Did you know that the average human attention span is now shorter than that of a goldfish? In the fast-paced world of day trading, mastering order flow can be your secret weapon to staying ahead. This article dives into the essentials of order flow, explaining its role in predicting market trends and enhancing trading decisions. You'll learn how to read order flow charts, utilize key indicators, and differentiate between order flow and price action. Discover strategies for identifying support and resistance, spotting market reversals, and integrating order flow with technical analysis. Plus, find out what tools are essential for successful order flow trading and how to practice effectively. With insights from DayTradingBusiness, you’ll be equipped to navigate the complexities of order flow and make informed trading choices.

What is order flow in day trading?

Order flow in day trading refers to the analysis of the buy and sell orders in the market to gauge supply and demand. It helps traders understand market sentiment and predict price movements. By observing how orders are placed and executed, traders can identify trends, reversals, and potential support and resistance levels. This data-driven approach allows day traders to make informed decisions based on real-time market activity.

How does order flow analysis improve trading decisions?

Order flow analysis improves trading decisions by providing insight into market dynamics through real-time data on buy and sell orders. It helps traders identify support and resistance levels based on actual market activity, allowing for more informed entry and exit points. By observing the volume and speed of orders, traders can gauge market sentiment, anticipate price movements, and react quickly to changes. This analysis allows for better risk management and enhances the ability to spot potential reversals or continuations in trends, ultimately leading to more profitable trades.

What are the key components of order flow?

The key components of order flow include:

1. Bid and Ask Prices: The highest price buyers are willing to pay and the lowest price sellers will accept.

2. Trade Volume: The number of shares or contracts traded, indicating market activity.

3. Market Orders: Orders executed immediately at the current market price, showing urgency.

4. Limit Orders: Orders set at specific prices, reflecting trader expectations and resistance levels.

5. Order Book: A real-time list of buy and sell orders that provides insights into market depth.

6. Price Action: The movement of price over time, influenced by supply and demand dynamics.

7. Liquidity: The ease of buying or selling without affecting the price, which impacts order execution.

Understanding these components helps day traders predict market trends and make informed decisions.

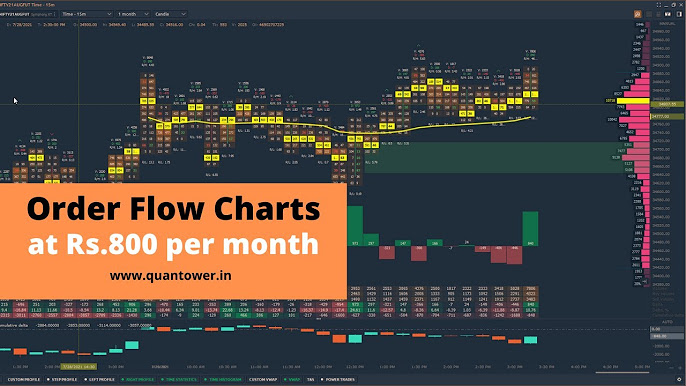

How can I read order flow charts effectively?

To read order flow charts effectively, focus on these key steps:

1. Understand Market Depth: Analyze the bid and ask sizes to gauge buying and selling pressure. Look for large orders that may indicate potential support or resistance levels.

2. Watch Price Action: Observe how price reacts to significant volume spikes. A price move accompanied by high volume often signals strength in that direction.

3. Identify Order Flow Imbalances: Look for discrepancies between buy and sell orders. Strong buying or selling imbalances can predict short-term trends.

4. Use Time and Sales Data: Review the transactions as they occur. This helps you see real-time activity and understand market sentiment.

5. Combine with Technical Analysis: Integrate order flow insights with technical indicators to confirm your predictions.

6. Practice Regularly: Gain experience by continuously analyzing different charts and scenarios to improve your interpretation skills.

By focusing on these elements, you can enhance your ability to predict market trends in day trading using order flow.

What indicators help analyze order flow?

Key indicators for analyzing order flow include:

1. Volume: Look for spikes in volume to identify strong buying or selling pressure.

2. Order Book Data: Monitor bid-ask spreads and levels of buy and sell orders to gauge market sentiment.

3. Delta: Analyze the difference between buying and selling volume to see who is in control.

4. Footprint Charts: Use these to visualize where trades occur at various price levels, showing market interest.

5. Cumulative Delta: Track the net buying or selling over time to identify trends.

6. Market Depth: Assess the number of orders at different price levels to understand potential support and resistance zones.

These indicators collectively provide insights into market trends and trader behavior for effective day trading.

How does order flow relate to market trends?

Order flow reveals real-time buying and selling activity, helping traders gauge market sentiment. By analyzing order volume and price levels, traders can identify potential trends. Increased buying typically signals a bullish trend, while selling often indicates bearish movement. Monitoring large orders can also highlight support and resistance levels, influencing future price action. Understanding these dynamics allows day traders to make informed predictions about market trends.

What is the difference between order flow and price action?

