Did you know that the majority of day traders spend more time analyzing charts than they do sleeping? In the fast-paced world of day trading, mastering advanced pattern recognition can be the key to gaining an edge over the market. This article delves into the intricacies of pattern recognition, explaining its significance for experienced traders, the key patterns to focus on, and how machine learning can enhance analysis. We’ll explore essential tools, the impact of candlestick patterns, and the interplay between price action and technical indicators. Additionally, we’ll highlight common mistakes, backtesting strategies, and the psychological aspects of pattern recognition. Finally, discover how to adapt to evolving market conditions and leverage resources for continuous learning. Join DayTradingBusiness to unlock the full potential of advanced pattern recognition in your trading strategy!

What is Advanced Pattern Recognition in Day Trading?

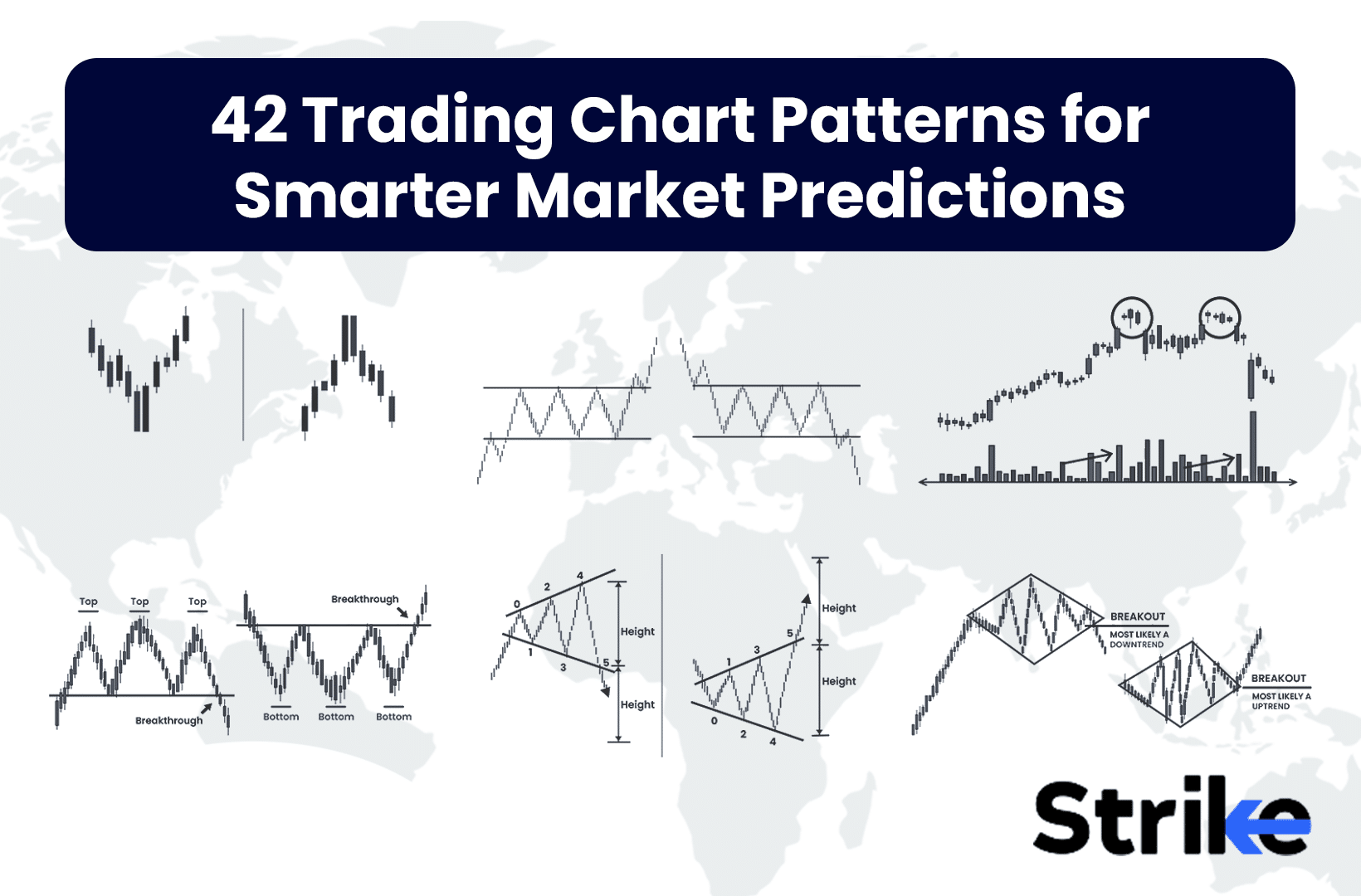

Advanced Pattern Recognition in day trading involves using sophisticated algorithms and tools to identify complex price patterns in market data. This technique helps traders spot trends, reversals, and potential breakout points by analyzing historical price movements and volume. Experienced day traders leverage these patterns, such as head and shoulders, flags, and Fibonacci retracements, to make informed decisions. By integrating advanced pattern recognition with other technical indicators, traders enhance their strategies and improve their chances of success in fast-paced markets.

How Can Experienced Traders Use Pattern Recognition?

Experienced traders can use pattern recognition to identify price trends, reversals, and market sentiment. By analyzing historical price movements and formations like head and shoulders, flags, or triangles, they can predict future price action. This helps in making informed decisions on entry and exit points. Additionally, combining pattern recognition with volume analysis and technical indicators enhances accuracy, allowing traders to capitalize on short-term opportunities. Regularly reviewing past trades and patterns strengthens their skills, making them more adept at recognizing and acting on emerging trends.

What Are the Key Patterns to Identify in Day Trading?

Key patterns to identify in day trading include:

1. Head and Shoulders: Indicates a reversal trend; watch for the left shoulder, head, and right shoulder formation.

