Did you know that some day traders can spot patterns faster than a hawk eyeing its prey? In the fast-paced world of day trading, staying updated on emerging patterns is crucial for success. This article dives into the latest trends and techniques for identifying new day trading patterns in real-time. Learn about the best resources, including social media platforms and trading forums, that can enhance your pattern recognition skills. Discover how to leverage technical analysis, key indicators, and news events to stay ahead of the curve. We’ll also cover common pitfalls to avoid and tools that can aid in your analysis. Whether you're a seasoned trader or just starting, these insights from DayTradingBusiness will sharpen your strategy and help you navigate the dynamic trading landscape effectively.

What are the latest emerging day trading patterns to watch?

To stay updated on emerging day trading patterns, follow these strategies:

1. Social Media: Monitor platforms like Twitter and Reddit for real-time insights from traders sharing new patterns.

2. Trading News Websites: Regularly check sites like Bloomberg, CNBC, or specialized trading forums for articles on emerging trends.

3. Technical Analysis Tools: Use charting software that highlights new patterns, such as moving averages or candlestick formations.

4. Trading Courses and Webinars: Participate in sessions by experienced traders who discuss the latest patterns and strategies.

5. Market Scanners: Implement scanners that filter stocks based on volume spikes and price movements, revealing potential patterns quickly.

6. Backtesting Software: Test new patterns against historical data to determine their viability before applying them in live trading.

Stay engaged with these resources to catch the latest patterns as they develop.

How can I identify new day trading patterns in real-time?

To identify new day trading patterns in real-time, follow these strategies:

1. Use Real-Time Scanners: Set up stock scanners that filter stocks based on volume, price movement, and volatility. Look for stocks with unusual trading activity.

2. Monitor News Feeds: Stay updated with financial news and alerts. Use platforms like Twitter, StockTwits, or dedicated financial news apps to catch breaking news that could create new patterns.

3. Follow Social Media and Forums: Engage with day trading communities on Reddit or Discord. Traders often share insights on emerging patterns.

4. Technical Analysis Tools: Utilize charting software with indicators like moving averages or RSI to spot potential patterns. Customize alerts for specific setups.

5. Backtesting: Analyze historical data to find patterns that have emerged during similar market conditions. This can help you anticipate their reappearance.

6. Practice with Simulators: Use trading simulators to test your ability to recognize patterns in real-time without risking capital.

7. Stay Educated: Continuously educate yourself through webinars and courses focused on day trading strategies and emerging market trends.

Implementing these strategies will help you spot new day trading patterns as they develop.

What resources are best for tracking day trading patterns?

The best resources for tracking day trading patterns include:

1. Stock Screeners: Tools like Finviz and Trade Ideas help filter stocks based on specific criteria, revealing patterns.

2. Charting Software: Platforms such as TradingView and Thinkorswim provide advanced charting features to analyze price movements.

3. Online Forums and Communities: Reddit's r/Daytrading and TradingView's social features allow you to discuss patterns with other traders.

4. News Aggregators: Websites like MarketWatch and Yahoo Finance keep you updated on market news that may trigger patterns.

5. Economic Calendars: Tools like Forex Factory show upcoming economic events that can influence trading patterns.

6. Technical Analysis Books: Reading materials like "Technical Analysis of the Financial Markets" by John Murphy can deepen your understanding of patterns.

Utilizing these resources will keep you informed about emerging day trading patterns effectively.

How do social media platforms influence day trading patterns?

Social media platforms influence day trading patterns by driving real-time information sharing, creating hype around stocks, and facilitating discussions among traders. Platforms like Twitter and Reddit can amplify trends quickly, pushing stocks to rise or fall based on sentiment. Traders often monitor these channels for breaking news, tips, and market sentiment, which can lead to sudden spikes in volume. Engaging with these platforms helps traders identify emerging patterns and adjust their strategies accordingly.

What role do trading forums play in discovering patterns?

Trading forums are crucial for discovering patterns in day trading. They provide real-time discussions where traders share insights, strategies, and observations about market movements. Participants often post charts, analysis, and experiences that highlight emerging trends. This collaborative environment helps traders spot patterns faster than through individual research. Engaging with a community allows for diverse perspectives, enhancing pattern recognition and strategy development.

How can I use technical analysis to spot emerging patterns?

