Did you know that market orders are like the fast food of trading? You get what you want quickly, but sometimes at a price you didn’t expect! In this article, we dive into the crucial role of market orders in day trading, exploring their definition and impact on order flow. We’ll discuss their advantages and risks, how they compare to limit orders, and the best times to use them. Furthermore, we’ll analyze their influence on stock prices, liquidity, and high-frequency trading, along with strategies to minimize slippage. Finally, we'll share best practices for placing market orders and how they fit into day trading risk management. Join us at DayTradingBusiness as we equip you with the insights you need to navigate the fast-paced world of market orders effectively.

What are market orders in day trading?

Market orders in day trading are buy or sell orders executed immediately at the current market price. Traders use them to quickly enter or exit positions, taking advantage of price movements without delay. This type of order prioritizes speed over price, making it essential for capturing short-term opportunities. While market orders ensure execution, they may result in slippage, where the final price differs from the expected price due to rapid market changes.

How do market orders affect order flow?

Market orders increase order flow by executing trades immediately at the current market price. This action adds liquidity to the market, as buyers and sellers are matched quickly. In day trading, high market order volume can lead to rapid price changes, influencing supply and demand dynamics. When traders place market orders, they often trigger further activity, creating a ripple effect that can drive trends or reversals. Overall, market orders are crucial in shaping the order flow, impacting volatility and the overall trading environment.

What are the advantages of using market orders?

Market orders offer several advantages in day trading. They ensure immediate execution at the current market price, which is crucial for capitalizing on quick price movements. This speed reduces the risk of price slippage, allowing traders to enter or exit positions quickly. Additionally, market orders are straightforward to place, requiring less analysis and decision-making compared to limit orders. They provide certainty of execution, which is vital when timing is critical in day trading. Overall, market orders enhance responsiveness and flexibility in fast-paced trading environments.

What risks are associated with market orders in day trading?

Market orders in day trading carry several risks:

1. Slippage: The execution price may differ from the expected price, especially in volatile markets.

2. Market Impact: Large market orders can significantly affect the stock's price, leading to unfavorable fills.

3. Lack of Control: You can't set a specific price; the order executes at the best available price, which may not be ideal.

4. High Volatility: Rapid price changes can result in unexpected losses before the order is filled.

5. Liquidity Issues: In thinly traded stocks, market orders may not get filled at all or may execute at a much worse price.

Understanding these risks is essential for managing your trading strategy effectively.

How do market orders compare to limit orders?

Market orders execute immediately at the current market price, ensuring quick entry or exit but with no price guarantee. Limit orders set a specific price for buying or selling, allowing more control over execution price but risking delayed execution if the market doesn't reach that price. In day trading, market orders are useful for speed, while limit orders help manage risk and target optimal entry or exit points.

When should traders use market orders?

Traders should use market orders when they need to execute a trade quickly at the current market price. This is ideal during high volatility or when entering or exiting positions rapidly, ensuring they capitalize on immediate opportunities. Market orders are also useful when liquidity is high, allowing for swift execution without significant price changes. However, they may not be the best choice in thinly traded markets where slippage can occur.

