Did you know that the average day trader spends more time analyzing charts than they do sleeping? In the fast-paced world of day trading, understanding the nuances of Order Flow Analysis and Technical Analysis is crucial for success. This article dives deep into how each method works, their key differences, and when to use them effectively. You’ll also discover the tools and indicators essential for both analyses, along with best practices and the impact of market sentiment. Whether you're a beginner or an experienced trader, this guide from DayTradingBusiness will enhance your trading strategy and decision-making process.

What is Order Flow Analysis in Day Trading?

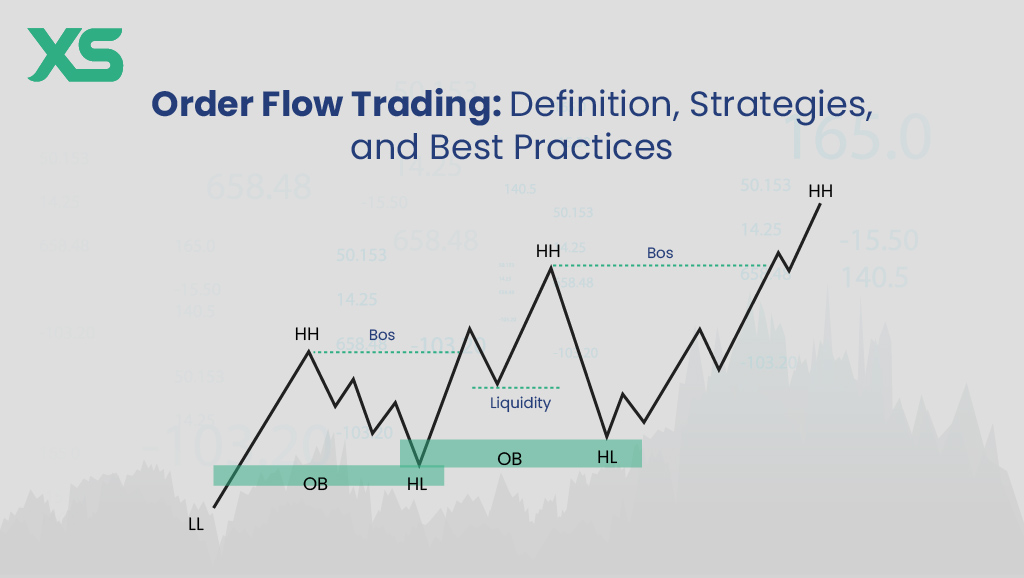

Order Flow Analysis in day trading involves examining the actual buy and sell orders in the market to understand supply and demand dynamics. It focuses on real-time trading activity, identifying where large orders are placed, which helps traders gauge market sentiment and potential price movements. In contrast to Technical Analysis, which relies on historical price charts and indicators, Order Flow Analysis provides insights based on current market conditions, allowing traders to make more informed decisions based on actual market behavior rather than just patterns.

How Does Technical Analysis Work in Day Trading?

Technical analysis in day trading involves analyzing price charts and using indicators to predict future price movements. Traders focus on patterns, trends, and volume to make buy or sell decisions.

Order flow analysis, on the other hand, looks at the actual buying and selling activity in the market. It examines how orders are placed and executed, providing insights into market sentiment and potential price movements.

While technical analysis uses historical data to forecast trends, order flow analysis captures real-time market dynamics. Both methods can be used together for a more comprehensive trading strategy.

What Are the Key Differences Between Order Flow Analysis and Technical Analysis?

Order flow analysis focuses on the real-time supply and demand in the market by examining the actual orders placed, showing how traders are positioned. It provides insights into market sentiment and potential price movements based on the volume and type of trades.

Technical analysis, on the other hand, relies on historical price data and chart patterns to predict future price movements. It uses indicators like moving averages and RSI to identify trends and entry/exit points.

In summary, order flow analysis gives immediate insight into market dynamics, while technical analysis emphasizes historical patterns and indicators.

When Should I Use Order Flow Analysis in Day Trading?