2. Triangles: Ascending, descending, and symmetrical triangles signal potential breakouts; look for volume spikes at breakouts.

3. Flags and Pennants: Short-term continuation patterns; identify a sharp price movement followed by a consolidation period.

4. Double Tops and Bottoms: Signify trend reversals; a double top indicates a bearish reversal, while a double bottom suggests bullish potential.

5. Support and Resistance Levels: Monitor these price points to anticipate potential reversals or breakouts.

Focus on volume and market sentiment to confirm patterns and enhance trading decisions.

How Does Machine Learning Enhance Pattern Recognition?

Machine learning enhances pattern recognition in day trading by analyzing vast amounts of historical data to identify market trends and anomalies. It uses algorithms to detect subtle patterns that humans might miss, improving prediction accuracy. Techniques like neural networks can adapt to new data, refining their models over time for better decision-making. Additionally, machine learning can automate trade execution based on identified patterns, increasing efficiency and speed in fast-moving markets. This leads to more informed trading strategies and potentially higher profits for experienced traders.

What Tools Are Best for Advanced Pattern Recognition?

The best tools for advanced pattern recognition in day trading include:

1. TradingView – Offers customizable charting tools and technical indicators.

2. MetaTrader 4/5 – Provides advanced charting capabilities and algorithmic trading options.

3. NinjaTrader – Features extensive market analysis tools and pattern recognition features.

4. Thinkorswim – Equipped with advanced technical analysis tools and scanning capabilities.

5. QuantConnect – Ideal for algorithmic traders, allowing for custom strategies and pattern recognition.

6. Amibroker – A powerful tool for backtesting and advanced charting.

Choose based on your trading style and specific needs.

How Can Candlestick Patterns Improve Trading Strategies?

Candlestick patterns can enhance trading strategies by providing visual insights into market sentiment and potential price reversals. Experienced day traders use these patterns to identify entry and exit points, improving timing and decision-making. For example, patterns like the "hammer" signal a potential bullish reversal, while "shooting stars" indicate bearish trends. By combining candlestick analysis with other technical indicators, traders can confirm signals and reduce risks, ultimately refining their strategies for better performance.

