Did you know that the oldest known stock market dates back to the 16th century, where traders exchanged shares of Dutch East India Company in coffeehouses? Fast forward to today, and historical data has become a cornerstone for day traders aiming to refine their strategies. This article delves into the essentials of using historical data for day trading pattern analysis, covering topics from what historical data is and how to access it, to the significance of identifying patterns and backtesting strategies. You'll learn about effective timeframes, common pitfalls, and the tools that can enhance your analysis. With insights from DayTradingBusiness, you’ll gain a clearer understanding of how to leverage historical data to elevate your trading game.

What is historical data in day trading?

Historical data in day trading refers to past price movements and trading volumes of financial instruments, such as stocks or currencies. Traders use this data to identify patterns, trends, and potential entry or exit points for trades. Analyzing historical data helps traders make informed decisions, improve their strategies, and enhance their chances of profitability.

How can I access historical data for day trading?

To access historical data for day trading, use the following methods:

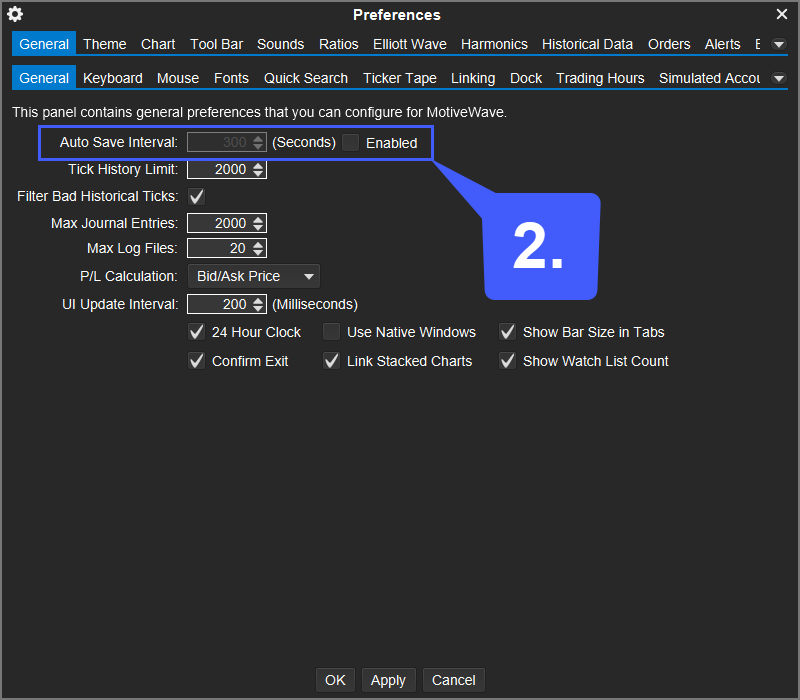

1. Broker Platforms: Many brokers provide historical data for stocks, futures, and options directly on their trading platforms. Check if your broker offers this feature.

2. Financial Websites: Sites like Yahoo Finance, Google Finance, and MarketWatch allow you to download historical price data in various formats.

3. Data Providers: Services like Quandl and Alpha Vantage offer comprehensive historical datasets. Some may require a subscription.

4. Trading Software: Platforms like TradingView and NinjaTrader allow you to analyze historical data and create custom patterns.

5. Excel or Google Sheets: Import data from financial websites or APIs for personalized analysis and pattern recognition.

Choose a method that fits your trading style and needs for effective day trading pattern analysis.

Why is historical data important for pattern analysis?

Historical data is crucial for pattern analysis in day trading because it reveals past price movements and trends, helping traders identify recurring patterns. By studying this data, traders can recognize potential entry and exit points, assess market behavior, and refine their strategies based on real-world outcomes. Historical data also aids in risk management, allowing traders to evaluate past performance and make informed decisions about future trades. In essence, it provides the foundation for predicting market movements and enhancing trading accuracy.

