Did you know that the phrase “order book” sounds like something you'd find at a library filled with trading secrets? In reality, it’s a crucial tool for day traders seeking insights into market dynamics. This article breaks down the essentials of reading an order book, explaining its components, such as bid and ask prices, and how to gauge market sentiment and liquidity. You’ll learn to identify support and resistance levels, the significance of order book depth, and how hidden orders play a role in analysis. Plus, we’ll cover practical tools and common pitfalls to avoid, ensuring you can effectively combine order book data with technical analysis. Dive in to enhance your trading strategies with the expertise that DayTradingBusiness offers!

What is an order book in day trading?

An order book in day trading is a live list of buy and sell orders for a specific asset, showing price levels and the number of shares or contracts available at each level. To read the order book, look for the bid prices (buy orders) on one side and the ask prices (sell orders) on the other. The difference between the highest bid and lowest ask is the bid-ask spread.

Pay attention to order size; larger orders can indicate strong support or resistance levels. Analyzing the order book helps traders anticipate price movements and market sentiment, enabling better decision-making.

How can I read an order book effectively?

To read an order book effectively, focus on these key steps:

1. Understand the Layout: Familiarize yourself with the bid and ask sections. Bids are buy orders, and asks are sell orders.

2. Analyze Depth: Look at the order book depth to gauge market sentiment. A thick bid side indicates strong buying interest, while a thick ask side shows selling pressure.

3. Monitor Price Levels: Pay attention to significant price levels where large orders exist. These can act as support or resistance.

4. Observe Order Flow: Watch how orders change in real-time. Rapid changes can signal upcoming price movements.

5. Use Time and Sales: Combine the order book with time and sales data to see executed trades and volume, providing context to the order flow.

6. Identify Patterns: Look for recurring patterns in how orders accumulate and get executed, helping you predict potential market moves.

By focusing on these aspects, you can gain valuable insights for day trading.

What key components should I look for in an order book?

Look for the following key components in an order book for day trading insights:

1. Bid and Ask Prices: Identify the highest bid (buy) and lowest ask (sell) prices to gauge market sentiment.

2. Order Size: Check the volume of orders at different price levels to understand supply and demand.

3. Market Depth: Analyze how many buy and sell orders exist at various price levels to assess potential price movements.

4. Order Flow: Monitor real-time changes in orders to see buying and selling pressure.

5. Trade History: Review recent trades to identify patterns and determine momentum.

6. Time and Sales: Use this to see the timing of trades and the aggressiveness of buyers or sellers.

These components together provide a comprehensive view of market dynamics crucial for day trading.

How does the order book influence price movements?

The order book influences price movements by showing the supply and demand dynamics in real-time. When buy orders exceed sell orders, prices tend to rise; conversely, if sell orders dominate, prices drop. Large buy or sell walls can indicate strong support or resistance levels, impacting trader behavior. Watching the order book helps identify potential price reversals or breakouts, as shifts in order volume can signal upcoming price changes. Understanding these patterns allows day traders to make informed decisions based on market sentiment.

What are bid and ask prices in the order book?

Bid prices in the order book represent the highest price buyers are willing to pay for a security. Ask prices indicate the lowest price sellers will accept. The difference between the bid and ask prices is called the spread. Day traders use this information to gauge market demand and supply, helping them make informed trading decisions.

How do order book levels indicate market sentiment?

Order book levels indicate market sentiment by showing the supply and demand dynamics at different price points. A high concentration of buy orders (bids) at a certain level suggests strong support, indicating bullish sentiment. Conversely, a large number of sell orders (asks) indicates resistance, reflecting bearish sentiment.

If bids consistently stack up, traders may feel confident in upward price movement. If asks dominate, it signals potential downward pressure. Watching how these levels change can provide insights into whether traders are eager to buy or sell, helping you gauge overall market sentiment.

What is the significance of order book depth?

Order book depth shows the number of buy and sell orders at different price levels, indicating market liquidity and potential price movement. It helps day traders gauge supply and demand, identify support and resistance levels, and anticipate price trends. A deep order book suggests strong liquidity, reducing slippage, while a shallow book can lead to rapid price changes. Understanding order book depth is crucial for making informed trading decisions and executing strategies effectively.

How can I identify support and resistance from the order book?

To identify support and resistance from the order book, look for large clusters of buy orders (support) and sell orders (resistance).

1. Buy Walls: A significant number of buy orders at a specific price level indicates strong support. If the price approaches this level and bounces back, it confirms support.

2. Sell Walls: Conversely, a high volume of sell orders at a certain price suggests resistance. If the price nears this level and reverses, it reinforces resistance.

3. Order Imbalances: Notice where the order book has more buy orders than sell orders (potential support) or vice versa (potential resistance).

4. Price Action: Monitor how the price reacts when it reaches these levels. A failure to break through resistance or a bounce off support solidifies these zones.

5. Volume Analysis: High trading volume at specific price levels can strengthen the significance of support and resistance identified in the order book.