What Role Does Price Action Play in Pattern Recognition?

Price action is crucial in pattern recognition as it reflects real-time market sentiment and trends. Experienced day traders analyze price movements to identify patterns like flags, triangles, and head and shoulders. These patterns signal potential reversals or continuations, guiding entry and exit points. By observing price action, traders can confirm the strength of a pattern, adjust their strategies, and manage risk effectively. Ultimately, price action serves as the foundation for making informed trading decisions based on recognized market behaviors.

How to Combine Technical Indicators with Pattern Recognition?

To combine technical indicators with pattern recognition, first identify key patterns like head and shoulders or triangles on your charts. Then, select relevant technical indicators, such as moving averages or RSI, to confirm these patterns. For instance, if you spot a bullish flag pattern, use the RSI to ensure it’s not overbought. This dual approach enhances your trading strategy, improving entry and exit points. Always backtest your combination to see how well they work together in past market conditions.

What Common Mistakes Do Traders Make with Patterns?

Traders often misinterpret patterns, leading to poor decisions. Common mistakes include:

1. Ignoring Context: Patterns need to be analyzed within the broader market context. Trading a pattern without considering trends or news can result in losses.

2. Overconfidence in Pattern Recognition: Relying solely on patterns without confirming signals from other indicators can lead to false entries.

3. Neglecting Volume: Patterns should be validated by volume; low volume can indicate a lack of conviction in the pattern.

4. Late Entries and Exits: Traders often enter after a pattern has formed completely, missing optimal entry points, or exit too early, ignoring potential gains.

5. Failure to Adapt: Markets change, and rigidly sticking to old patterns can lead to missed opportunities or losses.

6. Not Setting Stop Losses: Traders sometimes neglect to set stop losses when trading patterns, increasing risk exposure.

7. Confirmation Bias: Traders may force a pattern onto price action that isn't there, leading to poor trades.

Avoiding these mistakes requires a disciplined approach, continuous learning, and integrating multiple analysis techniques.

How to Backtest Pattern Recognition Strategies Effectively?

To backtest pattern recognition strategies effectively, follow these steps:

1. Define Patterns: Clearly the specific patterns you want to identify, such as head and shoulders or triangles.

2. Select a Reliable Platform: Use trading software like MetaTrader, TradingView, or ThinkorSwim that supports backtesting.

3. Gather Historical Data: Ensure you have high-quality historical price data for the assets you’re trading.

4. Create a Testing Framework: Develop a systematic approach to identify patterns, including entry and exit rules, stop-loss levels, and target prices.

5. Run Backtests: Execute the backtest on your selected platform, applying your defined rules over historical data to see how your strategy would have performed.

6. Analyze Results: Review metrics like win rate, profit factor, drawdowns, and overall profitability to assess effectiveness.

7. Refine Your Strategy: Based on the results, tweak your parameters and rules to improve performance.

8. Validate with Forward Testing: After backtesting, validate your strategy in a simulated trading environment before deploying it live.

This process will help you effectively evaluate the viability of your pattern recognition strategies.

What Are the Psychological Aspects of Pattern Recognition?

Psychological aspects of pattern recognition in advanced day trading include cognitive biases, emotional responses, and decision-making processes. Traders often rely on heuristics, which can lead to overconfidence or confirmation bias when identifying patterns. Stress and pressure can impair judgment, causing misinterpretation of signals. Successful traders cultivate discipline, patience, and a growth mindset to manage these psychological challenges effectively. They also use journaling to reflect on their decisions and improve pattern recognition skills over time.

How Can Traders Avoid Overfitting in Pattern Analysis?

Traders can avoid overfitting in pattern analysis by following these strategies:

1. Use Simpler Models: Stick to basic patterns rather than complex algorithms. This reduces the risk of capturing noise.

2. Cross-Validation: Split data into training and testing sets. This helps ensure that patterns perform well on unseen data.

3. Limit Variables: Focus on a few key indicators rather than including too many variables, which can lead to overfitting.

