Did you know that over 80% of traders fail to stick to their trading plan, often chasing patterns like a cat chases a laser pointer? In this article, we dive into effective strategies for trading patterns in real time, covering essential topics such as identifying common trading patterns quickly, utilizing the best tools for real-time pattern recognition, and understanding the influence of candlestick patterns on trading decisions. We’ll explore the critical role of volume, the application of moving averages, and the impact of different markets on trading strategies. Additionally, learn about the importance of risk management, backtesting best practices, and the psychological factors at play. With insights from DayTradingBusiness, you’ll also discover common mistakes to avoid and how to adjust your strategies for volatile markets, ensuring you're well-equipped for successful day trading.

What Are the Most Common Trading Patterns in Real Time?

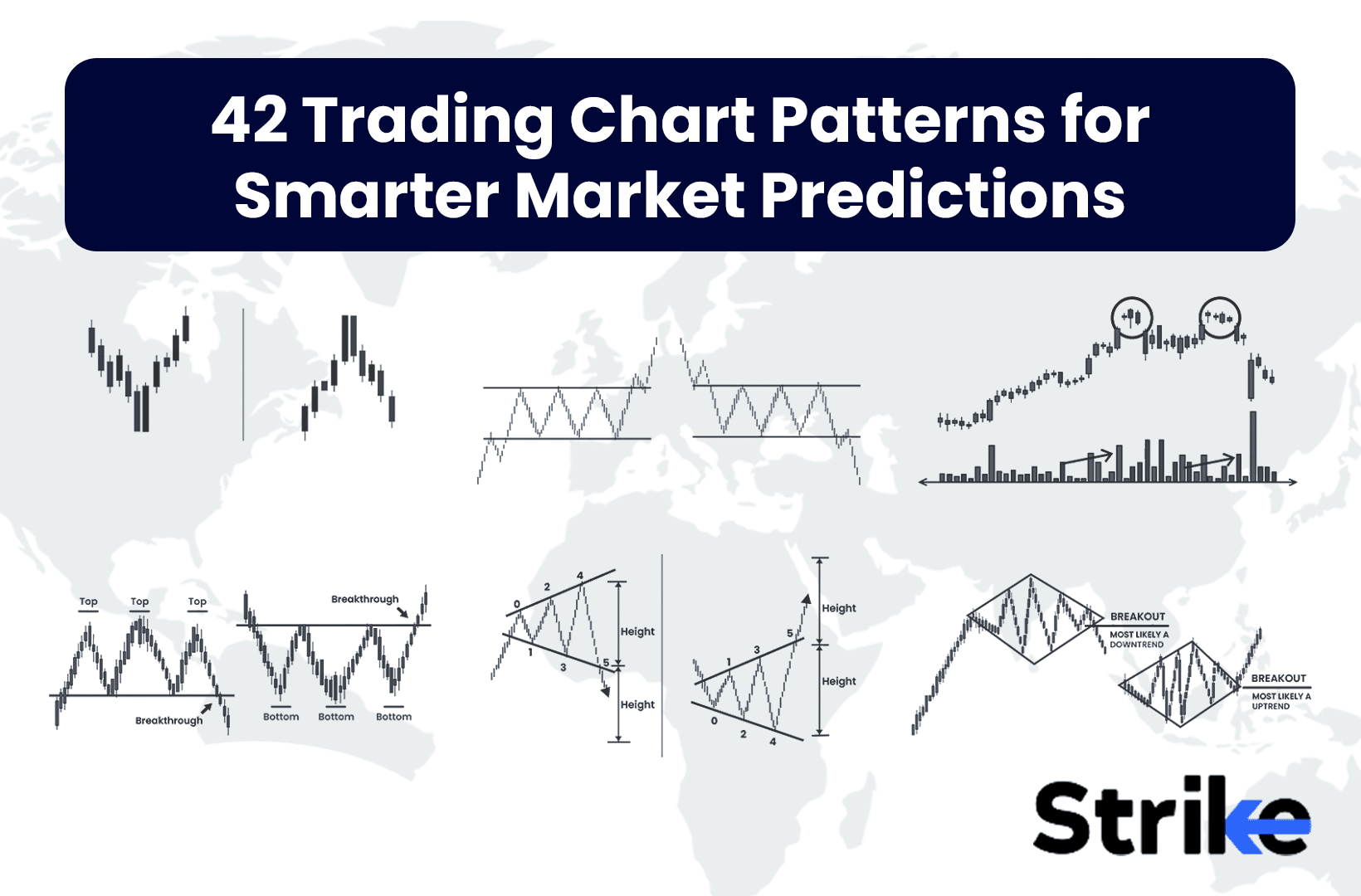

The most common trading patterns in real-time include:

