Did you know that the average trader spends more time analyzing their emotions than their actual trades? In the world of day trading, understanding the psychology of order flow is crucial for success. This article dives into the essence of order flow, explaining its definition and how psychological factors influence trading decisions. You'll uncover the importance of mastering order flow analysis, the impact of emotions like fear and greed, and the role of market sentiment. Additionally, we explore common pitfalls traders face, strategies to enhance decision-making, and practical techniques for stress management. Whether you're a beginner or a seasoned trader, this guide from DayTradingBusiness provides essential insights and tools to boost your trading performance.

What is order flow in day trading?

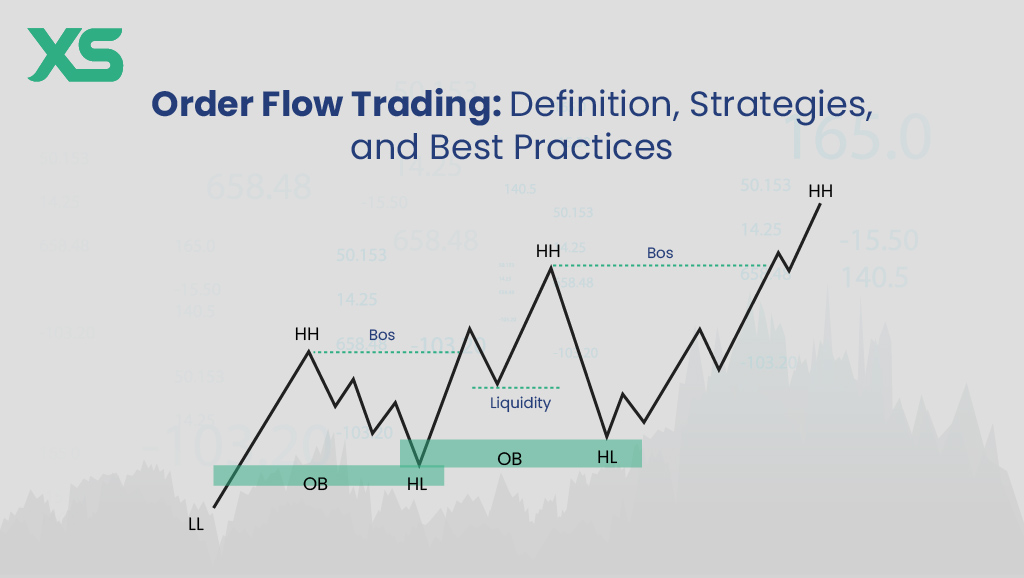

Order flow in day trading refers to the analysis of the buying and selling activity in the market. It involves tracking the volume and price movements of trades to understand market sentiment and identify potential trends. Traders use order flow to gauge the strength of a price move, predict future price actions, and make informed trading decisions based on real-time data. By observing how orders are executed, traders can discern whether buyers or sellers are in control, helping them to anticipate market shifts and optimize their strategies.

How does psychology influence order flow?

Psychology influences order flow in day trading by affecting traders' emotions and decisions. Fear and greed drive buying and selling behaviors, impacting market momentum. For example, during a market drop, fear can lead to panic selling, increasing sell orders and pushing prices down. Conversely, bullish sentiment can result in a surge of buy orders, creating upward pressure on prices. Additionally, cognitive biases like overconfidence can lead traders to underestimate risks, affecting their order placements. Understanding these psychological factors helps traders anticipate market movements and adapt their strategies accordingly.

Why is understanding order flow important for traders?

Understanding order flow is crucial for traders because it reveals real-time market dynamics. It helps identify buying and selling pressure, allowing traders to anticipate price movements. By analyzing order flow, traders can gauge market sentiment and make more informed decisions, leading to better entry and exit points. This insight reduces the risk of following false signals and enhances the overall trading strategy. Ultimately, mastering order flow can improve a trader's ability to capitalize on market opportunities.

What are the key components of order flow analysis?

The key components of order flow analysis in day trading are:

1. Volume: Understanding the amount of trading activity helps gauge market strength.

2. Price Action: Analyzing price movements reveals market sentiment and potential reversals.

3. Bid-Ask Spread: The difference between buying and selling prices indicates liquidity and market efficiency.

4. Order Types: Recognizing different orders (market, limit, stop) provides insight into trader intentions.

5. Time and Sales: Tracking real-time transactions shows the flow of orders and market dynamics.

6. Market Depth: Assessing buy and sell orders at various price levels helps predict support and resistance.

These components help traders interpret market psychology and make informed decisions.

How can emotions impact trading decisions related to order flow?

Emotions can significantly impact trading decisions related to order flow by influencing judgment and behavior. Fear may lead to premature selling during a downturn, while greed can cause traders to hold onto positions longer than advisable. Overconfidence can result in underestimating risks, leading to impulsive trades based on order flow signals. Conversely, anxiety may cause traders to hesitate, missing optimal entry or exit points. Understanding these emotional triggers is crucial for making rational decisions in day trading and effectively interpreting order flow data.

What role does market sentiment play in order flow?

