Did you know the average day trader spends more time analyzing charts than a chef does deciding what to cook for dinner? Understanding order flow in day trading can turn your culinary chaos into a well-prepared feast of profits. This article dives into the essentials of order flow—explaining what it is, its significance in enhancing trading strategies, and how to read order flow charts effectively. We will also cover critical components like liquidity, market versus limit orders, and the impact of news events. Plus, we'll highlight common mistakes to avoid and tools that can streamline your analysis. With insights from DayTradingBusiness, you’ll learn how to leverage order flow for better decision-making and risk management, ultimately sharpening your trading edge.

What is order flow in day trading?

Order flow in day trading refers to the analysis of the buying and selling activity in the market, showing how orders are being executed and affecting price movements. It helps traders understand market sentiment and identify potential trends by tracking the volume and speed of orders. By focusing on order flow, day traders can make informed decisions based on real-time market dynamics rather than relying solely on charts or indicators.

How does order flow analysis improve trading strategies?

Order flow analysis improves trading strategies by providing insights into market dynamics and real-time supply and demand. By tracking the volume and direction of trades, traders can identify potential reversals and continuations. This analysis helps in making informed decisions, optimizing entry and exit points, and managing risk effectively. Understanding where large orders are placed can also highlight key support and resistance levels, enhancing overall strategy effectiveness.

Why is understanding order flow crucial for day traders?

Understanding order flow is crucial for day traders because it reveals real-time market dynamics and trader sentiment. By analyzing order flow, traders can identify support and resistance levels, anticipate price movements, and make informed decisions. It helps in recognizing buying and selling pressure, which is essential for executing trades at optimal times. Additionally, understanding order flow allows traders to spot potential reversals and trends, improving their overall trading strategy.

What are the key components of order flow in trading?

The key components of order flow in trading are:

1. Market Orders: These are executed immediately at the current market price, reflecting real-time demand and supply.

2. Limit Orders: These set a specific price to buy or sell, showing trader intent and potential support or resistance levels.

3. Order Book: This lists all pending buy and sell orders, providing insight into market depth and liquidity.

4. Trade Volume: The number of shares or contracts traded indicates strength or weakness of price movements.

5. Time and Sales: This displays actual trades executed, helping traders gauge momentum and market activity.

6. Bid-Ask Spread: The difference between the highest bid and lowest ask reflects market sentiment and liquidity.

Understanding these components helps traders make informed decisions based on real-time market dynamics.