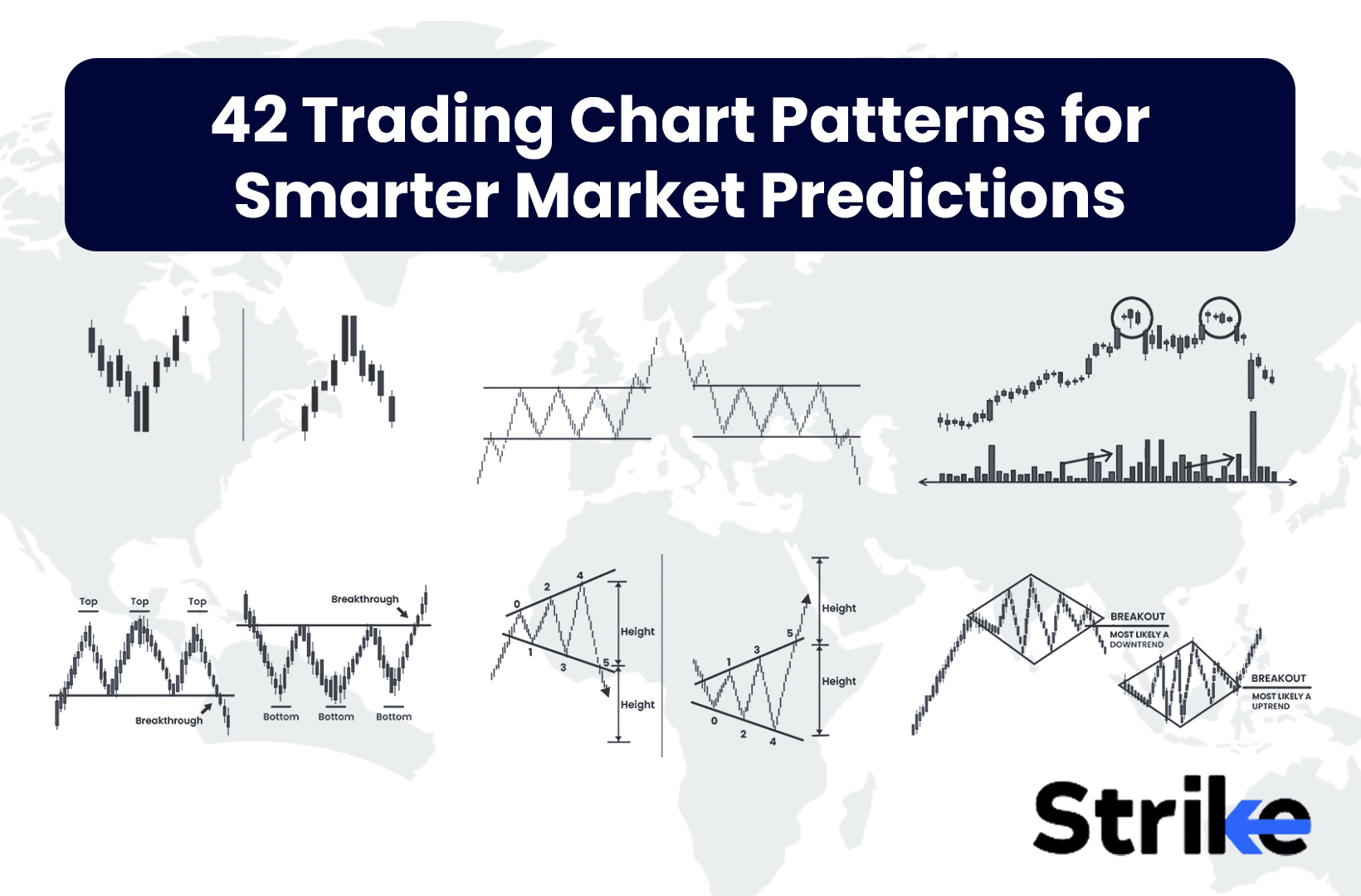

What day trading patterns can be identified using historical data?

