Did you know that even the stock market has a sense of humor? It can go up while you're down—and that's why mastering real-time order flow analysis is crucial for traders! This article dives into the essentials of order flow analysis, explaining its definition, benefits, and how it can elevate your trading decisions. Discover the best tools for real-time analysis, effective techniques to interpret data, and key indicators that matter. Learn how to set up your analysis software and avoid common pitfalls, while also exploring the interplay between market participants and order flow. Plus, find out how to integrate order flow with other trading strategies. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of the market.

What is real-time order flow analysis?

Real-time order flow analysis is the process of monitoring and interpreting live market orders to understand supply and demand dynamics. It involves tracking buy and sell orders as they occur, using tools like volume profiles and order book data. Traders utilize this analysis to make informed decisions about entry and exit points, identifying potential market reversals or trends based on the flow of orders. Techniques include reading level 2 market data and using footprint charts to visualize order activity.

How does order flow analysis improve trading decisions?

Order flow analysis improves trading decisions by providing real-time insights into market activity. Traders can see the actual buy and sell orders, allowing them to gauge supply and demand. This helps identify potential price movements before they happen. By analyzing order imbalances, traders can spot trends, reversals, and market sentiment. Tools like footprint charts and volume profiles enhance this analysis, offering a clearer picture of market dynamics. Ultimately, understanding order flow leads to more informed, timely trading decisions.

What tools are best for real-time order flow analysis?

The best tools for real-time order flow analysis include:

1. Bookmap – Offers detailed visualization of order flow with heatmaps and liquidity data.

2. Sierra Chart – Provides advanced charting, market depth, and customizable order flow tools.

3. NinjaTrader – Features real-time data analysis, including order flow and market analysis tools.

4. TradingView – While primarily a charting platform, it supports real-time data and order flow indicators.

5. Jigsaw Trading – Specializes in order flow trading with tools for depth and market analysis.

Choose based on your specific trading style and needs.