Order flow refers to the actual buy and sell orders in the market, showing how much volume is being traded at specific price levels. Price action, on the other hand, is the movement of prices over time, reflecting historical data and market sentiment without directly considering the underlying orders. In day trading, analyzing order flow helps traders predict market trends by identifying where significant buying or selling interest lies, while price action provides insights into market behavior and potential reversal points based on past price movements.

How can I identify support and resistance using order flow?

To identify support and resistance using order flow in day trading, focus on the following steps:

1. Analyze Order Book: Look for areas with high buy and sell orders. A concentration of buy orders indicates potential support, while sell orders signal resistance.

2. Watch Price Reactions: Observe how price behaves around these levels. If price bounces off a level repeatedly, it's likely support or resistance.

3. Volume Analysis: High volume at specific price points can reinforce support or resistance. Increasing volume on price breaks can confirm these levels.

4. Use Footprint Charts: These charts show volume at price levels, helping you visualize where buying or selling pressure is strongest.

5. Track Large Trades: Significant trades can create psychological barriers. Note where large orders are placed; these can indicate potential reversal points.

6. Identify Breaks and Retests: When price breaks through a support or resistance level, watch for a retest. If it holds, the level has shifted.

By combining these techniques, you can effectively identify and utilize support and resistance in your day trading strategy.

What role does volume play in order flow analysis?

Volume is crucial in order flow analysis as it indicates the strength of price movements. High volume often confirms trends, suggesting strong buyer or seller interest. When analyzing order flow, spikes in volume can signal reversals or continuations, helping traders identify potential entry and exit points. Low volume, on the other hand, may indicate weak trends or potential consolidation. Understanding volume alongside order flow helps traders gauge market sentiment and make informed decisions in day trading.

How can I use order flow to spot market reversals?

To use order flow to spot market reversals, focus on monitoring the volume and price action at key levels. Look for significant buying or selling pressure that disrupts the current trend. Pay attention to large orders (iceberg orders) and changes in the order book, as they can indicate strong interest at specific price points.

Watch for divergence between price movement and order flow indicators, such as the cumulative delta. If prices are making new highs but order flow shows decreasing buying volume, a reversal may be imminent. Additionally, look for imbalances where sell orders exceed buy orders at resistance levels or vice versa at support levels.

By analyzing these factors, you can better identify potential market reversals in day trading.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What strategies utilize order flow for day trading?

1. Analyzing Volume Profiles: Look for areas of high volume on price charts to identify support and resistance levels where traders are likely to enter or exit positions.

2. Reading the Order Book: Monitor the order book to see real-time buy and sell orders, which helps predict short-term price movements based on supply and demand.

3. Using Footprint Charts: Footprint charts display the volume traded at specific price levels, allowing traders to spot where buying or selling pressure is strongest.

4. Identifying Imbalances: Look for imbalances in buy and sell orders; significant buyer or seller presence can signal upcoming price moves.

5. Tracking Market Sentiment: Analyze the flow of market orders to gauge trader sentiment and adjust strategies based on bullish or bearish trends.

6. Following Large Trades: Pay attention to large trades executed in the market, as they can indicate the actions of institutional players and influence price direction.

7. Scalping with Speed: Use order flow to make quick decisions in scalping by reacting to immediate changes in market orders and liquidity.

Learn about Strategies for Effective Order Flow Analysis in Day Trading

How can I combine order flow with technical analysis?

To combine order flow with technical analysis in day trading, start by observing real-time order flow data, like volume and trade size, to gauge market sentiment. Use this data to confirm technical signals from charts, such as support and resistance levels.

For example, if a stock approaches a resistance level with high selling volume, it may indicate a potential reversal. Conversely, if you see strong buying interest near a support level, it could suggest a continuation of the trend.

Incorporate tools like footprint charts or delta analysis to visualize order flow alongside traditional indicators, such as moving averages or RSI. This synergy allows for more informed decisions, enhancing your ability to predict market trends effectively.

What tools are essential for order flow trading?