1. Head and Shoulders: Indicates a trend reversal; watch for a peak (head) between two smaller peaks (shoulders).

2. Double Top and Bottom: Double tops signal a bearish reversal, while double bottoms indicate bullish reversals.

3. Triangles: Ascending, descending, and symmetrical triangles show consolidation; breakouts can lead to strong moves.

4. Flags and Pennants: Short-term continuation patterns that appear after a strong price movement, suggesting a brief pause before the trend resumes.

5. Cup and Handle: A bullish continuation pattern; look for a rounded bottom followed by a consolidation period before a breakout.

For effective trading, identify these patterns on charts and confirm with volume and other indicators.

How Can I Identify Trading Patterns Quickly?

To identify trading patterns quickly, focus on these effective strategies:

1. Use Technical Indicators: Leverage tools like moving averages, RSI, and MACD to spot trends and reversals.

2. Chart Patterns: Familiarize yourself with common patterns like head and shoulders, triangles, and flags.

3. Candlestick Analysis: Pay attention to candlestick formations; they can signal potential market reversals or continuations.

4. Time Frames: Analyze multiple time frames. Shorter time frames can provide quicker signals, while longer ones help confirm trends.

5. Screening Software: Utilize trading platforms with built-in pattern recognition tools to automate the identification process.

6. Stay Informed: Keep up with news and events that could influence market behavior, as they often precede pattern formations.

7. Practice: Regularly review past trades to recognize patterns in your own trading history.

By combining these strategies, you can enhance your ability to spot trading patterns in real time.

What Tools Are Best for Real-Time Pattern Recognition?

The best tools for real-time pattern recognition in trading include:

1. TradingView: Offers advanced charting tools and community-driven pattern recognition alerts.

2. MetaTrader 4/5: Supports custom indicators and automated trading strategies for real-time analysis.

3. NinjaTrader: Provides powerful charting capabilities and real-time pattern recognition features.

4. Thinkorswim: Offers a robust platform with real-time data and customizable technical indicators.

5. Amibroker: Known for its high-speed analysis and coding capabilities to recognize patterns instantly.

These tools help traders identify patterns like head and shoulders, flags, and triangles as they form, enhancing decision-making in real time.

How Do Candlestick Patterns Influence Trading Decisions?

Candlestick patterns influence trading decisions by providing visual cues about market sentiment and potential price movements. Traders use patterns like dojis, hammers, and engulfing candles to identify reversals or trends. For instance, a bullish engulfing pattern might prompt a trader to enter a long position, while a bearish engulfing could signal a sell. Timing is crucial; traders often look for confirmation through subsequent price action before making moves. Integrating candlestick patterns with volume analysis and other indicators enhances decision-making and increases the likelihood of successful trades.

What Role Does Volume Play in Trading Patterns?

Volume indicates the strength of a trading pattern. High volume confirms the validity of a price movement, signaling strong interest and potential continuation. Conversely, low volume can suggest weakness, indicating a possible reversal or lack of conviction. Effective traders use volume to validate breakouts or reversals, enhancing their trading strategies in real-time. For example, if a stock breaks resistance with high volume, it’s likely to continue rising, while a break on low volume might fail. Monitoring volume helps traders make informed decisions and refine their strategies.

How Can I Use Moving Averages to Spot Patterns?

To use moving averages for spotting patterns, follow these steps:

1. Select the Right Type: Use a simple moving average (SMA) for smoother trends or an exponential moving average (EMA) for more responsive signals.

2. Identify Crossovers: Look for when a short-term moving average crosses above a long-term moving average (bullish signal) or below it (bearish signal).

3. Trend Confirmation: Confirm the trend direction by observing the price relative to the moving averages. Prices above the moving average suggest an uptrend, while prices below indicate a downtrend.

4. Support and Resistance: Use moving averages as dynamic support or resistance levels. Price bouncing off the moving average can signal potential reversals.

5. Combine with Other Indicators: Integrate moving averages with other tools like RSI or MACD to validate patterns and signals.