To spot emerging patterns using technical analysis, focus on these key steps:

1. Identify Key Indicators: Use moving averages, RSI, and MACD to gauge momentum and trend strength.

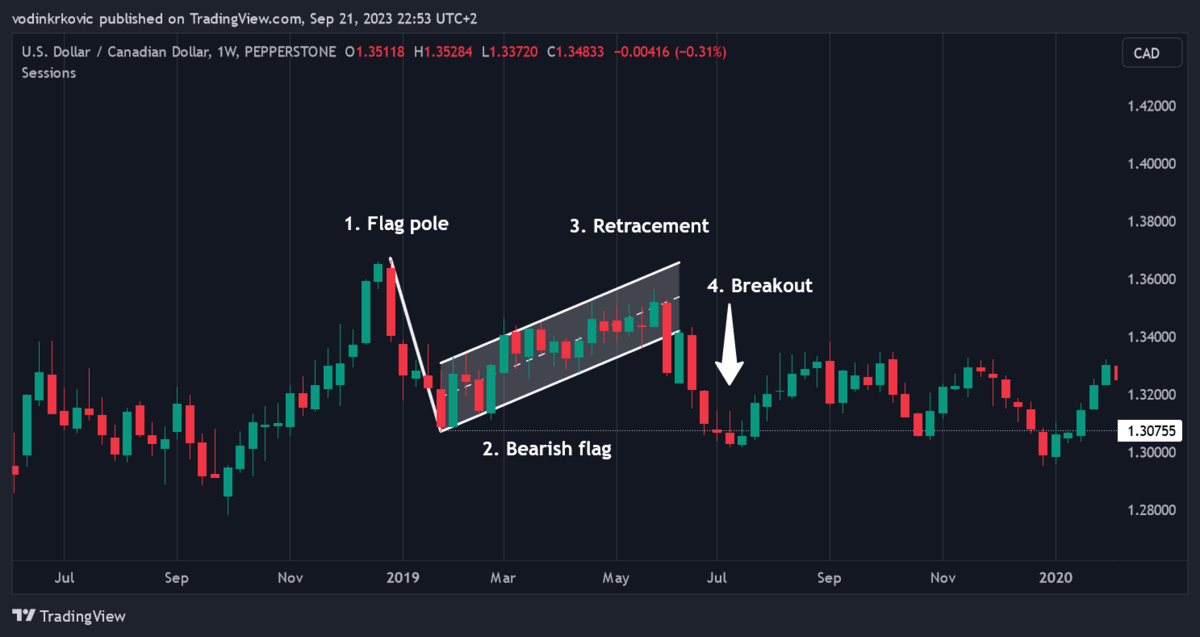

2. Chart Patterns: Look for classic formations like triangles, flags, and head-and-shoulders. These signal potential price movements.

3. Volume Analysis: Monitor trading volume alongside price changes. Increased volume often confirms pattern validity.

4. Time Frames: Analyze multiple time frames. Shorter ones reveal immediate trends, while longer ones provide context.

5. Stay Current: Follow financial news, forums, and social media for real-time insights on emerging trends and sentiment.

By combining these techniques, you can effectively spot and act on emerging trading patterns.

What indicators signal new day trading patterns?

Indicators that signal new day trading patterns include increased trading volume, significant price movements, and the formation of chart patterns like flags, triangles, or head and shoulders. Watch for key support and resistance levels being broken, as well as changes in volatility. Additionally, monitor news events and economic reports that may influence market sentiment. Using technical indicators like moving averages or the Relative Strength Index (RSI) can also help identify emerging trends.

How often should I review day trading patterns?

Review day trading patterns daily. Analyze your trades, market trends, and news that impact stock movements. Check for emerging patterns at least once a week to adapt your strategy. Use tools like charts and news feeds to stay current. Constantly refine your approach based on what you observe.

What are common mistakes when trying to identify trading patterns?

Common mistakes when identifying trading patterns include relying solely on historical data without considering current market conditions, ignoring volume trends that validate patterns, and misinterpreting patterns due to cognitive biases. Traders often overlook the importance of context, such as news events or economic indicators, which can affect pattern reliability. Additionally, failing to use multiple time frames can lead to a skewed perspective on pattern significance. Lastly, not having a clear entry and exit strategy tied to the identified pattern can result in poor trading decisions.

How can I use news and events to stay updated on trading patterns?

Follow these steps to use news and events for tracking trading patterns:

1. Set Up Alerts: Use platforms like Google Alerts or news aggregators to get real-time updates on relevant markets and events.

2. Follow Economic Calendars: Monitor economic calendars for scheduled reports, earnings releases, and major announcements that impact your trading assets.

3. Subscribe to Financial News: Regularly read financial news websites, subscribe to newsletters, or listen to podcasts focused on trading insights.