Common day trading patterns identified using historical data include:

1. Head and Shoulders: Indicates trend reversals.

2. Double Top/Bottom: Signals potential reversals after a strong trend.

3. Flags and Pennants: Show continuation of trends after brief consolidations.

4. Cup and Handle: Suggests bullish continuation.

5. Triangles: Ascending, descending, and symmetrical triangles indicate potential breakout directions.

Utilizing historical price movements, traders can spot these patterns to make informed decisions.

How do I analyze historical data for day trading strategies?

To analyze historical data for day trading strategies, start by collecting relevant data like price movements, volume, and market trends. Use charting software to visualize patterns and identify key indicators such as moving averages, RSI, and MACD.

Next, apply backtesting methods on your strategies, using historical data to see how they would have performed. Focus on specific timeframes—like 1-minute or 5-minute charts—to match your day trading style.

Additionally, look for recurring patterns, support and resistance levels, and news impacts on price movements. Document your findings to refine your strategies based on what works best historically.

What tools are best for analyzing historical trading data?

The best tools for analyzing historical trading data include:

1. TradingView: Offers advanced charting, indicators, and social community insights.

2. MetaTrader 4/5: Great for backtesting strategies with historical data and automated trading.

3. Thinkorswim: Provides extensive charting tools and historical analysis features.

4. NinjaTrader: Ideal for advanced trade analytics and backtesting capabilities.

5. Excel: Useful for custom data analysis and visualizing historical trends.

6. QuantConnect: For algorithmic traders, it allows backtesting strategies with extensive historical data.

Choose based on your specific trading style and analysis needs.

How can I backtest trading strategies using historical data?

To backtest trading strategies using historical data, follow these steps:

1. Select a Trading Strategy: Define the specific rules and conditions for your strategy.

2. Gather Historical Data: Obtain historical price data for the asset you want to test. Sources include financial websites, trading platforms, or data providers.

3. Choose a Backtesting Tool: Use software like MetaTrader, TradingView, or Python libraries (e.g., Backtrader) that allow you to input your strategy and historical data.

4. Implement Your Strategy: Code your trading rules into the backtesting tool, ensuring it reflects entry and exit points, stop-loss, and take-profit levels.

5. Run the Backtest: Execute the backtest to simulate trades based on historical data. The tool will apply your strategy over past market conditions.

6. Analyze Results: Review metrics like win rate, profit factor, maximum drawdown, and overall profitability. This helps gauge the effectiveness of your strategy.

7. Refine and Repeat: Adjust your strategy based on the results, and backtest again to see if improvements yield better outcomes.

Following these steps will help you systematically backtest your trading strategies using historical data.

What timeframes are most effective for historical data analysis?

For day trading pattern analysis, the most effective timeframes for historical data are 1-minute, 5-minute, and 15-minute charts. These shorter timeframes allow you to identify quick price movements and patterns. Additionally, analyzing daily and weekly charts can provide context for trends and support/resistance levels that influence intraday trading. Focus on these timeframes to optimize your analysis and enhance trading decisions.

How can I improve my day trading using historical data?

To improve your day trading using historical data, start by analyzing past price movements and patterns for the stocks or assets you trade. Use backtesting to evaluate your trading strategies against historical price data, identifying what worked and what didn’t. Focus on key indicators like support and resistance levels, volume spikes, and trends during specific timeframes.

Implement statistical analysis to find correlations and probabilities of price movements based on historical events. Create a trading journal to track your trades and outcomes, refining your strategy over time. Finally, continuously update your data sets to adapt to market changes and enhance your decision-making.

What are common mistakes when using historical data in trading?

Common mistakes when using historical data in trading include:

1. Overfitting: Creating models that are too complex and only work on past data, failing in real-time conditions.

2. Ignoring Market Changes: Not accounting for shifts in market conditions, regulations, or economic factors that affect patterns.

3. Data Snooping: Analyzing the same data multiple times to find patterns that may not be statistically significant.

4. Inadequate Sample Size: Relying on too few data points, which can lead to unreliable conclusions.

5. Confirmation Bias: Only selecting data that supports existing beliefs while ignoring contradictory evidence.

6. Neglecting Transaction Costs: Failing to factor in commissions or slippage that can erase profits from a strategy based on historical data.

