Did you know that the only thing scarier than a bear market might just be a trader’s psyche? In the world of trading, psychology plays a crucial role in influencing patterns and decisions. This article delves into the psychological factors that shape trading behaviors, including the impacts of fear and greed, the effects of stress, and the dangers of confirmation bias. We’ll explore how trader psychology can sway market trends and emotional triggers that lead to impulsive actions. Additionally, we’ll discuss strategies like mindfulness to improve mental resilience and techniques to manage anxiety effectively. By understanding these psychological elements, traders can develop a disciplined mindset and better navigate the unpredictable waters of the market. Join us at DayTradingBusiness as we unpack these vital insights for successful trading.

What are the psychological factors influencing trading patterns?

Key psychological factors influencing trading patterns include:

1. Fear and Greed: Traders often make decisions driven by fear of loss or the greed for profits, leading to impulsive actions.

2. Overconfidence: Many traders overestimate their knowledge and abilities, which can result in excessive trading and risk-taking.

3. Loss Aversion: The tendency to prefer avoiding losses over acquiring equivalent gains can lead to holding losing positions too long.

4. Herd Behavior: Following the crowd can cause traders to make decisions based on group dynamics rather than rational analysis.

5. Confirmation Bias: Traders may seek information that confirms their existing beliefs, ignoring contradictory data.

6. Emotional Attachment: Personal feelings towards a stock can cloud judgment, causing traders to make irrational decisions.

7. Mental Accounting: Traders might separate their money into different accounts, treating them differently, which can impact trading choices.

Understanding these factors can help traders manage their emotions and improve decision-making in their trading patterns.

How does fear impact trading decisions?

Fear can lead to impulsive trading decisions, causing traders to sell assets prematurely or avoid taking risks altogether. It often results in a loss of confidence, prompting overreactions to market fluctuations. This emotional response can create a cycle of panic selling, leading to missed opportunities and increased volatility in trading patterns. Fear can also make traders overly cautious, preventing them from following their strategies, which can hinder potential profits. Understanding and managing fear is crucial for making rational trading decisions.

What role does greed play in trading behavior?

Greed significantly influences trading behavior by driving traders to take excessive risks in pursuit of higher profits. It can lead to impulsive decisions, such as holding onto losing positions too long or overleveraging investments. Traders motivated by greed may ignore market signals and fundamentals, resulting in poor judgment. This often manifests in herd behavior, where individuals follow trends blindly, hoping to capitalize on short-term gains. Ultimately, greed can distort rational thinking and lead to substantial financial losses.

How can trader psychology affect market trends?

Trader psychology significantly influences market trends through emotions like fear and greed. When traders feel optimistic, they tend to buy more, driving prices up. Conversely, fear can lead to panic selling, causing sharp declines. Herd behavior often amplifies these effects, as traders follow the crowd, creating trends based on collective sentiment rather than fundamentals. Additionally, cognitive biases, like overconfidence, can distort decision-making, contributing to market volatility. Understanding these psychological factors helps traders anticipate shifts in market patterns.

Why do traders fall for confirmation bias?

Traders fall for confirmation bias because they seek information that supports their pre-existing beliefs about a stock or market trend. This tendency stems from a natural desire to reduce cognitive dissonance and feel more confident in their decisions. When traders focus on data that confirms their views, they often overlook contradictory evidence, leading to poor decision-making. Emotional investment in trades can further amplify this bias, as traders may ignore risks to validate their choices. Overall, confirmation bias can cloud judgment and hinder objective analysis in trading.

How does stress influence trading performance?

Stress negatively impacts trading performance by impairing decision-making and increasing emotional reactions. Traders under stress may make impulsive trades, overlook critical data, and fail to stick to their strategies. High stress can lead to anxiety and fear, causing traders to second-guess their choices or exit positions prematurely. This emotional volatility often results in losses and erratic trading patterns. Managing stress through techniques like mindfulness or disciplined routines can help improve focus and performance.

What are the common emotional triggers in trading?

Common emotional triggers in trading include fear, greed, overconfidence, and regret. Fear often leads to hesitation or panic selling. Greed can push traders to take excessive risks, chasing profits without proper analysis. Overconfidence may result in ignoring market signals or making impulsive decisions. Regret typically follows a loss, causing traders to second-guess their strategies and potentially make poor future choices. Recognizing these triggers is essential to maintaining a disciplined trading approach.

How can mindfulness improve trading psychology?

Mindfulness can improve trading psychology by enhancing self-awareness, reducing emotional reactivity, and fostering better decision-making. It helps traders recognize their emotional triggers and patterns, allowing them to respond calmly rather than react impulsively. Practicing mindfulness can also increase focus, enabling traders to stick to their strategies without being swayed by market noise. Ultimately, this leads to a more disciplined approach, improving overall trading performance.