Use these techniques to read the order book effectively and gain insights for day trading.

What are liquidity and volume in an order book context?

Liquidity in an order book refers to how easily assets can be bought or sold without significantly affecting the price. High liquidity means there are many buy and sell orders, making it easier to execute trades quickly.

Volume, on the other hand, indicates the total amount of assets traded over a specific period. In the order book context, it reflects the number of shares or contracts changing hands, providing insights into market activity and interest in a particular asset.

In day trading, looking for high liquidity and volume helps identify potential entry and exit points with less price slippage.

How do hidden orders affect order book analysis?

Hidden orders can significantly impact order book analysis by skewing the perceived supply and demand. Since these orders aren’t visible in the order book, they can create false signals about market sentiment. Traders may misinterpret low liquidity or think price levels are stronger than they are. For day trading, it’s crucial to look for sudden price movements or volume spikes that may indicate hidden orders are being triggered. Monitoring these anomalies can provide insights into potential market shifts, helping traders make more informed decisions.

What tools can help me read the order book better?

To read the order book better for day trading insights, use these tools:

1. Trading Platforms: Software like Thinkorswim, Interactive Brokers, and NinjaTrader provide detailed order book views.

2. Level 2 Quotes: Access Level 2 data to see real-time bids and asks, giving you insight into market depth.

3. Order Flow Analysis Tools: Tools like Jigsaw Trading and Bookmap visualize order flow, helping you spot patterns.

4. Market Depth Indicators: Use indicators that display the number of buy and sell orders at various price levels.

5. Volume Profile Tools: These show price levels with high trading activity, indicating potential support and resistance zones.

6. Charting Software: Incorporate platforms like TradingView for custom indicators and overlays that enhance order book interpretation.

Using these tools will improve your understanding of market dynamics and help you make informed trading decisions.

How can I combine order book data with technical analysis?

To combine order book data with technical analysis, start by identifying key support and resistance levels using charts. Then, analyze the order book to see where large buy or sell orders are placed near these levels. Look for discrepancies; if a strong resistance level shows a significant sell wall in the order book, it may reinforce your analysis.

Use volume and price action from technical indicators like moving averages alongside real-time order book changes to confirm trends. For instance, if the price approaches a moving average and the order book shows increased buying interest, it could signal a potential upward movement.

Additionally, monitor the liquidity and depth of the order book; thin liquidity can lead to sudden price movements, which can be crucial for day trading decisions. Combine these insights to make informed trades based on both market sentiment and technical signals.

What common mistakes should I avoid when reading the order book?

1. Ignoring Market Depth: Always pay attention to the number of buy and sell orders at various price levels. This shows real supply and demand.

2. Misinterpreting Order Types: Understand the difference between market orders and limit orders. This can impact your trading decisions significantly.

3. Focusing on One Level: Don’t just look at the top of the order book. Analyze deeper levels to get a clearer picture of potential price movements.

4. Overreacting to Small Changes: Avoid making hasty decisions based on minor fluctuations. Look for patterns over time instead.

5. Neglecting News Impact: Be aware of how news events can affect order flow. Don’t ignore external factors that influence the market.

6. Lack of Context: Always consider the broader market trends. Reading the order book without context can lead to misinterpretation.

7. Assuming All Orders Are Real: Be cautious of spoofing, where traders place fake orders to manipulate prices.

8. Not Practicing: Familiarize yourself with the order book through practice. Understanding it takes time and experience.

How does time and sales data complement the order book?

Time and sales data complements the order book by providing real-time insights into actual trades executed, showing the price and volume at which transactions occur. While the order book displays pending orders, time and sales reveals the market's activity and liquidity. This helps traders gauge market sentiment and identify trends. For instance, if a large volume of trades occurs at a certain price level, it may indicate strong support or resistance. Together, they give a fuller picture of market dynamics, enhancing decision-making for day trading.

What is the role of market makers in the order book?

Market makers provide liquidity in the order book by continuously buying and selling assets. They place buy and sell orders at various price levels, creating a smoother trading experience. This helps reduce price volatility and ensures that trades can be executed quickly. By doing so, they facilitate price discovery and maintain orderly markets, allowing day traders to enter and exit positions efficiently.

