Did you know that understanding order flow can be as vital to day trading as knowing when to eat your lunch? In this article, we delve into the essential aspects of order flow data, a key component in making informed day trading decisions. You'll learn what order flow data is, effective analysis techniques, and the critical components involved. Discover how order flow impacts price movements, the best tools for tracking it, and how to identify trends and reversals. We'll also clarify the differences between order flow and volume analysis, discuss common mistakes to avoid, and explore the role of market depth. Finally, we’ll touch on how order flow can enhance risk management and trading strategies. With insights from DayTradingBusiness, you’ll be equipped to elevate your trading game.

What is order flow data in day trading?

Order flow data in day trading refers to the real-time information about buy and sell orders in the market. It shows the volume and direction of trades, revealing where buyers and sellers are active. By analyzing this data, traders can gauge market sentiment, identify support and resistance levels, and make informed decisions on entry and exit points. Understanding order flow helps traders anticipate price movements and improve their strategies.

How can I analyze order flow data effectively?

To analyze order flow data effectively for day trading, focus on three key steps:

1. Use a Trading Platform: Choose a platform that offers real-time order book data and volume analysis tools. This helps you see buy and sell orders as they happen.

2. Identify Key Levels: Look for areas of high volume and price clustering. These levels often indicate support and resistance, guiding your entry and exit points.

3. Monitor Market Sentiment: Pay attention to the imbalance between buyers and sellers. A surge in buy orders can signal bullish momentum, while an increase in sell orders may indicate bearish pressure.

By combining these elements, you can make informed trading decisions based on order flow data.

What are the key components of order flow analysis?

The key components of order flow analysis include:

1. Volume: The number of shares or contracts traded, indicating market strength.

2. Bid-Ask Spread: The difference between buy and sell prices, showing liquidity.

3. Order Types: Understanding market orders, limit orders, and stop orders helps gauge trader intent.

4. Market Depth: The number of buy and sell orders at various price levels, indicating potential support and resistance.

5. Trade Prints: Real-time data of executed trades, providing insight into market sentiment.

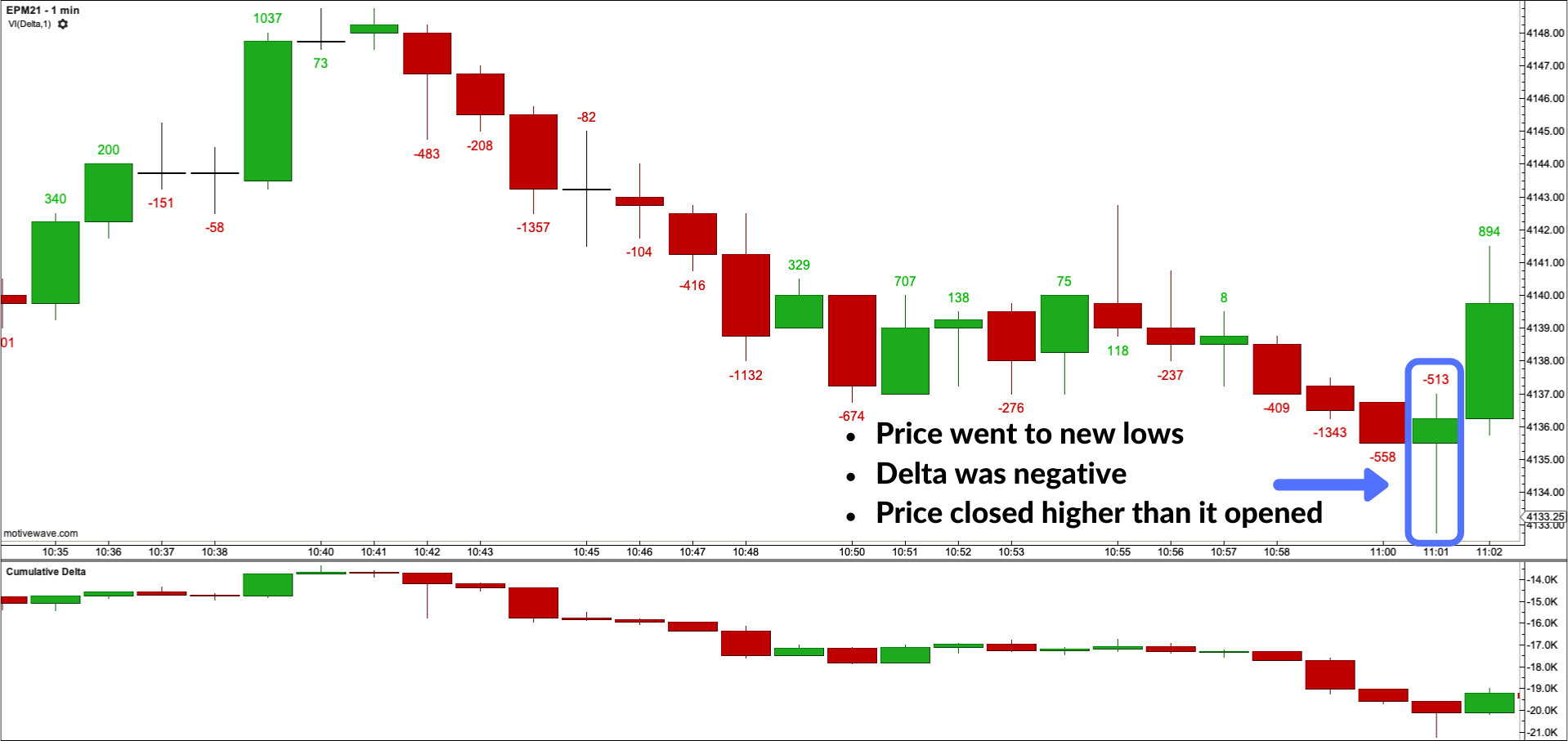

6. Cumulative Delta: Tracks the difference between buying and selling pressure over time, highlighting shifts in momentum.

7. Footprint Charts: Visual representations of volume and price action, showing where and how trades occur.

These components help traders make informed decisions based on real-time market dynamics.

How does order flow impact price movements?

Order flow impacts price movements by revealing the supply and demand dynamics in the market. When buyers outnumber sellers, prices typically rise as demand increases. Conversely, when sellers dominate, prices tend to fall. By analyzing order flow data, traders can identify trends and potential reversals, allowing for more informed trading decisions. For example, a surge in buy orders may indicate strong bullish sentiment, prompting traders to enter long positions. Understanding this flow helps anticipate price movements and adjust strategies accordingly.

What tools are best for tracking order flow?

The best tools for tracking order flow include:

1. Footprint Charts: Visualize order flow with detailed volume data at each price level.

2. DOM (Depth of Market): Shows real-time buy and sell orders, helping you gauge market sentiment.

3. Order Flow Indicators: Tools like Delta Volume and Cumulative Delta highlight buying and selling pressure.

4. Trade Analyzer Software: Analyze past trades to identify patterns and improve strategies.

5. Tick and Volume Charts: Provide insights into market movements based on time or transaction volume.

These tools help you interpret order flow data effectively for day trading decisions.

How can I use order flow data to identify trends?

To use order flow data for identifying trends, start by analyzing the volume and price action during specific time frames. Look for significant increases in buy or sell orders, as these often precede price movements. Pay attention to the bid-ask spread; a narrowing spread can indicate bullish sentiment, while a widening spread may signal bearish trends. Use tools like footprint charts to visualize trades at specific price levels, revealing buying and selling pressure. Monitor the cumulative delta to track net buying or selling over time, helping you confirm if a trend is strengthening or weakening. Lastly, combine order flow analysis with other indicators for a more comprehensive view.

What is the difference between order flow and volume analysis?

Order flow analysis focuses on the actual transactions occurring in the market, revealing the buying and selling activity of traders. It examines how orders are executed, helping traders understand market sentiment and potential price movements.

Volume analysis, on the other hand, looks at the total number of shares or contracts traded during a specific period. It indicates the strength of a price movement but doesn’t provide insight into the specific order dynamics.

In summary, order flow reveals the behavior behind trades, while volume shows the amount of trading activity. Both are essential for making informed day trading decisions.

How can I interpret large orders in order flow?

To interpret large orders in order flow, focus on the following:

1. Identify Block Trades: Look for unusually large trades that stand out from typical volume. This often indicates institutional interest.

2. Analyze Side of Market: Determine whether these large orders are buys or sells. Heavy buying may suggest bullish sentiment, while heavy selling could indicate bearish pressure.

3. Observe Price Movement: Check how the market reacts to these large orders. If prices rise with significant buying, it confirms demand; if they fall with selling, it signals supply dominance.

4. Monitor Time and Sales: Track the frequency and timing of large orders. A cluster of large buys in a short period can signal a potential reversal or continuation.

5. Cross-Reference with Technical Indicators: Use indicators like volume profiles or VWAP to see if large orders align with key support or resistance levels.

By analyzing these aspects, you can gain insights into market sentiment and make more informed day trading decisions.

What role does market depth play in order flow analysis?

Market depth shows the supply and demand at various price levels, which is crucial for order flow analysis. It helps traders understand potential price movements by revealing hidden liquidity and the strength of buying or selling pressure. By analyzing market depth, traders can identify support and resistance levels, spot large orders that might impact price, and gauge the likelihood of price reversals or continuations. This insight allows for more informed day trading decisions, enhancing entry and exit strategies.

How can I spot reversals using order flow data?

To spot reversals using order flow data, look for significant shifts in buying and selling pressure. Monitor the Delta, which shows the difference between buy and sell orders; a sudden change can indicate a potential reversal. Pay attention to volume spikes at key price levels—high volume on a price drop followed by a quick recovery may signal a reversal. Also, analyze the order book for large limit orders that might absorb selling pressure or indicate strong buying interest. Finally, watch for changes in market sentiment through trade executions and the speed of order fills, as these can provide clues about potential reversals.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What are common mistakes when analyzing order flow?