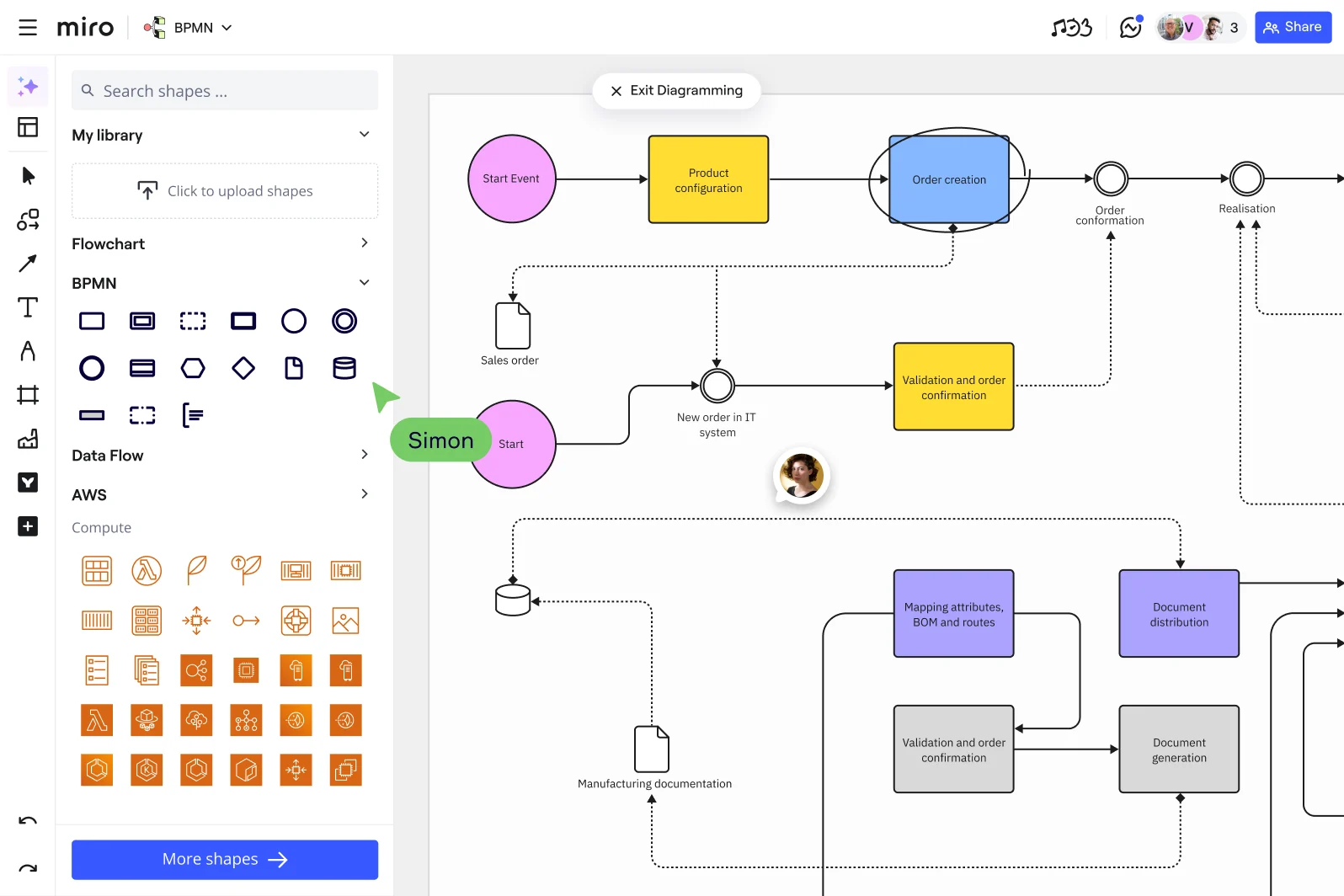

How can I set up order flow analysis software?

To set up order flow analysis software, follow these steps:

1. Choose Software: Select a platform like Sierra Chart, NinjaTrader, or Bookmap that supports order flow analysis.

2. Install the Software: Download and install the software on your computer, following the provided instructions.

3. Connect to Data Feed: Sign up for a real-time data feed from a broker or data provider, then configure the software to connect to this feed.

4. Set Up Charts: Create charts that display order flow metrics, such as volume profiles, order book data, and trade footprints.

5. Customize Indicators: Add and customize indicators specific to order flow analysis, like Delta, VWAP, or cumulative volume.

6. Practice: Use demo accounts to familiarize yourself with the tools and techniques before trading live.

7. Review and Adjust: Continuously analyze your setup and make adjustments based on performance and market conditions.

This setup will enable you to effectively analyze real-time order flow.

What techniques enhance order flow analysis accuracy?

To enhance order flow analysis accuracy, focus on these techniques:

1. Tape Reading: Analyze time and sales data to understand real-time buying and selling pressure.

2. Volume Analysis: Assess volume spikes alongside price movements to confirm trends or reversals.

3. Footprint Charts: Use these charts to visualize buy/sell orders at specific price levels, revealing market sentiment.

4. Market Depth: Monitor the order book to gauge liquidity and identify potential support and resistance zones.

5. Delta Analysis: Examine the difference between buying and selling volume to spot aggressive buyers or sellers.

6. Liquidity Gaps: Identify areas with low liquidity that may lead to price volatility during order execution.

7. Time-Based Analysis: Track order flow changes at specific times (like market opens or closes) to spot patterns.

Implementing these techniques will improve your real-time order flow analysis and trading decisions.

How do I interpret order flow data effectively?

To interpret order flow data effectively, focus on three key techniques:

1. Volume Analysis: Monitor the volume of buy and sell orders at different price levels. High volume at a specific price indicates strong interest, signaling potential support or resistance.

2. Order Book Observation: Analyze the order book to see real-time bids and asks. Look for large orders that may indicate market sentiment or potential price movements.

3. Trade Execution Patterns: Pay attention to the speed and size of trades. Rapid execution of large trades can signal aggressive buying or selling, providing clues about market direction.

Using tools like trading platforms with order flow indicators can enhance your analysis.

What are the key indicators in order flow analysis?

Key indicators in order flow analysis include:

1. Volume: Measures the number of contracts or shares traded, indicating market activity.

2. Order Book Depth: Shows buy and sell orders at various price levels, revealing market sentiment.

3. Trade Prints: Displays executed trades, highlighting changes in supply and demand.

4. Bid-Ask Spread: The difference between the highest bid and lowest ask, indicating liquidity.

5. Delta: The difference between buying and selling volume, signaling aggressive buying or selling.

6. Market Imbalance: A significant difference between buy and sell orders, suggesting potential price movement.

These indicators help traders assess market direction and make informed decisions.

How does order flow analysis differ from traditional analysis?

Order flow analysis focuses on actual market transactions and the flow of buy and sell orders in real-time, providing insights into market sentiment and potential price movements. In contrast, traditional analysis relies on historical data, chart patterns, and indicators to forecast future price action. Order flow reveals immediate market dynamics, while traditional analysis offers a broader, more delayed perspective. This real-time insight helps traders make quicker, more informed decisions compared to the lagging signals often seen in traditional methods.

Can I use order flow analysis for day trading?

Yes, you can use order flow analysis for day trading. It helps you understand market dynamics by analyzing the buying and selling activity in real time. Tools like footprint charts, volume profile, and Level II data are essential for this analysis. By tracking order flow, you can make informed decisions about entry and exit points, identify potential reversals, and gauge market sentiment.

What are the benefits of using order flow tools?

Order flow tools provide several benefits:

1. Enhanced Market Understanding: They reveal real-time buying and selling activity, helping traders gauge market sentiment.

2. Improved Decision-Making: By analyzing order flow, traders can identify potential price movements before they happen.

3. Increased Precision: These tools allow for better entry and exit points based on actual market orders, reducing guesswork.

4. Risk Management: They help in spotting areas of high liquidity and potential reversals, aiding in effective risk assessment.