Market sentiment significantly influences order flow by affecting traders' decisions. When sentiment is bullish, more buy orders flood the market, increasing upward pressure on prices. Conversely, in a bearish sentiment, sell orders dominate, driving prices down. Understanding this psychological aspect helps traders anticipate potential price movements and make informed decisions based on prevailing emotions in the market.

How can traders use order flow to predict price movements?

Traders can use order flow to predict price movements by analyzing real-time buy and sell orders to gauge market sentiment. By observing the volume of orders at different price levels, traders identify support and resistance zones. High buying pressure signals potential upward movement, while strong selling indicates downward trends.

Additionally, tracking the speed and size of trades reveals the strength behind price movements. For example, if large buy orders consistently come in, it often suggests bullish sentiment. Conversely, if sell orders dominate, it can indicate bearish pressure.

Using tools like footprint charts and order book data, traders can spot imbalances that hint at future price action. Understanding these dynamics helps traders make informed decisions and anticipate market shifts effectively.

What are common psychological pitfalls in order flow trading?

Common psychological pitfalls in order flow trading include:

1. Overtrading: Traders may react impulsively to market movements, leading to excessive trades and increased losses.

2. Fear of Missing Out (FOMO): This can cause traders to enter positions without proper analysis, chasing trends instead of following their strategy.

3. Loss Aversion: Traders often hold losing positions too long, hoping for a reversal, which can worsen losses.

4. Confirmation Bias: Traders may focus on information that supports their beliefs while ignoring contradictory data in the order flow.

5. Emotional Decision-Making: Stress and anxiety can cloud judgment, leading to poor trading choices based on feelings rather than analysis.

6. Anchoring: Traders might fixate on past prices, making it hard to adapt to current market conditions.

Recognizing these pitfalls is crucial for improving trading performance in order flow trading.

How do institutional traders utilize order flow psychology?

Institutional traders utilize order flow psychology by analyzing the buying and selling patterns in the market to gauge market sentiment. They observe large volume trades to identify the intentions of other market participants. By understanding where retail traders might be placing their orders, institutional traders can anticipate price movements and position themselves advantageously. They often employ tactics like liquidity hunting, where they provoke retail stop-loss orders to trigger market moves that benefit their positions. This insight into order flow helps them make informed decisions and optimize their trading strategies.

What strategies can improve decision-making in order flow trading?

To improve decision-making in order flow trading, focus on these strategies:

1. Develop a Trading Plan: clear entry and exit points based on market conditions. Stick to your plan to avoid emotional decisions.

2. Use Real-Time Data: Monitor live order flow and volume to gauge market sentiment. This helps you react quickly to changes.

3. Practice Patience: Wait for high-probability setups rather than forcing trades. This reduces impulsive decisions.

4. Visualize Market Structure: Understand support and resistance levels. This aids in predicting price movements based on order flow.

5. Emotional Regulation: Recognize and manage your emotions. Techniques like mindfulness can help maintain focus during trading.

6. Review and Reflect: Analyze past trades to identify patterns in your decision-making. Learn from mistakes to refine your approach.

7. Simulated Trading: Use demo accounts to practice without financial risk. This builds confidence and sharpens decision-making skills.

Implementing these strategies can enhance your decision-making process in order flow trading.

How does fear and greed affect order flow dynamics?

Fear and greed significantly impact order flow dynamics in day trading. Greed drives traders to buy aggressively, pushing prices up as they chase profits. Conversely, fear leads to panic selling, causing rapid price declines. This interplay creates volatile market conditions where order flow reflects heightened buying or selling activity. Traders often react to these emotions in real-time, resulting in momentum shifts that can change the direction of price trends quickly. Understanding this psychological aspect helps traders anticipate market movements and adjust their strategies accordingly.

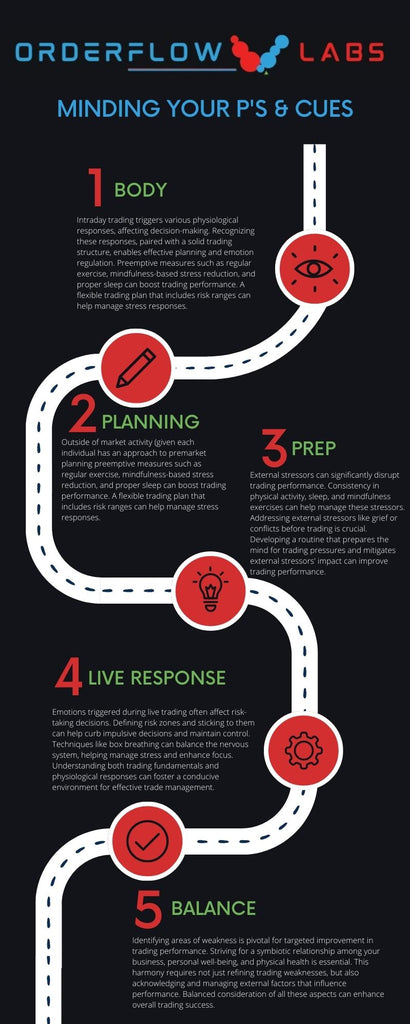

What techniques can help manage stress in day trading?