Use order flow analysis in day trading when you want to understand market dynamics, gauge supply and demand, and make real-time decisions based on actual trades. It’s particularly effective during high-volume trading sessions or news events, as it reveals the intentions of large market participants. Combine it with technical analysis to confirm entry and exit points, but rely on order flow for immediate market insights and timing.

When Is Technical Analysis More Effective in Day Trading?

Technical analysis is more effective in day trading when market conditions are trending or when there's high volatility. It shines in identifying patterns, support and resistance levels, and momentum indicators. Use it alongside order flow analysis to confirm trades and gauge market sentiment. In ranging markets, however, technical analysis may be less reliable, as price action can be erratic. Prioritize technical analysis during news releases or significant events for better results.

What Tools Are Used for Order Flow Analysis?

Tools for order flow analysis include:

1. Order Book: Displays real-time buy and sell orders to gauge market sentiment.

2. Footprint Charts: Show volume at specific price levels, revealing buying and selling pressure.

3. Volume Profile: Indicates where most trading occurred at different price levels, highlighting support and resistance.

4. Time and Sales: Provides a live feed of trades, showing price, size, and direction.

5. Market Depth: Offers insight into the liquidity of an asset by showing pending orders at different prices.

6. Volume Delta: Analyzes the difference between buying and selling volume to identify market strength.

These tools help traders make informed decisions based on real-time market activity rather than relying solely on historical price patterns used in technical analysis.

What Indicators Are Common in Technical Analysis?

Common indicators in technical analysis include moving averages, relative strength index (RSI), moving average convergence divergence (MACD), Bollinger Bands, and Fibonacci retracements. These tools help traders identify trends, momentum, volatility, and potential reversal points in the market.

How Can Order Flow Analysis Improve My Trading Strategy?

Order flow analysis improves your trading strategy by providing real-time insights into market supply and demand. Unlike technical analysis, which relies on historical price patterns, order flow shows actual trades happening, helping you identify potential price movements before they occur. By analyzing volume and order types, you can spot market sentiment and make more informed decisions. This approach allows for better timing of entries and exits, ultimately increasing your win rate in day trading.

Is Technical Analysis Enough for Successful Day Trading?

No, technical analysis alone is not enough for successful day trading. While it provides insights through charts and indicators, combining it with order flow analysis gives a clearer picture of market dynamics. Order flow analysis helps you understand real-time market sentiment and the actions of other traders, which can lead to more informed decisions. For optimal results, use both methods together to enhance your trading strategy.

What Are the Pros and Cons of Order Flow Analysis?

Pros of Order Flow Analysis:

1. Real-Time Data: Provides immediate insights into market sentiment and trading activity.

2. Market Depth: Shows order book data, helping traders understand supply and demand levels.

3. Enhanced Decision-Making: Allows for more informed trading decisions based on actual market behavior rather than lagging indicators.

Cons of Order Flow Analysis:

1. Complexity: Requires a deep understanding of market mechanics and can be overwhelming for beginners.

2. Data Overload: The sheer volume of information can lead to analysis paralysis.

3. False Signals: High-frequency trading can create misleading signals that may confuse traders.

In comparison, technical analysis relies on historical price data and indicators, which can lag and may not reflect current market conditions as effectively.

What Are the Strengths and Weaknesses of Technical Analysis?

Strengths of Technical Analysis: It uses historical price data and chart patterns to predict future price movements. Traders can identify trends, support and resistance levels, and make decisions based on visual signals. It’s widely accessible, with many resources and tools available.

Weaknesses of Technical Analysis: It can be subjective, as different traders may interpret charts differently. It often relies on past performance, which may not predict future results. It can lead to overtrading and false signals, especially in volatile markets.

Order Flow Analysis Strengths: It focuses on real-time market data, providing insights into buyer and seller behavior. This can lead to more accurate predictions and better entry and exit points.

Order Flow Analysis Weaknesses: It requires a deeper understanding of market mechanics and can be complex for beginners. It may involve higher costs for specialized tools and data feeds.

How Do I Combine Order Flow Analysis and Technical Analysis?