What techniques can help manage trading anxiety?

To manage trading anxiety, try these techniques:

1. Set Clear Goals: Define specific, achievable trading objectives to reduce uncertainty.

2. Develop a Trading Plan: Create a detailed strategy that outlines entry and exit points, which helps minimize impulsive decisions.

3. Practice Mindfulness: Engage in mindfulness exercises or meditation to stay present and reduce stress.

4. Limit Exposure: Set time limits on how often you check the markets to prevent overwhelm.

5. Use Journaling: Keep a trading journal to track your emotions and decisions, which can help identify triggers.

6. Focus on Education: Continuously learn about trading patterns and market behavior to boost confidence.

7. Implement Risk Management: Use stop-loss orders and position sizing to manage risk, which can alleviate fear of significant losses.

8. Take Breaks: Step away from trading periodically to clear your mind and reduce anxiety.

Incorporating these strategies can help you navigate the psychological challenges of trading effectively.

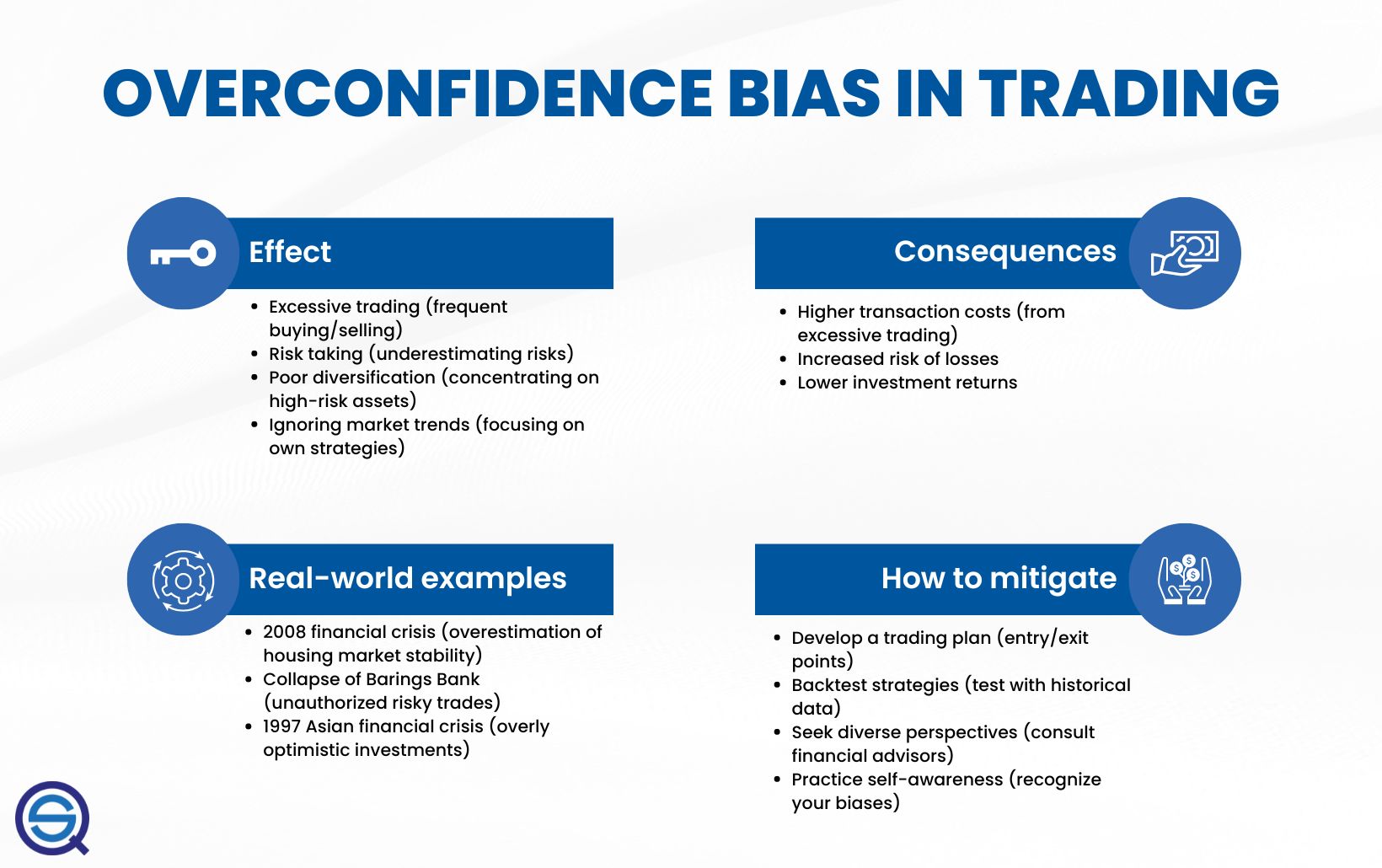

How does overconfidence affect trading outcomes?