6. Watch for Convergence and Divergence: Note when moving averages converge (indicating a potential breakout) or diverge (suggesting a trend continuation).

By applying these strategies, you can effectively spot trading patterns in real time.

What Are Some Effective Strategies for Day Trading Patterns?

1. Identify Common Patterns: Focus on well-known patterns like flags, triangles, and head and shoulders. Recognizing these can help predict price movements.

2. Use Technical Indicators: Combine patterns with indicators like moving averages or RSI to confirm signals and enhance decision-making.

3. Set Clear Entry and Exit Points: Define specific levels for entering and exiting trades based on pattern breakouts and support/resistance levels.

4. Implement Risk Management: Use stop-loss orders to protect against significant losses. Risk no more than 1-2% of your capital per trade.

5. Monitor Volume: Look for increased volume on breakouts to validate the strength of the pattern, as this indicates greater interest.

6. Practice with Simulations: Use paper trading to test strategies in real-time without financial risk, allowing you to refine your approach.

7. Stay Informed: Keep up with market news and events that could impact price movements, as they can affect the reliability of patterns.

8. Review and Adapt: Regularly analyze your trades to identify what works and what doesn’t, adjusting your strategies accordingly.

How Do Different Markets Affect Trading Patterns?

Different markets affect trading patterns by influencing supply and demand dynamics. For instance, in a bullish market, traders tend to buy more, creating upward trends, while in bearish conditions, selling increases, leading to downward trends.

Economic indicators, geopolitical events, and market sentiment can also shift trading patterns. For example, positive earnings reports may lead to increased buying pressure in stocks, while negative news can trigger sell-offs.

To adapt, traders should stay informed on market news, utilize technical analysis to identify trends, and implement risk management strategies. Monitoring volume and price action in real time helps in recognizing shifts in market behavior. Adjusting strategies based on these insights can enhance trading effectiveness.

What Is the Importance of Risk Management in Pattern Trading?

Risk management in pattern trading is crucial because it protects your capital and minimizes losses. It helps you determine the appropriate position size based on your risk tolerance, ensuring you don’t overexpose yourself to any single trade. Implementing stop-loss orders and setting risk-reward ratios are key strategies that provide a safety net. Additionally, effective risk management allows for more disciplined trading, helping you stick to your plan and avoid emotional decisions. By managing risk, you can sustain long-term profitability and navigate market volatility more effectively.

How Can I Combine Technical Indicators with Trading Patterns?

Combine technical indicators with trading patterns by first identifying a trading pattern, like head and shoulders or double tops. Use indicators such as moving averages or RSI to confirm the pattern's validity. For example, if a double bottom forms and the RSI is below 30, it suggests a potential reversal. Set entry points based on breakout levels of the pattern and use volume indicators to gauge strength. Always incorporate stop-loss orders to manage risk effectively.