5. Strategy Development: Traders can refine strategies based on real-time data, optimizing performance and adapting to market conditions.

How do market participants influence order flow?

Market participants influence order flow through their buying and selling actions. Large institutional traders can create significant volume, impacting price levels and liquidity. Retail traders often follow trends set by these institutions, contributing to momentum. Additionally, market makers adjust spreads based on order flow to manage risk. High-frequency traders utilize algorithms to exploit small price discrepancies, further shaping order flow in real-time. Understanding these dynamics is crucial for effective order flow analysis.

What common mistakes should I avoid in order flow analysis?

Avoid these common mistakes in real-time order flow analysis:

1. Ignoring Context: Always consider market conditions; don't analyze order flow in isolation.

2. Overlooking Volume: Pay attention to volume alongside price movements; low volume can distort signals.

3. Misinterpreting Data: Ensure you understand what the data represents; misunderstanding can lead to incorrect conclusions.

4. Relying Solely on Indicators: Use order flow in conjunction with other tools; don't rely on one method alone.

5. Neglecting Timing: Analyze order flow in real-time; delayed analysis can lead to missed opportunities.

6. Failing to Practice: Regularly practice your analysis skills; the more you analyze, the better your understanding becomes.

7. Ignoring Market Sentiment: Factor in trader sentiment; order flow reflects not just data, but emotions driving decisions.

By avoiding these mistakes, you can enhance your order flow analysis and make more informed trading decisions.

Learn about Common Mistakes in Order Flow Analysis for Day Traders

How can I combine order flow analysis with other strategies?

To combine order flow analysis with other strategies, start by integrating it with technical analysis. Use order flow to confirm price patterns or signals from indicators like moving averages.

Next, incorporate it with fundamental analysis by observing how large trades react to news events. This helps gauge market sentiment.

Additionally, blend order flow with risk management strategies. Monitor volume spikes to adjust your stop-loss levels based on market activity.

Finally, consider using order flow to enhance your trading psychology. Understanding real-time market movements can improve your decision-making under pressure.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What are the limitations of order flow analysis?

Order flow analysis has several limitations:

1. Data Overload: Real-time data can be overwhelming, making it difficult to discern actionable insights amidst noise.

2. Market Manipulation: Large players can manipulate order flow, skewing signals and leading to false interpretations.

3. Lagging Indicators: Often, order flow data reflects past actions, which may not predict future price movements accurately.

4. Requires Expertise: Effective analysis demands significant experience and understanding of market dynamics, which can be a barrier for beginners.

5. Technical Limitations: Dependence on technology and platforms can introduce errors or delays in data processing.

6. Short-Term Focus: Order flow analysis typically benefits short-term trading strategies, making it less useful for long-term investors.

7. Context Sensitivity: The effectiveness of order flow analysis can vary significantly based on market conditions and external factors.

How does price action relate to order flow analysis?

Price action reflects the movement of an asset's price over time, while order flow analysis examines the underlying buy and sell orders driving that movement. By analyzing order flow, traders can understand market sentiment and predict price movements. For instance, if order flow shows a surge in buy orders, it often leads to upward price action. Conversely, an increase in sell orders can indicate potential downward movement. Essentially, price action is the result of order flow dynamics, making them closely intertwined in real-time trading strategies.

What resources are available for learning order flow analysis?

For learning real-time order flow analysis, consider the following resources:

1. Books: "Order Flow Trading for Fun and Profit" by J. K. L. and "The Art of Trading" by Christopher Tate.

2. Online Courses: Websites like Udemy and Coursera offer courses focused on order flow analysis.

3. Trading Platforms: Tools like Sierra Chart, NinjaTrader, and Bookmap provide order flow analysis features and tutorials.

4. YouTube Channels: Channels like "The Trading Coach" and "Market Profile" offer free videos explaining order flow concepts.

5. Forums and Communities: Join platforms like Trade2Win or Elite Trader for discussions and insights from experienced traders.

6. Webinars: Many trading educators host live webinars focusing on order flow techniques.

Engage with these resources to deepen your understanding of order flow analysis.

Conclusion about Real-Time Order Flow Analysis: Tools and Techniques

Incorporating real-time order flow analysis into your trading strategy can significantly enhance decision-making. By utilizing the right tools and techniques, traders can gain deeper insights into market dynamics, leading to more informed trades. Understanding key indicators and avoiding common pitfalls are essential for maximizing the effectiveness of this approach. For those looking to deepen their trading knowledge, resources and support from experts like DayTradingBusiness can provide valuable guidance in mastering order flow analysis.

Sources:

- Videometric mass flow control: A new method for real-time ...

- Real-time traffic monitoring system using IoT-aided robotics and ...

- Expediting online liquid chromatography for real-time monitoring of ...

- Analytical methods for process and product characterization of ...

- RETRACTED: Future of process safety: Insights, approaches, and ...

- Literature Review of Accelerated CFD Simulation Methods towards ...