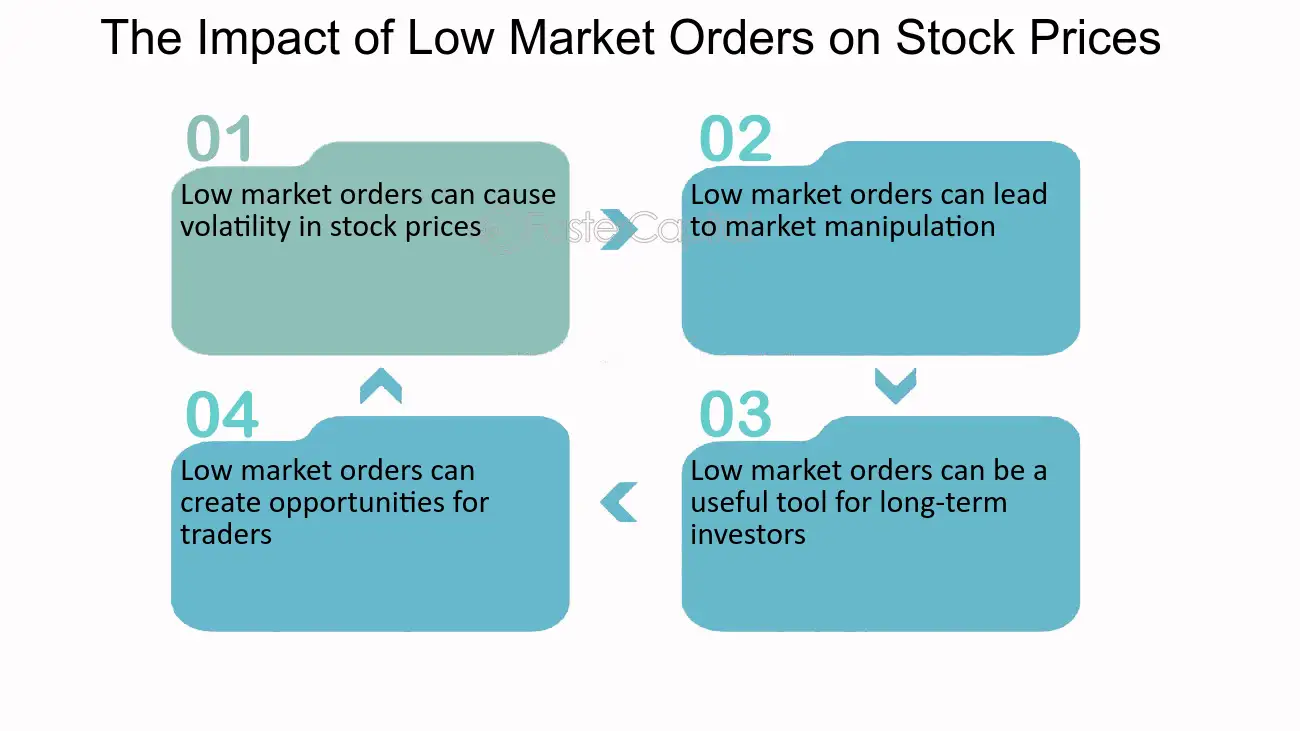

What is the impact of market orders on stock prices?

Market orders can significantly impact stock prices by increasing volatility and influencing supply and demand dynamics. When traders place market orders, they buy or sell shares at the best available price, often leading to rapid price changes, especially in illiquid stocks. Large market orders can push prices up if demand exceeds supply or drive prices down if selling pressure is intense. In day trading, this can lead to swift price movements and create opportunities or risks for traders. Overall, market orders contribute to order flow, shaping short-term price trends.

How can market orders influence liquidity?

Market orders can significantly influence liquidity by increasing trading volume and reducing bid-ask spreads. When traders place market orders, they buy or sell immediately at the current market price, which can quickly absorb available liquidity. This influx of buy or sell orders can tighten spreads, making it easier for other traders to enter or exit positions. However, large market orders can also create slippage, temporarily impacting prices and leading to decreased liquidity in volatile conditions. Ultimately, market orders play a crucial role in shaping the order flow and overall market liquidity in day trading.

What role do market orders play in high-frequency trading?

Market orders are crucial in high-frequency trading as they facilitate rapid execution of trades at the current market price. Traders use them to capitalize on small price movements and gain quick profits. Their speed and immediacy help maintain liquidity and ensure efficient order flow, allowing high-frequency traders to enter and exit positions almost instantaneously. This responsiveness is essential for executing strategies that depend on timing and price fluctuations.

How do news events affect market orders in day trading?

News events can significantly impact market orders in day trading by causing rapid price fluctuations. When positive or negative news breaks, traders often react quickly, placing market orders to capitalize on immediate price movements. This surge in order volume can lead to increased volatility, resulting in slippage—where the execution price differs from the expected price. For day traders, understanding this relationship is crucial for making timely decisions and managing risk effectively. Keeping an eye on news releases and economic indicators helps traders anticipate potential market reactions and adjust their strategies accordingly.

Learn about How Do Market Makers and Liquidity Providers Affect Day Trading?

What strategies incorporate market orders effectively?

To effectively incorporate market orders in day trading, consider these strategies:

1. Use for Quick Entries/Exits: Execute market orders when you need to enter or exit a trade rapidly, especially in volatile markets.