Learn about How to Use Technical Indicators with Day Trading Patterns

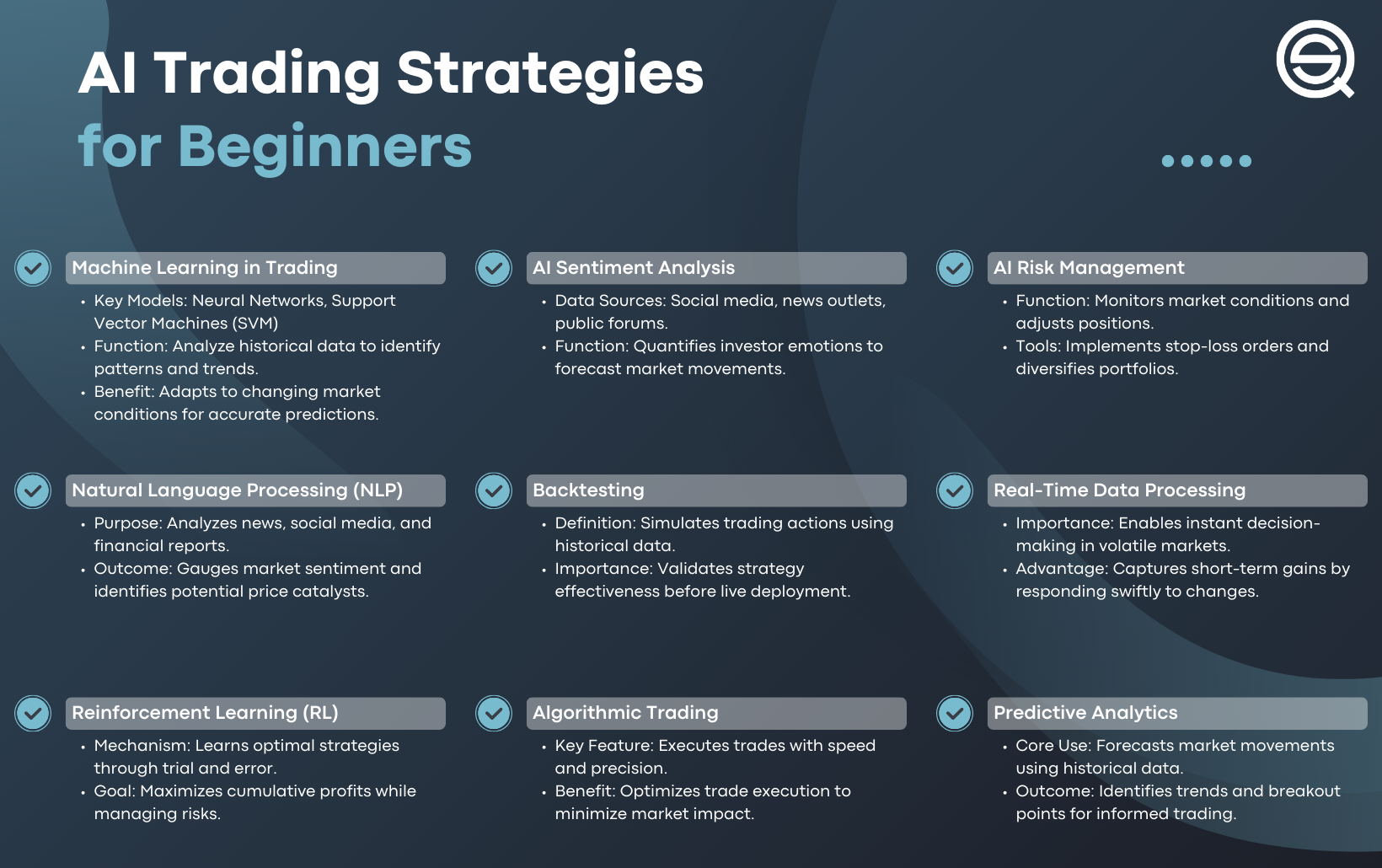

What Are the Best Practices for Backtesting Trading Patterns?

1. Define Clear Objectives: Establish what you aim to achieve with backtesting, like strategy validation or performance metrics.

2. Use Historical Data: Gather high-quality, relevant historical data to ensure accuracy in your backtesting results.

3. Select Appropriate Timeframes: Test patterns across multiple timeframes to understand their effectiveness in different market conditions.

4. Implement Strict Risk Management: Incorporate stop-loss and take-profit levels to assess potential risk and reward in your strategies.

5. Avoid Look-Ahead Bias: Ensure your testing does not use future data to influence past decisions, which can skew results.

6. Analyze Trade Metrics: Focus on key metrics like win rate, average profit/loss, and maximum drawdown to evaluate performance.

7. Incorporate Slippage and Commissions: Factor in realistic trading costs to get a true picture of potential profitability.

8. Use Robust Software: Employ reliable backtesting platforms that allow for detailed analysis and simulation.

9. Validate with Forward Testing: After backtesting, test the strategy in a live environment with a demo account to confirm its effectiveness.

10. Continuously Refine: Regularly review and adjust your strategies based on backtesting results and changing market conditions.

How Do Market News and Events Impact Trading Patterns?

Market news and events significantly influence trading patterns by driving price volatility and investor sentiment. Key economic reports, earnings announcements, and geopolitical developments can trigger rapid buying or selling. Traders can adopt strategies like news-based trading, where they capitalize on short-term price movements following news releases, or trend following, which involves identifying and riding the momentum created by these events. Staying updated with real-time news feeds and using technical analysis can help traders make informed decisions that align with market reactions.

Learn about How News Events Impact Day Trading Decisions

What Psychological Factors Should I Consider in Pattern Trading?