7. Assuming Past Patterns Will Repeat: Believing that historical trends will always hold true in future trading scenarios.

How does market volatility affect historical data analysis?

Market volatility influences historical data analysis by altering the patterns and trends that traders observe. High volatility can distort price movements, making trends less predictable and historical patterns less reliable. During volatile periods, past data may reflect erratic swings rather than stable patterns, complicating day trading strategy development. Traders need to adjust their analysis methods, focusing on shorter time frames or incorporating volatility indicators to account for these fluctuations. This ensures that their pattern analysis remains relevant and actionable in the current market environment.

Can historical data predict future trading patterns?

Yes, historical data can predict future trading patterns by identifying trends, support and resistance levels, and market behaviors. Analyzing past price movements helps traders spot recurring patterns, such as breakouts or reversals. However, it's not foolproof; market conditions can change due to factors like news events or economic shifts. Therefore, while historical data is a valuable tool for day trading pattern analysis, it should be used alongside current market insights for better accuracy.

How do I interpret historical price charts for day trading?

To interpret historical price charts for day trading, focus on key elements:

1. Identify Trends: Look for upward or downward trends in the price movement. Use tools like trend lines to clarify direction.

2. Support and Resistance Levels: Mark significant price levels where the stock has historically bounced (support) or reversed (resistance). These can guide entry and exit points.

3. Candlestick Patterns: Analyze patterns like doji, hammer, or engulfing to gauge market sentiment and potential reversals.

4. Volume Analysis: Check volume alongside price movements. High volume can confirm trends or reversals, while low volume may indicate weak signals.

5. Moving Averages: Use moving averages to smooth out price data. The crossover of short-term and long-term moving averages can signal buy or sell opportunities.

6. Indicators: Incorporate indicators like RSI or MACD to assess overbought or oversold conditions.

7. Time Frames: Use multiple time frames to gain a comprehensive view of price action. Day traders often focus on 1-minute, 5-minute, and 15-minute charts.

By consistently applying these techniques, you can improve your day trading strategies based on historical data analysis.

Learn about How to Analyze Historical Data Using Day Trading Charts

What role do indicators play in historical data analysis?

Indicators in historical data analysis help identify trends and patterns in price movements. They offer quantifiable metrics, like moving averages or RSI, to signal potential buy or sell opportunities. By analyzing these indicators, traders can make informed decisions based on past performance, enhancing their strategies in day trading. Effective use of indicators can reveal entry and exit points, improving overall trading accuracy.

How often should I update my historical data for trading?

You should update your historical data for day trading at least once a month to ensure accuracy and relevance. However, if market conditions change significantly or you notice shifts in trading patterns, update it more frequently, such as weekly. Staying current helps you make better decisions based on the latest trends and patterns.

What are the limitations of using historical data in day trading?

Using historical data in day trading has several limitations. First, past performance does not guarantee future results; market conditions can change rapidly. Second, historical data may not account for current market sentiment or news events that can impact price movements. Third, reliance on historical patterns can lead to overfitting, where traders assume patterns will repeat without considering volatility. Additionally, the availability and accuracy of historical data can vary, potentially skewing analysis. Finally, high-frequency trading and algorithmic strategies can create market dynamics that historical data may not effectively capture.

Learn about How to Analyze Historical Data Using Day Trading Charts

Conclusion about Using Historical Data for Day Trading Pattern Analysis

Incorporating historical data into your day trading strategy is crucial for identifying patterns, optimizing performance, and making informed decisions. By accessing reliable historical data and utilizing the right tools, traders can backtest strategies and enhance their analysis. However, it’s essential to stay aware of the limitations and common pitfalls associated with historical data. Leveraging these insights will empower you to refine your approach and adapt to market volatility. For comprehensive guidance and resources, DayTradingBusiness is here to support your trading journey.

Learn about How to Analyze Historical Data Using Day Trading Charts