Common mistakes when analyzing order flow include:

1. Ignoring context: Failing to consider market conditions can lead to misinterpretation of order flow signals.

2. Overreacting to small changes: Traders often mistake minor fluctuations for significant trends, leading to premature decisions.

3. Neglecting volume: Not paying attention to volume alongside order flow can result in false signals.

4. Relying solely on one time frame: Analyzing only short-term order flow without broader context may miss key trends.

5. Misinterpreting large orders: Assuming large orders always indicate strong market intent can be misleading; they might represent stop-loss placements or hedging.

6. Lack of a plan: Not integrating order flow analysis into a cohesive trading strategy can lead to inconsistent results.

7. Confirmation bias: Allowing personal beliefs to skew the interpretation of order flow data can cloud judgment.

Avoid these pitfalls to improve your day trading decisions based on order flow analysis.

How does order flow analysis differ across asset classes?

Order flow analysis varies by asset class due to differences in liquidity, volatility, and market structure. In equities, order flow often reflects retail and institutional trading patterns, making it essential to monitor large trades and volume spikes. For futures, the focus shifts to open interest and market depth, which can signal potential price movements. In forex, order flow is influenced by macroeconomic events and geopolitical factors, requiring traders to consider currency correlations. Cryptocurrencies exhibit high volatility, so order flow analysis must account for rapid price swings and market sentiment. Each asset class demands tailored strategies for interpreting order flow data effectively.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

Can order flow data help with risk management in trading?

Yes, order flow data can significantly enhance risk management in trading. By analyzing real-time buy and sell orders, traders can identify market trends, gauge liquidity, and spot potential reversals. This insight allows for better entry and exit points, reducing the risk of losses. Understanding order flow helps traders adjust their position sizes based on market conditions, leading to more informed decisions and improved risk control.

How do market participants influence order flow?

Market participants influence order flow through their buying and selling activities, which create supply and demand dynamics. Large institutional traders can shift order flow significantly by placing substantial buy or sell orders, affecting price levels. Retail traders impact order flow as well, often following trends or reacting to market news. By analyzing order flow data, traders can identify where the majority of buying or selling pressure is coming from, allowing them to make better day trading decisions. Understanding the sentiment and behavior of different market participants helps in predicting price movements and optimizing entry and exit points.

What strategies can enhance my trading decisions with order flow?

To enhance your trading decisions with order flow, focus on these strategies:

1. Analyze Volume: Pay attention to volume spikes to identify potential reversals or continuations. High volume often precedes significant price moves.

2. Use Footprint Charts: These charts display volume at specific price levels, helping you see where buyers and sellers are most active.

3. Watch the Bid-Ask Spread: A narrowing spread often indicates increasing interest in a stock, while a widening spread can signal uncertainty.

4. Identify Large Orders: Look for large buy or sell orders, known as "icebergs," which can indicate market sentiment and potential support or resistance levels.

5. Leverage Tape Reading: Monitor the time and sales data to gauge the speed and size of trades, providing real-time insights into market psychology.

6. Track Order Imbalances: Notice when buy orders significantly outnumber sell orders (or vice versa), as this can indicate the direction of the next price move.

7. Integrate with Technical Analysis: Combine order flow insights with traditional technical indicators to confirm signals and enhance decision-making.

Implementing these strategies can lead to more informed and effective trading decisions.

How can I combine technical analysis with order flow insights?

To combine technical analysis with order flow insights, start by identifying key support and resistance levels using technical charts. Then, monitor order flow data—such as volume spikes and buy/sell orders—around these levels. Look for divergences between price action and order flow; for example, if prices rise but order flow shows declining buy orders, it may signal a reversal. Use tools like footprint charts to analyze the volume at price levels, helping you understand market sentiment. Finally, align your trade entries with confirmed signals from both technical indicators and order flow trends for better day trading decisions.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

Conclusion about Interpreting Order Flow Data for Better Day Trading Decisions

Incorporating order flow data into your trading strategy can significantly enhance decision-making and improve overall performance. By understanding its components, analyzing trends, and utilizing effective tools, traders can gain a competitive edge. Recognizing the differences between order flow and volume analysis, as well as understanding market depth, further refines your approach. Avoiding common pitfalls and integrating these insights with technical analysis allows for more informed trading decisions. For comprehensive guidance and resources on mastering order flow data, DayTradingBusiness is here to support your journey to successful day trading.

Learn about Leveraging Institutional Trading Data for Better Day Trading Decisions

Sources:

- Are institutions informed about news? - ScienceDirect

- Does high-frequency trading actually improve market liquidity? A ...

- What drives volatility persistence in the foreign exchange market ...

- Private Information, Capital Flows, and Exchange Rates; by Jacob ...

- Does information drive trading in option strategies? - ScienceDirect