To manage stress in day trading, consider these techniques:

1. Set Clear Goals: Define specific, achievable targets for each trading session to maintain focus.

2. Limit Trading Hours: Avoid overtrading by setting a specific time frame for trades to prevent burnout.

3. Practice Mindfulness: Use meditation or deep breathing exercises to stay calm and centered during volatile market conditions.

4. Develop a Routine: Establish a consistent daily routine to reduce uncertainty and create structure.

5. Use Risk Management: Implement stop-loss orders and position sizing to minimize financial stress.

6. Take Breaks: Step away from the screen periodically to clear your mind and regain composure.

7. Reflect on Trades: Keep a trading journal to analyze decisions and emotions, helping to reduce anxiety about future trades.

8. Stay Educated: Continuous learning about market trends and order flow can boost confidence and reduce stress.

Incorporating these techniques can improve your psychological resilience and overall performance in day trading.

How can mindfulness improve order flow trading performance?

Mindfulness can enhance order flow trading performance by improving focus and emotional regulation. It helps traders stay present, reducing impulsive decisions driven by fear or greed. By cultivating awareness, traders can better interpret market signals and maintain discipline in executing their strategies. Mindfulness also aids in managing stress, which can lead to clearer thinking during volatile market conditions. Overall, being mindful allows traders to make more informed, rational decisions, ultimately boosting their trading success.

Learn about How Can Mindfulness Improve Trading Psychology?

What tools are available for analyzing order flow?

Tools for analyzing order flow in day trading include:

1. Order Flow Software: Platforms like Sierra Chart, Jigsaw Trading, and Bookmap provide detailed visualizations of market orders and liquidity.

2. Footprint Charts: These charts display volume at price levels, helping traders understand buying and selling pressure.

3. Market Depth Tools: Tools like Level II quotes show real-time supply and demand by displaying limit orders in the market.

4. Volume Profile: This tool analyzes trading volume at various price levels over a specified time, highlighting areas of support and resistance.

5. Time and Sales: This feature tracks real-time trades, showing price, volume, and direction, allowing traders to gauge market sentiment.

Using these tools can enhance your understanding of market dynamics and improve trading decisions.

How can beginners effectively learn about order flow psychology?

Beginners can effectively learn about order flow psychology by starting with these steps:

1. Read Books and Articles: Focus on resources specifically about order flow trading and market psychology. Books like "Order Flow Trading for Beginners" provide foundational knowledge.

2. Watch Educational Videos: Seek out video tutorials that explain order flow concepts visually, making it easier to grasp complex ideas.

3. Use Trading Simulators: Practice with demo accounts to observe real-time order flow without financial risk. This helps in understanding market reactions and trader psychology.

4. Join Trading Communities: Engage with forums and social media groups where experienced traders share insights on order flow and psychological strategies.

5. Analyze Real Trades: Study past trades, focusing on how order flow influenced decisions. Look for patterns in price movement and trader behavior.

6. Keep a Trading Journal: Document trades and emotions to identify psychological triggers and improve decision-making over time.

7. Attend Webinars or Workshops: Participate in live sessions to learn from experts about interpreting order flow and the psychology behind trading choices.

By combining these methods, beginners can build a solid understanding of order flow psychology in day trading.

What are the best practices for interpreting order flow data?

1. Understand Market Context: Analyze the overall market trend before interpreting order flow data. Recognizing whether the market is bullish or bearish can guide your decisions.

2. Focus on Volume: Pay attention to volume spikes. High volume often indicates strong interest and can signal potential price reversals or continuations.

3. Look for Imbalances: Identify buying and selling imbalances. A significant number of buy orders over sell orders may suggest upward pressure.

4. Use Time and Sales: Monitor the time and sales data to see real-time transactions. This helps gauge market sentiment and the strength of price movements.

5. Watch for Price Levels: Pay attention to key support and resistance levels. Order flow around these levels can indicate potential breakouts or reversals.

6. Analyze Order Types: Differentiate between market orders and limit orders. Market orders indicate urgency, while limit orders show where traders are willing to enter or exit.

7. Combine with Technical Analysis: Use order flow data alongside technical indicators for a comprehensive view. This can enhance your trading strategy and improve decision-making.

8. Keep Emotions in Check: Stay disciplined and avoid emotional trading. Order flow can evoke strong reactions, but sticking to your plan is crucial.

9. Practice Patience: Wait for clear signals from the order flow before making trades. Rushing can lead to mistakes.

10. Review Past Trades: Analyze previous trades based on order flow data to learn from successes and mistakes. This helps refine your strategy over time.

Conclusion about The Psychology of Order Flow in Day Trading

Understanding the psychology of order flow is crucial for effective day trading. By grasping how emotions like fear and greed influence trading decisions, traders can make more informed choices and avoid common pitfalls. Utilizing strategies to manage stress and incorporating mindfulness can enhance performance, while being aware of market sentiment and institutional behaviors can aid in predicting price movements. For those looking to deepen their knowledge and skills, resources from DayTradingBusiness can provide valuable insights and guidance on mastering order flow analysis.

Learn about Building a Day Trading Strategy Around Order Flow Insights