2. Capitalize on Momentum: Buy or sell using market orders during strong price movements to catch momentum and avoid slippage.

3. Combine with Limit Orders: Use market orders alongside limit orders to secure profits while ensuring you enter at an optimal price.

4. Set Up for Scalping: Implement market orders for quick trades in scalping strategies, where speed is crucial for small profits.

5. Manage Risk: Place market orders to exit losing positions swiftly, minimizing potential losses.

6. Trade Liquid Stocks: Focus on high-volume stocks for market orders to ensure better fills and reduce slippage.

7. Avoid During Major News: Refrain from using market orders right before or after significant news releases to prevent unexpected price jumps.

These strategies help optimize your trading performance by leveraging market orders effectively.

How can traders avoid slippage with market orders?

Traders can avoid slippage with market orders by using the following strategies:

1. Limit Orders: Instead of market orders, use limit orders to specify the maximum price you're willing to pay or the minimum price you're willing to accept, reducing the chance of slippage.

2. Trade During High Liquidity: Execute trades during peak market hours when trading volume is high, which can help ensure better price execution.

3. Monitor Market Conditions: Stay aware of news events or economic releases that can cause volatility, leading to slippage.

4. Use Direct Market Access: Consider platforms that offer direct market access, giving you faster execution times and better price control.

5. Set Price Alerts: Use alerts to trigger trades at specific prices, allowing for more precise entry and exit points.

Implementing these strategies can significantly minimize slippage when using market orders.

What are the best practices for placing market orders?

1. Timing: Place market orders during high-volume trading hours to minimize slippage.

2. Size: Avoid large orders that can impact the market; break them into smaller trades.

3. Analysis: Use technical analysis to identify optimal entry points before placing a market order.

4. Volatility: Be aware of market volatility; avoid placing market orders during significant news releases.

5. Execution: Monitor the order execution closely to ensure it fills at a price you’re comfortable with.

6. Liquidity: Ensure the asset has sufficient liquidity; thinly traded stocks can result in unexpected price changes.

7. Confirmation: After placing an order, confirm that the trade has executed and monitor it closely for adjustments.

How do market orders interact with other types of orders?

Market orders execute immediately at the current market price, impacting order flow by prioritizing speed over price. They can absorb liquidity in the market, often filling existing limit orders. When a market order is placed, it may trigger stop-loss orders if the price moves significantly, affecting nearby limit orders. This interaction can lead to slippage, where the execution price differs from the expected price. In day trading, market orders are essential for quick entries and exits, but traders must be mindful of their influence on overall market dynamics.

What tools can help traders analyze market order flow?

Traders can use tools like Order Flow Analytics, Sierra Chart, and NinjaTrader to analyze market order flow. These platforms offer features like real-time volume analysis, order book depth visualization, and footprint charts. Additionally, tools like TradingView and Thinkorswim provide custom indicators for tracking order flow dynamics. Using these tools helps traders make informed decisions based on market sentiment and liquidity.

How do market orders fit into day trading risk management?

Market orders play a crucial role in day trading risk management by allowing traders to enter and exit positions quickly at the current market price. This speed is vital for minimizing losses and capturing profits in fast-moving markets. However, they come with the risk of slippage, where the execution price may differ from the expected price due to market volatility.

To manage this risk, traders often combine market orders with stop-loss orders, setting predetermined exit points to limit potential losses. Using market orders effectively can enhance liquidity in a trader's strategy, ensuring they can act swiftly in response to market changes. Overall, while market orders facilitate quick execution, they require careful consideration of market conditions to mitigate inherent risks.

Learn about How Can AI Help in Day Trading Risk Management?

Conclusion about The Role of Market Orders in Day Trading Order Flow

In conclusion, understanding market orders is crucial for effective day trading. They play a significant role in order flow, impacting liquidity and stock prices while offering advantages like quick execution. However, risks such as slippage must be managed carefully. Traders should use market orders strategically, especially during high-frequency trading and news events. By integrating best practices and utilizing the right tools, traders can enhance their decision-making processes. For more insights and support in navigating the complexities of trading, consider leveraging the expertise of DayTradingBusiness.

Learn about Using Order Flow to Predict Market Trends in Day Trading