Overconfidence can lead traders to overestimate their knowledge and skills, resulting in poor decision-making. This often manifests as excessive trading, ignoring risks, and holding onto losing positions too long. When traders are overconfident, they may underestimate market volatility, leading to significant losses. Additionally, it can create a false sense of security, causing them to disregard sound analysis and strategy. Ultimately, overconfidence can distort judgment, diminish profits, and increase the likelihood of failure in trading.

Learn about How Does Confidence Fluctuate and Affect Trading Outcomes?

What is the psychological impact of market volatility?

Market volatility can lead to heightened anxiety and stress among traders, causing emotional decision-making. Fear of losses may prompt impulsive selling, while greed can lead to risky investments. This emotional rollercoaster often results in overtrading or holding onto losing positions longer than necessary. Additionally, prolonged volatility can erode confidence, leading to a more cautious approach or even withdrawal from the market. Understanding these psychological effects is crucial for developing effective trading strategies.

How can understanding group psychology enhance trading strategies?

Understanding group psychology can enhance trading strategies by revealing how market sentiment influences price movements. Traders can identify patterns driven by collective behavior, such as fear or greed, which often lead to trends or reversals. By analyzing social dynamics, like herd mentality, traders can anticipate when the market might overreact or underreact. This insight allows for more informed decision-making, such as entering or exiting positions at optimal times. Additionally, awareness of psychological biases—like confirmation bias or loss aversion—can help traders refine their strategies and improve risk management.

What are the signs of emotional trading?

Signs of emotional trading include:

1. Overreacting to Market Changes: Making impulsive decisions after minor price fluctuations.

2. Chasing Losses: Increasing position sizes to recover lost money quickly.

3. Ignoring Strategy: Deviating from a trading plan based on fear or excitement.

4. Frequent Checking of Prices: Obsessively monitoring market movements, leading to anxiety.

5. Holding onto Losing Trades: Refusing to cut losses due to emotional attachment.

6. Overconfidence After Wins: Taking excessive risks following a series of successful trades.

7. Fear of Missing Out (FOMO): Jumping into trades late to capitalize on perceived opportunities.

Recognizing these signs can help traders maintain discipline and stick to their strategies.

How do cognitive biases alter trading patterns?

Cognitive biases affect trading patterns by influencing decision-making and risk perception. For instance, overconfidence leads traders to underestimate risks and overestimate their abilities, often resulting in impulsive trades. Loss aversion makes traders hold onto losing positions longer, hoping for a rebound, while anchoring can cause them to rely too heavily on past prices when making decisions. Confirmation bias prompts traders to seek information that supports their existing beliefs, ignoring contrary evidence. These biases can create erratic trading behaviors and market trends, ultimately impacting profitability.

Learn about How Do Cognitive Biases Affect Trading Risk Management?

What strategies can help develop a disciplined trading mindset?

To develop a disciplined trading mindset, start by setting clear goals and a trading plan. Stick to your plan, even when emotions run high. Keep a trading journal to reflect on your decisions and learn from mistakes. Practice mindfulness and manage stress through techniques like meditation or deep breathing. Limit distractions during trading sessions to maintain focus. Implement risk management strategies to safeguard your capital. Lastly, seek continuous education to build confidence and adaptability in your trading approach.

How can traders recover from psychological setbacks?

Traders can recover from psychological setbacks by implementing a few key strategies. First, practice mindfulness or meditation to regain focus and reduce anxiety. Second, analyze past trades to identify mistakes without self-judgment; this helps in learning and improving decision-making. Third, establish a trading routine that includes breaks to prevent burnout. Additionally, set realistic goals to avoid overwhelming pressure. Joining a trading community can provide support and shared experiences, reinforcing a positive mindset. Finally, consider keeping a trading journal to track emotions and thoughts, helping to identify triggers and patterns in behavior.

Conclusion about The Psychological Aspect of Trading Patterns

In conclusion, understanding the psychological factors influencing trading patterns is crucial for success in the market. Emotions like fear and greed can significantly impact decision-making, while cognitive biases such as confirmation bias can lead to flawed strategies. By incorporating mindfulness and discipline, traders can manage anxiety, improve performance, and navigate market volatility more effectively. Ultimately, enhancing trader psychology not only aids in personal growth but also contributes to more informed trading strategies. Leveraging insights from DayTradingBusiness can further empower traders to optimize their mental approach and achieve consistent results.