4. Regularization Techniques: Apply methods like Lasso or Ridge regression to penalize overly complex models.

5. Look for Consistency: Ensure patterns are consistent across different time frames and market conditions before relying on them.

6. Avoid Curve Fitting: Don’t tailor your analysis to fit historical data too closely; aim for generalizable insights.

7. Backtesting with Caution: Test strategies on historical data but remain aware that past performance doesn’t guarantee future results.

Implementing these strategies can enhance your pattern recognition while minimizing the risk of overfitting.

What Are the Benefits of Real-Time Pattern Recognition?

Real-time pattern recognition allows experienced day traders to quickly identify market trends and price movements, enhancing decision-making. It improves trade execution speed, enabling traders to capitalize on fleeting opportunities. This technology reduces emotional trading by relying on data-driven insights rather than gut feelings. Additionally, it helps in risk management by highlighting potential reversals or breakouts, allowing traders to adjust their strategies on the fly. Overall, it increases profitability by providing a competitive edge in fast-moving markets.

How Do Market Conditions Affect Pattern Recognition?

Market conditions significantly impact pattern recognition in day trading. In bullish markets, patterns like flags and breakouts often yield reliable signals, as momentum is strong. Conversely, in bearish markets, reversal patterns may be more prevalent, but they can also lead to false signals due to increased volatility. High volatility can obscure patterns, making them harder to identify, while low volatility can lead to fewer opportunities. Experienced traders adapt their strategies based on these conditions, using tools like volume analysis and price action to enhance their recognition of patterns.

Learn about How Market Conditions Affect HFT Strategies

What Resources Are Available for Learning Advanced Patterns?

For advanced pattern recognition in day trading, consider these resources:

1. Books: "Technical Analysis of the Financial Markets" by John Murphy and "Encyclopedia of Chart Patterns" by Thomas Bulkowski provide in-depth insights.

2. Online Courses: Platforms like Udemy and Coursera offer specialized courses on advanced trading strategies and pattern recognition.

3. Webinars: Many trading firms and educators host live webinars focusing on advanced patterns and market analysis.

4. Trading Forums: Join communities like Elite Trader or Trade2Win to discuss patterns with experienced traders.

5. Software Tools: Utilize platforms like TradingView or Thinkorswim for chart analysis and pattern recognition features.

6. YouTube Channels: Follow channels like Rayner Teo or SMB Capital for visual learning on advanced techniques.

7. Mentorship Programs: Consider one-on-one coaching with seasoned traders who can provide personalized guidance on recognizing complex patterns.

Engage with these resources to enhance your advanced pattern recognition skills in day trading.

How Do Experienced Traders Adapt to Changing Patterns?

Experienced traders adapt to changing patterns by constantly analyzing market data and adjusting their strategies. They use advanced pattern recognition techniques, such as identifying key support and resistance levels, employing technical indicators, and utilizing price action analysis. Regularly backtesting strategies helps them refine their approach and anticipate shifts in market behavior. Additionally, they stay informed about economic news and events that could impact trends, ensuring they can pivot quickly. Flexibility and continuous learning are essential for maintaining an edge in dynamic market conditions.

Conclusion about Advanced Pattern Recognition for Experienced Day Traders

Incorporating advanced pattern recognition techniques can significantly enhance the trading strategies of experienced day traders. By mastering key patterns and leveraging machine learning tools, traders can improve their decision-making and adapt to ever-changing market conditions. It is essential to remain vigilant about common pitfalls and continuously backtest strategies to optimize performance. For those looking to deepen their understanding and refine their skills, resources provided by DayTradingBusiness are invaluable in navigating the complexities of day trading effectively.

Learn about Pattern Recognition Techniques for Day Traders

Sources:

- A parallel hybrid neural networks model for forecasting returns with ...

- Perception and sensing for autonomous vehicles under adverse ...

- Financial Fraud: A Review of Anomaly Detection Techniques and ...

- Stock Market Prediction with High Accuracy using Machine Learning ...

- Understanding the potential applications of Artificial Intelligence in ...

- Shortlisting machine learning-based stock trading recommendations ...