surprises can drive stock prices up, creating bullish sentiment among traders. Conversely, disappointing results often lead to sharp declines, fostering bearish sentiment. Traders closely watch these reports for volatility and potential trading opportunities, as they can lead to rapid price movements and increased volume. Overall, earnings reports serve as critical indicators that shape immediate market reactions and trader behavior.

Can Political News Shift Day Trading Strategies?

Yes, political news can significantly shift day trading strategies. Traders often react to headlines about government policies, elections, or economic reforms, leading to volatility in stock prices. For example, news about tax changes can cause stocks in certain sectors to surge or drop. Day traders must stay informed and adjust their strategies quickly to capitalize on these movements or mitigate risks. Understanding the sentiment behind political news is crucial for making informed trading decisions.

How Should Traders React to Breaking News?

Traders should react to breaking news by quickly assessing its relevance and impact on the market. Stay calm and avoid impulsive decisions; instead, analyze how the news aligns with current trends. Use news to adjust your trading strategy—consider entering or exiting positions based on the sentiment shift. Monitor market reactions and volume to gauge whether the news will lead to sustained movement or a short-lived spike. Always set stop-loss orders to manage risk effectively.

What Is the Relationship Between News Timing and Day Trading?

News timing significantly affects day trading sentiment. When major news breaks, traders react quickly, often leading to increased volatility. Positive news can boost stock prices, while negative news can trigger sell-offs. Traders use news calendars to anticipate these events, aiming to capitalize on price movements. Rapidly changing sentiment based on news can create opportunities for quick profits or losses. Timing your trades around news releases is crucial for maximizing gains and managing risks.

How Do Analysts’ Opinions Affect Day Trading Sentiment?

Analysts’ opinions significantly impact day trading sentiment by influencing trader perceptions and decisions. Positive ratings or upgrades can boost stock prices, creating bullish sentiment and prompting traders to buy. Conversely, negative assessments or downgrades can lead to selling pressure and bearish sentiment. Traders often react quickly to these opinions, as they can signal market trends or shifts in stock performance. Additionally, analysts’ comments can trigger broader market movements, affecting overall trading strategies.

What Tools Can Help Traders Monitor News Impact?

Traders can use several tools to monitor news impact on day trading sentiment:

1. News Aggregators: Tools like Feedly or NewsNow collect headlines from multiple sources, allowing traders to stay updated on market-moving news.

2. Financial News Platforms: Bloomberg, Reuters, and CNBC provide real-time news and analysis that influence trading decisions.

3. Economic Calendars: Websites like Investing.com or Forex Factory list upcoming economic events and reports, helping traders anticipate market reactions.

4. Social Media Monitoring Tools: Platforms like StockTwits and Twitter can gauge public sentiment and reactions to news.

5. Brokerage Platforms: Many trading platforms include news feeds and alerts tailored to specific stocks or markets.

6. Sentiment Analysis Tools: Services like MarketPsych analyze news sentiment and provide insights on how it may affect trading behavior.

Using these tools, traders can stay informed and better assess how news impacts market sentiment and trading opportunities.

How Does Social Media Influence Day Trading Sentiment?

Social media significantly impacts day trading sentiment by rapidly disseminating news and opinions. Traders often react to trending topics, tweets, and posts, which can lead to swift price movements. Positive sentiment from influencers or popular posts can drive buying pressure, while negative news can trigger panic selling. Platforms like Twitter and Reddit are particularly influential, shaping traders' perceptions and decisions in real-time. The viral nature of social media amplifies both bullish and bearish sentiments, making it a crucial factor in day trading strategies.

Learn about How Liquidity and Depth Influence Day Trading Decisions

How Can Traders Stay Updated on Relevant News?

Traders can stay updated on relevant news by following financial news websites, subscribing to market analysis newsletters, and using real-time news aggregators. Social media platforms like Twitter provide instant updates from reputable financial analysts. Joining trading forums and communities can also offer insights into market sentiment. Utilizing news apps and setting alerts for specific stocks or economic indicators keeps traders informed about developments that could impact day trading. Regularly checking economic calendars helps anticipate major announcements.

What Are the Risks of Trading Based on News?

Trading based on news can lead to several risks. First, market volatility can spike unexpectedly, causing rapid price swings that may result in losses. Second, misinterpretation of news can lead to poor trading decisions. Third, news can cause herd behavior, causing prices to move against your position. Fourth, timing is critical; reacting too late can mean missing out on potential gains or facing losses. Lastly, reliance on news can create overtrading, leading to increased transaction costs and emotional stress.

How Do Market Reactions to News Differ by Sector?

Market reactions to news vary by sector due to differing sensitivities and investor expectations. For instance, tech stocks often react sharply to earnings reports or innovation announcements, leading to rapid price swings. In contrast, consumer staples may respond more steadily to economic news, reflecting their stable demand. Financials can fluctuate with interest rate news, while energy stocks often react to geopolitical events or oil price changes. Each sector's unique characteristics shape how traders interpret news, influencing day trading sentiment and strategies.

How Can Sentiment Analysis Tools Aid Day Traders?