Consider these psychological factors in pattern trading:

1. Emotional Discipline: Stick to your trading plan without letting fear or greed influence decisions.

2. Patience: Wait for patterns to develop fully before entering trades. Rushing can lead to mistakes.

3. Confidence: Trust your analysis and strategies. Doubting yourself can result in hesitance and missed opportunities.

4. Risk Management: Understand your risk tolerance. Don’t let overconfidence lead to larger-than-intended positions.

5. Mindset: Cultivate a growth mindset. Learn from losses instead of dwelling on them.

6. Focus: Minimize distractions while trading. Clear focus helps in recognizing patterns accurately.

7. Stress Management: Develop techniques to handle stress, as high pressure can cloud judgment.

8. Adaptability: Be open to adjusting your strategies based on market changes or new insights.

Incorporating these psychological factors can enhance your effectiveness in pattern trading.

How Can I Develop a Trading Plan Based on Patterns?

To develop a trading plan based on patterns, start by identifying the specific patterns you want to trade, such as head and shoulders, flags, or triangles.

1. Define Entry and Exit Points: Establish clear criteria for entering and exiting trades based on the patterns. For example, enter when the price breaks above a resistance level and exit at a predetermined profit target or stop-loss.

2. Set Risk Management Rules: Determine how much capital you’re willing to risk on each trade, ideally no more than 1-2% of your trading account.

3. Backtest Your Strategy: Test your pattern-based strategy using historical data to see how it would have performed in the past. Adjust your plan based on the results.

4. Keep a Trading Journal: Document each trade, including the pattern identified, entry and exit points, and the outcome. This helps refine your strategy over time.

5. Stay Disciplined: Stick to your plan and avoid emotional trading. Follow your rules for entries, exits, and risk management without deviation.

By focusing on these steps, you can create a robust trading plan that leverages patterns effectively in real-time trading.

Learn about How to Develop a Risk Management Plan for Day Trading

What Are Common Mistakes to Avoid When Trading Patterns?

1. Ignoring Market Context: Always consider the broader market trend before trading a pattern.

2. Overtrading: Resist the urge to trade every pattern you see; focus on high-probability setups.

3. Lack of Risk Management: Set stop-loss orders to prevent significant losses.

4. Misinterpreting Patterns: Ensure you fully understand the pattern before executing a trade.

5. Emotional Trading: Avoid letting fear or greed dictate your decisions.

6. Not Confirming Breakouts: Wait for confirmation of a pattern breakout before entering a trade.

7. Neglecting Volume: Pay attention to volume; patterns are stronger with higher trading volume.

8. Failing to Adapt: Be flexible and adjust your strategy based on real-time market conditions.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How Should I Adjust My Strategies for Volatile Markets?

To adjust your strategies for volatile markets, focus on these key approaches:

1. Tighten Stop Losses: Reduce your stop-loss levels to limit potential losses during rapid price swings.

2. Use Smaller Position Sizes: Decrease the amount you invest per trade to manage risk better.

3. Increase Monitoring: Stay glued to real-time data and news that might impact your trades.

4. Leverage Technical Analysis: Rely on chart patterns and indicators like Bollinger Bands or RSI to identify entry and exit points.

5. Implement Scalping or Day Trading: Take advantage of small price movements rather than holding positions for longer.

6. Diversify: Spread your investments across different assets to mitigate risk.

7. Stay Disciplined: Stick to your trading plan and avoid emotional decisions that could lead to losses.

8. Adapt Quickly: Be ready to change your strategy based on market conditions and price action.

These adjustments can help you navigate the challenges of volatile markets effectively.

Conclusion about Effective Strategies for Trading Patterns in Real Time

Mastering trading patterns in real time requires a solid understanding of market dynamics, effective tools, and a disciplined approach. By leveraging candlestick patterns, volume analysis, and moving averages, traders can enhance their pattern recognition skills and make informed decisions. Incorporating risk management and backtesting practices further strengthens your strategy. Always consider the influence of market news and psychological factors on your trading decisions. For ongoing support and detailed insights, DayTradingBusiness is here to guide you in optimizing your trading strategy.

Sources:

- Utilizing RNN for Real-time Cryptocurrency Price Prediction and ...

- An efficient hybrid approach for forecasting real-time stock market ...

- Setting the future of digital and social media marketing research ...

- A new key performance indicator model for demand forecasting in ...

- AI-powered ensemble machine learning to optimize cost strategies ...