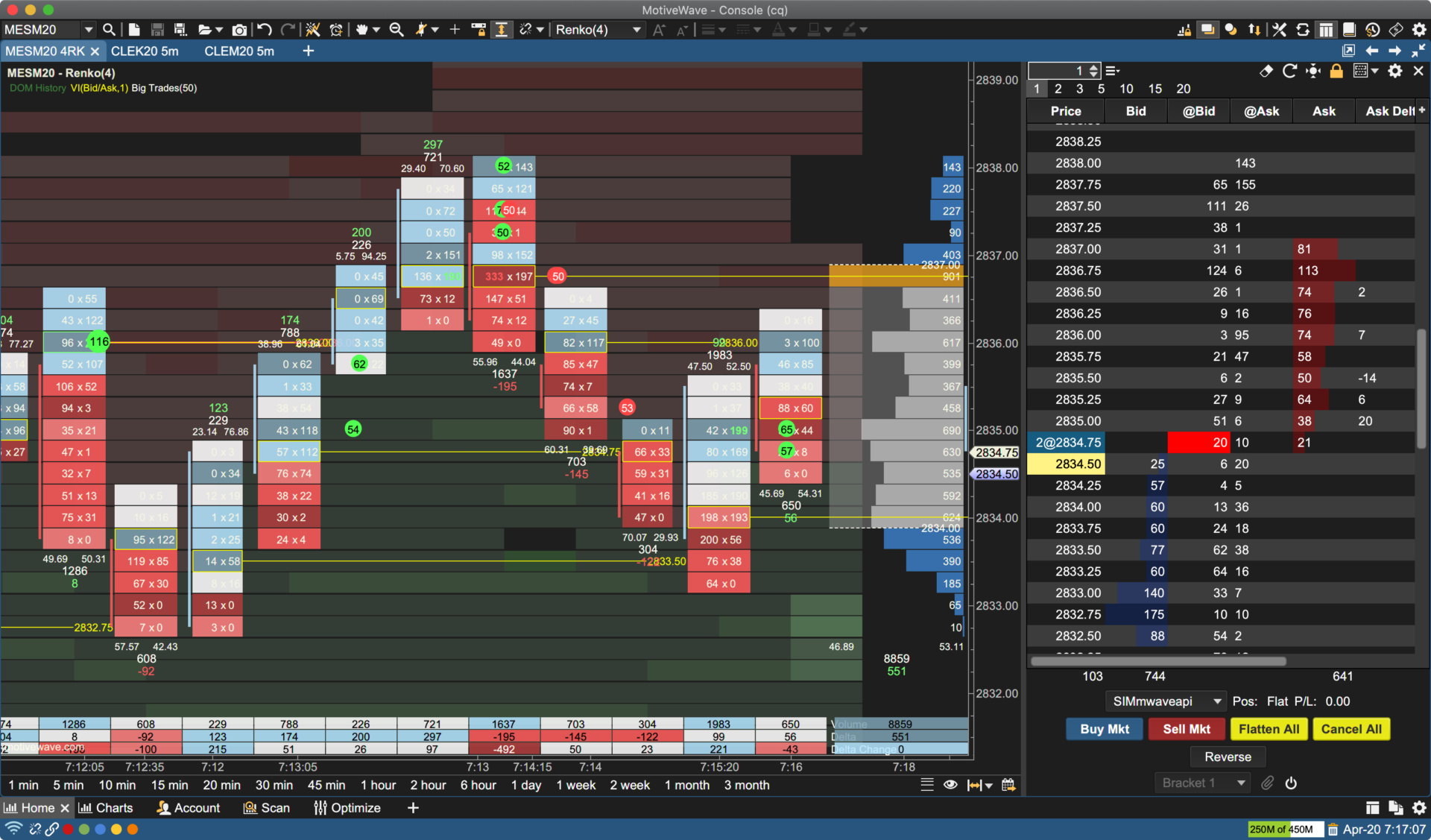

How can I read order flow charts effectively?

To read order flow charts effectively, focus on these key steps:

1. Identify Key Levels: Look for support and resistance zones where price action tends to react.

2. Analyze Volume: Pay attention to spikes in volume; they often indicate strong buying or selling interest.

3. Watch the Bid-Ask Spread: A narrow spread suggests liquidity, while a wide spread may indicate uncertainty.

4. Look for Imbalances: Notice when buy orders significantly outnumber sell orders and vice versa; this can signal potential price movement.

5. Track Order Types: Understand the difference between market orders and limit orders; market orders execute immediately, while limit orders wait for a specific price.

6. Monitor Time and Sales: Check the tape for real-time transactions to gauge market sentiment.

7. Practice with Simulations: Use demo accounts to familiarize yourself with interpreting order flow without financial risk.

By combining these strategies, you can gain a clearer understanding of market dynamics and make informed trading decisions.

What tools are best for order flow analysis in day trading?

The best tools for order flow analysis in day trading include:

1. BookMap: Offers detailed visualizations of market depth and order flow.

2. Sierra Chart: Provides advanced charting capabilities and order flow tools.

3. Jigsaw Trading: Focuses on order flow and market depth analysis.

4. NinjaTrader: Includes features for tracking order flow and managing trades.

5. TradeStation: Offers customizable tools for analyzing order flow and volume.

These tools help traders understand market dynamics and make informed decisions.

How does order flow differ from traditional technical analysis?

Order flow focuses on the actual buying and selling activity in the market, highlighting how trades impact price movement. Traditional technical analysis relies on historical price charts and indicators to predict future price movements. While technical analysis looks at patterns and trends, order flow reveals real-time supply and demand dynamics, allowing traders to see where large orders are placed. This insight helps in making more informed decisions about market direction, whereas traditional analysis often lags behind current market conditions.

What role does liquidity play in order flow trading?

Liquidity is crucial in order flow trading because it ensures that trades can be executed quickly and at desired prices. High liquidity means tighter spreads and less slippage, allowing traders to enter and exit positions efficiently. It also provides better visibility into market orders, helping traders make informed decisions based on real-time data. In essence, liquidity enhances the effectiveness of order flow strategies by facilitating smoother transactions and reducing the risk of market impact.

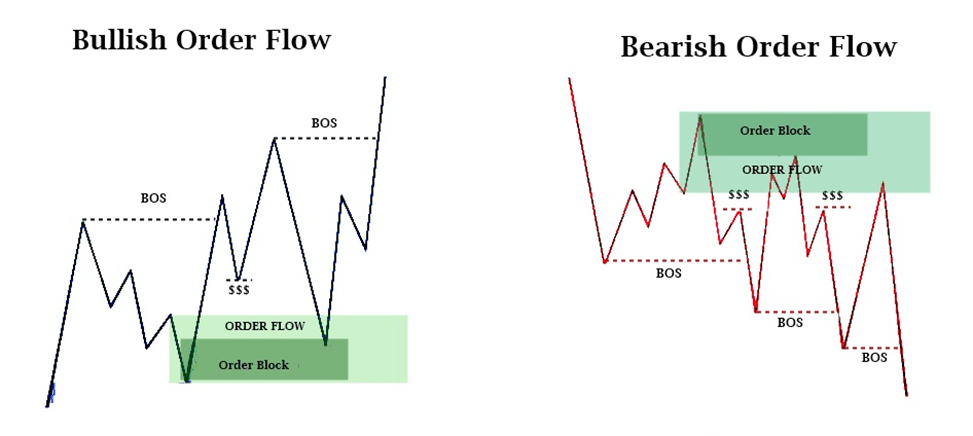

How can I identify bullish and bearish order flow?