4. Join Trading Communities: Engage in forums or social media groups where traders discuss current news and its effects on market patterns.

5. Analyze Market Reactions: Observe how the market reacts to news events. Look for patterns that emerge following major announcements.

6. Utilize Technical Analysis: Incorporate news with technical analysis to identify emerging patterns. Look for price movements that coincide with news releases.

7. Backtest Strategies: Test your findings by analyzing historical data to see how past news events affected trading patterns.

By integrating these methods, you can effectively stay updated on emerging day trading patterns influenced by news and events.

Learn about How to Stay Updated on Crypto Market News for Day Trading

What tools can help me analyze day trading patterns?

To analyze day trading patterns, consider using tools like TradingView for charting and technical analysis, Thinkorswim for advanced analytics, and StockCharts for customizable indicators. Additionally, platforms like MetaTrader offer algorithmic trading features. For real-time news and sentiment analysis, try Benzinga or MarketWatch. Using these tools will help you identify and stay updated on emerging day trading patterns effectively.

How do I interpret chart patterns for day trading?

To interpret chart patterns for day trading, focus on key formations like flags, triangles, and head-and-shoulders. Look for breakout points where price action indicates a potential move. Use volume to confirm these patterns; higher volume often signals stronger trends.

Stay updated on emerging patterns by following financial news, joining trading forums, and using charting software that highlights new formations. Keep an eye on social media platforms like Twitter and Reddit for real-time insights and discussions among traders. Regularly review your charts to identify recurring patterns and adjust your strategy accordingly.

Learn about How to Use Chart Patterns for Day Trading Analysis

What are the best websites for day trading pattern analysis?

The best websites for day trading pattern analysis include:

1. TradingView – Offers real-time data, advanced charting tools, and a community for sharing insights.

2. Investopedia – Provides educational content and guides on trading patterns and strategies.

3. StockCharts – Features powerful charting tools and technical indicators for pattern analysis.

4. Finviz – Good for stock screening and visualizing patterns through its heat maps and charts.

5. Yahoo Finance – Offers news, charts, and analysis tools to track emerging patterns.

Stay updated by visiting these sites regularly and engaging with community discussions.

Learn about What Are the Best Tools for Day Trading Analysis?

How can I subscribe to alerts for emerging trading patterns?

To subscribe to alerts for emerging trading patterns, start by choosing a trading platform or app that offers alert features, such as Thinkorswim, TradingView, or MetaTrader. Create an account and customize your settings to receive notifications based on specific criteria like price movements, volume spikes, or technical indicators. You can also follow financial news websites and subscribe to their newsletters for updates. Additionally, consider joining trading forums or communities on social media where members share alerts and insights on emerging patterns.

In what ways can I network with other traders to learn about patterns?

Join online trading forums and social media groups focused on day trading. Attend local trading meetups or workshops to connect with traders in person. Participate in webinars and virtual conferences where experienced traders share insights. Follow influential traders on platforms like Twitter or Instagram for real-time updates. Use Discord or Slack channels dedicated to trading to exchange ideas and strategies. Consider using trading simulators with community features to collaborate and learn from others.

What educational resources are available for mastering day trading patterns?

To master day trading patterns, utilize online courses from platforms like Udemy or Coursera. Follow trading blogs and forums such as Investopedia and Elite Trader for real-time discussions. Subscribe to YouTube channels focused on day trading analysis. Use trading simulators to practice pattern recognition. Join social media groups on platforms like Twitter and Reddit for insights from experienced traders. Consider premium services like TradingView for advanced charting tools. Regularly read financial news to stay informed about market trends.

Learn about Day Trading Brokers with Educational Resources

Conclusion about How to Stay Updated on Emerging Day Trading Patterns

Staying updated on emerging day trading patterns is essential for maximizing trading success. By leveraging real-time resources, social media, and technical analysis, traders can identify new opportunities and avoid common pitfalls. Engaging with trading forums and networking with peers enhances your understanding and keeps you informed. Regularly reviewing and interpreting chart patterns, along with utilizing alerts and educational resources, will give you a competitive edge. For comprehensive insights and tools tailored to your trading journey, explore the offerings of DayTradingBusiness.

Learn about How to Stay Updated on Crypto Market News for Day Trading

Sources:

- Daily Momentum and New Investors in an Emerging Stock Market

- Gambling and online trading: emerging risks of real-time stock and ...

- Measuring Liquidity in Financial Markets

- Dollar Dominance in the International Reserve System: An Update

- AI revolutionizing industries worldwide: A comprehensive overview ...

- Setting the future of digital and social media marketing research ...