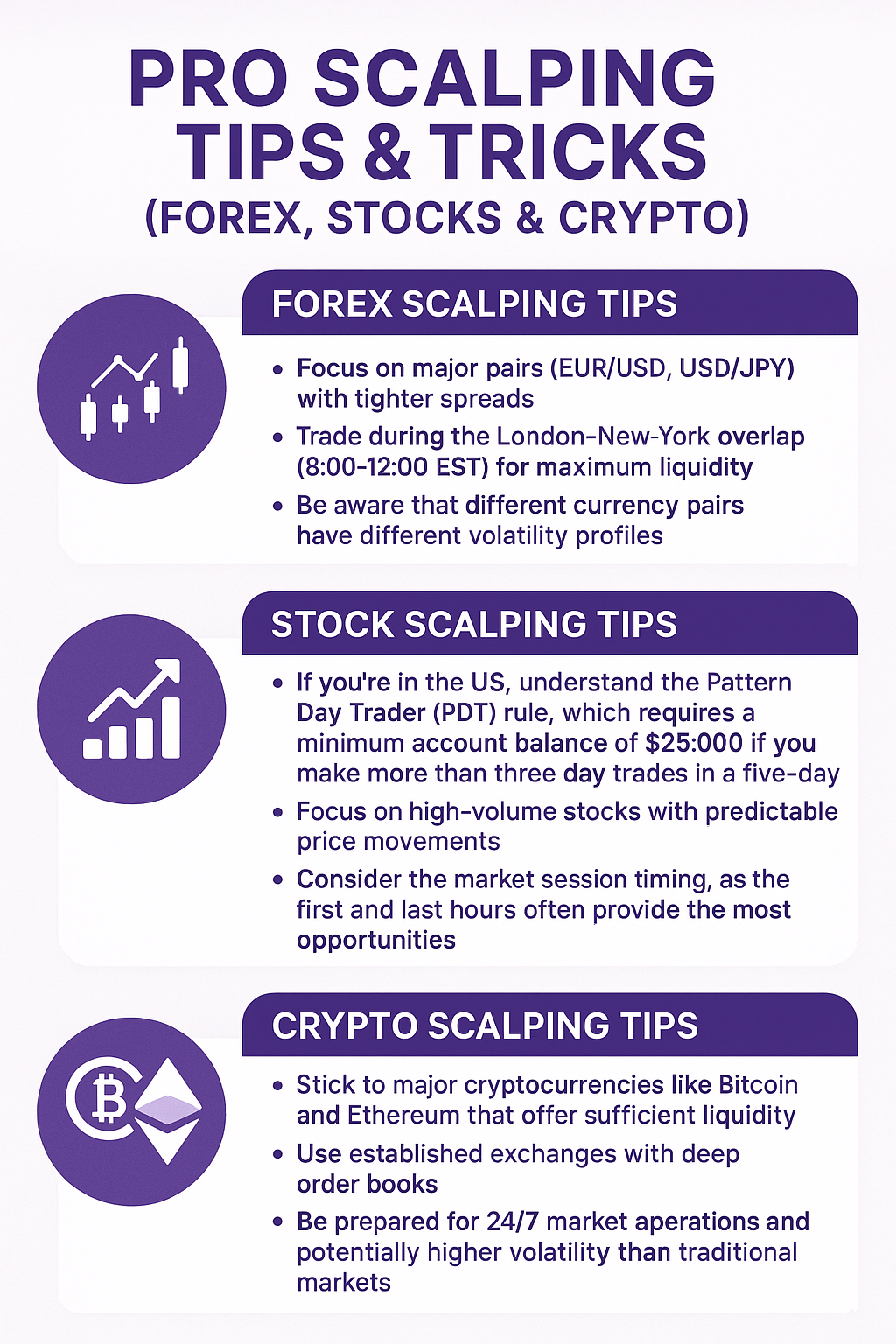

How can I use the order book for scalp trading strategies?

To use the order book for scalp trading, focus on these key aspects:

1. Identify Support and Resistance Levels: Look for large buy (support) and sell (resistance) orders. These can indicate where price might bounce or reverse.

2. Monitor Order Flow: Pay attention to how orders are being filled. A sudden increase in buy orders may signal upward momentum, while a surge in sell orders could indicate a downturn.

3. Look for Imbalances: If there are significantly more buy orders than sell orders (or vice versa), this can suggest potential price movement in that direction.

4. Use Time and Sales Data: Analyze the speed and size of trades to gauge market sentiment. Quick, large trades often precede price changes.

5. Scalp Around Key Levels: Place trades just before expected price movements based on order book insights, capturing small gains quickly.

6. Set Tight Stop Losses: Given the fast-paced nature of scalp trading, protect your capital with tight stop losses based on the order book’s support and resistance.

7. Stay Agile: Be ready to adjust your strategy based on real-time changes in the order book. Scalping requires quick reactions.

Implement these techniques to enhance your scalp trading strategy effectively.

Conclusion about How to Read the Order Book for Day Trading Insights

In summary, mastering the order book is essential for effective day trading. By understanding its components—such as bid and ask prices, market sentiment, and liquidity—you can make informed trading decisions that enhance your strategies. Avoiding common pitfalls and integrating order book data with technical analysis can further improve your trading performance. For comprehensive insights and guidance on utilizing the order book in your day trading practices, consider exploring resources from DayTradingBusiness.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

Sources:

- ClusterLOB: Enhancing Trading Strategies by Clustering Orders in ...

- A market-clearing role for inefficiency on a limit order book ...

- French Market Authority Report on High-Frequency Trading — No ...

- The short-term predictability of returns in order book markets: A deep ...

- Statistical arbitrage trading on the intraday market using the ...