To identify bullish order flow, look for higher highs and higher lows in price action, along with increasing volume on upward moves. Monitor the bid-ask spread; if the ask is consistently being hit, it indicates buying pressure.

For bearish order flow, watch for lower highs and lower lows, with increasing volume on downward movements. A shrinking bid-ask spread and heavy selling at the bid suggest strong selling pressure. Use tools like footprint charts or volume profiles to get clearer insights.

What are the common mistakes in interpreting order flow?

Common mistakes in interpreting order flow include:

1. Ignoring Context: Focusing solely on order size without considering market conditions can lead to misinterpretation.

2. Overreacting to Noise: Trading based on minor fluctuations or irregularities in order flow can result in false signals.

3. Neglecting Time Frames: Analyzing order flow in the wrong time frame can distort the actual picture of market intent.

4. Misinterpreting Large Orders: Assuming that large buy or sell orders always indicate strong market sentiment can be misleading; they might be part of a strategy or liquidity provision.

5. Failing to Confirm with Other Indicators: Relying exclusively on order flow without corroborating it with price action or technical indicators can lead to poor decisions.

6. Not Understanding Market Participants: Misjudging who is behind the orders (retail vs. institutional) can skew your interpretation of order flow dynamics.

7. Ignoring Volume Analysis: Failing to consider volume alongside order flow can lead to incomplete insights about market strength or weakness.

How do market orders and limit orders affect order flow?

Market orders execute immediately at the current market price, increasing order flow by quickly filling buy or sell requests. This can lead to rapid price changes and increased volatility. Limit orders, on the other hand, set a specific price for buying or selling, which can slow down order flow as they wait for the market to meet that price. While limit orders contribute to liquidity, they may not execute if the market doesn’t reach the specified price, potentially leaving unfilled orders and impacting market dynamics. In summary, market orders boost immediate activity in order flow, while limit orders provide control and can influence longer-term price movements.

Learn about How Do Institutional Orders Impact Market Liquidity?

Can order flow analysis help with risk management in trading?

Yes, order flow analysis can significantly enhance risk management in trading. By studying real-time buy and sell orders, traders can gauge market sentiment and identify potential price reversals. This insight helps in placing stop-loss orders more effectively and minimizing losses. Additionally, understanding order flow enables traders to adjust their positions based on market activity, reducing exposure during volatile conditions. Overall, it provides a clearer picture of market dynamics, leading to more informed and strategic trading decisions.

What is the impact of news events on order flow?

News events significantly impact order flow in day trading by creating volatility and influencing trader sentiment. Positive news can lead to increased buying pressure, while negative news often results in selling pressure. This shift affects the bid-ask spread, liquidity, and overall market dynamics. Traders react quickly to news, which can result in rapid order execution and price changes. Understanding how news events drive order flow is crucial for making informed trading decisions.

How do professional traders use order flow to make decisions?

Professional traders analyze order flow by observing real-time buying and selling activity in the market. They track the volume of trades, identifying where large orders are placed, which can indicate institutional interest. By studying the imbalance between buyers and sellers, traders gauge market sentiment and anticipate price movements. They also use tools like Level 2 quotes and footprint charts to visualize order flow, helping them time entries and exits more effectively. This insight allows traders to make informed decisions based on actual market dynamics rather than relying solely on indicators or historical data.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What are the benefits of using footprint charts for order flow?

Footprint charts provide several benefits for understanding order flow in day trading. They offer a visual representation of buying and selling pressure at specific price levels, helping traders identify market sentiment. These charts highlight volume at price, allowing traders to see where significant buying or selling occurred. This can aid in spotting support and resistance zones. Additionally, footprint charts help traders analyze trade activity over time, improving decision-making for entry and exit points. Overall, they enhance clarity in complex market dynamics.

How can I combine order flow with other trading indicators?

To combine order flow with other trading indicators, first identify key price levels using order flow data, such as support and resistance areas. Then, use technical indicators like moving averages or RSI to confirm trends or reversals at those levels. For example, if order flow shows strong buying at a support level and the RSI is oversold, consider a buy signal. Additionally, integrate volume analysis; high volume at price levels can validate order flow signals. Finally, backtest your strategy to ensure effectiveness before live trading.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

Conclusion about Understanding Order Flow in Day Trading

In conclusion, mastering order flow is essential for day traders seeking to enhance their strategies and decision-making processes. By understanding its key components, effectively reading order flow charts, and utilizing the right tools, traders can gain a significant edge in the market. Recognizing the impact of liquidity and news events further refines this approach, helping to identify market trends and manage risks. For those looking to deepen their trading knowledge, resources from DayTradingBusiness can provide valuable insights and strategies to navigate the complexities of order flow effectively.

Learn about The Psychology of Order Flow in Day Trading

Sources:

- News and intraday retail investor order flow in foreign exchange ...

- Information and trading targets in a dynamic market equilibrium ...

- Order Flow and Exchange Rate Dynamics Martin D. D. Evans ...

- Price-setting in the foreign exchange swap market: Evidence from ...

- FRB: Order Flow and Exchange Rate Dynamics in Electronic ...

- What does currency order flow tell about spot exchange rates of ...