Sentiment analysis tools can help day traders by analyzing news and social media to gauge market sentiment. These tools provide insights into how positive or negative news impacts stock prices, enabling traders to make informed decisions quickly. By tracking sentiment trends, traders can identify potential price movements before they happen. Additionally, sentiment analysis can highlight investor behavior, allowing day traders to align their strategies with prevailing market emotions. This can lead to more effective entry and exit points, ultimately improving trading outcomes.

Learn about How to Build a Sentiment Analysis Dashboard for Day Trading

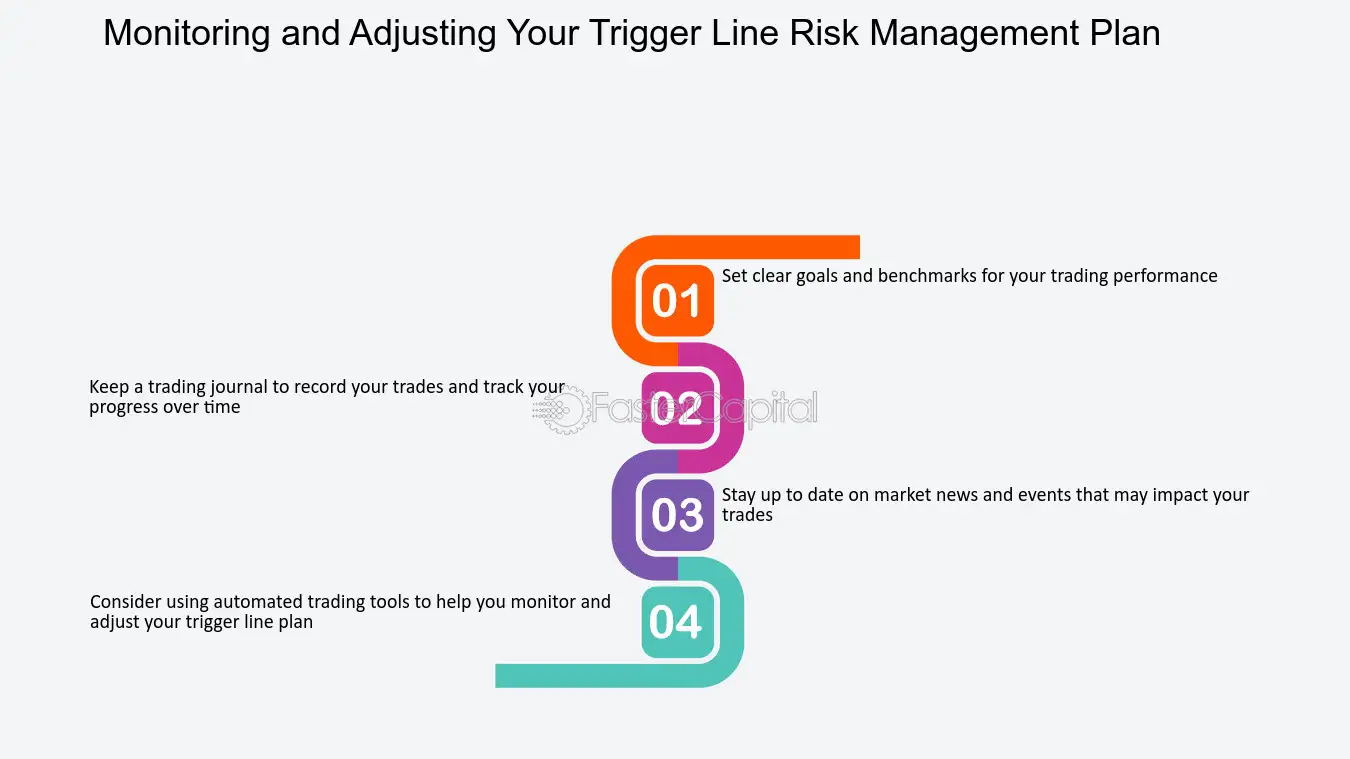

What Strategies Minimize News-Related Trading Risks?

1. Stay Informed: Monitor news feeds and economic calendars to anticipate market-moving events.

2. Set Alerts: Use trading platforms to set alerts for significant news announcements and price movements.

3. Limit Exposure: Avoid trading immediately before or after major news releases to reduce volatility risks.

4. Technical Analysis: Incorporate technical indicators to identify trends and confirm signals, balancing news impact with chart patterns.

5. Diversify Trades: Spread risk across multiple assets rather than concentrating on a single news event.

6. Use Stop-Loss Orders: Implement stop-loss orders to protect against unexpected market swings following news.

7. Practice Discipline: Stick to your trading plan and avoid emotional reactions to news headlines.

8. Review Historical Data: Analyze past news events to understand their impact on price movements and sentiment.

9. Limit Position Size: Reduce the size of trades during high-volatility news periods to manage risk effectively.

Conclusion about How News Affects Day Trading Sentiment

In summary, understanding how news impacts day trading sentiment is crucial for successful trading strategies. Traders must stay informed about various news types, including economic reports, earnings releases, and political developments, as these can significantly influence market movements. By effectively utilizing sentiment analysis tools and monitoring real-time updates, traders can better navigate the volatility that news events create. Adopting a strategic approach that incorporates both news awareness and risk management is essential for thriving in the fast-paced world of day trading, as emphasized by DayTradingBusiness.

Learn about How Market News Affects Day Trading Stocks