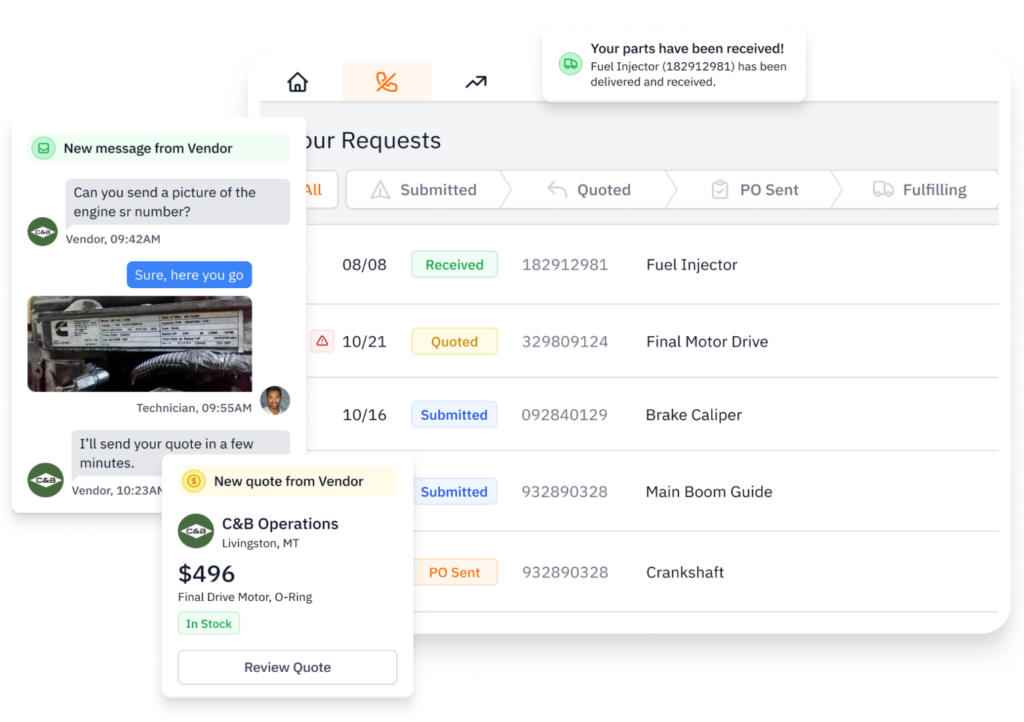

Essential tools for order flow trading include a reliable trading platform with advanced charting capabilities, a depth of market (DOM) tool to view real-time buy and sell orders, and a volume profile indicator to analyze price levels. Additionally, a time and sales tool helps track actual trades, while a footprint chart provides insights into buying and selling pressure. Finally, a news feed is crucial for understanding market context and potential impacts on order flow.

Learn about Essential Tools for Order Flow Analysis in Day Trading

How can I practice order flow trading strategies?

To practice order flow trading strategies, start by using a trading platform that offers real-time order flow data. Focus on the following steps:

1. Study Order Flow Basics: Understand how order flow works, including concepts like bid-ask spreads, volume, and market depth.

2. Use a DOM (Depth of Market): Monitor the DOM to see live buy and sell orders. This helps identify areas of support and resistance.

3. Analyze Volume: Pay attention to volume spikes. High volume can indicate strong buying or selling interest.

4. Simulate Trades: Use a demo account to simulate trades based on order flow signals without risking real money.

5. Review Historical Data: Look at past order flow data to identify patterns and trends that led to price movements.

6. Keep a Trading Journal: Document your trades and the order flow signals that influenced your decisions. Review this regularly to learn and adjust your strategies.

7. Join Trading Communities: Engage with other traders to share insights and strategies related to order flow trading.

By consistently applying these practices, you'll enhance your understanding and effectiveness in using order flow to predict market trends in day trading.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What are common mistakes in order flow trading?

Common mistakes in order flow trading include:

1. Ignoring market context: Focusing solely on order flow without considering market trends can lead to poor decisions.

2. Overtrading: Engaging in too many trades based on minor order flow signals can increase risk and reduce profitability.

3. Misinterpreting signals: Confusing volume spikes with genuine market interest may result in false entries or exits.

4. Lack of risk management: Failing to set stop-loss orders can expose traders to significant losses.

5. Emotional trading: Letting emotions dictate trades instead of relying on data can derail strategies.

6. Neglecting timeframes: Using mismatched timeframes for analysis can lead to inconsistent results.

7. Poor record-keeping: Not tracking trades and outcomes prevents learning from mistakes and improving strategies.

Learn about Common Mistakes in Order Flow Analysis for Day Traders

How can I track order flow in real-time?

To track order flow in real-time for day trading, use a combination of tools and techniques:

1. Level II Quotes: Access Level II data through your trading platform. This shows real-time bids and asks, helping you see market depth.

2. Time and Sales: Monitor the time and sales window to view actual trade executions. This reveals buying and selling momentum.

3. Volume Profile: Utilize volume profile indicators to analyze trading volume at specific price levels over time. This helps identify support and resistance.

4. Order Flow Software: Consider specialized order flow trading software like Sierra Chart or Jigsaw Trading. These provide advanced analytics and visualizations.

5. Market Depth: Keep an eye on the market depth chart to see pending orders. It helps predict potential price movements based on existing orders.

6. Tape Reading: Practice reading the tape to interpret price action and volume in real time. This skill enhances your understanding of market sentiment.

Implement these strategies to effectively track real-time order flow and improve your day trading decisions.

Conclusion about Using Order Flow to Predict Market Trends in Day Trading

Incorporating order flow analysis into your day trading strategy can significantly enhance your market predictions and decision-making. By understanding the dynamics of order flow and its relationship with market trends, traders can identify key support and resistance levels, spot potential reversals, and improve their overall trading effectiveness. Utilizing the right tools and strategies, along with a solid grasp of order flow concepts, empowers traders to navigate the complexities of the market more successfully. For a deeper understanding and further assistance, consider exploring the resources offered by DayTradingBusiness.

Learn about Day Trading Indicators That Predict Market Trends