To combine order flow analysis and technical analysis in day trading, start by using technical indicators to identify key support and resistance levels. Once you've established these levels, analyze order flow to see how buyers and sellers are interacting at these points. Look for large volume spikes or imbalances that signal potential reversals or breakouts. Use candlestick patterns alongside order flow data to confirm your entries and exits. This approach allows you to make informed decisions based on both market sentiment and price action.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

Can Beginners Use Order Flow Analysis Effectively?

Yes, beginners can use order flow analysis effectively, but it requires some foundational knowledge and practice. Unlike technical analysis, which relies on charts and indicators, order flow analysis focuses on real-time market data, such as buy and sell orders. Beginners should start by understanding key concepts like bid-ask spreads, volume, and order types. Using platforms that provide order flow tools can enhance their learning. With time and experience, beginners can develop skills to interpret market movements and make informed trading decisions.

What Are the Best Practices for Technical Analysis in Day Trading?

The best practices for technical analysis in day trading include:

1. Use Multiple Time Frames: Analyze charts across different time frames to identify trends and key levels.

2. Focus on Volume: Pay attention to volume alongside price movements to confirm trends.

3. Identify Support and Resistance: Recognize key support and resistance levels to make informed entry and exit decisions.

4. Employ Indicators Wisely: Use indicators like Moving Averages, RSI, and MACD to gauge market conditions, but don’t rely solely on them.

5. Practice Risk Management: Set stop-loss orders to limit potential losses and determine position sizes based on risk tolerance.

6. Stay Updated: Monitor news and events that can impact market sentiment and volatility.

7. Develop a Trading Plan: Create a clear strategy outlining your goals, rules, and criteria for trades.

8. Backtest Strategies: Test your technical analysis methods on historical data to evaluate their effectiveness before applying them in real-time.

9. Keep a Trading Journal: Document trades to analyze what works and what doesn’t for continuous improvement.

10. Maintain Discipline: Stick to your trading plan and avoid emotional decision-making.

Integrating these practices enhances the effectiveness of technical analysis in day trading.

Learn about What Are the Best Practices for Using AI in Day Trading?

How Does Market Sentiment Affect Order Flow Analysis?

Market sentiment significantly impacts order flow analysis by influencing trader behavior and decision-making. When sentiment is positive, buyers tend to dominate, leading to an increase in buy orders. Conversely, negative sentiment results in more sell orders. This shift affects the order flow, as the balance between buying and selling pressure directly impacts price movements.

In day trading, recognizing sentiment can help traders anticipate changes in order flow, enabling them to make informed decisions. For instance, if order flow shows a surge in buying amid positive news, traders might seize the opportunity to enter long positions. Understanding this dynamic can enhance the effectiveness of order flow analysis compared to relying solely on technical analysis, which may lag behind real-time market reactions.

What Role Do Volume and Liquidity Play in Order Flow Analysis?

Volume and liquidity are crucial in order flow analysis because they indicate the strength and reliability of price movements. High volume suggests strong interest and can validate trends, while low volume may signal weakness. Liquidity ensures that orders can be executed quickly without significantly impacting the price, which is vital for day traders looking to enter and exit positions swiftly. In contrast to technical analysis, which often relies on historical price patterns and indicators, order flow analysis focuses on real-time market activity, making volume and liquidity essential for understanding market sentiment and potential reversals.

Conclusion about Order Flow Analysis vs. Technical Analysis in Day Trading

In summary, understanding the distinctions between order flow analysis and technical analysis is crucial for successful day trading. Each method offers unique advantages and can be employed strategically depending on market conditions. By integrating insights from both approaches, traders can enhance their decision-making and refine their strategies. For those looking to deepen their trading knowledge and improve their tactics, resources from DayTradingBusiness can provide valuable guidance and support.

Learn about Differences Between Order Flow and Volume Analysis in Day Trading

Sources:

- Chasing trends at the micro-level: The effect of technical trading on ...

- Wisdom or Whims? Decoding the Language of Retail Trading with ...

- Stop-loss orders and price cascades in currency markets ...

- Delegated trading and the speed of adjustment in security prices ...

- Non-linear, hybrid exchange rate modeling and trading profitability ...